Wilkin County Quitclaim Deed from Individual to Joint Tenants Form

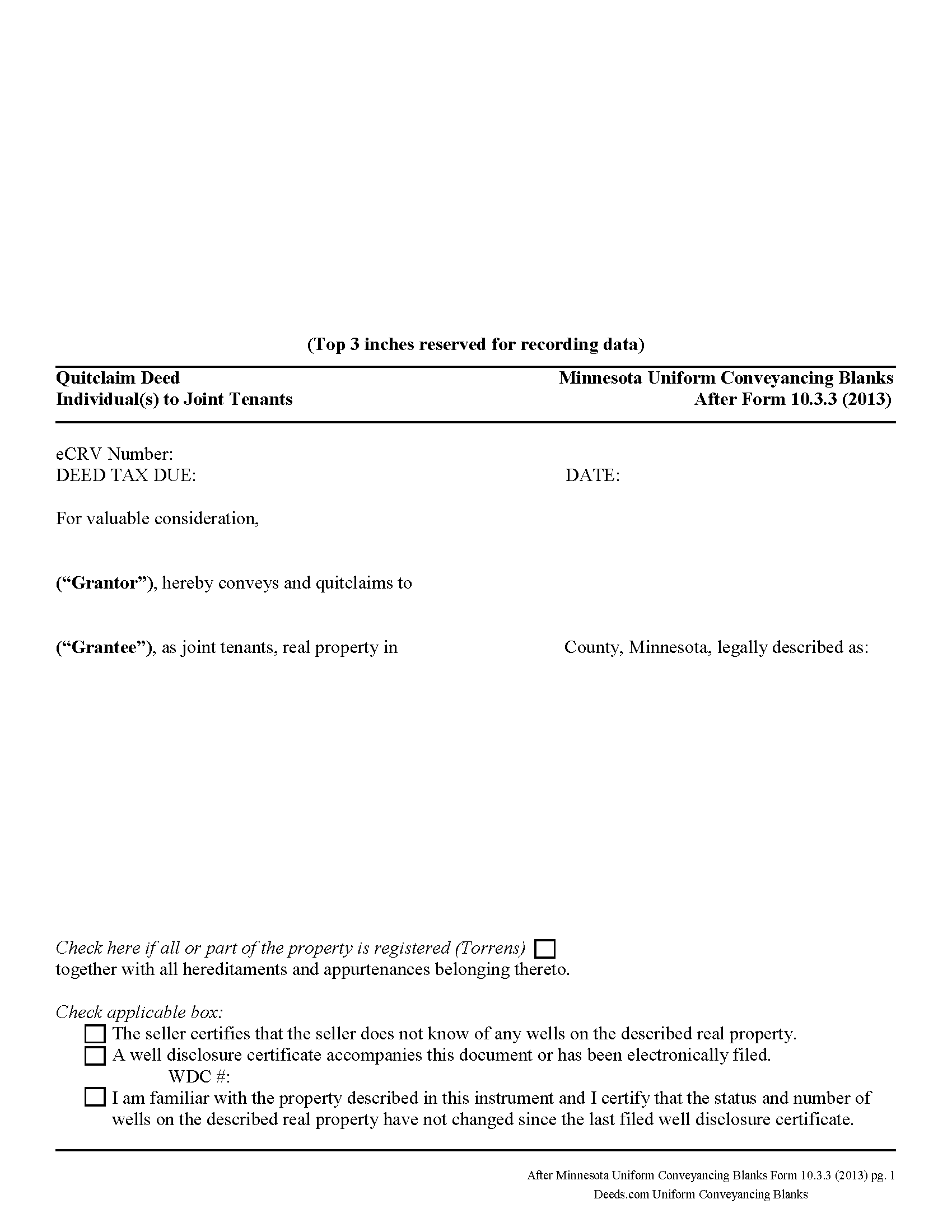

Wilkin County Quitclaim Deed from Individual to Joint Tenants Form

Fill in the blank Quitclaim Deed from Individual to Joint Tenants form formatted to comply with all Minnesota recording and content requirements.

