Pennington County Receipt and Waiver of Mechanic Lien Form

Pennington County Receipt and Waiver of Mechanic Lien Form

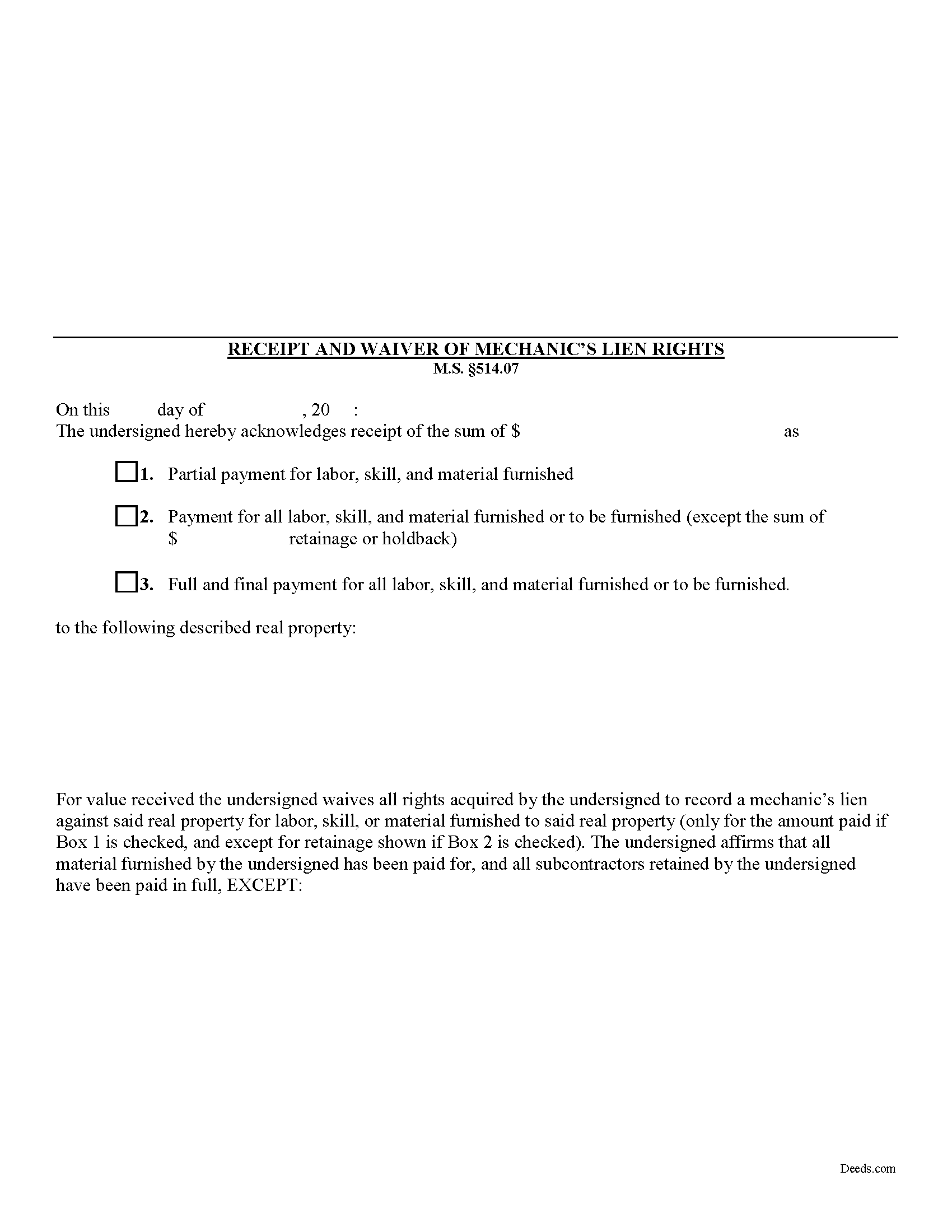

Fill in the blank Receipt and Waiver of Mechanic Lien form formatted to comply with all Minnesota recording and content requirements.

