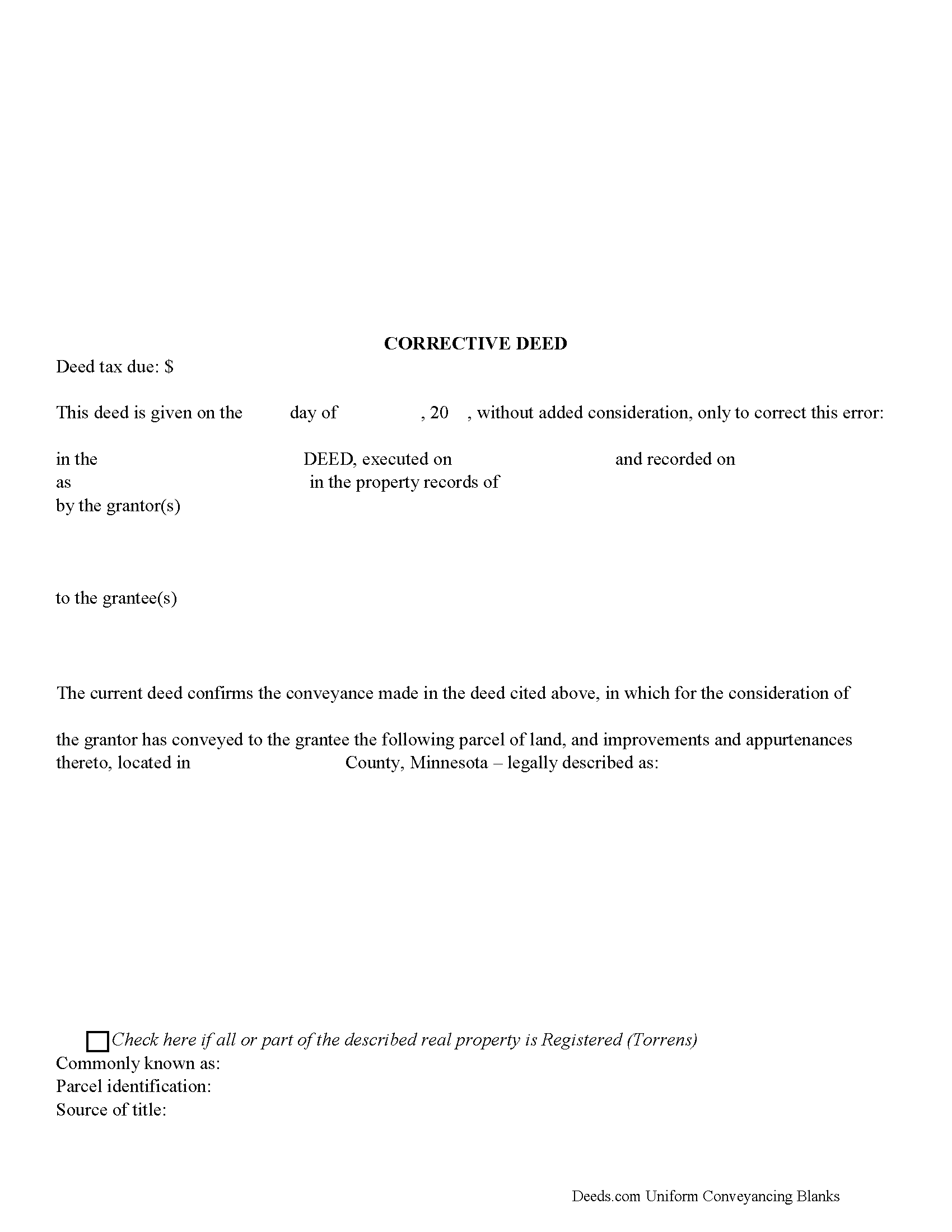

Norman County Correction Deed Form

Norman County Corrective Deed Form

Fill in the blank form formatted to comply with all recording and content requirements.

