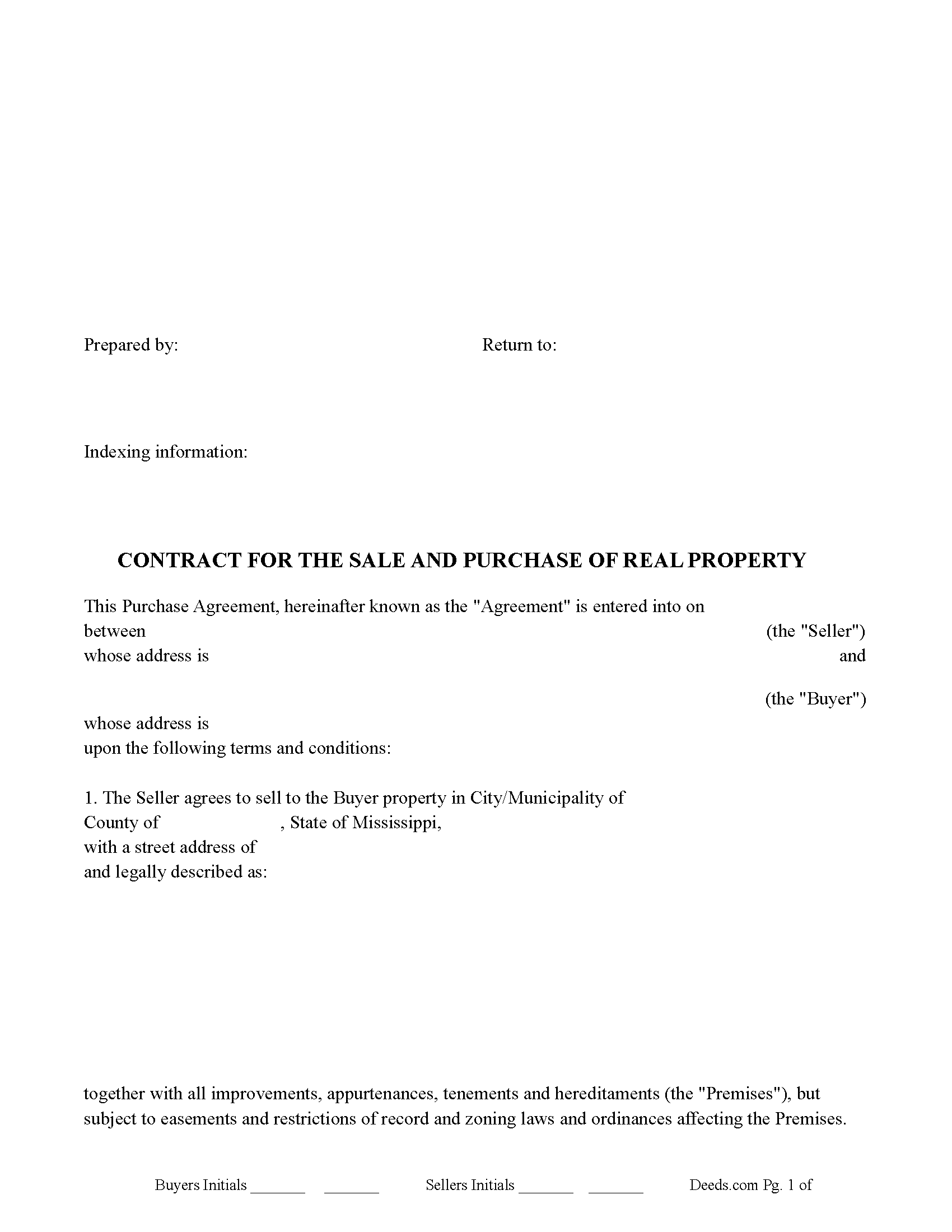

Smith County Contract for the Sale and Purchase Of Real Property Form

Smith County Contract for the Sale and Purchase Of Real Property Form

Fill in the blank form formatted to comply with all recording and content requirements.