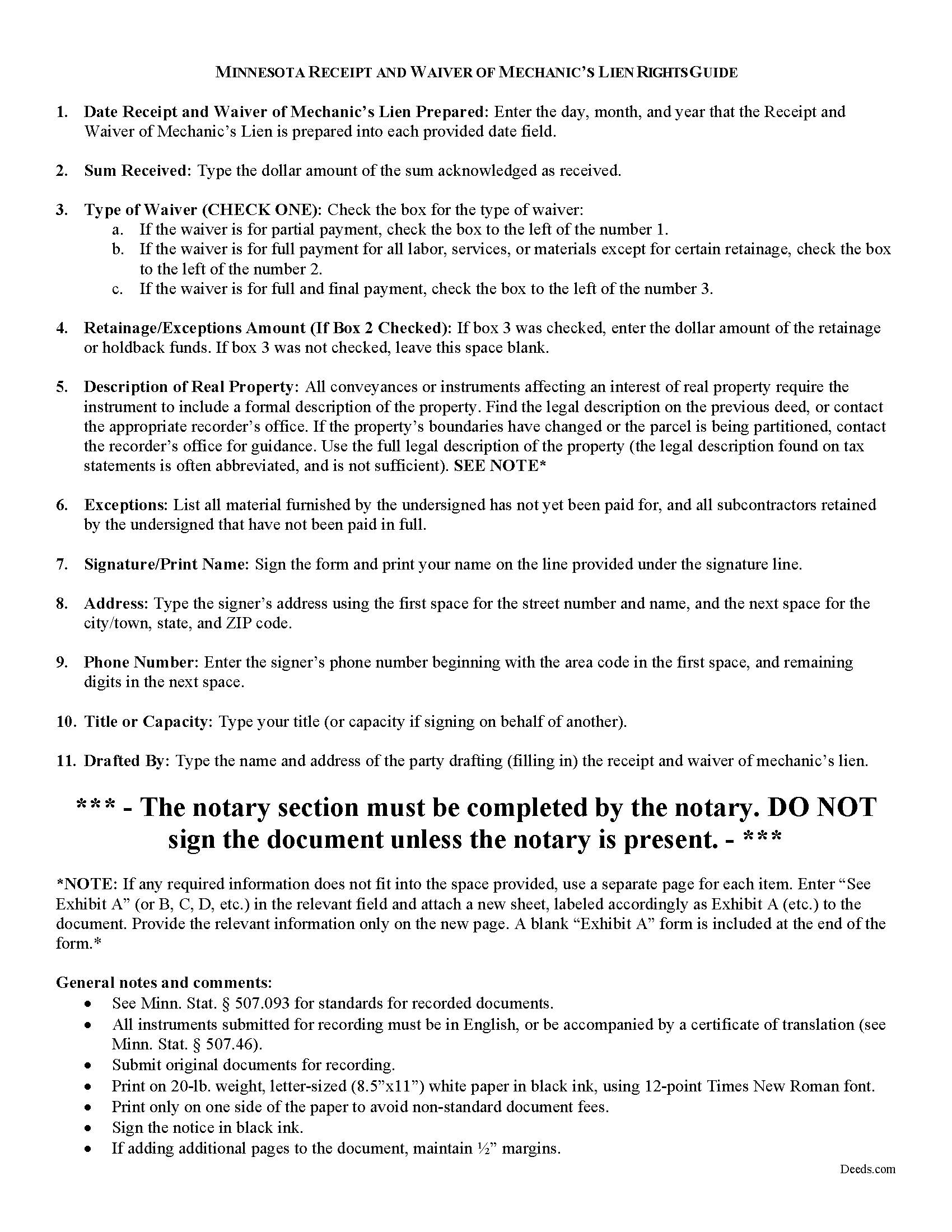

Pennington County Receipt and Waiver of Mechanic Lien Guide

Line by line guide explaining every blank on the form.

