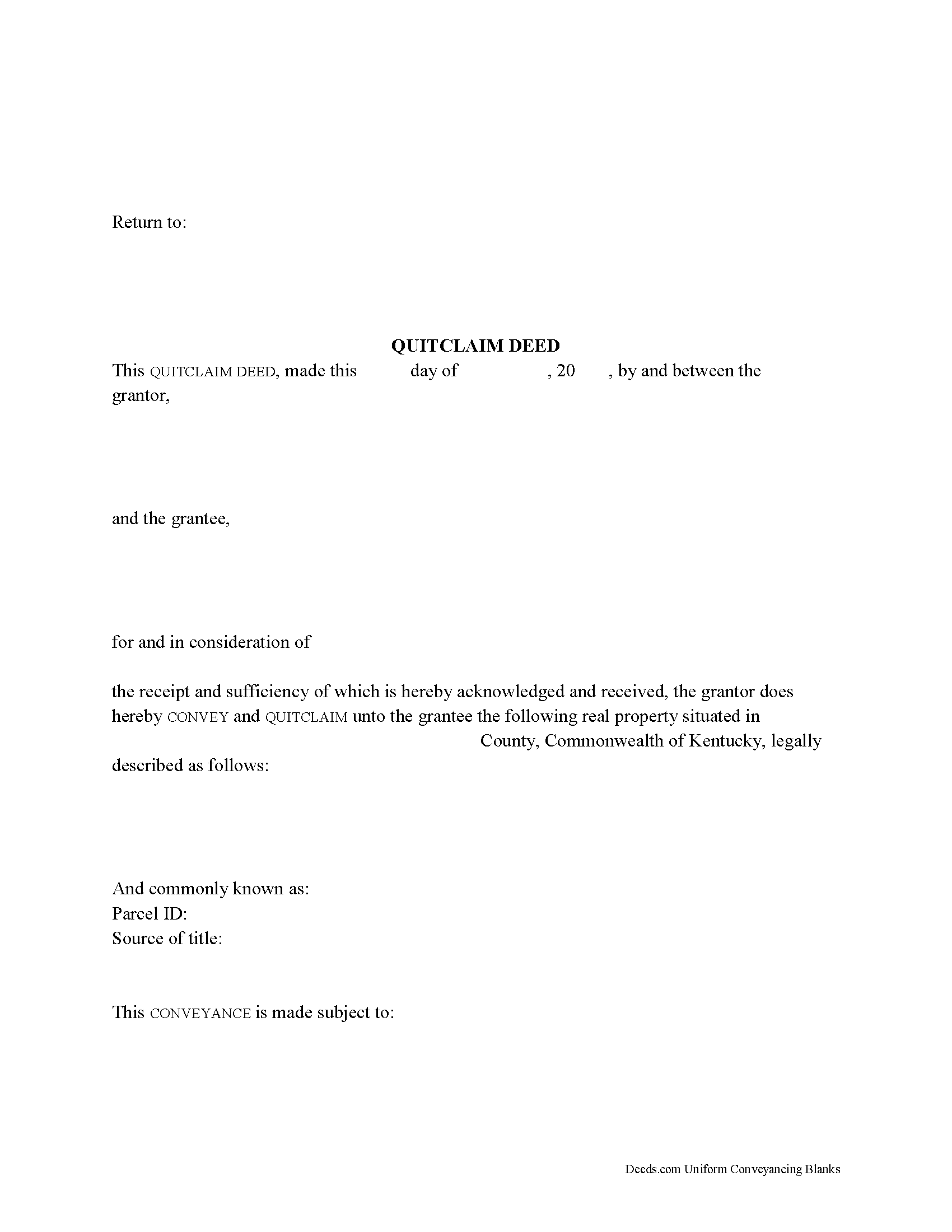

Todd County Quitclaim Deed Form

Todd County Quitclaim Deed Form

Fill in the blank Quitclaim Deed form formatted to comply with all Kentucky recording and content requirements.