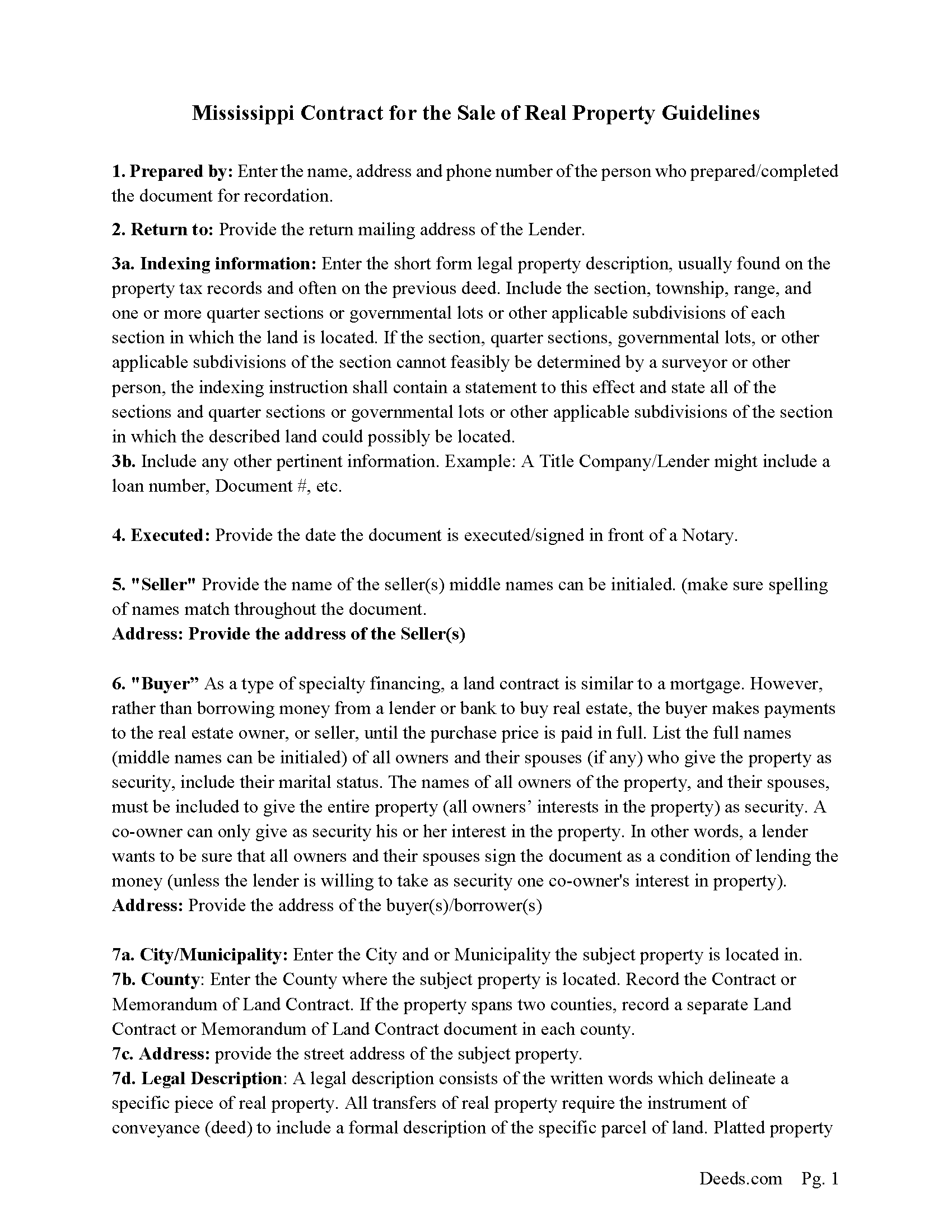

Smith County Contract for the Sale and Purchase of Real Property Guidelines

Fill in the blank form formatted to comply with all recording and content requirements.