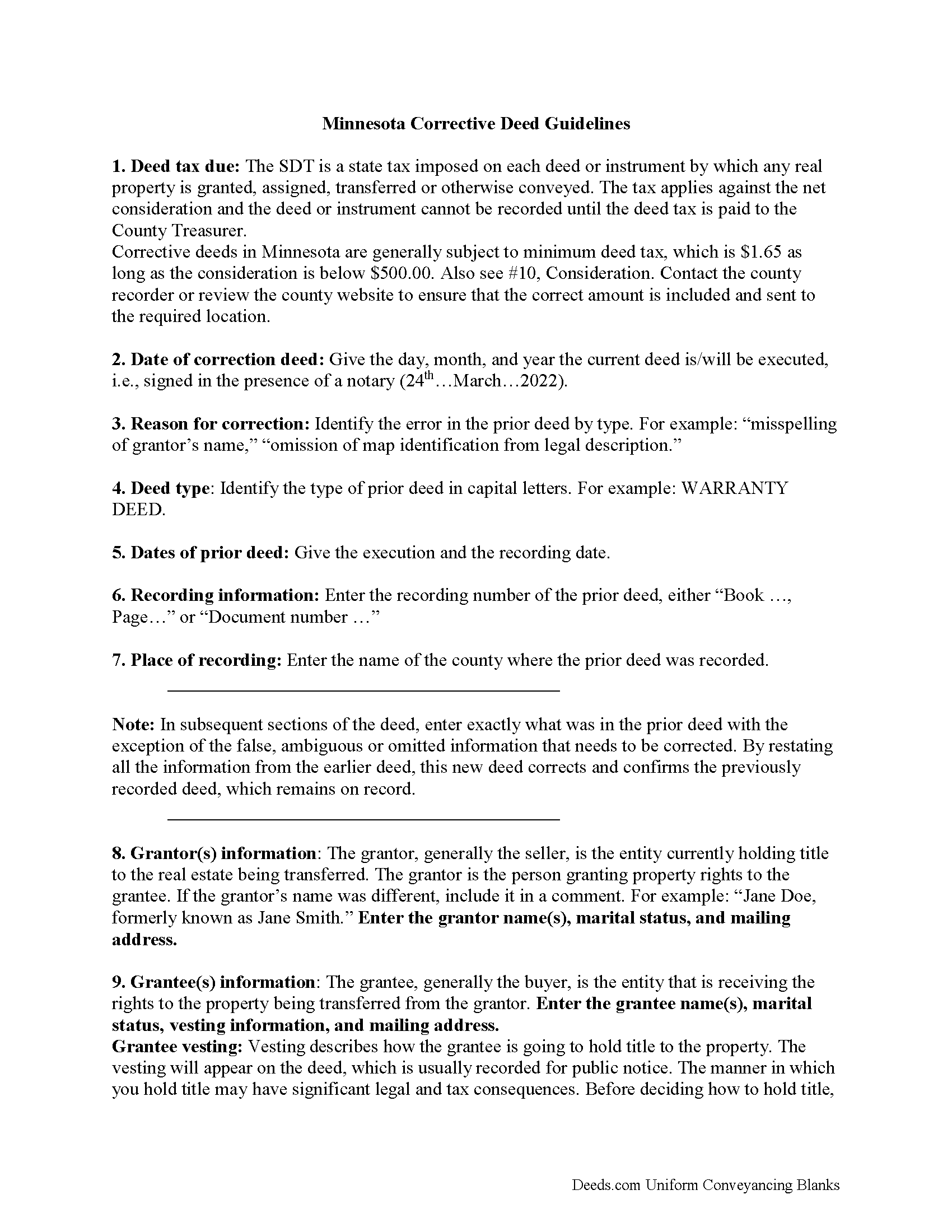

Norman County Correction Deed Guide

Line by line guide explaining every blank on the form.