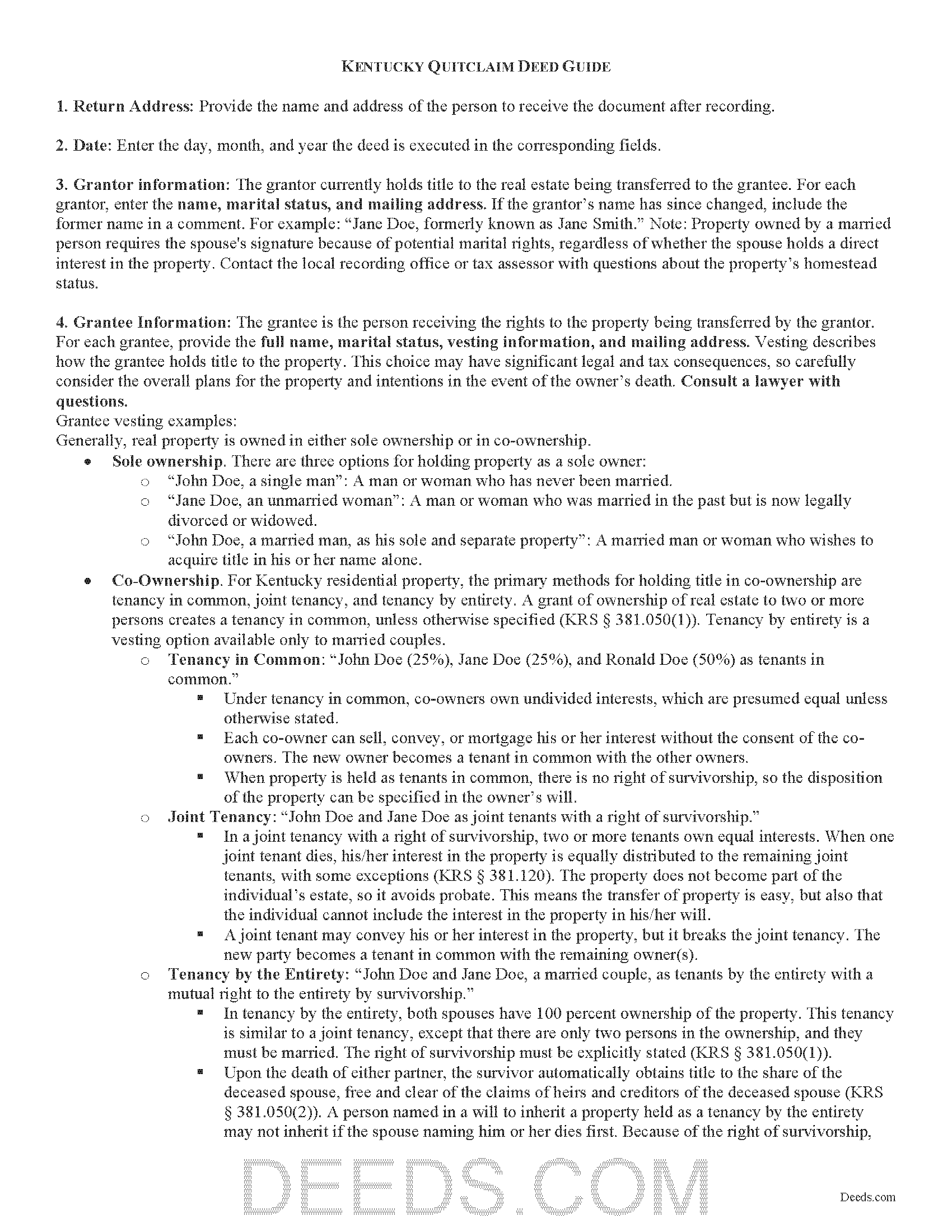

Todd County Quitclaim Deed Guide

Line by line guide explaining every blank on the Quitclaim Deed form.

