Adair County Quitclaim Deed Form

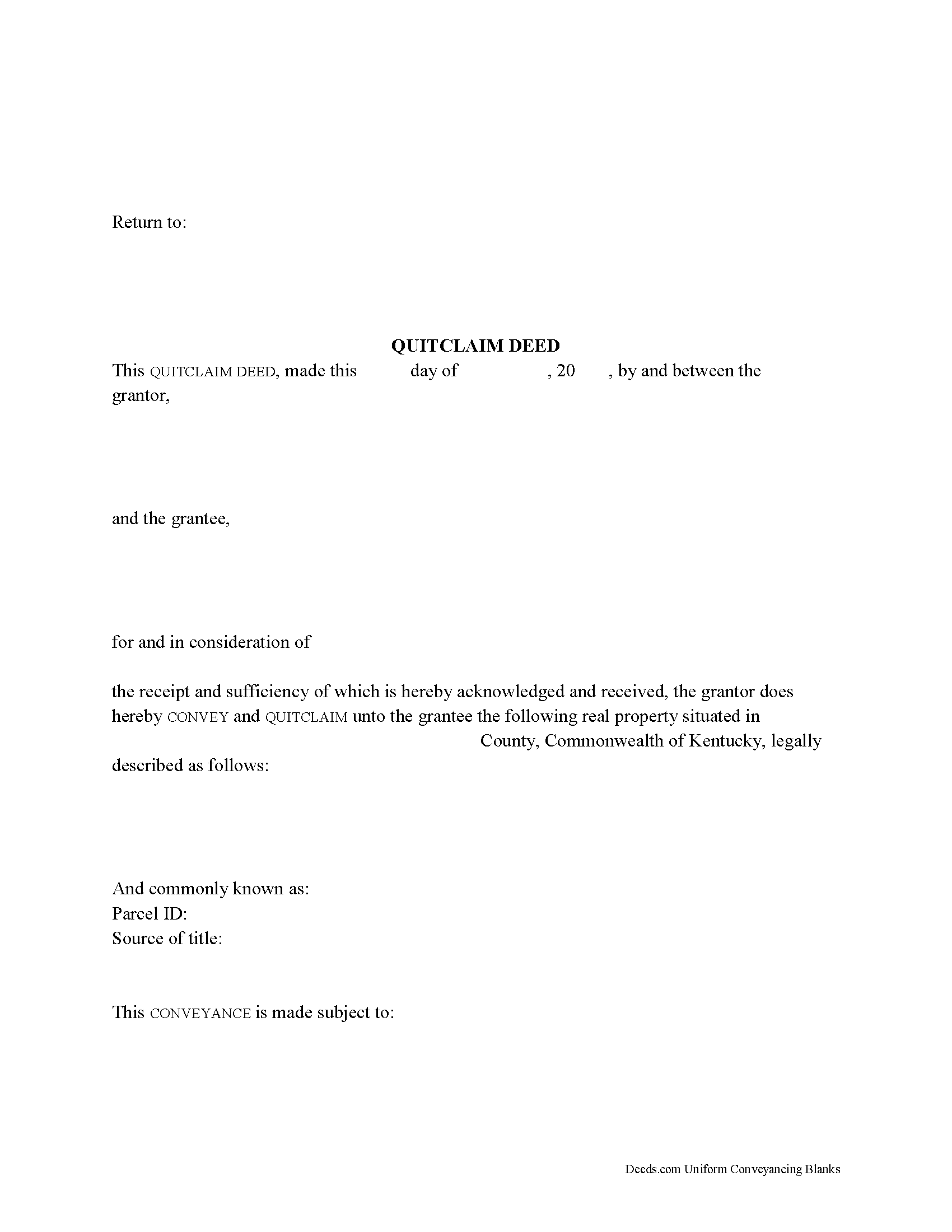

Adair County Quitclaim Deed Form

Fill in the blank Quitclaim Deed form formatted to comply with all Kentucky recording and content requirements.