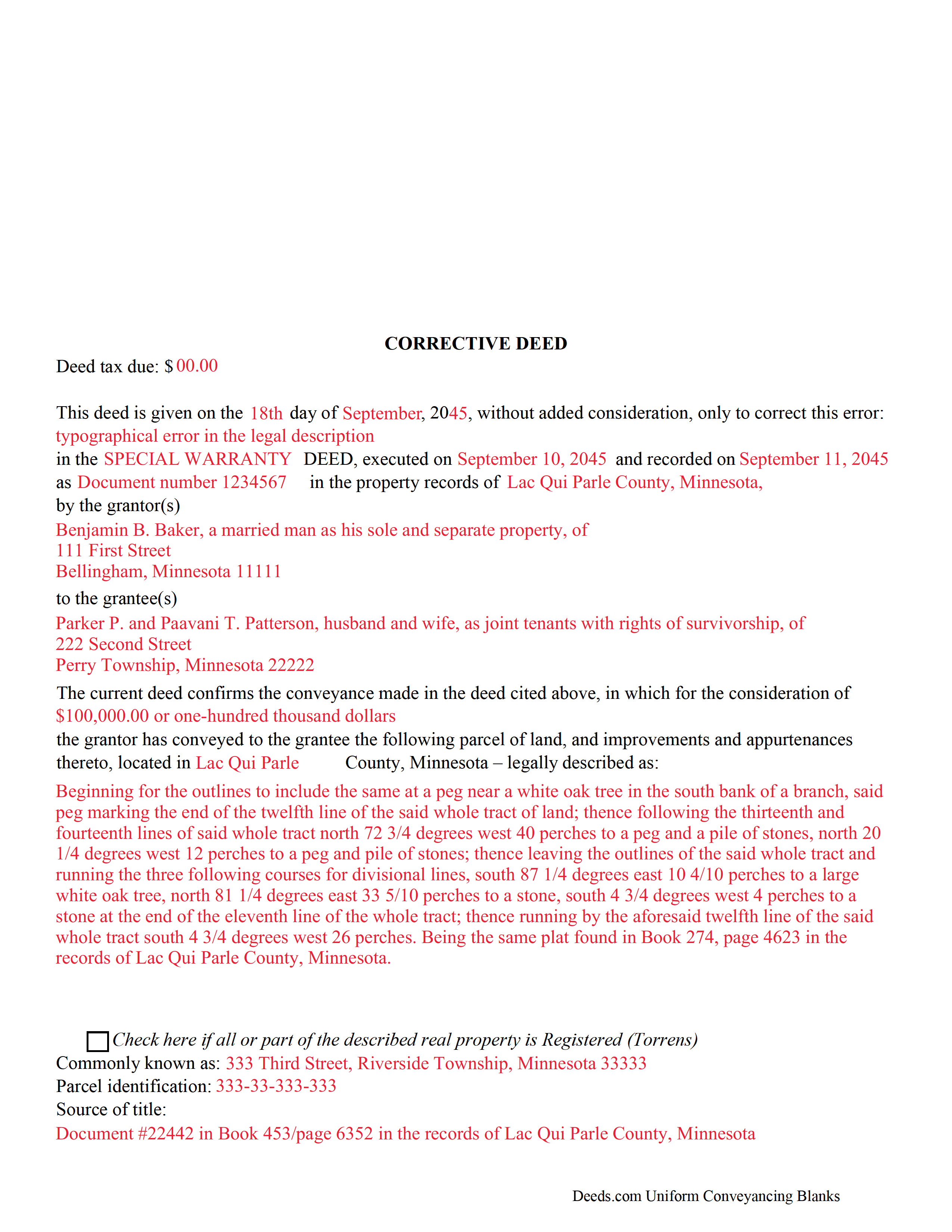

Norman County Completed Example of the Corrective Deed Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Minnesota and Norman County documents included at no extra charge:

Where to Record Your Documents

Norman County Recorder

Ada, Minnesota 56510-0146

Hours: 8:30 to 4:30 M-F

Phone: (218) 784-5481

Recording Tips for Norman County:

- Bring your driver's license or state-issued photo ID

- White-out or correction fluid may cause rejection

- Leave recording info boxes blank - the office fills these

- Both spouses typically need to sign if property is jointly owned

- Make copies of your documents before recording - keep originals safe

Cities and Jurisdictions in Norman County

Properties in any of these areas use Norman County forms:

- Ada

- Borup

- Flom

- Gary

- Halstad

- Hendrum

- Perley

- Shelly

- Twin Valley

Hours, fees, requirements, and more for Norman County

How do I get my forms?

Forms are available for immediate download after payment. The Norman County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Norman County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Norman County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Norman County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Norman County?

Recording fees in Norman County vary. Contact the recorder's office at (218) 784-5481 for current fees.

Questions answered? Let's get started!

Use the corrective deed to amend a previously recorded deed of conveyance with an error that could affect the title.

In Minnesota, there are two options for correcting a deed, re-recording the corrected original deed and recording a newly drafted corrective deed. When re-recording the original deed, make corrections directly on the document, but keep in mind that legal documents cannot be altered with strikeout, whiteout, line through or correction tape. Check with the county's recording office before choosing this option to verify local requirements regarding title pages, required attachments and how to handle the correcting itself.

A re-recorded document must be re-signed by the original parties and re-acknowledged and contain a correction statement that gives the reason for the re-recording and refers to the prior recording. Keep in mind that adding extra pages for the various required statements and the signatures will increase the overall page count of the re-recording, which may affect recording fees.