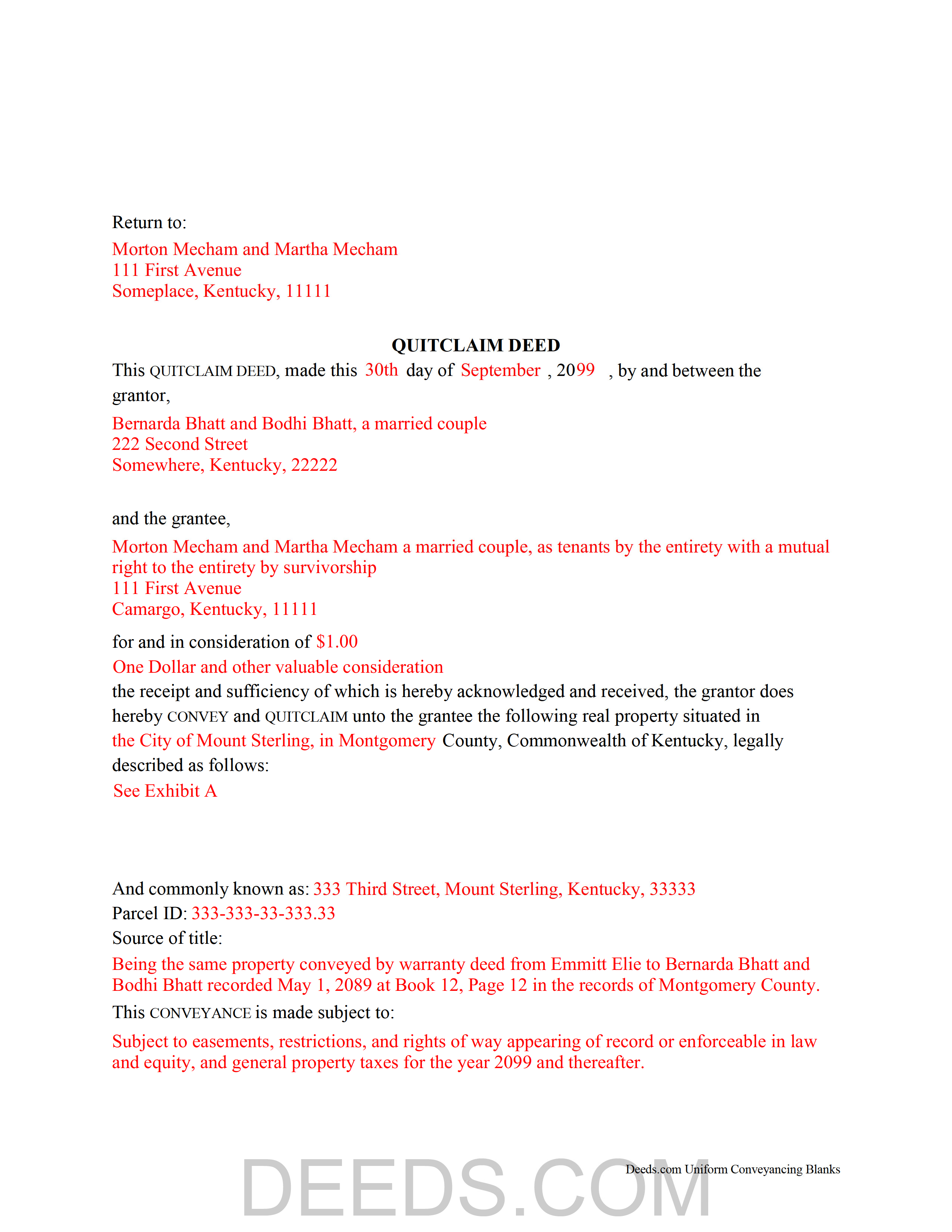

Todd County Completed Example of the Quitclaim Deed Document

Example of a properly completed Kentucky Quitclaim Deed document for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Kentucky and Todd County documents included at no extra charge:

Where to Record Your Documents

Todd County Clerk

Elkton, Kentucky 42220

Hours: 8:30 to 4:30 M-F

Phone: (270) 265-9966

Recording Tips for Todd County:

- Documents must be on 8.5 x 11 inch white paper

- Check margin requirements - usually 1-2 inches at top

- Make copies of your documents before recording - keep originals safe

- Leave recording info boxes blank - the office fills these

Cities and Jurisdictions in Todd County

Properties in any of these areas use Todd County forms:

- Allensville

- Clifty

- Elkton

- Guthrie

- Sharon Grove

- Trenton

Hours, fees, requirements, and more for Todd County

How do I get my forms?

Forms are available for immediate download after payment. The Todd County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Todd County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Todd County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Todd County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Todd County?

Recording fees in Todd County vary. Contact the recorder's office at (270) 265-9966 for current fees.

Questions answered? Let's get started!

Real property transfers are governed by Chapter 382 of the Kentucky Revised Statutes.

Although they are not defined in the statutes, Kentucky accepts quitclaim deeds to transfer the rights, title, and interest in real estate, if any, from the grantor (seller) to the grantee buyer), with no protections for the grantee. There may be potential unknown claims or restrictions on the title, and the buyer accepts the risk that the grantor may not have complete ownership of the property. Because of this, quitclaim deeds are commonly used to clear title, for transfers between family members, or in other situations where warranties are not necessary.

