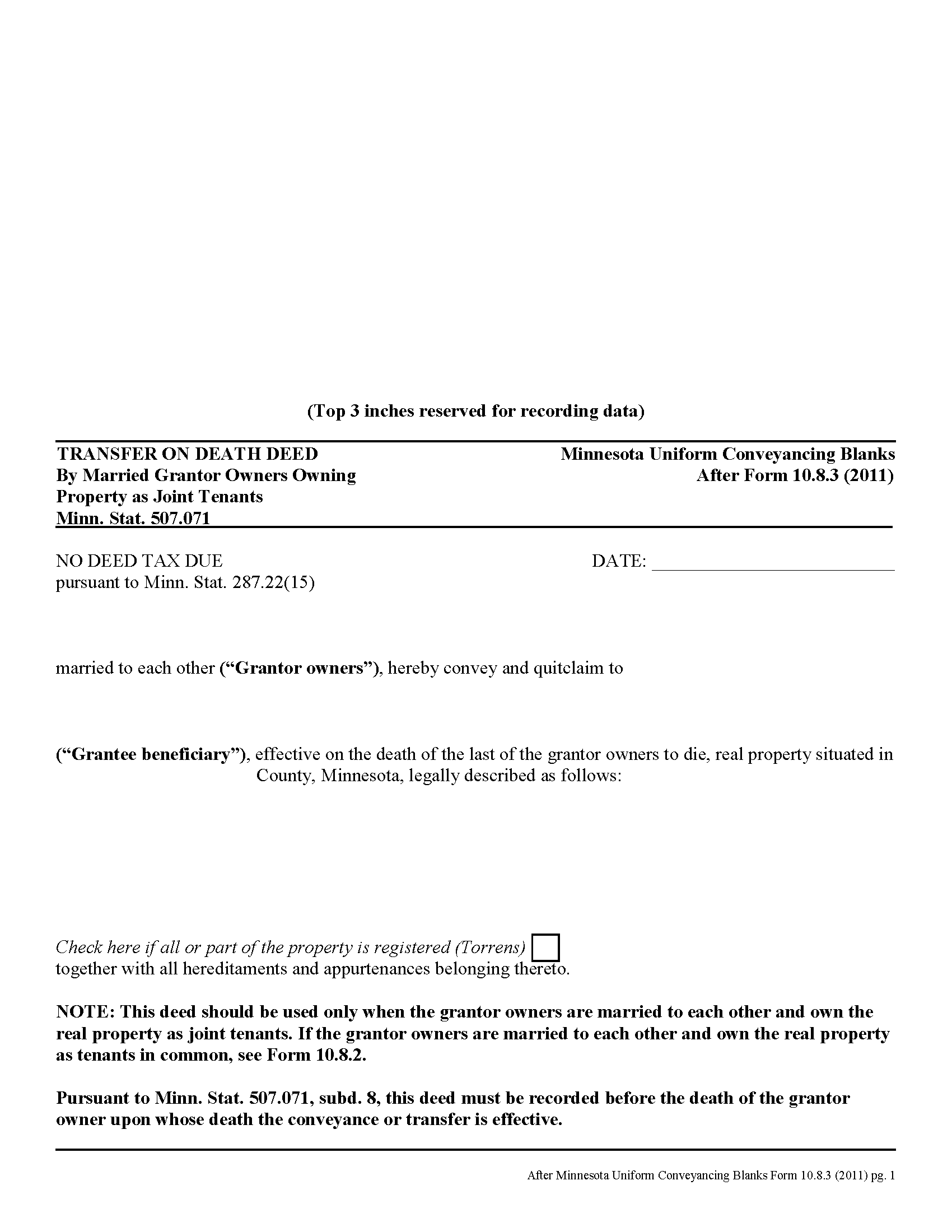

Morrison County Transfer on Death Deed by Married Joint Tenants Form

Morrison County Transfer on Death Deed by Married Joint Tenants Form

Fill in the blank Transfer on Death Deed by Married Joint Tenants form formatted to comply with all Minnesota recording and content requirements.

