Smith County Special Warranty Deed Form

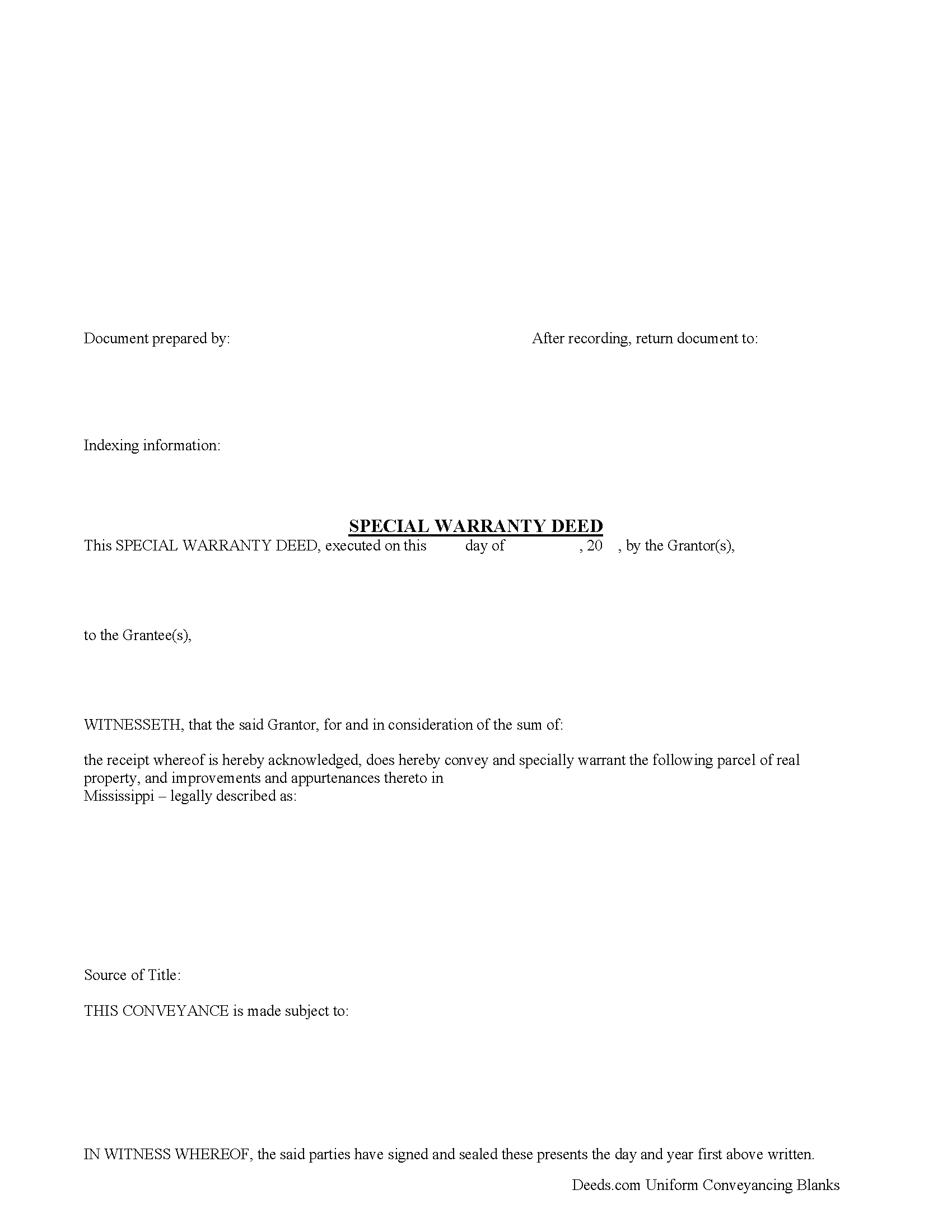

Smith County Special Warranty Deed Form

Fill in the blank form formatted to comply with all recording and content requirements.