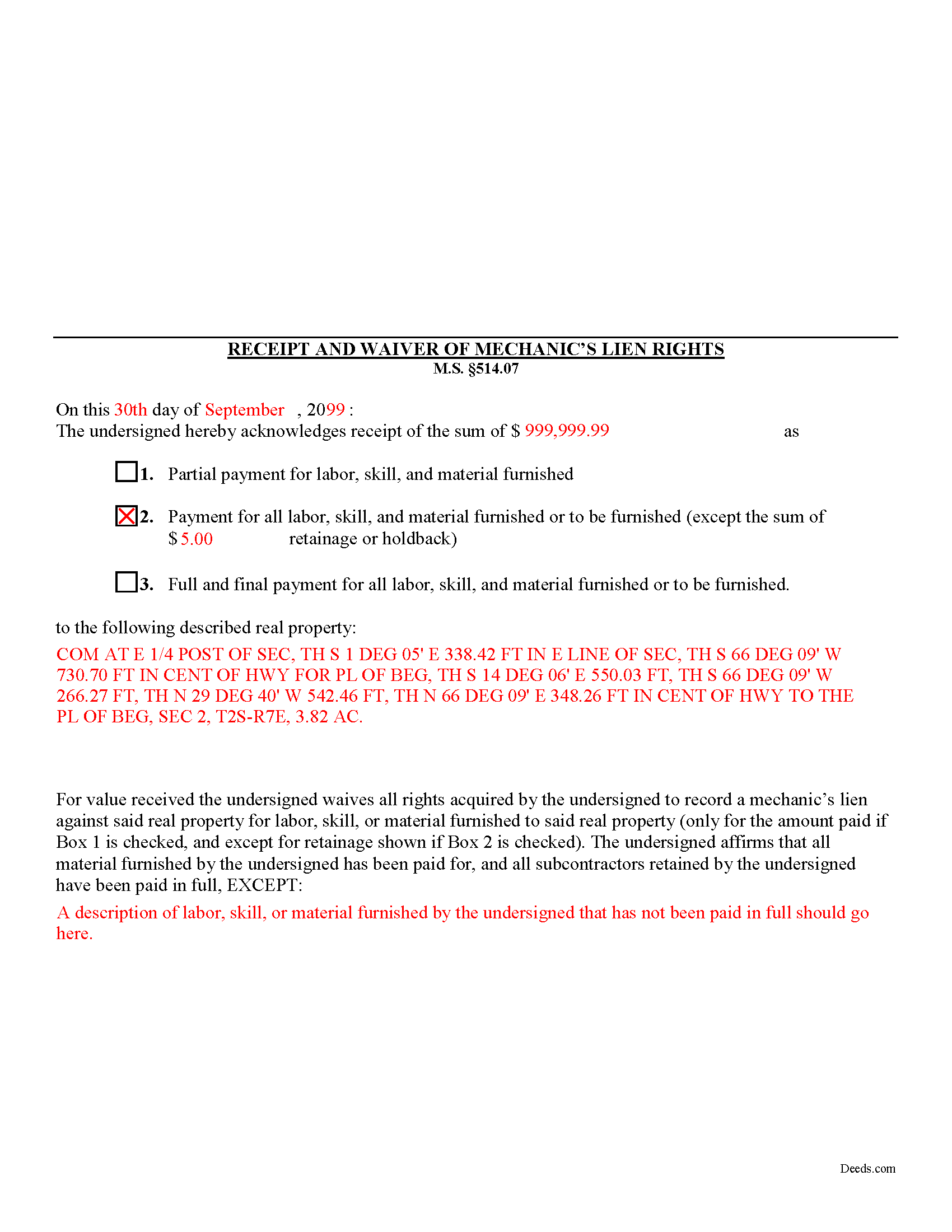

Pennington County Completed Example of the Receipt and Waiver of Mechanic Lien Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Minnesota and Pennington County documents included at no extra charge:

Where to Record Your Documents

Pennington County Recorder

Thief River Falls, Minnesota 56701

Hours: 8:30 to 4:30 M-F

Phone: (218) 683-7027

Recording Tips for Pennington County:

- Request a receipt showing your recording numbers

- Ask about their eRecording option for future transactions

- Recording fees may differ from what's posted online - verify current rates

Cities and Jurisdictions in Pennington County

Properties in any of these areas use Pennington County forms:

- Goodridge

- Saint Hilaire

- Thief River Falls

Hours, fees, requirements, and more for Pennington County

How do I get my forms?

Forms are available for immediate download after payment. The Pennington County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Pennington County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Pennington County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Pennington County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Pennington County?

Recording fees in Pennington County vary. Contact the recorder's office at (218) 683-7027 for current fees.

Questions answered? Let's get started!

Receipt and Waiver of Mechanic's Liens Rights in Minnesota

During the construction process, the owner (or other parties) may make one or more progress or partial payments on the work or materials furnished to date. Additionally, the owner might pay the full amount or the full amount less any retainage or holdback amounts (used to pay subs and other worker's wages). When a full or partial payment is made, you can issue the owner a waiver for a lien on the amount paid. By issuing the waiver, you give up the right to claim a mechanic's lien for either the full or partial payment amount.