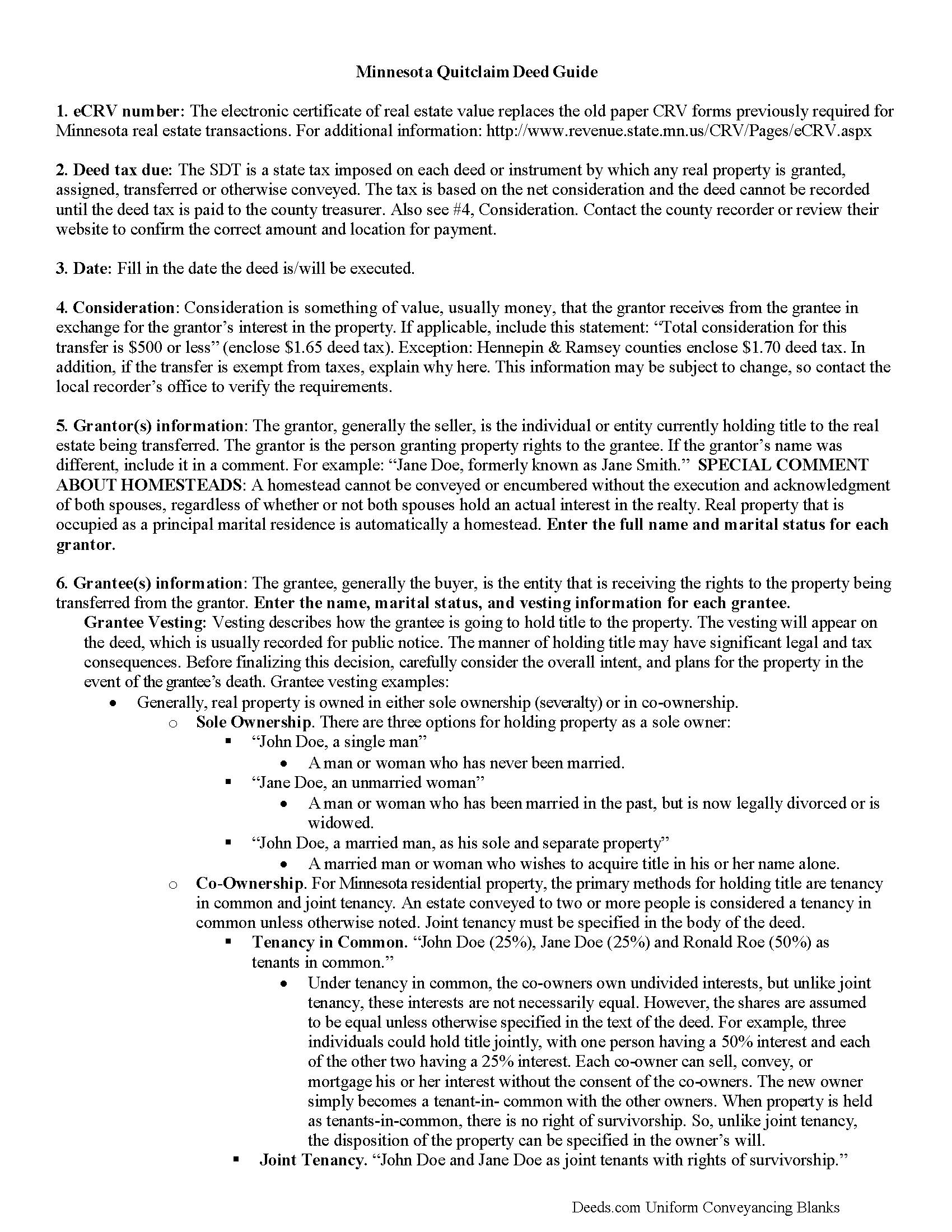

Wilkin County Quitclaim Deed from Individual to Joint Tenants Guide

Line by line guide explaining every blank on the Quitclaim Deed from Individual to Joint Tenants form.

