Pennington County Affidavit of Trustee for Non-testamentary Trust Form

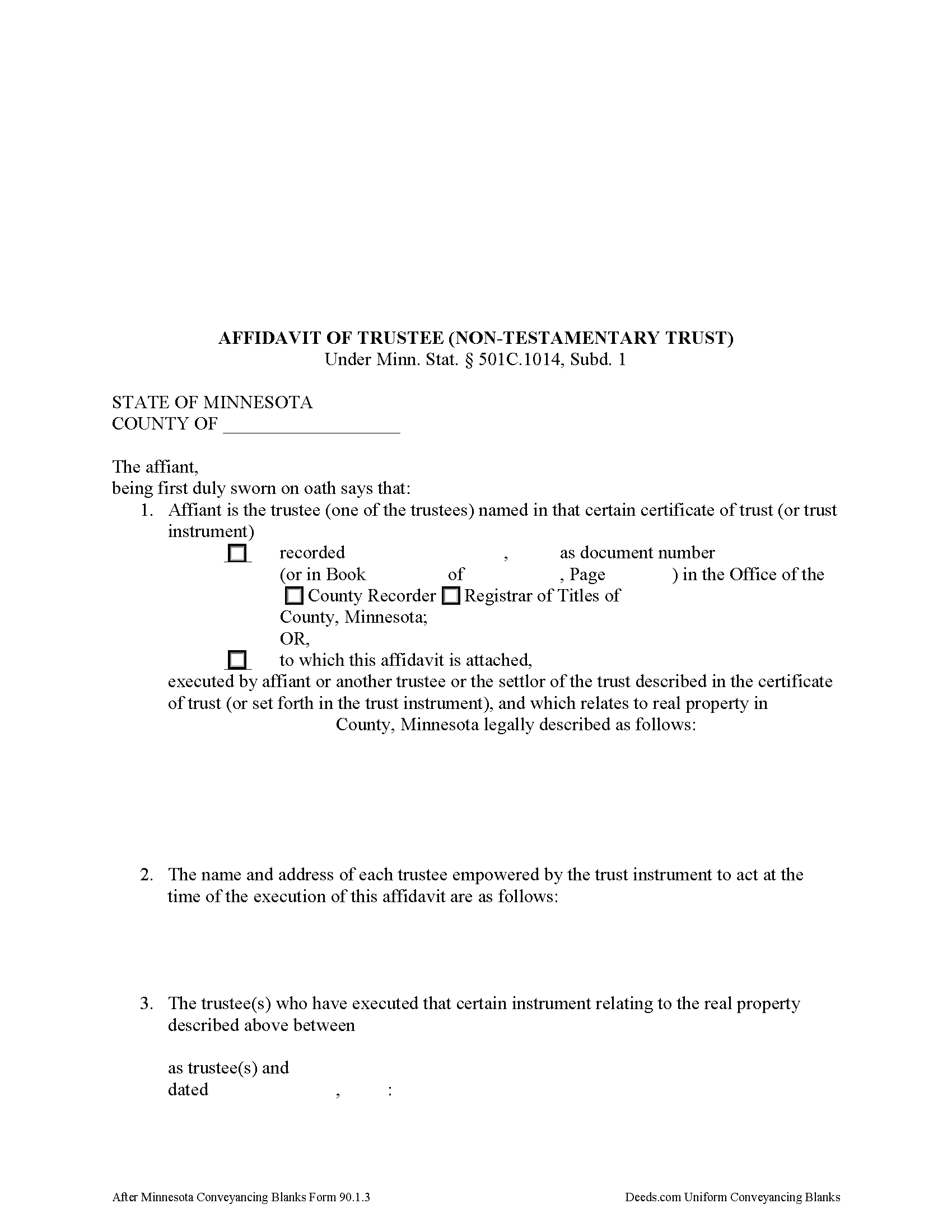

Pennington County Affidavit of Trustee Form

Fill in the blank form formatted to comply with all recording and content requirements.