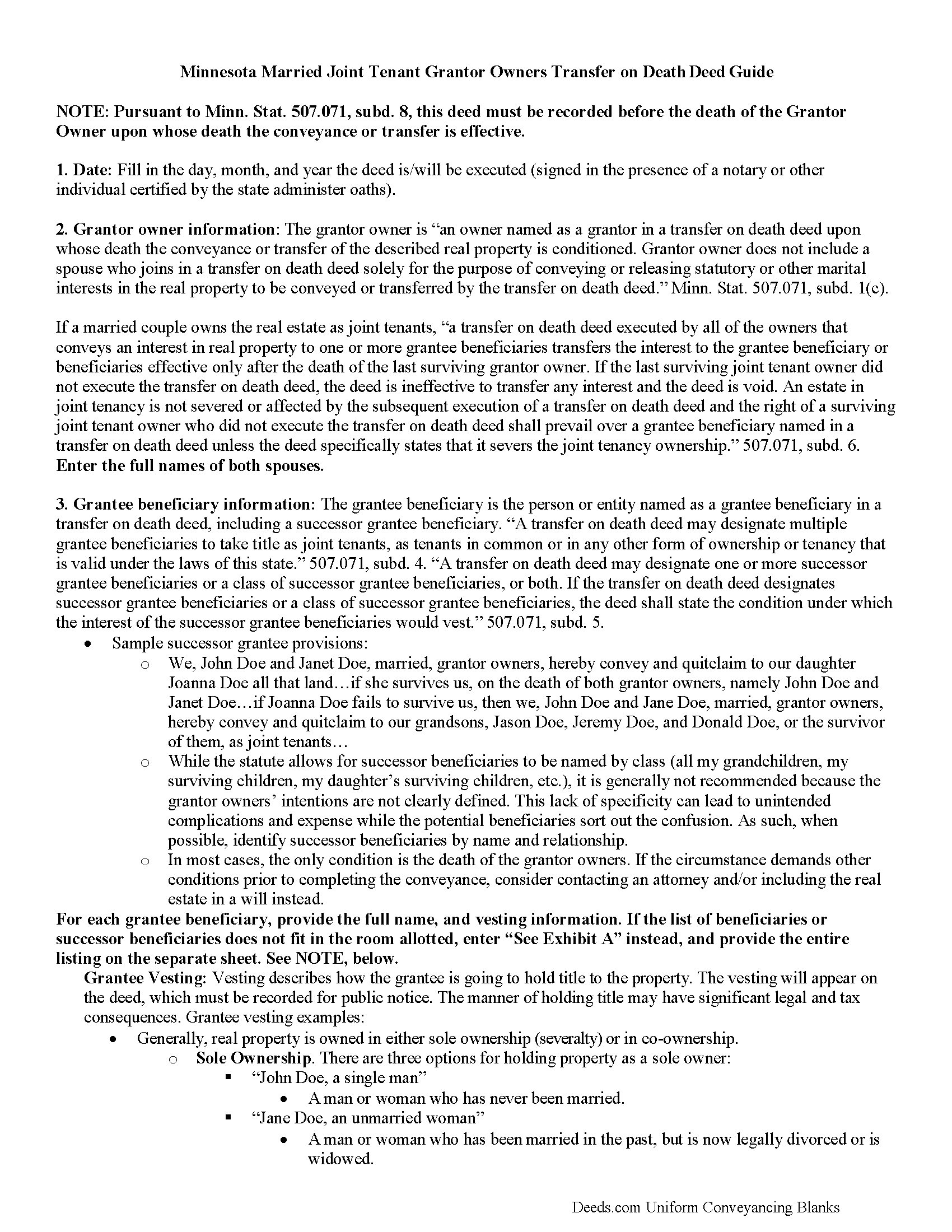

Morrison County Transfer on Death Deed by Married Joint Tenants Guide

Line by line guide explaining every blank on the form.

