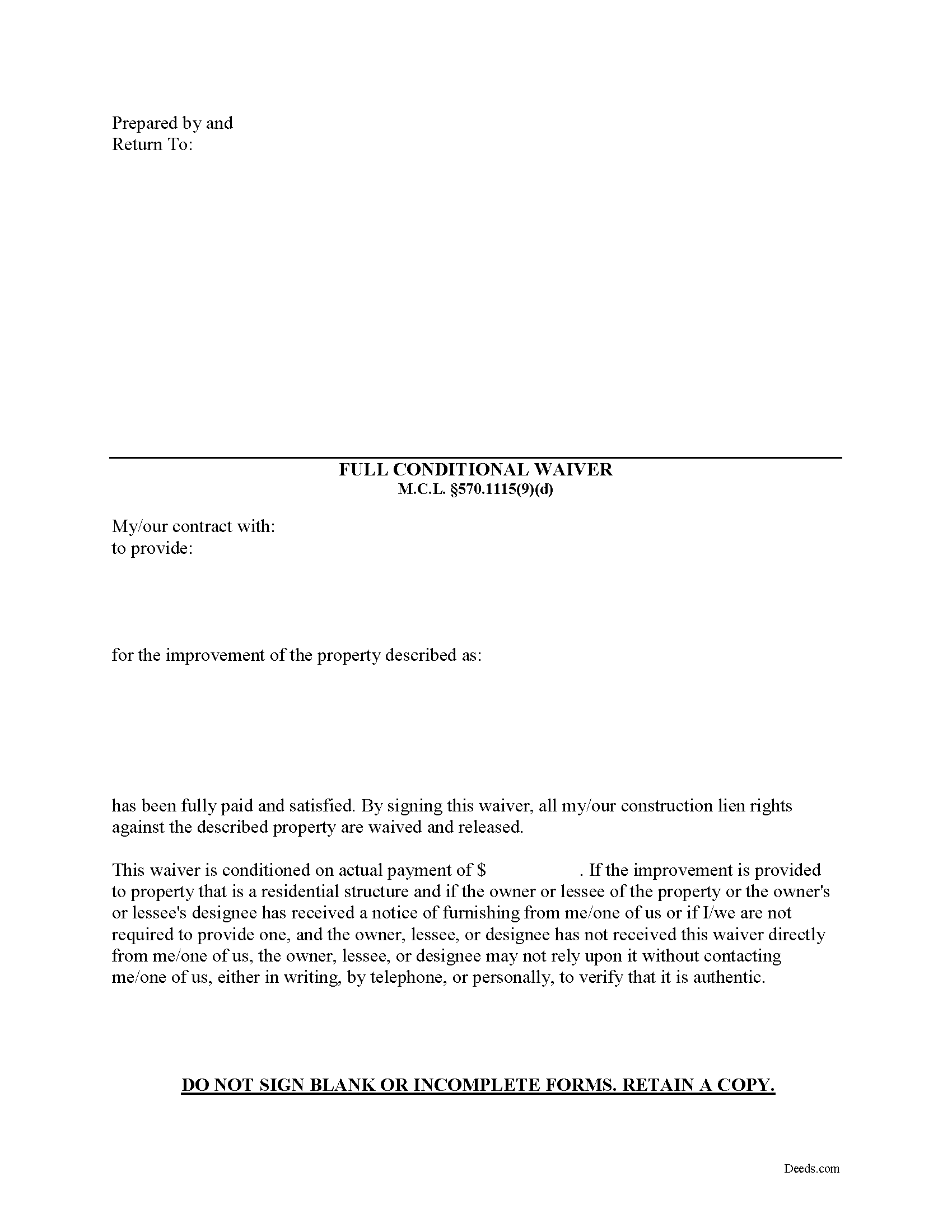

Oakland County Full Conditional Waiver of Lien Form

Oakland County Full Conditional Waiver of Lien Form

Fill in the blank form formatted to comply with all recording and content requirements.

