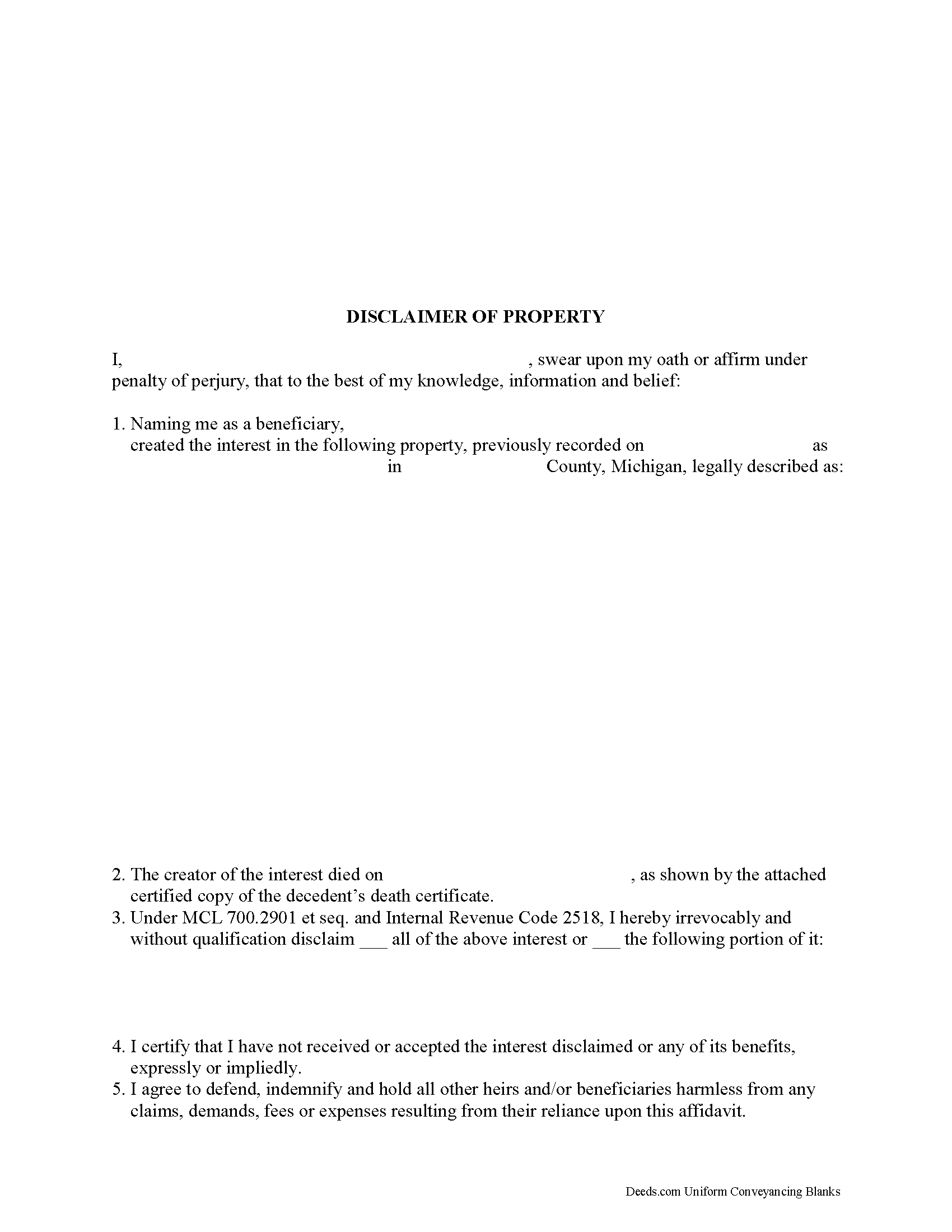

Wexford County Disclaimer of Interest Form

Wexford County Disclaimer of Interest Form

Fill in the blank form formatted to comply with all recording and content requirements.