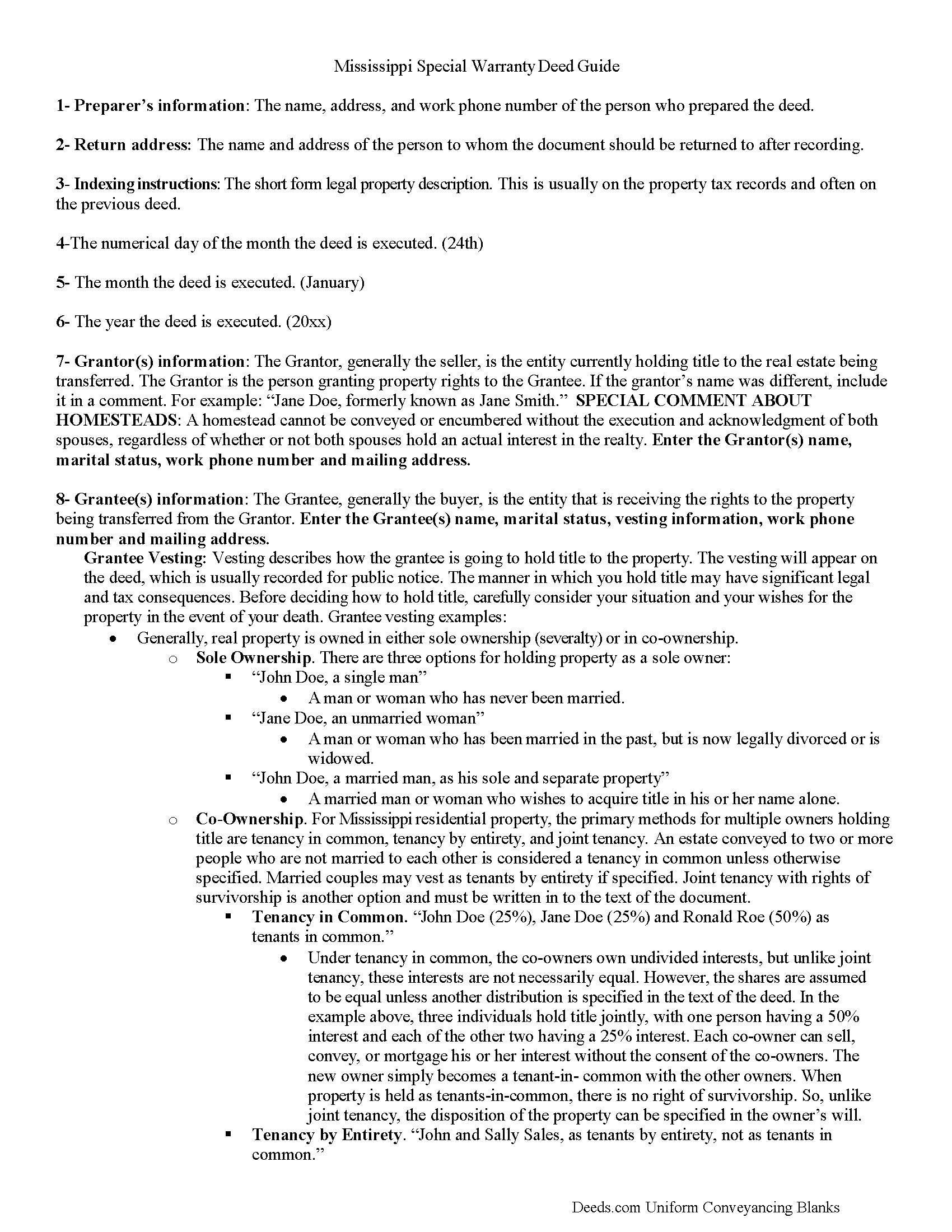

Smith County Special Warranty Deed Guide

Line by line guide explaining every blank on the form.