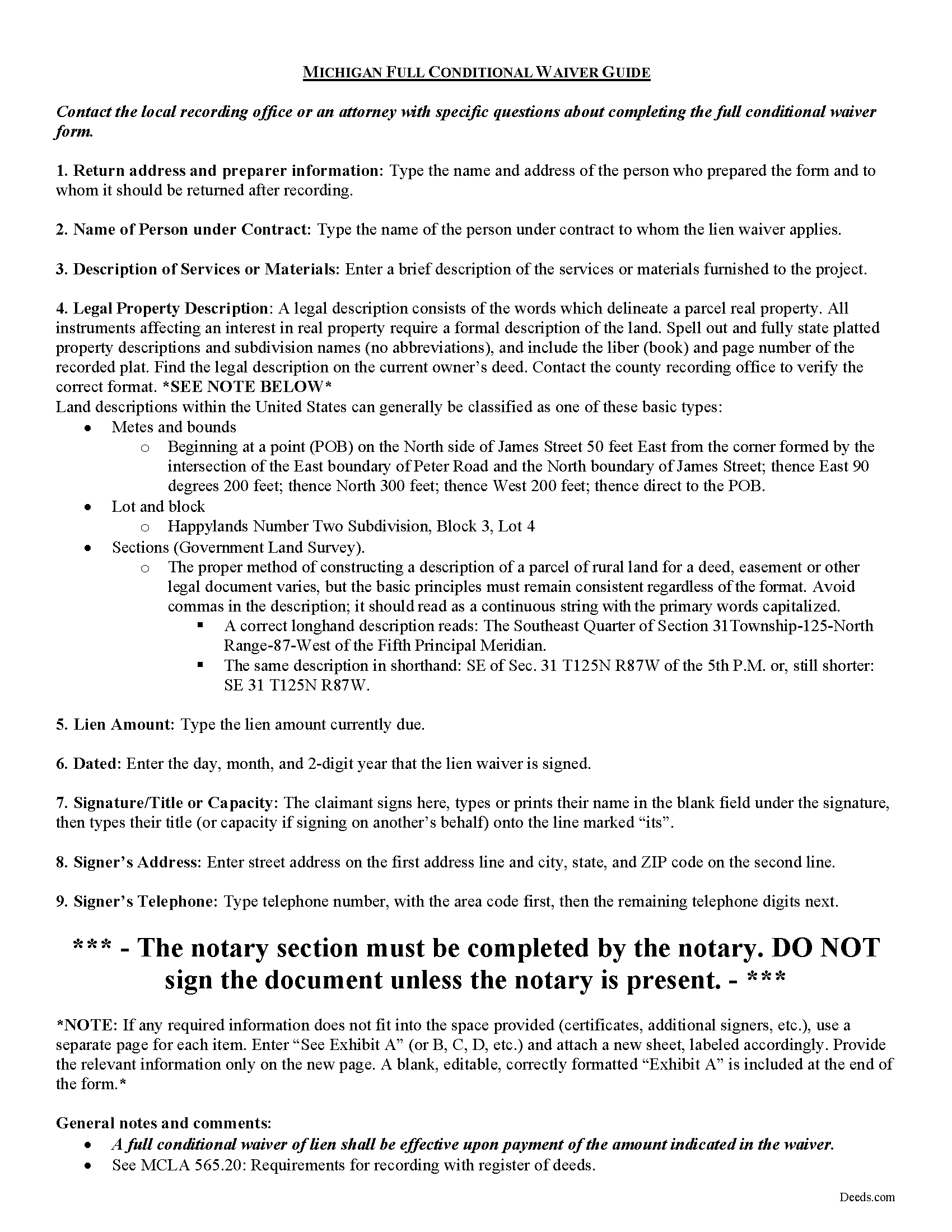

Oakland County Full Conditional Waiver of Lien Guide

Line by line guide explaining every blank on the form.