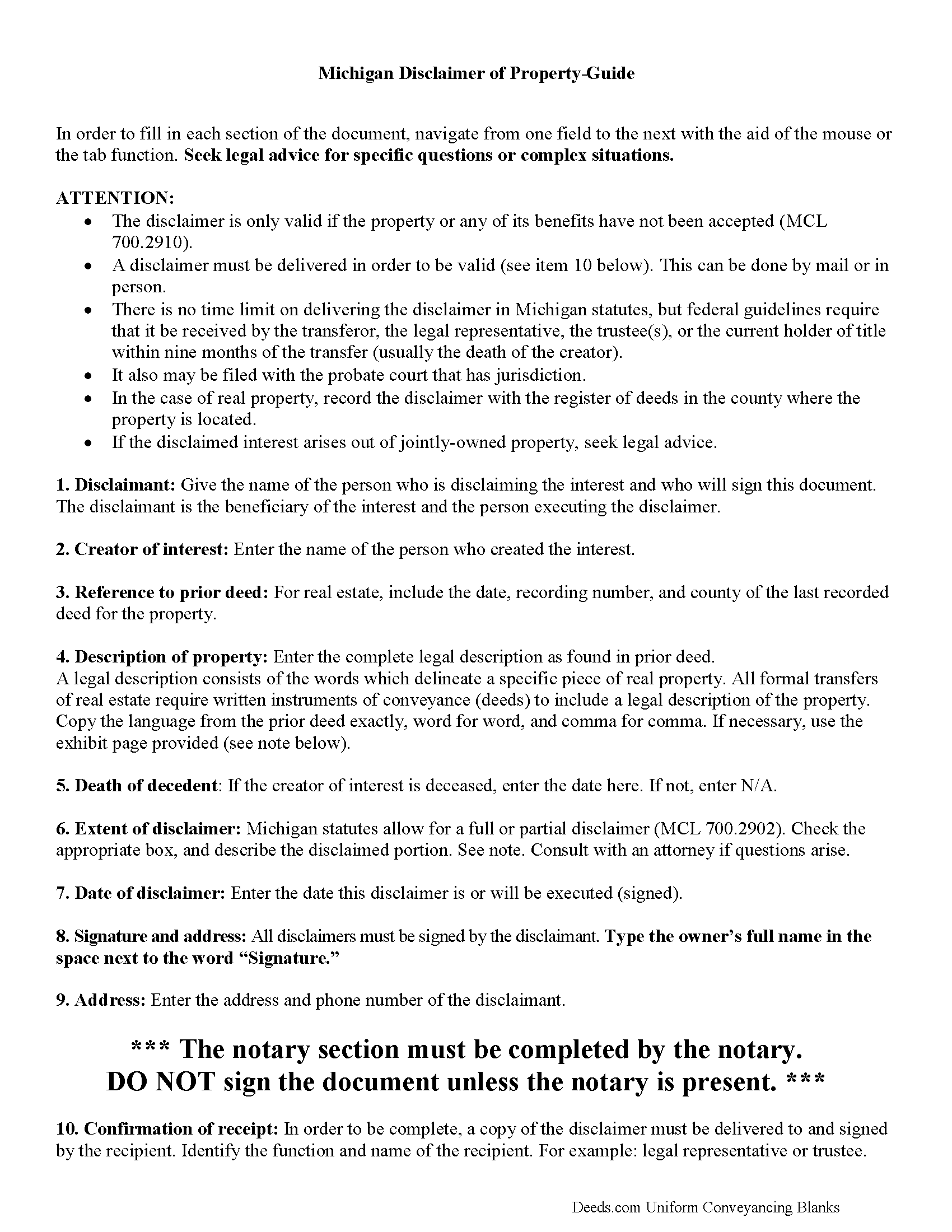

Wexford County Disclaimer of Interest Guide

Line by line guide explaining every blank on the form.