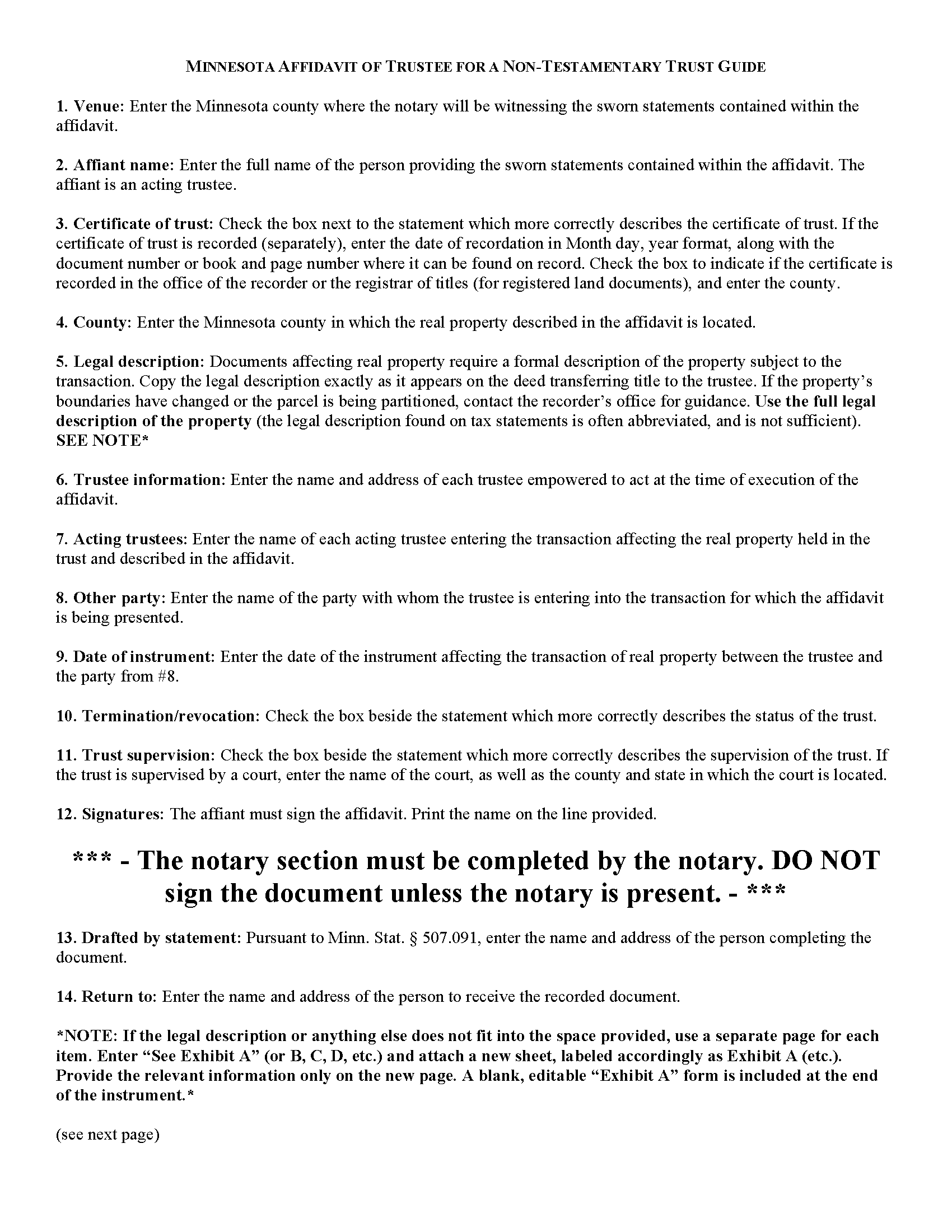

Pennington County Affidavit of Trustee Guide

Line by line guide explaining every blank on the form.