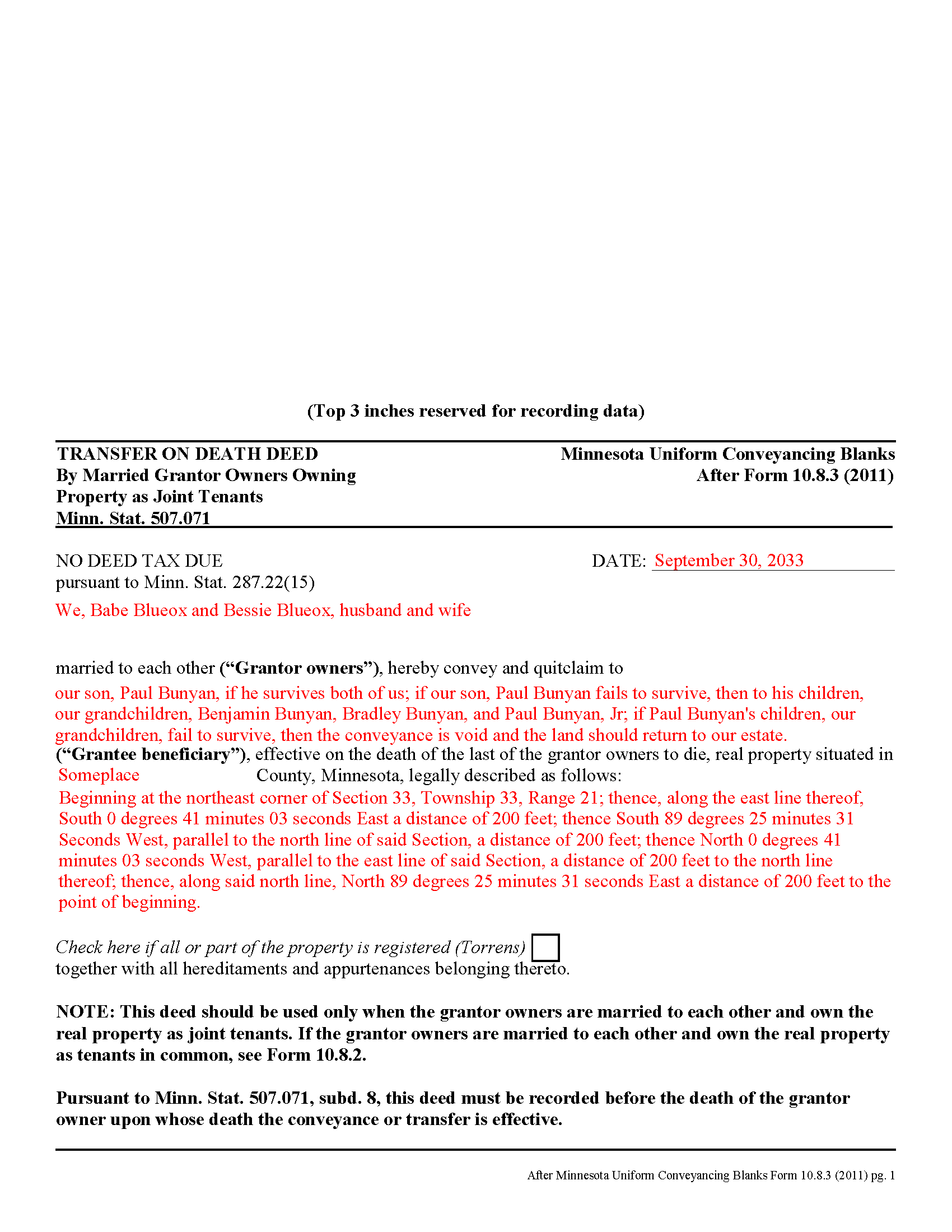

Morrison County Completed Example of the Transfer on Death Deed by Married Joint Tenants Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Minnesota and Morrison County documents included at no extra charge:

Where to Record Your Documents

Morrison County Recorder

Little Falls, Minnesota 56345

Hours: 8:00am to 4:30pm Monday through Friday

Phone: (320) 632-0146

Recording Tips for Morrison County:

- Check that your notary's commission hasn't expired

- Ask if they accept credit cards - many offices are cash/check only

- Ask about their eRecording option for future transactions

Cities and Jurisdictions in Morrison County

Properties in any of these areas use Morrison County forms:

- Bowlus

- Buckman

- Cushing

- Flensburg

- Hillman

- Lastrup

- Little Falls

- Motley

- Pierz

- Randall

- Royalton

- Swanville

- Upsala

Hours, fees, requirements, and more for Morrison County

How do I get my forms?

Forms are available for immediate download after payment. The Morrison County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Morrison County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Morrison County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Morrison County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Morrison County?

Recording fees in Morrison County vary. Contact the recorder's office at (320) 632-0146 for current fees.

Questions answered? Let's get started!

In Minnesota, transfer on death deeds are governed by Minn. Stat. 507.071.

While the statute provides a basic form, as well as overall content requirements, the state authorized the development of uniform conveyance documents for some specific situations. Transfer on death deeds are useful estate planning tools for those who wish to pass real estate down to designated beneficiaries, outside of the probate process.