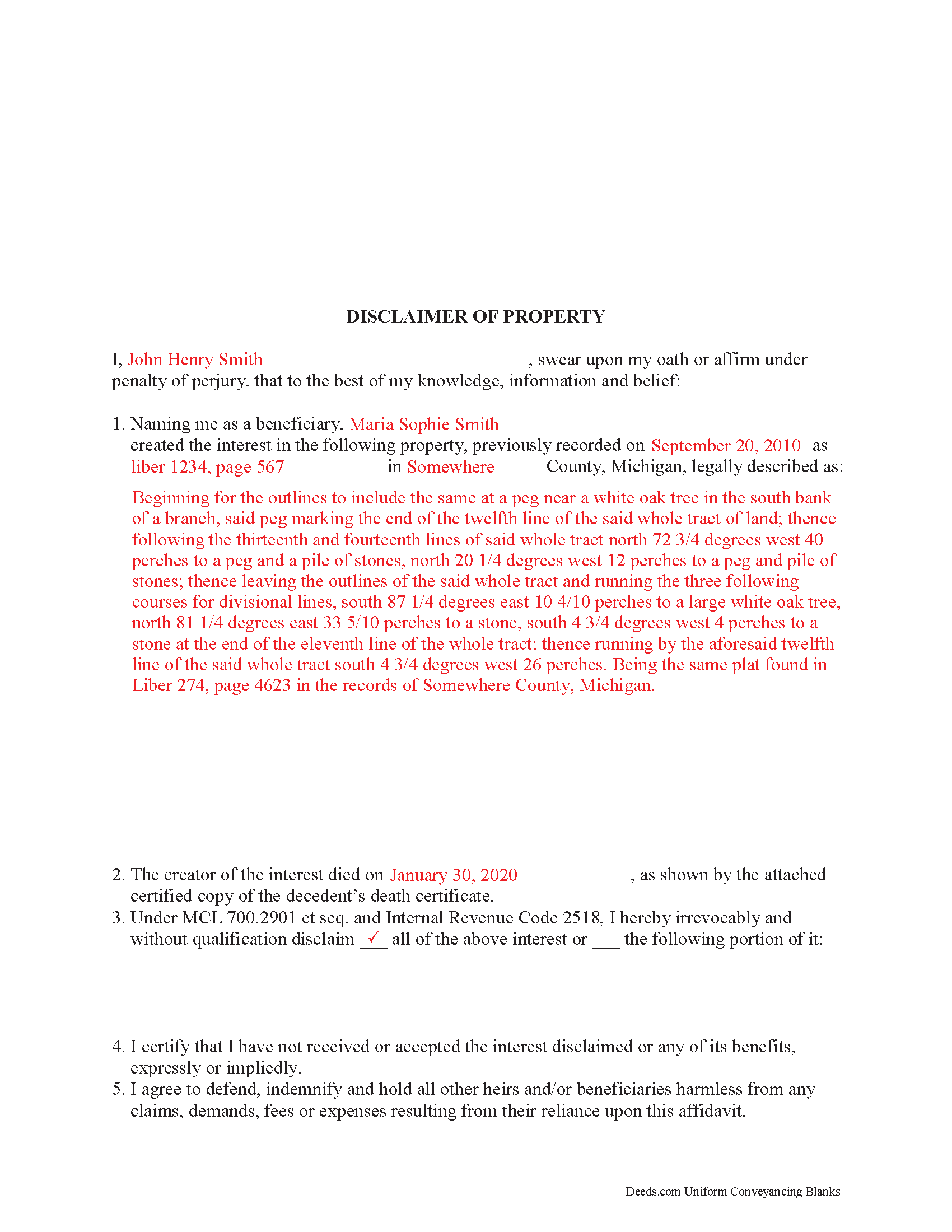

Wexford County Completed Example of the Disclaimer of Interest Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Michigan and Wexford County documents included at no extra charge:

Where to Record Your Documents

Wexford County Register of Deeds

Cadillac, Michigan 49601

Hours: Monday-Friday 8:30am to 5:00pm / Vault until 4:00pm

Phone: (231) 779-9455

Recording Tips for Wexford County:

- Verify all names are spelled correctly before recording

- Ask about their eRecording option for future transactions

- Make copies of your documents before recording - keep originals safe

- Recorded documents become public record - avoid including SSNs

- Recording early in the week helps ensure same-week processing

Cities and Jurisdictions in Wexford County

Properties in any of these areas use Wexford County forms:

- Boon

- Buckley

- Cadillac

- Harrietta

- Manton

- Mesick

Hours, fees, requirements, and more for Wexford County

How do I get my forms?

Forms are available for immediate download after payment. The Wexford County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Wexford County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Wexford County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Wexford County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Wexford County?

Recording fees in Wexford County vary. Contact the recorder's office at (231) 779-9455 for current fees.

Questions answered? Let's get started!

Michigan Disclaimer/Renunciation of Property - Description

A beneficiary of an interest in property in Michigan can disclaim and renounce all or part of a bequeathed interest in, or power over, that property under MCL 700.2902, as long as it has not been accepted through actions that indicate ownership or through a written waiver of the right to disclaim (MCL 700.2910).