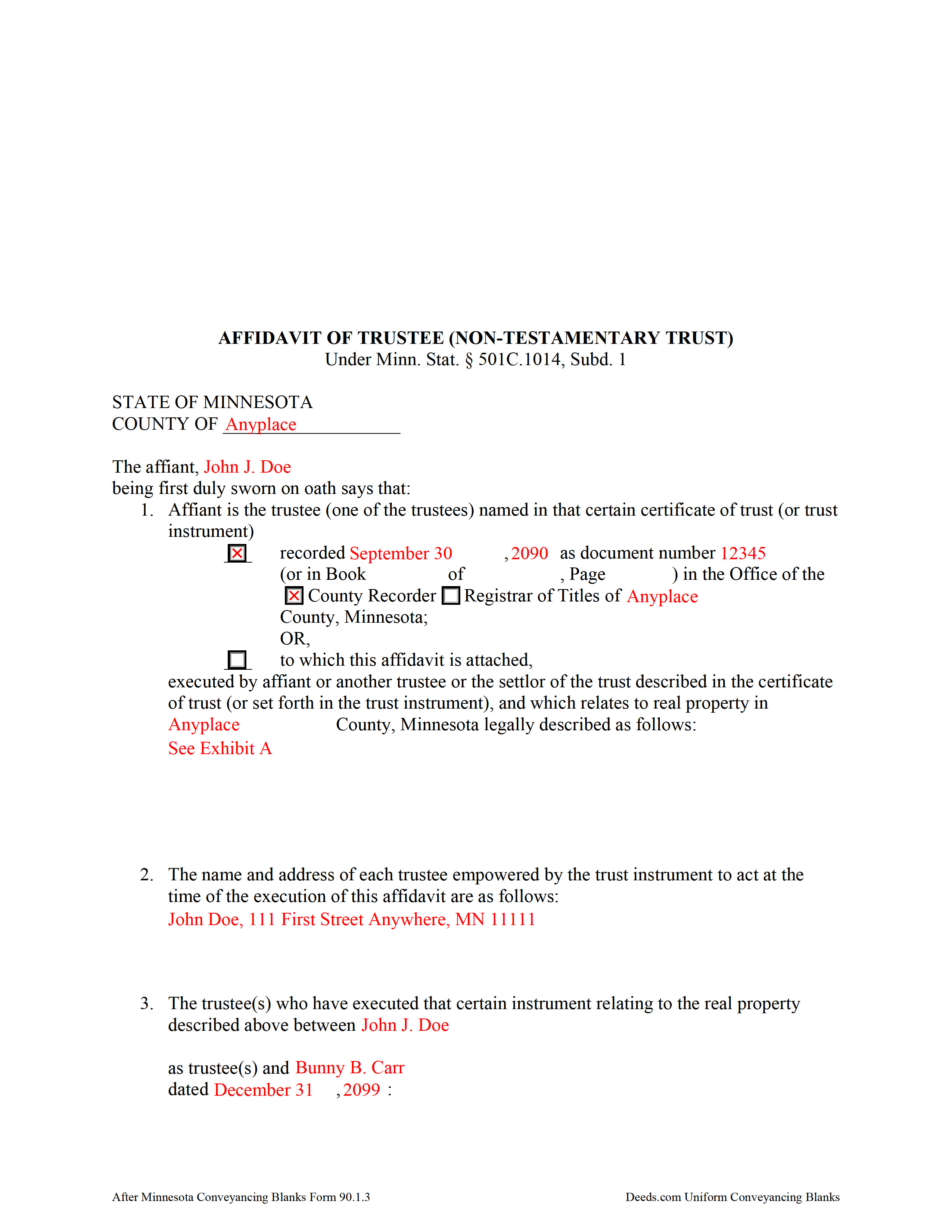

Pennington County Completed Example of the Affidavit of Trustee Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Minnesota and Pennington County documents included at no extra charge:

Where to Record Your Documents

Pennington County Recorder

Thief River Falls, Minnesota 56701

Hours: 8:30 to 4:30 M-F

Phone: (218) 683-7027

Recording Tips for Pennington County:

- Double-check legal descriptions match your existing deed

- Request a receipt showing your recording numbers

- If mailing documents, use certified mail with return receipt

Cities and Jurisdictions in Pennington County

Properties in any of these areas use Pennington County forms:

- Goodridge

- Saint Hilaire

- Thief River Falls

Hours, fees, requirements, and more for Pennington County

How do I get my forms?

Forms are available for immediate download after payment. The Pennington County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Pennington County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Pennington County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Pennington County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Pennington County?

Recording fees in Pennington County vary. Contact the recorder's office at (218) 683-7027 for current fees.

Questions answered? Let's get started!

An affidavit of trustee contains sworn statements made by a trustee and relating to a specific transaction involving real property contained by the trust. The affidavit of trustee for a non-testamentary trust is codified at Minn. Stat. 501C.1014, Subd. 1.

A non-testamentary trust, also called an inter vivos or living trust, is a trust that takes effect during a settlor's lifetime. A settlor is "a person, including a testator, who creates or contributes property to a trust" (Minn. Stat. 501C.0103(o)). The affidavit of trustee for a non-testamentary trust references a recorded certificate of trust, including the recording date and location, or states that the affidavit is attached to the certificate, and confirms that the certificate was executed by the affiant, another trustee, or the settlor of the trust described in the certificate and relating to the specific parcel of land described in the affidavit.