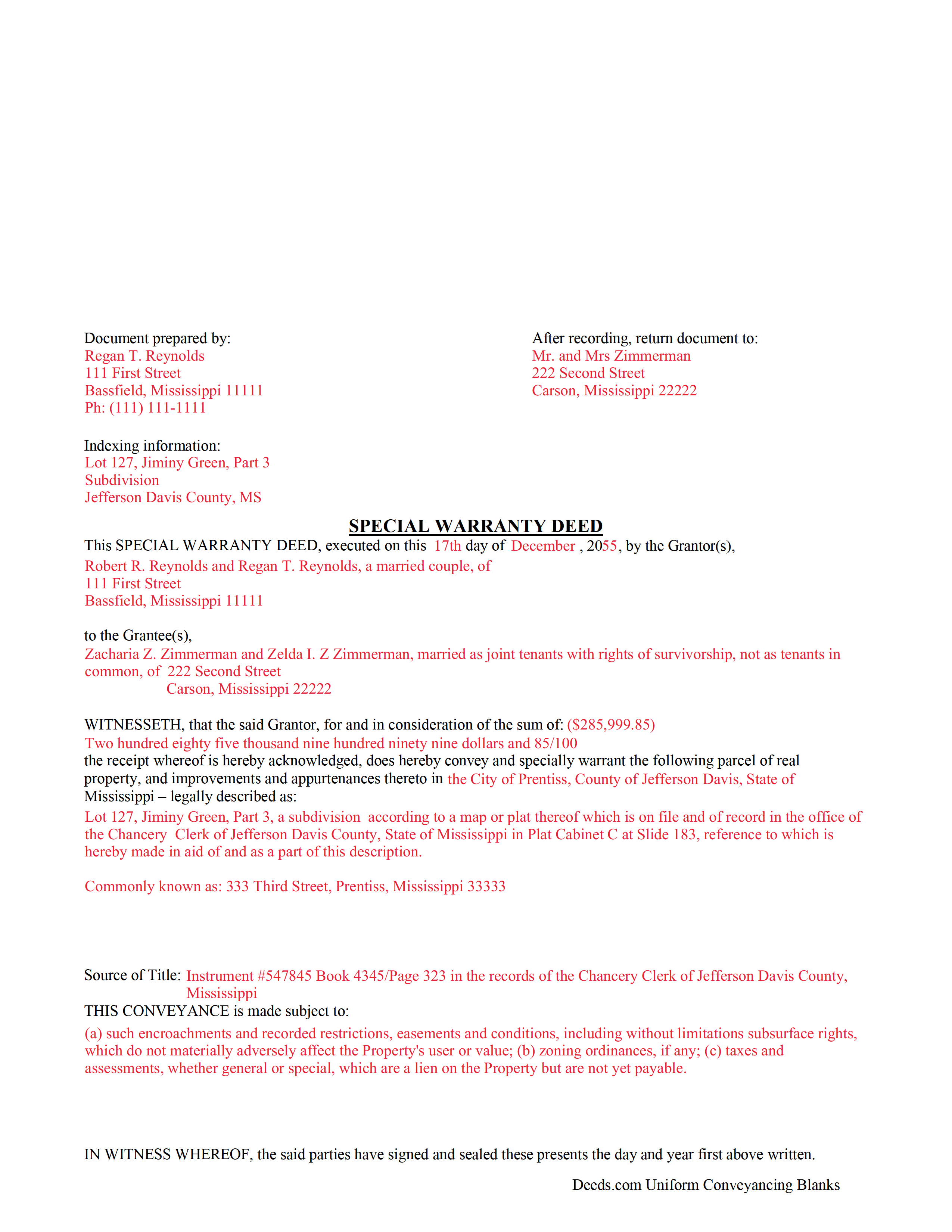

Smith County Completed Example of the Special Warranty Deed Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Mississippi and Smith County documents included at no extra charge:

Where to Record Your Documents

Smith County Chancery Clerk

Raleigh, Mississippi 39153

Hours: 8:00 to 5:00 M-F

Phone: (601) 782-9811

Recording Tips for Smith County:

- Documents must be on 8.5 x 11 inch white paper

- Bring extra funds - fees can vary by document type and page count

- Request a receipt showing your recording numbers

Cities and Jurisdictions in Smith County

Properties in any of these areas use Smith County forms:

- Mize

- Raleigh

- Taylorsville

Hours, fees, requirements, and more for Smith County

How do I get my forms?