Oakland County

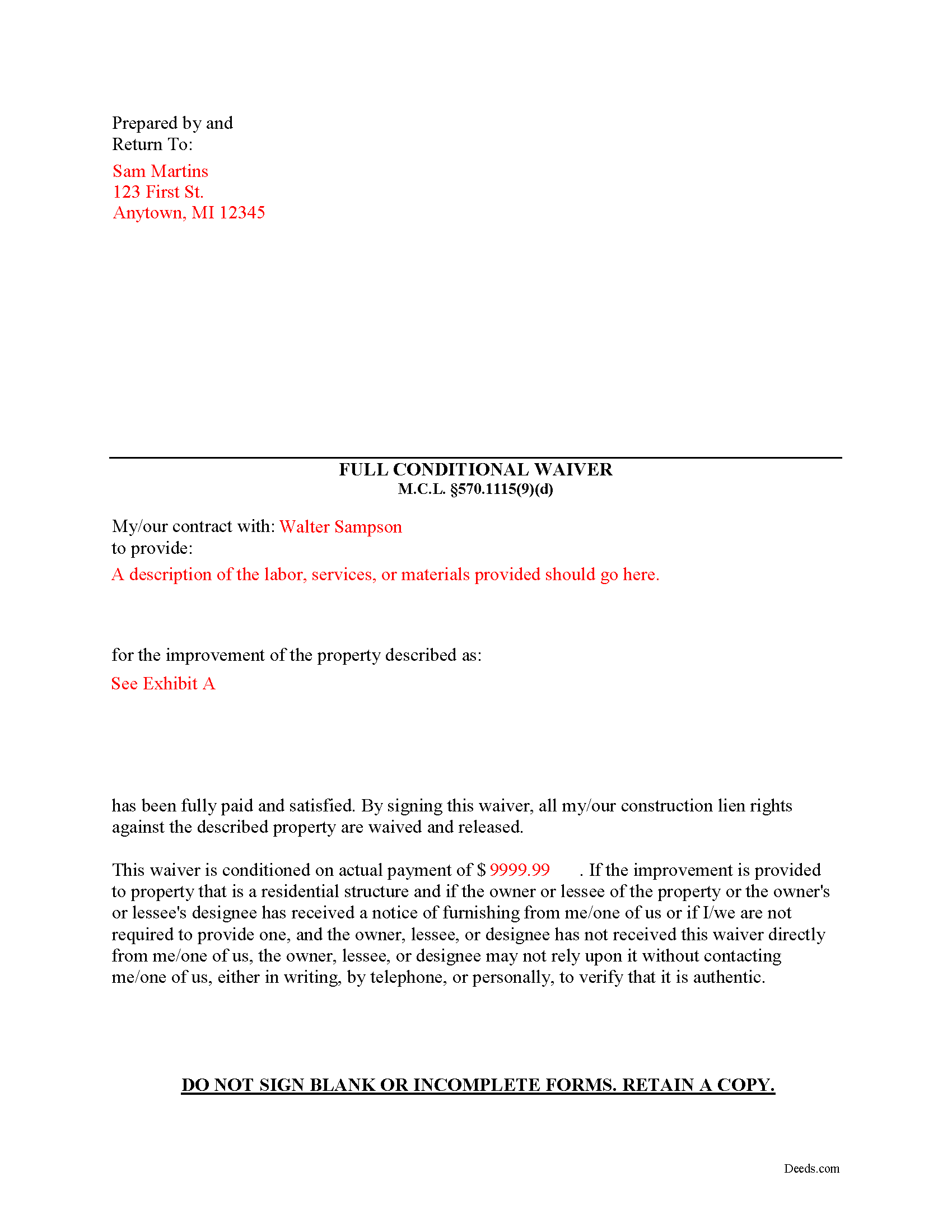

Completed Example of the Full Conditional Waiver of Lien Document

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Michigan and Oakland County documents included at no extra charge:

Where to Record Your Documents

Oakland Register of Deeds

Pontiac, Michigan 48341

Hours: 8:00am to 4:30pm M-F

Phone: (248) 858-0597

Recording Tips for Oakland County:

- Verify all names are spelled correctly before recording

- Leave recording info boxes blank - the office fills these

- Make copies of your documents before recording - keep originals safe

- Avoid the last business day of the month when possible

- Mornings typically have shorter wait times than afternoons

Cities and Jurisdictions in Oakland County

Properties in any of these areas use Oakland County forms:

- Auburn Hills

- Berkley

- Birmingham

- Bloomfield Hills

- Clarkston

- Clawson

- Commerce Township

- Davisburg

- Drayton Plains

- Farmington

- Ferndale

- Franklin

- Hazel Park

- Highland

- Holly

- Huntington Woods

- Keego Harbor

- Lake Orion

- Lakeville

- Leonard

- Madison Heights

- Milford

- New Hudson

- Novi

- Oak Park

- Oakland

- Ortonville

- Oxford

- Pleasant Ridge

- Pontiac

- Rochester

- Royal Oak

- South Lyon

- Southfield

- Troy

- Union Lake

- Walled Lake

- Waterford

- West Bloomfield

- White Lake

- Wixom

Hours, fees, requirements, and more for Oakland County

How do I get my forms?