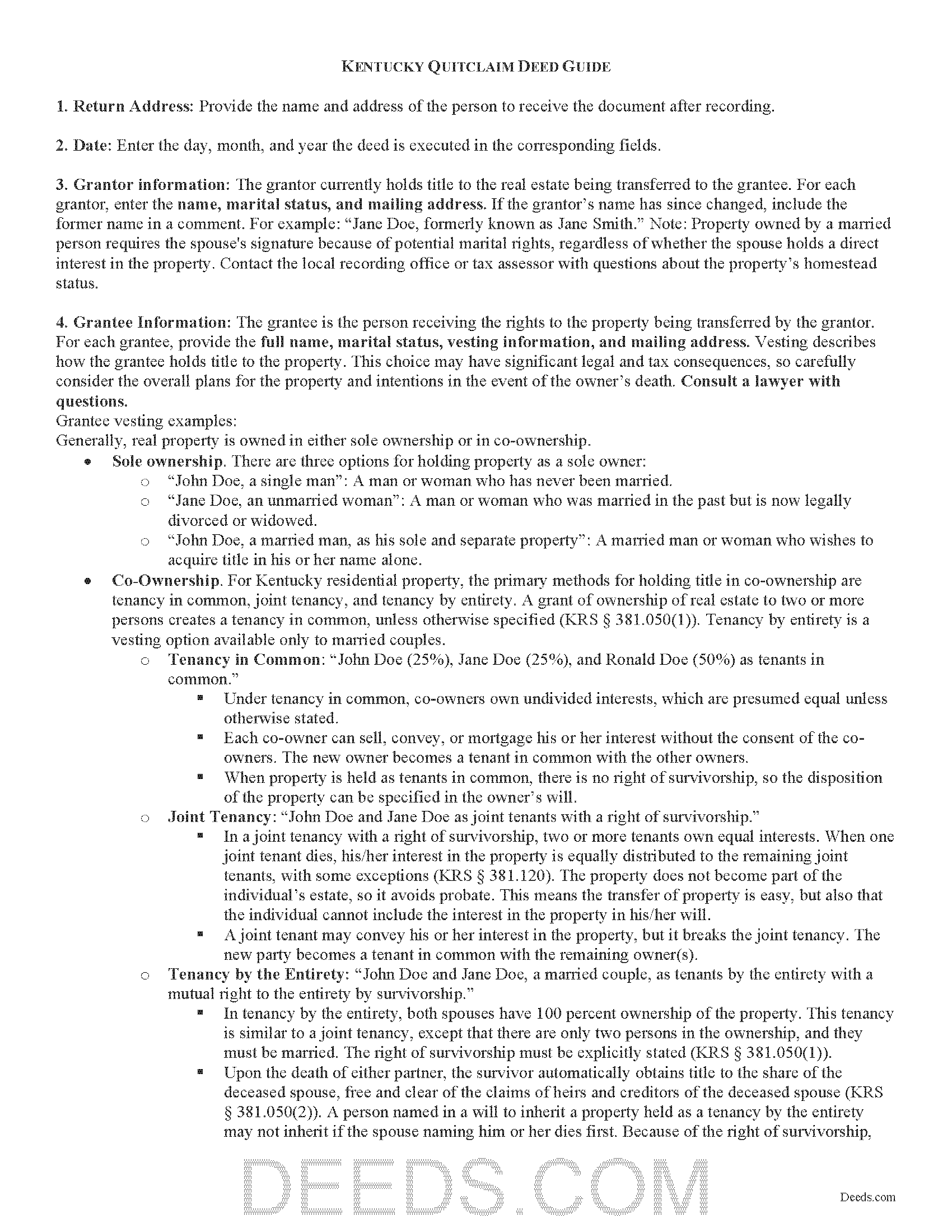

Adair County Quitclaim Deed Guide

Line by line guide explaining every blank on the Quitclaim Deed form.

