Download Louisiana Special Warranty Deed Legal Forms

Louisiana Special Warranty Deed Overview

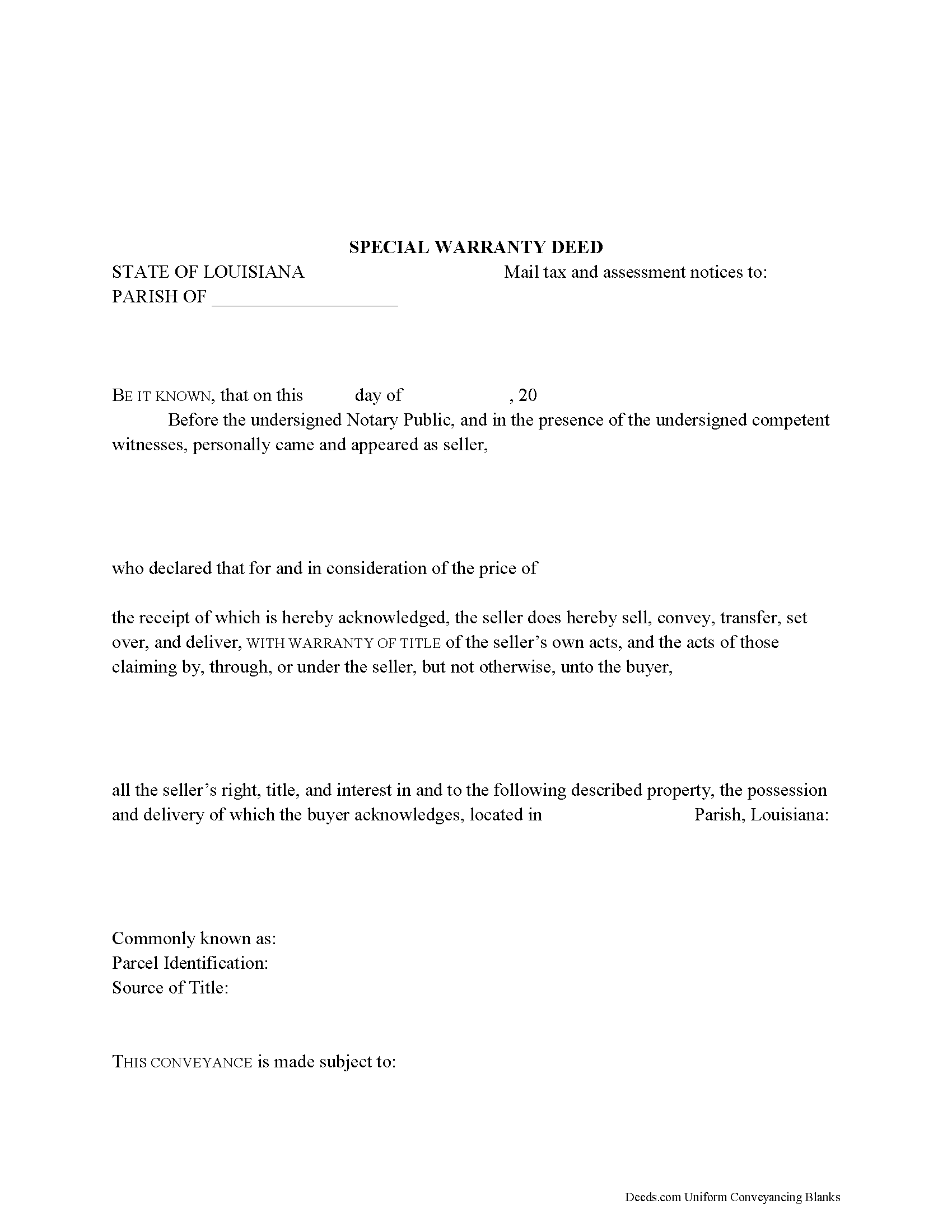

Sales of immovable property in Louisiana are typically referred to as acts of sale or cash sales. Louisiana Statutes do not provide statutory forms for deeds. Special warranty deeds convey fee simple title to the buyer with certain covenants on the part of the seller.

Typically, a special warranty deed contains an explicit covenant of warranty that the granting party will defend the title against claims arising by, through, or under him, with implied covenants that the granting party is lawfully seized and possessed of the property in fee simple and has a good right to convey it, and that the property is unencumbered, unless noted on the face of the deed.

In Louisiana, all sales contain the implied warranties that the buyer will have peaceful possession of the property and that such property is free of defects. Sellers also warrant that the thing sold "is fit for its intended use" (Civil Code Arts. 2475, 2524).

The promise that the property is free of defects is referred to as the warranty against redhibitory defects (CC 2520). A redhibitory defect is defined as a defect that renders the property useless, or its use would be so inconvenient that it is presumed that the buyer would not have purchased the property had he known about the defects (CC 2520). Louisiana law permits the parties to agree on a limitation of the warranty against redhibitory defects (CC 2548).

Pursuant to La. Civil Code Art. 2440, a sale or transfer of immovable property must be made by authentic act or by act under private signature. An authentic act is defined as an act executed before a notary public or other qualified officer in the presence of two witnesses, and signed by each person executing the act, each person witnessing the act, and each notary public before whom the act was executed (CC 1833(A)).

Louisiana's recording laws provide incentive to record. Because Louisiana is a "race" state, the person who records first, regardless of notice of a prior claim on the title, has priority of title. To provide notice to third parties and establish priority of title, record the deed in the recording office of the parish where the property is located.

La. Civil Code Art. 3352 sets forth the requirements for recorded acts. These include the full names and addresses of both parties to the transfer; the marital status of all individuals and whether there has been a change in marital status since the transferor obtained title; the property's address; and the notary's ID number or bar roll number and typed or printed name of the notary and witnesses. Conveyances of immovable property also require the name and address of the person responsible for all property taxes and assessments (RS 9:2721). This information should also be supplied to the tax assessor of the parish where the immovable property is located.

Recorded acts pertaining to an interest in real property should also include a legal description of the parcel, a derivation clause citing the seller's source of title, and the manner in which the buyer intends to hold title to the property.

Ownership of property is transferred as soon as there is agreement on the property transferred and the price for the transfer is fixed, though the property sold may not yet be delivered to the buyer (Civil Code Art. 2456). Delivery of immovable property occurs by law upon execution of the written act of transfer (CC 2477).

When recording the act, ensure compliance with all state and parish requirements for form and content of recorded acts of sale. Contact the parish to verify additional requirements, such as cover sheets, are applicable. If the property is situated in the City of New Orleans, a transaction tax is due from the seller upon recording.

Consult a lawyer with questions regarding the legal implications of special warranty deeds, transfers of immovable property, and recording acts of sale in Louisiana.

(Louisiana SWD Package includes form, guidelines, and completed example)