Forms are available for immediate download after payment. The Oakland County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Oakland County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Oakland County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Oakland County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Oakland County?

Recording fees in Oakland County vary. Contact the recorder's office at (248) 858-0597 for current fees.

Questions answered? Let's get started!

During the construction process, a property owner (or his or her lessee) may ask the contractor for a mechanic's lien waiver in exchange for a full or partial payment.

Michigan defines four permissible types of lien waivers. These include: (1) Partial Unconditional Waiver, (2) Partial Conditional Waiver, (3), Full Unconditional Waiver, and (4) Full Conditional Waiver. M.C.L. 570.1115(9).

Use a full conditional waiver of lien when the claimant receives full payment for his or her contract from the owner, lessee, or designee. M.C.L. 570.1115(4). A waiver of a lien under this section takes effect when a person makes payment relying on the waiver, unless at the time the payment was made, the person making the payment had written notice that the payment or consideration for the waiver has failed (i.e., the check bounced at the bank). M.C.L. 570.1115(6).

Lien waiver forms must be in writing and must comply with Michigan law to be valid. Include the names of the contractor and the property owner, and identify the property and dates covered by the recorded lien.

Lien waivers can be confusing and issuing the wrong type of waiver (or issuing one too early) can result in dire consequences for mechanic's liens. Contact an attorney with questions about waivers or any other issues related to liens in Michigan.

Important: Your property must be located in Oakland County to use these forms. Documents should be recorded at the office below.

This Full Conditional Waiver of Lien meets all recording requirements specific to Oakland County.

Our Promise

The documents you receive here will meet, or exceed, the Oakland County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Oakland County Full Conditional Waiver of Lien form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4578 Reviews )

alex b.

February 16th, 2021

I appreciate the very quick response that I received and I am very impressed with the access that you provide to records. I'm still in the process of trying to find out what's there but that will take a bit of time. All in all, you are to be commended for a first class operation.

Thank you!

Deirdre M.

July 11th, 2022

Thank for you guidance to amend & correct & recover my home with evidence you provide in Dead Fraud. I'll keep you updated.

Thank you!

Abigail Frances B.

December 28th, 2018

Thanks for the easy download, clear instructions, good price- I'm looking forward to filling them out.

Thank you for your feedback. We really appreciate it. Have a great day!

Gladys B.

January 23rd, 2019

Good and fast service. Thank you.

Thank you for your feedback. We really appreciate it. Have a great day!

Darren D.

December 29th, 2019

Easy-peasy to find, download and use the forms!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

diana c.

February 24th, 2022

quick and easy, thankyou

Thank you!

Margaret P.

May 15th, 2025

EXCELLENT WEBSITE AND SERVICE, HIGHLY RECOMMENDED.

Your feedback is greatly appreciated. Thank you for taking the time to share your experience!

Charles S.

September 15th, 2022

I was very please with the deed, deed of trust and the deed of trust note. It save me a lot of preparation time.

Thank you!

Jeff H.

November 7th, 2020

Fast, inexpensive, great customer service. I will definitely use them a gain.

Thank you!

Thomas G.

March 16th, 2020

A few parts are confusing'.Like sending Tax statements to WHO ?/ The rest is simple I hope.Have not tried to record yet

Thank you!

PEGGY D.

April 1st, 2022

Very easy to find what I needed. Really liked the instructions included with the forms and also the suggestion of other forms that I might need.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Tom D.

May 4th, 2019

I have one suggestion and couple of question I would think that most TOD's would be from married couples. It would be real helpful to have a example of the I(we) block for married couples. Why would I check or not check the "property is registered (torrents)" Do I need a notarized signature of the Grantee

Thank you for your feedback. We really appreciate it. Have a great day!

harriet l.

June 21st, 2019

Worked very smoothly and got the job done

Thank you for your feedback. We really appreciate it. Have a great day!

Sidney L.

July 22nd, 2022

Not a fan. Filling in the WI RE transfer return was simple enough. However, it downloaded as a DOR file and I can't find a program to open it. So, I have no way to print the form to complete the process.

Thank you for your feedback. We really appreciate it. Have a great day!

Will C.

April 8th, 2019

I was very happy with my interaction. The county didn't supply the book and page which was what I needed. The tech refunded my money since I didn't get the info I needed. I will use Deeds.com again.

Thank you for your feedback. We really appreciate it. Have a great day!