The receipt and waiver contains the following information: 1) date drafted; 2) amount received as full or partial payment; 3) a designation as partial payment for labor, skill, and material furnished; payment for all labor, skill, and material furnished or to be furnished; or full and final payment for all labor, skill, and material furnished or to be furnished; 4) if there are exceptions for amounts for retainage or holdback, the total amounts withheld; and 5) a property description; and 6) description of all materials not yet paid for or names of contractors not yet paid.

Finally, you should ensure that the proper box is checked for the waiver type. If a partial or progress payment was made, check Box #1. If a payment is made for all labor, materials or services furnished or to be furnished except for certain retainage or holdbacks, check Box #2. If a full and final payment was made without exceptions, check Box #3.

This article is provided for informational purposes only and should not be relied upon as a substitute for the advice of an attorney. Please contact a Minnesota attorney with any questions about lien waivers or other related issues.

Important: Your property must be located in Pennington County to use these forms. Documents should be recorded at the office below.

This Receipt and Waiver of Mechanic Lien meets all recording requirements specific to Pennington County.

Our Promise

The documents you receive here will meet, or exceed, the Pennington County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Pennington County Receipt and Waiver of Mechanic Lien form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4585 Reviews )

Lowell P.

May 26th, 2020

Exceptionally helpful instruments that are compliant with State law and anticipate various contingencies. Very pleased.

Thank you for your feedback. We really appreciate it. Have a great day!

JOANNE W.

November 13th, 2019

Excellent product and so easily obtained. Well worth the price.

Thank you for your feedback. We really appreciate it. Have a great day!

Jeff R.

December 10th, 2020

Easy process to receive service. thank you

Thank you!

Sara M.

October 5th, 2024

Efficient, well written documents

Thank you for your feedback. We really appreciate it. Have a great day!

Sally Ann C.

November 16th, 2019

Thank you for your service. It seems to have worked, I printed a document purporting to be the Deed I needed. I was somewhat disappointed though - I was expecting something as impressive as the Title Search, which goes back to 1828 and includes Millard Fillmore, admittedly not one of our most celebrated Presidents. But I am happy to have what I have, and thank you again! peace - SAVC

Thank you for your feedback. We really appreciate it. Have a great day!

David T.

September 6th, 2022

This is a great service and terrific value. The form package provided (blank form, example form & set of instructions) was clear and easy to follow. Being able to complete the forms using the computer to insert the needed information saved countless hours. My completed form was accepted by the Clerk & Recorder office without any issue. Well worth the investment

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Clifford K.

February 17th, 2024

got the forms we needed, and ones we did not even know we needed!

Your feedback is greatly appreciated. Thank you for taking the time to share your experience!

Stan P.

November 16th, 2020

Great, covered all the legal area I needed to identify.

Thank you!

Tricia M.

May 15th, 2020

The document I purchased (QuitClaim Deed) had detailed directions explaining how to complete the form. This made it easy to complete without any doubt that it was completed incorrectly (which was my fear). I also used the E-File service and it was processed very quickly without any issues. Thank you for making this process simple! I will definitely use this service again.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Kimberly E.

July 6th, 2019

It was very easy to order,download, and print. The only issue I have is that the guide that came with my form really did not help me filling it out. I feel the explanations could have been better and suited more for the standard person. I was still confused when filling it out and will probably have to get a lawyer to make sure it's filled out correctly

Thank you for your feedback. We really appreciate it. Have a great day!

crystal l.

January 16th, 2019

Another legal professional directed me to this site. The best advice I've received from the legal profession! Forms were instantly available, easily printed & exactly what I needed at a cost that was more than affordable!! I will definitely be back again!!

Thank you Crystal and please thank your associate for us. Have a fantastic day!

Joseph R.

February 17th, 2021

So easy to use. I like the way they kept me informed to the progress being made on my filing. If the occasion occurs I'll definitely use them again.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Gary J.

September 15th, 2020

Whomever "KCH" is, that person was of great help. It took me several tries due my inexperience with ADOBE SCAN, but that certainly is no fault of yours!! KVH was very patient with me, and in fact resolved the things I was doing wrong for me, without my even requesting the assistance.

Thank you!

Pamela M.

May 13th, 2021

Saved a great deal of time and hassle. THANKS

Thank you!

Myrna P.

March 18th, 2019

Easy to download, form very user friendly, and its customized to our county. Very much worth the money.

Thank you Myrna. Have a fantastic day!