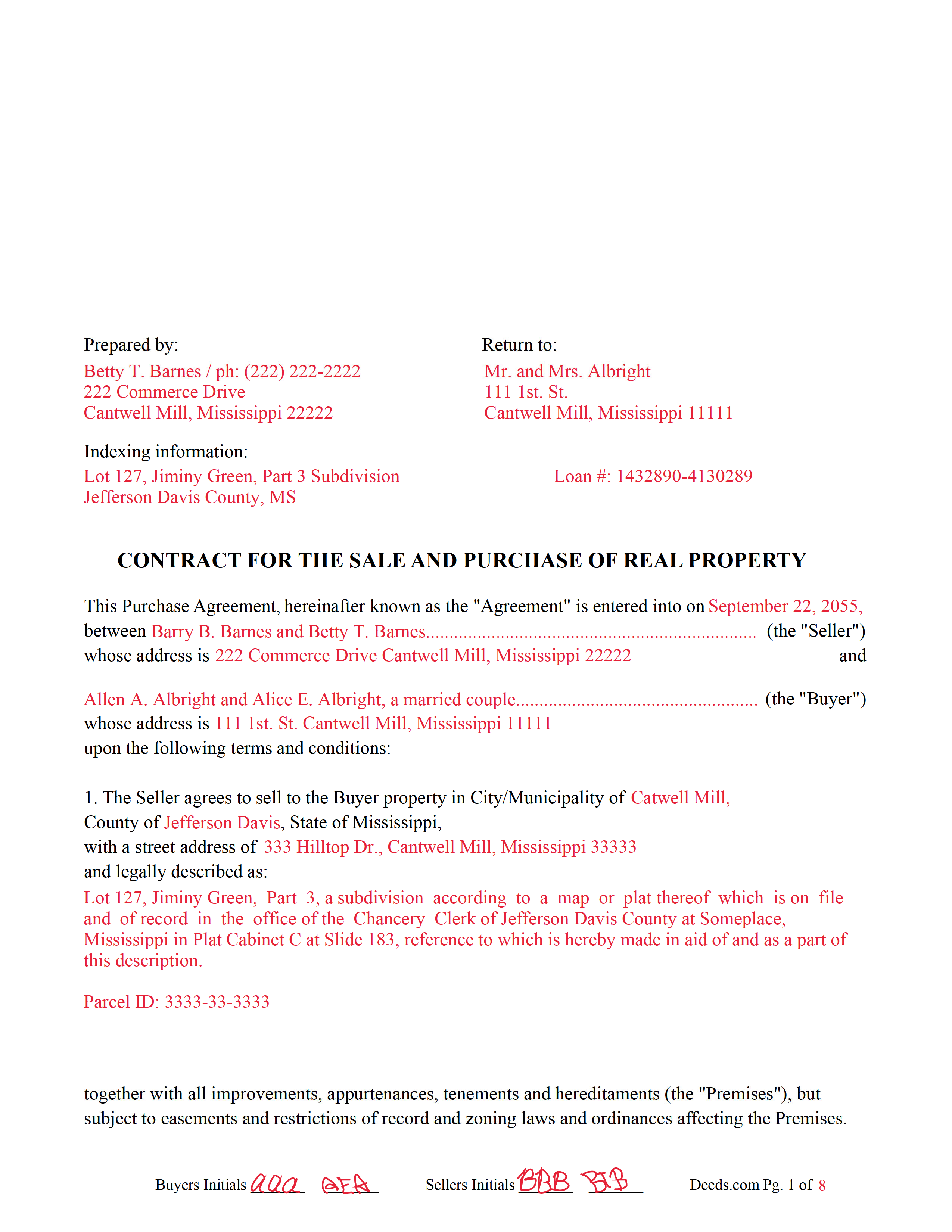

Smith County Completed Example of the Contract for the Sale and Purchase of Real Property Document

Example of a properly completed form for reference.