The written disclaimer must identify the creator of the interest, provide a description of the disclaimed interest, a declaration of the disclaimer and its extent, and it must be signed by the disclaiming party (MCL 700.2903).

A disclaimer must be delivered in order to be valid, which can be done by mail or in person (MCL700.2906(1)). There is no time limit on this delivery in Michigan statutes, but federal guidelines require that it be received by the transferor, the legal representative, the trustee(s), or the current holder of title within nine months of the transfer (usually the death of the creator). The disclaimer may also be filed with the probate court that would or is going to handle the estate. In the case of real property, it can be recorded with the register of deeds in the county where the property is located (MCL 700.2906(3)).

A disclaimer functions as a non-acceptance rather than as transfer of the interest; it is irrevocable and binding for the disclaimant and those claiming under him or her (MCL 700.2909), so be sure to consult an attorney when in doubt about the drawbacks and benefits of disclaiming inherited property.

(Michigan DOI includes form, guidelines, and completed example)

Important: Your property must be located in Wexford County to use these forms. Documents should be recorded at the office below.

This Disclaimer of Interest meets all recording requirements specific to Wexford County.

Our Promise

The documents you receive here will meet, or exceed, the Wexford County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Wexford County Disclaimer of Interest form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4588 Reviews )

Jo Carol K.

October 17th, 2020

The information/forms/and ease of filling in the blanks provided me with the confidence to "do it myself". Excellent customer service. Thank you for being there.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

laura s.

February 2nd, 2023

thanks for providing my with exactly what I needed, almost instantly!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

LINDA C.

June 29th, 2020

EASY, FAST, AND CONVENIENT.

Thank you!

Biinah B.

December 24th, 2020

Wished I had known about this site earlier. Just what we needed. Get tool to get lip to date legal help.

Thank you for your feedback. We really appreciate it. Have a great day!

Brady D.

October 17th, 2023

I would give you a zero if possible. The webpage is as cumbersome has all get out. I am on web pages all day every day and this one is by far the hardest one to get around in.

Thank you for sharing your feedback regarding your experience with our website. We are truly sorry to hear that navigating our site proved to be a challenge for you. Your insights are invaluable, and we will definitely take your comments into consideration as we work towards improving our online platform.

We wish you all the best in your future endeavors.

Doug C.

November 20th, 2020

Great Job guys! I would not even have thought to look for this service. The county recorder's office and kiosks are all closed because of covid. I was directed to you because of a referral on the county site. I wish I had known you had forms available as well. I searched for a day to find the appropriate form.

Thank you for your feedback. We really appreciate it. Have a great day!

Jennifer B.

February 8th, 2019

I didn't care for it because I was having to do other things in between filling it out and all of a sudden it would not allow me back in it to make changes. Luckily I had saved it and then had to do FILL/SIGN option which looks ugly but that was the only way I could add what I needed.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Martin P.

April 6th, 2019

The DEEDs website is very easy to navigate and find the required documents. I have not yet had an opportunity to review the documents I purchased and downloaded. That is the reason I have assigned a rating of four stars. I fully hope that can raise my rating to five stars after I've used those documents.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Cecelia S.

July 31st, 2021

I was looking for a copy of my deed and was able to complete the request and get copy fast.

Thank you!

FLORIN D.

December 3rd, 2020

Excellent service, will use in the future and will recommend to anyone that needs to record documents.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Doreen A.

February 13th, 2024

Easy to navigate Efficient Service

Your kind words warm our hearts. Thank you for sharing your experience!

Darren G.

December 10th, 2021

Your beneficiary deed sample contains a error of the LDPS designation. I copied the designation of LPDS instead of the correct designation

Thank you for your feedback. We really appreciate it. Have a great day!

Burr A.

November 7th, 2020

So far so good. Prompt and responsive. Thank you.

Thank you!

Margaret D.

October 7th, 2020

They deliver!

Thank you!

Janette K.

May 17th, 2019

I ordered a Transfer of Deed on Death document. It was easy to fill in, came with a useful guide and was customized to my county/state. It got the job done and was well worth the money!

Thank you for your feedback. We really appreciate it. Have a great day!