Forms are available for immediate download after payment. The Smith County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Smith County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Smith County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Smith County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Smith County?

Recording fees in Smith County vary. Contact the recorder's office at (601) 782-9811 for current fees.

Questions answered? Let's get started!

A special warranty deed can be used to convey real property in this state. The use of the words "warrant specially" in a conveyance of real estate in Mississippi constitute a covenant that the grantor, his heirs, and personal representatives, will forever warrant and defend the title of the property unto the grantee and his heirs, representatives, and assigns, against the claims of all persons claiming by, through, or under the grantor ( 89-1-35). The statutory language for a conveyance in section 89-1-61 of the Mississippi Revised Code can be used for a special warranty if the words "warrant specially" are inserted. The grantor in a special warranty deed makes no warranty for the preceding owner's title.

For a special warranty deed or other conveyance of land to be effective, it must be signed by the grantor and delivered ( 89-1-3). The acknowledgment or proof of a special warranty deed is necessary to entitle the instrument to be recorded. The acknowledgment or proof should be certified by any of the officers listed in section 89-3-3 of the Mississippi Revised Code. If the party executing the special warranty deed resides in a state other than Mississippi, the deed can be acknowledged or proved by any of the officers listed in 89-3-9 of the Mississippi Revised Code. The special warranty deed will be as good and effectual as if the certificate of acknowledgment or proof had been made by an authorized officer in Mississippi ( 89-3-9). A special warranty deed that has not been acknowledged or proved in the manner provided by Mississippi statutes may be refused by the recording clerk. However, if an instrument has not been acknowledged or proved according to law but is otherwise admitted to record, then all persons are considered to be on constructive notice of the instrument ( 89-3-1).

All real property documents, including special warranty deeds, are recorded in the office of the clerk of the chancery court in the county where the property is located. A special warranty deed will take effect as to all creditors and subsequent purchasers for a valuable consideration without notice only from the time it is delivered to the clerk to be recorded ( 89-5-5). After the special warranty deed has been filed with the clerk, the priority of time of filing will determine the priority of all conveyances of the same land as between the several holders of such conveyances ( 89-5-1). Failure to file a special warranty deed with the clerk for record will prevent any claim of priority by the holder of such instrument over any similar recorded instrument affecting the same property, to the end that with reference to all instruments which may be filed for record, the priority thereof is governed by the priority in time of the filing of the several instruments, in the absence of actual notice. An unrecorded special warranty deed will be valid and binding only between the parties and their heirs, and all subsequent purchasers with notice or without valuable consideration ( 89-5-3).

(Mississippi SWD Package includes form, guidelines, and completed example)

Important: Your property must be located in Smith County to use these forms. Documents should be recorded at the office below.

This Special Warranty Deed meets all recording requirements specific to Smith County.

Our Promise

The documents you receive here will meet, or exceed, the Smith County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Smith County Special Warranty Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4574 Reviews )

brian t.

December 19th, 2020

The docs were precise and accurate for my specific needs. I greatly appreciated the accompanying forms and instructional guidance to help make the use of the forms direct and easy to complete. Equally important, I was not suckered in to get a great price for the docs I needed only to be led to expensive subscriptions or additional fees. Very impressive and professional site.

Thank you for your feedback. We really appreciate it. Have a great day!

Julia C.