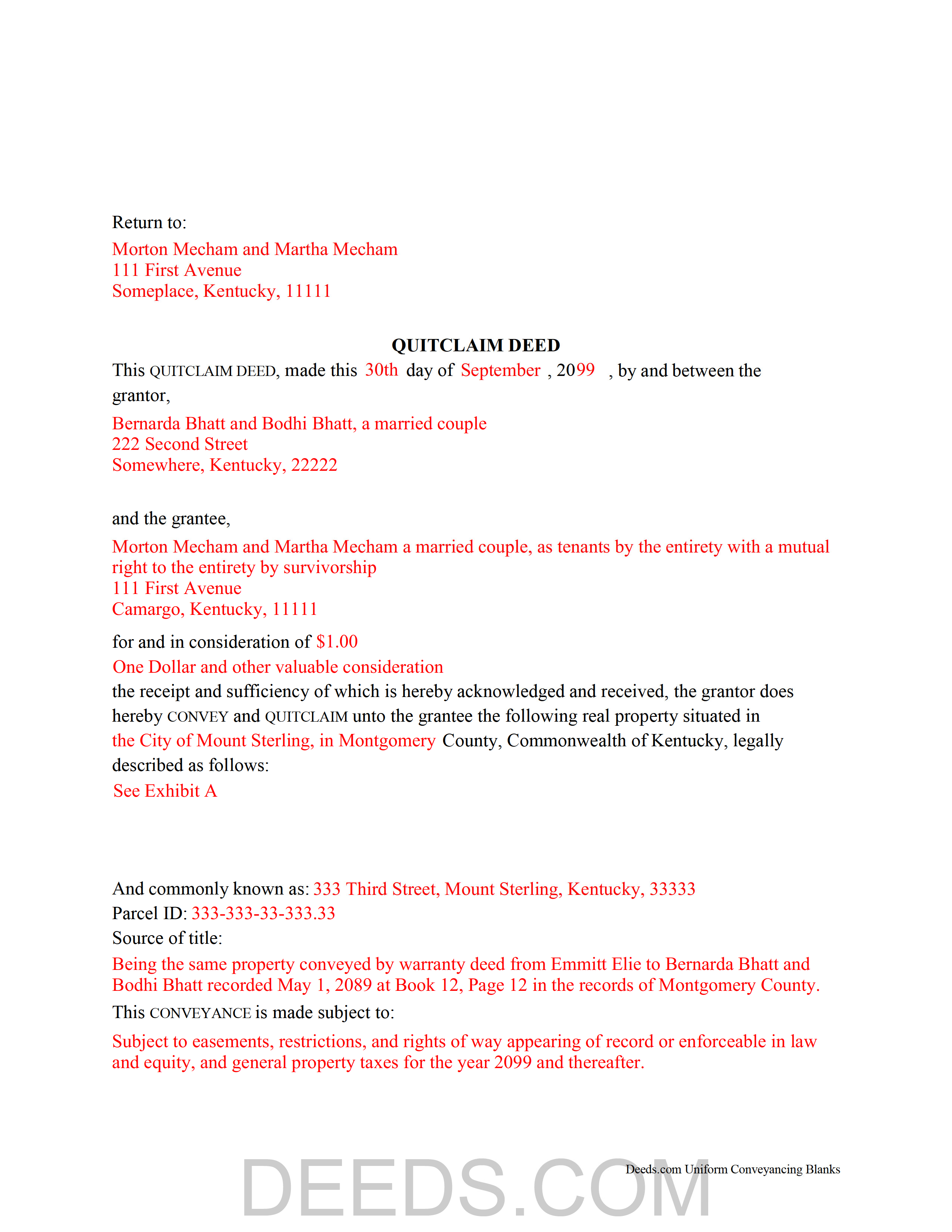

Adair County Completed Example of the Quitclaim Deed Document

Example of a properly completed Kentucky Quitclaim Deed document for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Kentucky and Adair County documents included at no extra charge:

Where to Record Your Documents

Adair County Clerk

Columbia, Kentucky 42728-1493

Hours: Monday-Friday 8:00 - 4:00 & Saturday 8:00 - 12:00

Phone: (270) 384-2801

Recording Tips for Adair County:

- Bring your driver's license or state-issued photo ID

- Ensure all signatures are in blue or black ink

- Double-check legal descriptions match your existing deed

- Ask about their eRecording option for future transactions

- Recorded documents become public record - avoid including SSNs

Cities and Jurisdictions in Adair County

Properties in any of these areas use Adair County forms:

- Breeding

- Cane Valley

- Columbia

- Glens Fork

- Gradyville

- Knifley

Hours, fees, requirements, and more for Adair County

How do I get my forms?

Forms are available for immediate download after payment. The Adair County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Adair County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Adair County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Adair County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Adair County?

Recording fees in Adair County vary. Contact the recorder's office at (270) 384-2801 for current fees.

Questions answered? Let's get started!

Real property transfers are governed by Chapter 382 of the Kentucky Revised Statutes.

Although they are not defined in the statutes, Kentucky accepts quitclaim deeds to transfer the rights, title, and interest in real estate, if any, from the grantor (seller) to the grantee buyer), with no protections for the grantee. There may be potential unknown claims or restrictions on the title, and the buyer accepts the risk that the grantor may not have complete ownership of the property. Because of this, quitclaim deeds are commonly used to clear title, for transfers between family members, or in other situations where warranties are not necessary.