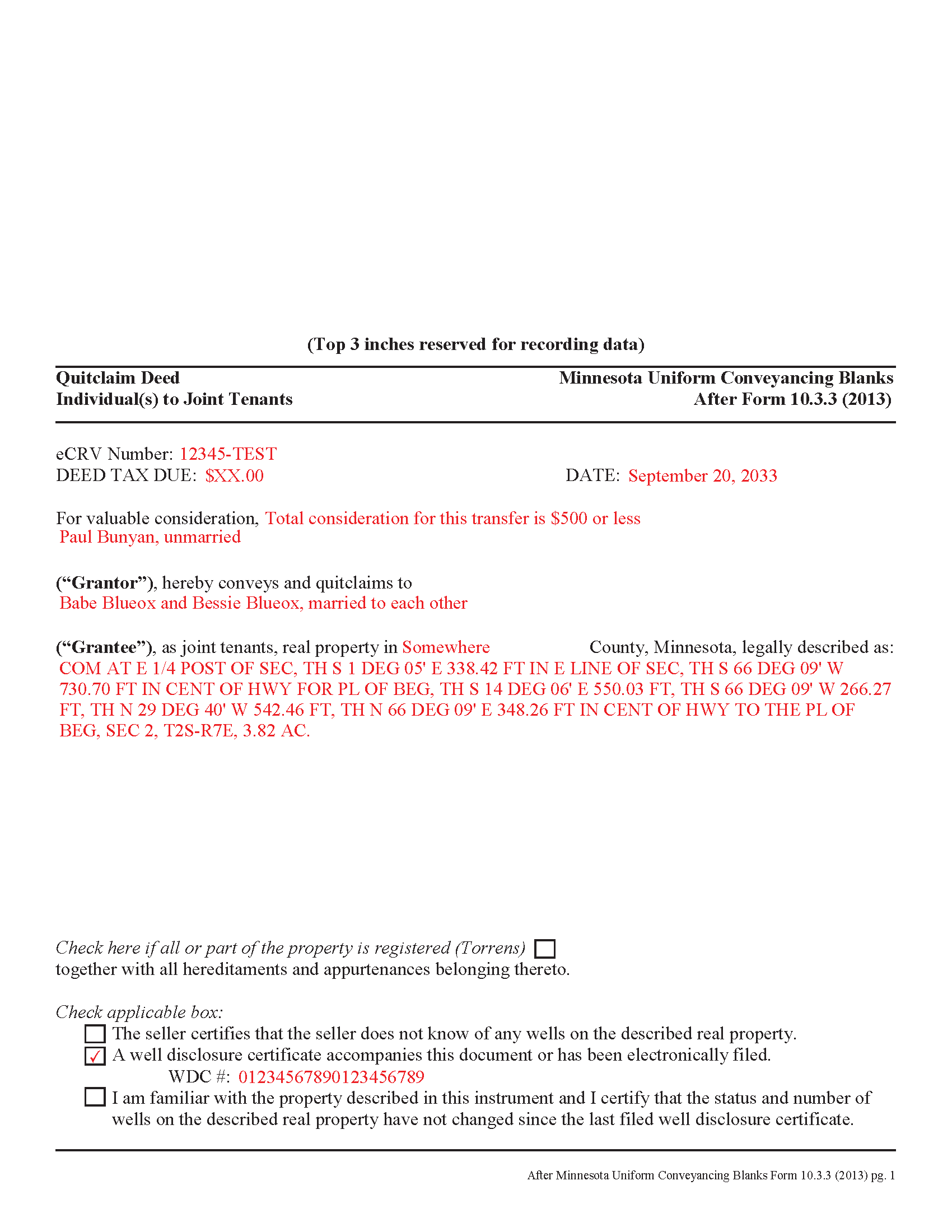

Wilkin County Completed Example of the Quitclaim Deed from Individual to Joint Tenants Document

Example of a properly completed Minnesota Quitclaim Deed from Individual to Joint Tenants document for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Minnesota and Wilkin County documents included at no extra charge:

Where to Record Your Documents

Wilkin County Recorder

Breckenridge, Minnesota 56520

Hours: 8:00am to 4:30pm Monday through Friday

Phone: (218) 643-7164

Recording Tips for Wilkin County:

- Verify all names are spelled correctly before recording

- Check margin requirements - usually 1-2 inches at top

- Leave recording info boxes blank - the office fills these

- Both spouses typically need to sign if property is jointly owned

- Recording early in the week helps ensure same-week processing

Cities and Jurisdictions in Wilkin County

Properties in any of these areas use Wilkin County forms:

- Breckenridge

- Campbell

- Foxhome

- Kent

- Nashua

- Rothsay

- Wolverton

Hours, fees, requirements, and more for Wilkin County

How do I get my forms?