The affidavit must contain a full legal description of the property subject to the transaction for which the affidavit is presented. It references the trustee and other party involved in the transaction, and offers proof that the required number of trustees are entering the transaction and that those trustees are authorized under the trust instrument to act on the title to the real property held in the trust, and that there are no trust amendments that limit the power of the trustees.

The affiant confirms that the trust has not terminated and that the trust instrument has not been revoked, or that, if the trust has terminated, the transaction involving the real property is made pursuant to the provisions of the trust. If the trust is under court supervision, the affidavit provides the name and location of the court.

The affidavit of trustee must be signed by an acting trustee in the presence of a notary public and may be recorded separately or as an attachment to a certificate of trust under Minn. Stat. 501C.1013. Submit the instrument for recording with the county recorder, or registrar of titles in the case of registered land, in the county in which the real property described in the affidavit is situated.

Consult a lawyer with questions regarding affidavits of trustee or Minnesota trust law in general, as each situation is unique and trust law can quickly become complex.

(Minnesota AOT Non-testamentary Trust Package includes form, guidelines, and completed example)

Important: Your property must be located in Pennington County to use these forms. Documents should be recorded at the office below.

This Affidavit of Trustee for Non-testamentary Trust meets all recording requirements specific to Pennington County.

Our Promise

The documents you receive here will meet, or exceed, the Pennington County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Pennington County Affidavit of Trustee for Non-testamentary Trust form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4582 Reviews )

Laura B.

May 5th, 2020

Quick and easy! Took the hassle out of trying to locate information during this quarantine.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Cathy P.

March 18th, 2021

I purchased the La St. Tammany Parish Quit Claim Deed as a gift for a friend. Currently waiting on a lawyer to draft his second version of what a La Quit Claim should look like. I have downloaded this St. Tammany La packet for simplicity and double protection for my friend. So far, I really like what I see from Deeds.com, short and to the point. It's truly a breath of fresh air. Thank you so much. Layperson Cathy for a friend.

Thank you for your feedback. We really appreciate it. Have a great day!

Karen P.

March 19th, 2021

Very easy to use.

Thank you!

Celeste F.

November 24th, 2020

Great experience. No hassle. It kept me out of a government office.

Thank you for your feedback. We really appreciate it. Have a great day!

L B W.

January 22nd, 2021

Bottom line - it was certainly worth the $21 (+-?) I paid for the form and instructions, etc. Admittedly the form is a little inflexible in terms of editing for readability but I understand that offering greater flexibility would likely make theft more likely. So I'm happy with what I got. One suggestion - add more info about what's required in the "Source of Title" section.

Thank you for your feedback. We really appreciate it. Have a great day!

davidjrhall e.

March 13th, 2023

So far its been good. The David Jr Hall Estate Trust is a Business Blind Trust and we are looking forward to working with your platform and seeing how far we can go.

Thank you!

David R.

January 11th, 2019

Great source of all required legal documents and supplements.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

David J.

November 12th, 2019

Excellent documents, downloaded quick, completed and printed with no problems. Thank you

Thank you!

David K.

March 25th, 2019

Worked Great! First time go at the courthouse

Thank you!

Daniel S.

August 28th, 2019

Fast. Easy. More than I expected. Hope it all works with MD bureaucrats.

Thank you for your feedback. We really appreciate it. Have a great day!

Grace V.

February 29th, 2020

Easy to use

Thank you!

ieva r.

March 14th, 2019

Excellent! I was worried because I saw some negative reviews online but I really needed an e-recording company and they completed everything perfectly. I will most definitely recommend them and use them again in the future. All the staff was super nice and very helpful.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Julie S.

April 3rd, 2020

My county clerks office referred me to this website and I am so glad she did. This site is very easy to use, they do NOT try to sell you other things you don't need (or want) nor do they make you sign up for anything. Pick what you need and whalaa - there for you in seconds. Thank you so much - will use again should the need arise. JS

Thank you for your feedback. We really appreciate it. Have a great day!

Veronica F.

April 24th, 2019

Im so happy with this site. It was quick and painless and worth the money hassle free if I ever need to settle another deed I will be back.

Thank you Veronica, we really appreciate your feedback.

Glenda W.

April 22nd, 2021

It is a very helpful and awesome website. I was so glad to hear about it. It is very convenient and saves money as well. I'm sure I will be using it again in the future. Thumbs up to deeds.com!

Thank you for your feedback. We really appreciate it. Have a great day!