A lawful quitclaim deed identifies the names and addresses of each grantor and grantee. Kentucky law requires all recorded documents or documents affecting a change in property ownership to contain information on how the grantee will hold title (vesting). For residential property, the primary methods for holding title in co-ownership are tenancy in common, joint tenancy, and tenancy by entirety. A grant of real estate to two or more persons creates a tenancy in common, unless otherwise specified. Tenancy by entirety is available to married couples only (KRS 381.050(1)).

Provide the complete legal description of the property and a reference to the previously recorded document transferring title to the grantor. State the full amount of consideration exchanged during the transfer, or, if nominal or no consideration has been exchanged, the fair cash value of the property (KRS 385.135). The county assesses a transfer tax on the consideration, due at the time of recording, unless the transaction is exempt under KRS 142.050. At the end of the instrument, include the preparer's name, address, and signature (KRS 382.335) and identify the in-care-of tax address (KRS 382.110(2)). Finally, the form must meet all state and local standards for recorded documents.

The signatures of both the grantor and grantee must be notarized for the deed to be recorded (KRS 382.130). Submit the signed, completed deed, along with any supplemental documentation necessary for the specific transaction, to the local county clerk's office of the county in which the property is located (KRS 382.110(1)). Recording the deed preserves a clear chain of ownership history and provides public notice of the transfer.

This article is provided for informational purposes only and is not a substitute for legal advice. Contact an attorney with questions about quitclaim deeds or for any other issues related to the transfer of real property in Kentucky.

(Kentucky Quitclaim Deed Package includes form, guidelines, and completed example)

Important: Your property must be located in Todd County to use these forms. Documents should be recorded at the office below.

This Quitclaim Deed meets all recording requirements specific to Todd County.

Our Promise

The documents you receive here will meet, or exceed, the Todd County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Todd County Quitclaim Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4582 Reviews )

MARCO G.

May 9th, 2019

Very easy to use. Got the emailed documents within minutes.

We appreciate your feedback Marco, thank you.

Lucus S.

May 19th, 2022

I tried to do it myself by copying an old deed and ended up with a bunch of headaches (expensive ones) wish I would have used these documents first. Live and learn.

Thank you!

Ray L.

February 8th, 2019

Thank you, I am very satisfied with the process and will provide a final review after the documents are completed and accepted by the state.

Thank you for your feedback. We really appreciate it. Have a great day!

Frank W.

January 19th, 2023

Everything worked smoothly

Thank you!

Tong B.

May 7th, 2020

hi, It is very easy to do it. tanks.

Thank you!

Curtis T.

May 12th, 2020

Deeds support was awesome and constant. Thank you.

Thank you!

Laurie R.

August 31st, 2022

FIVE STARS !!! Clear instructions Easy to navigate Thanks for making this easy for those of us who are not tech savvy

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

John H.

June 8th, 2020

This was pretty easy especially for a old guy like me.

Thanks John, glad we could help!

LEIGH M.

February 19th, 2022

Skamania County, WA tax affidavit wouldn't download. Otherwise, a good program

Thank you!

Richard W.

May 25th, 2023

Very happy I tried your service/product. The quit deed forms were excepted by the register of deeds with no issue. Thank You

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Tina C.

August 26th, 2021

Quick and easy ordering and download. Appreciated that I could get the form that is used in my county. Would have like to be able to add paragraphs to form.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Armando B.

October 23rd, 2021

This was so simple to get around your web site. Guide was easy to follow. Great experience. Would use again.

Thank you for your feedback. We really appreciate it. Have a great day!

Chelsie F.

April 3rd, 2020

Super customer service and communication! Fast service and more informative than expected! Can't say thanks enough.

Thank you!

Larry P.

October 14th, 2020

Very nice, they include a guide download that tells you all the lawyer speak!! I'll be using them again.

Thank you for your feedback. We really appreciate it. Have a great day!

Lucinda L.

December 29th, 2021

mostly good; however, you need to update the annual exclusion gift amount from $14,000 to $15,000 (where it has ben for several years), and you need to make your Gift Deed final paragraph be gender neutral like "they" or "he or she" rather than just"he". We women lawyers and our women clients appreciate that.

Thank you for your feedback. We really appreciate it. Have a great day!