Mistakes or omissions in such deeds can force the property back into the estate and subject it to probate distribution, despite the grantor owner's best intentions. For example, the rules for joint tenants who wish to convey property with a transfer on death deed are found in 507.071, subd. 6. A correctly-completed basic statutory form is effective in many cases, but because joint tenants are often married to one another, and to ensure that all the required information is included, there is a special deed for this circumstance.

This transfer on death deed form is for use ONLY by married grantor owners who hold title as joint tenants.

As with other transfer on death deeds, this form must be executed and RECORDED during the grantor owner's lifetime.

(Minnesota TOD Deed by Married JT Package includes form, guidelines, and completed example)

Important: Your property must be located in Morrison County to use these forms. Documents should be recorded at the office below.

This Transfer on Death Deed by Married Joint Tenants meets all recording requirements specific to Morrison County.

Our Promise

The documents you receive here will meet, or exceed, the Morrison County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Morrison County Transfer on Death Deed by Married Joint Tenants form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4582 Reviews )

Desiree R.

August 19th, 2024

very easy to use

We are delighted to have been of service. Thank you for the positive review!

Rebekah T.

February 8th, 2021

Easy to use especially with instruction page and examples. Thank you!

Thank you for your feedback. We really appreciate it. Have a great day!

Janet S.

April 7th, 2021

I would've done this years ago if I'd known how easy it was! The plus is it's not expensive either. Thank you deeds.com

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Heather M.

January 9th, 2019

Great service, convenient, fast and easy to use. Thumbs Up!!!!w

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Jamie F.

March 13th, 2020

Your service was very helpful as we were able to obtain a form for another state for our client.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Johnny A.

December 15th, 2018

My complete name is Johnny Alicea Rodriguez And the DEED is on my half brother and mine name. Jimmy Dominguez and myself Thanks

Edward B.

May 13th, 2020

Thank you for the rapid response. I shall persevere in my search using other public records. I shall keep your website handy for other such searches in the future.

Thank you!

RONALD F.

July 24th, 2020

Great service. Very reasonable cost. All necessary detailed information provided.

Thank you for your feedback. We really appreciate it. Have a great day!

Shane T.

March 7th, 2020

The Transfer on Death Deed form package was very good. But like anything, could use some improvements. There is not enough space to fill more than one beneficiary with any level of additional detail like "as his sole and separate property" The area for the legal description could be a bit bigger and potentially fit many legal descriptions. Or it could be made to simply say "See Exhibit A" as is likely necessary for most anyway. The guide should indicate what "homestead property" means so the user doesn't have to research the legal definition. (which turns out to be obvious, at least in my state, if you live there, it's your homestead.) It would be helpful if an "Affidavit of Death" form were included in the package for instances where the current deed hasn't been updated to reflect a widowed owner as the sole owner before recording with only the one signature.

Thank you for your feedback. We really appreciate it. Have a great day!

Kimberly G.

April 5th, 2021

It would be helpful if there were a specific example of putting a deed into a trust. Also, the limitation of characters on the description of the property was not enough.

Thank you for your feedback. We really appreciate it. Have a great day!

Susan G.

February 17th, 2023

This is very helpful.

Thank you!

Maribel P.

July 14th, 2023

Thank you so much for providing simple but very significant documents one can basically do PRO SE, without any additional huge counsel expenses and yet be legitimate enough to officially file them as state law allows and extends to basic documents processing and filings. Thank you so much for the professional documents provided as they do the proper job. MP

Thank you for the kind words Maribel. Glad we were able to help!

Don M.

September 9th, 2021

I find the site very difficult to nagitagte.

Sorry to hear that Don, we’ll try harder.

Michael R.

August 25th, 2025

A suggestion: Include instructions on how to add your spouse to the deed, rather than transferring completely to a third party

Thank you for your thoughtful feedback. Adding a spouse to a deed is a common need, and suggestions like yours help us identify where additional guidance would be useful. We’ll take this into consideration as we continue improving our resources.

Alison B.

March 17th, 2021

The Deed of trust form was fine but the promissory note was less user friendly since I needed to change a few things that were fixed in the template. I ended up using white-out after I got no response when I emailed the help site that was provided in one of your emails, so it looks a little odd but should be usable

Thank you for your feedback. We really appreciate it. Have a great day!