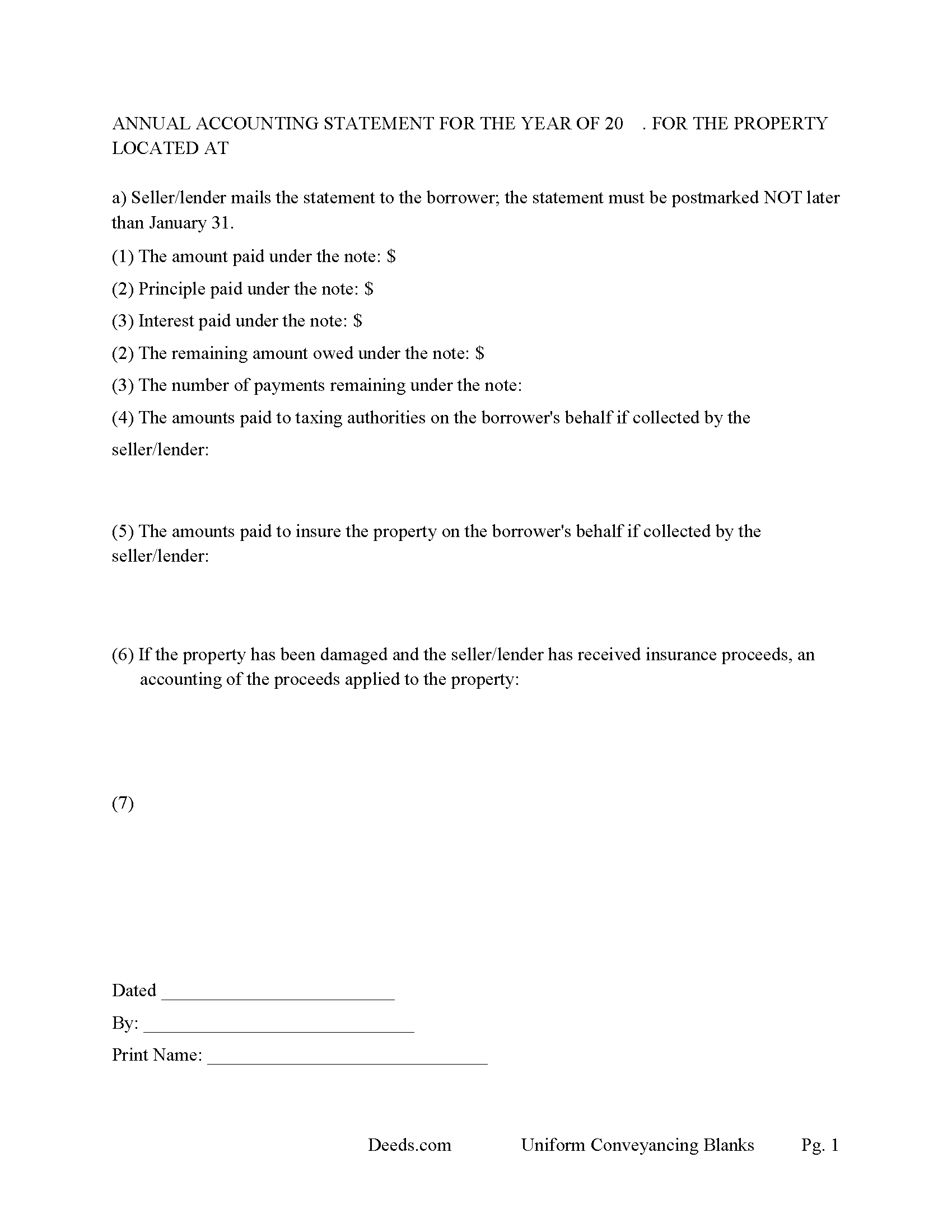

Smith County Annual Accounting Statement Form

Use for fiscal year reporting, issue annually to borrower/buyer, showing interest and principal, paid.

All 4 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Mississippi and Smith County documents included at no extra charge:

Where to Record Your Documents

Smith County Chancery Clerk

Raleigh, Mississippi 39153

Hours: 8:00 to 5:00 M-F

Phone: (601) 782-9811

Recording Tips for Smith County:

- Ask if they accept credit cards - many offices are cash/check only

- White-out or correction fluid may cause rejection

- Request a receipt showing your recording numbers

- Check margin requirements - usually 1-2 inches at top

Cities and Jurisdictions in Smith County

Properties in any of these areas use Smith County forms:

- Mize

- Raleigh

- Taylorsville

Hours, fees, requirements, and more for Smith County

How do I get my forms?

Forms are available for immediate download after payment. The Smith County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Smith County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Smith County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Smith County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Smith County?

Recording fees in Smith County vary. Contact the recorder's office at (601) 782-9811 for current fees.

Questions answered? Let's get started!