A lawful quitclaim deed identifies the names and addresses of each grantor and grantee. Kentucky law requires all recorded documents or documents affecting a change in property ownership to contain information on how the grantee will hold title (vesting). For residential property, the primary methods for holding title in co-ownership are tenancy in common, joint tenancy, and tenancy by entirety. A grant of real estate to two or more persons creates a tenancy in common, unless otherwise specified. Tenancy by entirety is available to married couples only (KRS 381.050(1)).

Provide the complete legal description of the property and a reference to the previously recorded document transferring title to the grantor. State the full amount of consideration exchanged during the transfer, or, if nominal or no consideration has been exchanged, the fair cash value of the property (KRS 385.135). The county assesses a transfer tax on the consideration, due at the time of recording, unless the transaction is exempt under KRS 142.050. At the end of the instrument, include the preparer's name, address, and signature (KRS 382.335) and identify the in-care-of tax address (KRS 382.110(2)). Finally, the form must meet all state and local standards for recorded documents.

The signatures of both the grantor and grantee must be notarized for the deed to be recorded (KRS 382.130). Submit the signed, completed deed, along with any supplemental documentation necessary for the specific transaction, to the local county clerk's office of the county in which the property is located (KRS 382.110(1)). Recording the deed preserves a clear chain of ownership history and provides public notice of the transfer.

This article is provided for informational purposes only and is not a substitute for legal advice. Contact an attorney with questions about quitclaim deeds or for any other issues related to the transfer of real property in Kentucky.

(Kentucky Quitclaim Deed Package includes form, guidelines, and completed example)

Important: Your property must be located in Adair County to use these forms. Documents should be recorded at the office below.

This Quitclaim Deed meets all recording requirements specific to Adair County.

Our Promise

The documents you receive here will meet, or exceed, the Adair County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Adair County Quitclaim Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4582 Reviews )

Sara R.

June 19th, 2019

Worked well for me to create a deed for a house I inherited. It was very thorough and easy to use. I have no experience with the law so I just googled terms I didn't understand and was fine. I also called land records a lot and ended up not needing a lot of the material included, but it was still good to have it.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Jacqueline T.

June 17th, 2021

Worth it for the time saved as the supplemental forms required were included the purchase. First time user, easy peasy. 5 stars from me.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Brad T.

November 9th, 2019

I didn't spend a lot of time there but seems to be a good site with a valuable service.

Thank you!

Cheryl M.

April 12th, 2020

Easy.

Thank you!

Roberta J B.

February 17th, 2021

User friendly

Thank you!

Pamela W.

April 11th, 2019

Signing up was easy and the form was amazing. The ability to type on it (I am on a MAC) was beyond my expectations, the ability to save a blank, save my two documents, save the instructions and sample was excellent. The documents are in the mail and we are hopefully they will be approved. Blessings,

Thank you for your feedback. We really appreciate it. Have a great day!

Jill A.

March 26th, 2021

Finding current forms in one place helps simplify the process. Thank you.

Thank you!

Ruth L.

August 18th, 2021

Easy to use form. I filled it out and took it to the county office. Entire process took less than 20 min.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Laura H.

January 12th, 2023

Process was easy. The instructions for TOD and a sample completed form was very helpful. E-recording of deed saved a trip to the county building and well worth the very reasonable charge.

Thank you for your feedback. We really appreciate it. Have a great day!

Natalie F.

April 13th, 2020

So convenient and easy to use! Will definitely recommend to anyone.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Annette H.

September 8th, 2022

Deeds.com has done a wonderful job! They are quick to get back to me either with the Deed or reason why there is no Deed. You have saved me so much time using your services that I hope to keep using them for years to come! Thank you!

Thank you!

JUDITH-DIAN W.

June 28th, 2023

I didn't have any problem downloading and filling out the form on my computer and printing it yesterday. I didn't know what to put for "Source of Title". I called the county recording office; they didn't know either and said to leave it blank. I got the form notarized at my bank and took it in to the recording office. They checked it, accepted it, I paid a fee, and it's done. So easy. My children will appreciate that I've done this. Added note: You do have one typo on your form--you left out 'at'. It should read: "You should carefully read all information at the end of this form."

Thank you for your feedback. We really appreciate it. Have a great day!

Ralph N.

April 5th, 2022

Fast download and clear, easy-to-follow directions. A great service.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Danny W.

August 13th, 2020

download complete..I am happy with results. Correct document for the state and my application, and it was a simple transaction.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Jo Carol K.

October 17th, 2020

The information/forms/and ease of filling in the blanks provided me with the confidence to "do it myself". Excellent customer service. Thank you for being there.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!