Forms are available for immediate download after payment. The Wilkin County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Wilkin County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Wilkin County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Wilkin County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Wilkin County?

Recording fees in Wilkin County vary. Contact the recorder's office at (218) 643-7164 for current fees.

Questions answered? Let's get started!

Minnesota's real estate deeds are governed by Minn. Stat. 507, which contains the basic form and requirements for lawful conveyance of property. A quitclaim deed is used in Minnesota real estate transactions where the grantor agrees that "such instrument, duly executed, shall be a conveyance to the grantee, the grantee's heirs and assigns, of all right, title, and interest of the grantor in the premises described, but shall not extend to after acquired title, unless words expressing such intention be added." (507.07). In other words, a quitclaim deed generally transfers only the grantor's current interest, if any, in the property at the time of the deed's execution.

While properly completed statutory form may suffice in many situations, they leave the possibility for errors based on incorrect or missing information. To reduce confusion about the information needed for different real estate transactions, Minnesota suggests guidelines for uniform conveyancing forms, each with a specific purpose. See Minn. Stat. 507.09-507.14.

This quitclaim deed form, specifically intended for real property transfers from individual owner(s) to joint tenants, matches the format, content, and requirements set forth in the most recent update.

(Minnesota QCD Ind to JT Package includes form, guidelines, and completed example)

Important: Your property must be located in Wilkin County to use these forms. Documents should be recorded at the office below.

This Quitclaim Deed from Individual to Joint Tenants meets all recording requirements specific to Wilkin County.

Our Promise

The documents you receive here will meet, or exceed, the Wilkin County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Wilkin County Quitclaim Deed from Individual to Joint Tenants form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4582 Reviews )

jim g.

June 4th, 2020

so far so good. was hoping to have the recorded document already. i need the recorded document by friday, june 5th for my city approval. anyway you can please get it to me tomorrow. thanks, jim

Thank you!

Robert H.

April 18th, 2020

I am very pleased with your service.

Thank you!

Bakul W.

February 2nd, 2021

You guys did a great job for us yday. With the strim coming and the registry being closed to visitors I didn't know how I was going to get my work done and I found your website and in less than a day everything was done. Thank you.

Thank you!

Kim C.

October 5th, 2020

Very user-friendly and easy to obtain exactly what I needed. I am impressed by the sample forms as well. I will definitely be using Deeds.com again!!

Thank you for your feedback. We really appreciate it. Have a great day!

Susan J.

June 29th, 2020

very fast service. immediate response and kept me informed along the way. the county was not cooperating and this was communicated to me and my fee was refunded, just like that. will definitely use this company again

Thank you!

Susan M.

November 20th, 2020

It was easy to use and clear directions.

Thank you!

Aleksander M.

May 2nd, 2023

So far all is perfect! Thank you for all your help!

Thank you!

Virginia K.

October 24th, 2021

Easy to use instructions and fast service delivery. I was kept up to date on the status of my filing.

Thank you!

Edward S.

June 10th, 2020

I was able to e-record 3 document with ease. The Middlesex registry of deeds is closed due to COVID-19 and this was my only option. Even if it was open, this is much faster and saves me time and money on parking ..etc. Great services.

Thank you!

Lori G.

June 17th, 2019

I needed to add my husband to my deed. an attorney would charge me $275.00. I decided to file myself. This makes it easy. Not done w/the process yet. But so far so good! :)

Thank you for your feedback. We really appreciate it. Have a great day!

Robert S.

July 22nd, 2020

Process was easy to follow and worked as advertised. Thought the price was a little high.

Thank you!

Andrea R.

July 10th, 2020

Easy and fast. Thank you so much!!

Thank you!

EILEEN K.

March 17th, 2022

I received my product in great condition and it works ok. Thankyou!!!

Thank you!

Yvonne W.

December 30th, 2018

I'm not certain yet that this is all I need to do what I need to do. Marion Co. Clerk's office has not been helpful. I found this site from that site & hopefully it will help.

Thanks for the feedback Yvonne. We hope you found what you needed. Have a wonderful day!

angela t.

December 4th, 2019

good forms for what i needed.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!