The easiest and cleanest option is to record a new corrective deed, which mostly restates the prior deed, but also contains the reason for the correction, reference to the prior deed by date, recording number and title, as well as the actual corrected information. By restating all the information from the earlier deed, the new deed corrects and confirms the previously recorded deed, which remains on record.

Take advantage of the statutorily defined right to have a corrective instrument inspected by the county attorney, who, "on finding that such deed is given for the purpose of correcting a defect in the title, or on account of a technical error in a prior conveyance," will certify those findings so that the deed can be recorded even if "there are unpaid taxes or assessments upon such land." (Minn. Stat. 272.15) As far as deed tax is concerned, corrective deeds in Minnesota are generally subject to minimum deed tax. Contact the county recorder or review the county website to ensure that the correct amount is included and sent to the required location.

(Minnesota CD Package includes form, guidelines, and completed example)

Important: Your property must be located in Norman County to use these forms. Documents should be recorded at the office below.

This Correction Deed meets all recording requirements specific to Norman County.

Our Promise

The documents you receive here will meet, or exceed, the Norman County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Norman County Correction Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4582 Reviews )

Carole L.

December 30th, 2018

Perfectly easy, perfectly complete! I had no problems with downloading these forms. I have been a paralegal for 20 years and came up on a situation where I was not familiar with the forms. Deeds.com saved my life and allowed me to get the documents done and done right. I will keep deeds.com on my list of favorites!

Thank you Carole. Glad we could help. We appreciate you taking the time to leave your review.

Michael K.

April 21st, 2020

Service seems smooth. I just wonder what the turn around time on recording is (I need proof of recordation).

Thank you!

Justin F.

March 2nd, 2022

Provided the template and guide I was looking for. Reasonable pricing,

Thank you!

Andrew M.

March 20th, 2021

Very easy to find the Quitclaim Deed form I needed. It was correct format and was accepted by my bank.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Ken W.

February 3rd, 2019

Everything perfect, good price. Completely satisfied

Thank you!

steven l.

July 29th, 2020

As a first time user and not having knowledge of how your site worked it was awkward to upload a file and not know what to do next. I found out there is nothing to do next but that after some time looking for a submit button or some kind of confirmation that I was doing the right thing. Ended up being very easy, just wasted time trying to figure out what to do when there was nothing left to do.

Thank you!

Anne S.

June 13th, 2019

Responsive and honest. They were unable to obtain records for me, no fault of theirs, and immediately let me know and credited my account. I give Deeds dot com five stars and would come back. Thank you.

Thank you for your feedback. We really appreciate it. Have a great day!

Sherri S.

July 3rd, 2019

Appreciate your diligent assistance.

Thank you!

Lynnellen S.

May 9th, 2019

My rating is not a 5. Although it had good instructions, it would NOT print the whole document no matter how many times I inputted the names. I ended up writing it in to complete. I also recommend putting it on one page. I had to pay an additional fees per page and if I had to notarize it, why did I have to find 2 witnesses as well. I deserve a discount for the time I spent repeatedly putting the same data. I was trying to save money since Im on social security only. It didnt. Get it to work correctly

Thank you for your feedback Lynnellen. Sorry to hear of your struggle with our document. We've gone ahead and refunded your payment. Hope you have a wonderful day.

Thomas W.

July 14th, 2020

Very quick and responsive. Faster than finding out by mail if you've done something incorrectly. Very satisfied with offerings and service.

Thank you for your feedback. We really appreciate it. Have a great day!

Sheri S.

May 25th, 2024

So happy to have found this site. It’s just what I was looking for.

We are grateful for your feedback and looking forward to serving you again. Thank you!

Sarah A.

August 3rd, 2020

Uploading the document was simple, and it was recorded much faster than I thought! Deeds.com makes the process incredibly easy.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Rhonda D.

February 24th, 2021

The boxes do not allow you to add the entire information. The after recording return to box would not let me add a zipcode.

Thanks for the feedback Rhonda, we’ll take a look at that input field.

David S.

April 6th, 2024

This site was recommended by my County's Clerks office website. Let me tell you when I received my specific State and County's Quit Claim Deed forms from Deeds.com, every conceivable form that could be needed in addition to the full instructions, and a sample filled out form, I was impressed (five stars) and made things so easy for me to feel confident in my legal activity on a land transaction.

Thank you for your positive words! We’re thrilled to hear about your experience.

Barbara M.

August 2nd, 2020

Easy to do.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!