May 18th, 2025

Deeds.com was such a blessing in order for me to get something done that my lawyers could not get done. Transferring a mineral right from my deceased parents to me and my husband. The mineral company person I worked with went above and beyond helping me fill the paperwork out perfectly so that it had “right of survivorship” (and other things phrased properly) so that either my husband or I won’t have the issue I have had. Had it not been for deeds.com I don’t think I would have been able to complete this process. I hope anyone that ever needs something such as this learns about I deeds.com.

Thank you, Julia, for your kind and thoughtful review. We're truly honored to have played a role in helping you and your husband secure your mineral rights — especially after such a frustrating experience elsewhere. It’s great to hear that our team and resources were able to guide you through the process with clarity and care. Your words mean a lot to us, and we hope others in similar situations find the support they need through Deeds.com, just like you did. Wishing you continued peace of mind and security with your property.

Fernando V.

February 28th, 2023

Excellent!

Thank you!

KATHLEEN S.

January 21st, 2021

Excellent service, great feedback and recommendations by the deed preparer, and I really appreciate the personalized service. The website is amazing, everything is well thought out, and all messages are saved, clear and easy to read. I wish my website was so easy to navigate! Seriously, the person who worked on my account is awesome. They made recommendations about what to include and what not to include. They didn't make me feel dumb for asking questions about out-of-state service and filing procedures, and I will be using Deeds.com exclusively on my cases. Five stars !

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Jennifer E.

March 8th, 2024

Very fast Process to get this to ROD

We are grateful for your feedback and looking forward to serving you again. Thank you!

Daphne M.

March 19th, 2023

As always I found Deeds.com to be excellent. Every item required on the forms I chose was explained completely. The fact that documents are available from so many states is amazing. Daphne M.

Thank you for your feedback. We really appreciate it. Have a great day!

Michael D.

November 9th, 2019

I sent Deeds.com an email with a question, asking for a little guidance as to which form(s) I need, but I'm waiting for a reply. My wife and I own 3 homes (2 in Indiana & 1 in Florida). We are needing to deed each to ourselves and put them into our living trust. I asked Deeds.com to please help by suggesting which forms I need for this. I do not want to get the wrong ones. I have not received a reply yet. When I receive a helpful reply and am able to purchase the correct forms, I am fairly certain my rating will go from 1 to 5. I withhold judgement until later.

Thank you for your feedback Michael. We make available do it yourself deed documents. We do not prepare documents or provide legal advice. If you have done research and are still unsure of which documents you need we are not the website for you. We highly recommend seeking the advice of a legal professional familiar with your specific situation moving forward. Have a wonderful day.

Alan K.

May 14th, 2019

The instructions and example for filling out the form were very clear and detailed making the whole process fairly easy. An attorney I talked to wanted $200 to fill out this simple form. I haven't tried to file it yet but I will let you know if there are any issues. Really a great deal. $20 vs $200.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

William Q.

September 30th, 2020

The website and information is fine. The proof in the pudding, of course, is whether the forms I used now will provide the results I want if the changes are challenged at some future date.

Thank you for your feedback. We really appreciate it. Have a great day!

Blaine G.

February 4th, 2022

Pretty good promissory note...but unable to delete some of the not needed stuff. Fill in blanks are fine but not all the template language is appropriate in my situation

Thank you for your feedback. We really appreciate it. Have a great day!

Jonelle R.

March 13th, 2023

Paperwork very easy to retrieve. Hope going to get it recorded will be this easy.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Thomas B.

May 29th, 2020

My deeds were filed with Pinellas County Florida with a simple process and with no problems. 5 star for sure.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Beverly J. A.

November 27th, 2022

The forms where easy to follow with the directions showing how to fill out the forms that I needed.

Thank you for your feedback. We really appreciate it. Have a great day!

Joseph L.

August 11th, 2021

I am an invalid and needed just one quitclaim form. I was able to quickly enter and complete the form. Unfortunately, it will probably be a last hurrah for me..

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Jany F.

November 8th, 2021

Great and quick service.

Thank you!