A "CONTRACT FOR THE SALE AND PURCHASE OF REAL PROPERTY" in some states referred to a Land Contract or Contract for Deed is a written legal agreement used to purchase real estate; it is typically used in owner/seller financing.

This form can be used for traditional monthly installments or a balloon payment, which is common with seller financing, (example: three years payments with a balloon payment of $ ______. Or 15 years payment of $______) etc.)

LATE CHARGE: Any above noted payment which is at least days past due, shall be subject to a late charge of $ And an additional $ per day until the payment is received. If any balloon payment is late, it shall be subject to a late fee of $ per day.

IN ADDITION TO ANY OTHER REMEDIES available to the Lender if this Note is not paid in full at the Maturity Date, Borrowers shall pay to Lender an Overdue Loan Fee, which fee shall be due at the time this Note is otherwise paid in full. The "Overdue Loan Fee" shall be determined based upon the outstanding principal balance of this Note as of the Maturity Date and shall be:

(a) one percent (1.0%) Of such principal balance if the Note is paid in full on or after thirty (30) days after the Maturity Date but less than sixty (60) days after the Maturity Date, or

(b) two percent (2.0%) of such principal balance if the Note is paid in full on or after sixty (60) days after the Maturity Date.

A contract with stringent default terms can be beneficial to seller.

(Mississippi Contract for Sale Package includes form, guidelines, and completed example) For use in Mississippi only.

Important: Your property must be located in Smith County to use these forms. Documents should be recorded at the office below.

This Contract for the Sale and Purchase Of Real Property meets all recording requirements specific to Smith County.

Our Promise

The documents you receive here will meet, or exceed, the Smith County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Smith County Contract for the Sale and Purchase Of Real Property form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4581 Reviews )

David P.

August 26th, 2020

Easy to use and very straight forward. Glad I used Deeds.com

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Margo M.

February 11th, 2021

So far help has been good given some of the information you don't have as far as making corrections. This is my first time using your service so maybe I will be better at utilizing it if I have to again.

Thank you for your feedback. We really appreciate it. Have a great day!

Hilary C.

October 9th, 2020

Within 10 minutes I had my Deed!!! Fantastic!!!!

Thank you for your feedback. We really appreciate it. Have a great day!

Rhoads H.

December 3rd, 2020

Excellent, thank you.

Thank you!

Lori G.

June 17th, 2019

I needed to add my husband to my deed. an attorney would charge me $275.00. I decided to file myself. This makes it easy. Not done w/the process yet. But so far so good! :)

Thank you for your feedback. We really appreciate it. Have a great day!

Thomas F.

February 18th, 2021

Very convenient!

Thank you!

Stacey S.

January 27th, 2022

The system was easy to use and download my documents but the way the packages are set up it was confusing and I wish there was a way to delete an item from a package if you make a mistake.

Thank you for your feedback. We really appreciate it. Have a great day!

Monica D. N.

April 8th, 2019

The Web site is very intuitive, organized well and forms are easily found. The instructions provided are very helpful. Value in terms of price is very good.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Steven S.

June 22nd, 2020

Very convenient and great tool for my real estate business. I'm a fan and will be a repeat customer.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Gary B.

September 28th, 2021

The whole experience was amazing. Your site was easy to work with and the staff was supper responsive. We were in and out in a flash!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Thomas B.

March 17th, 2022

Spent several weeks searching the net for warranty deeds. For the money and correctness, IMHO, Deeds.com is far and away the best.

Thank you for your feedback. We really appreciate it. Have a great day!

Caroline E.

February 14th, 2021

VERY easy to register, to request relevant deeds that apply to your own county/state, and to download. And bonus - you get instructional materials too! Highly recommend! Thank you!

Thank you for your feedback. We really appreciate it. Have a great day!

ANA I p.

December 14th, 2020

Wow this was nice that I could used the service . Love it

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

CEDRIC D.

December 2nd, 2021

need more instructions for each form

Thank you for your feedback. We really appreciate it. Have a great day!

Lourdes O.

June 5th, 2020

Extremely efficient website. Beats going to Court House to record documents. My document was recorded in less then 24 hours! Amazing! I will be using deeds.com from now on.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!