Randolph County Beneficiary Deed Form

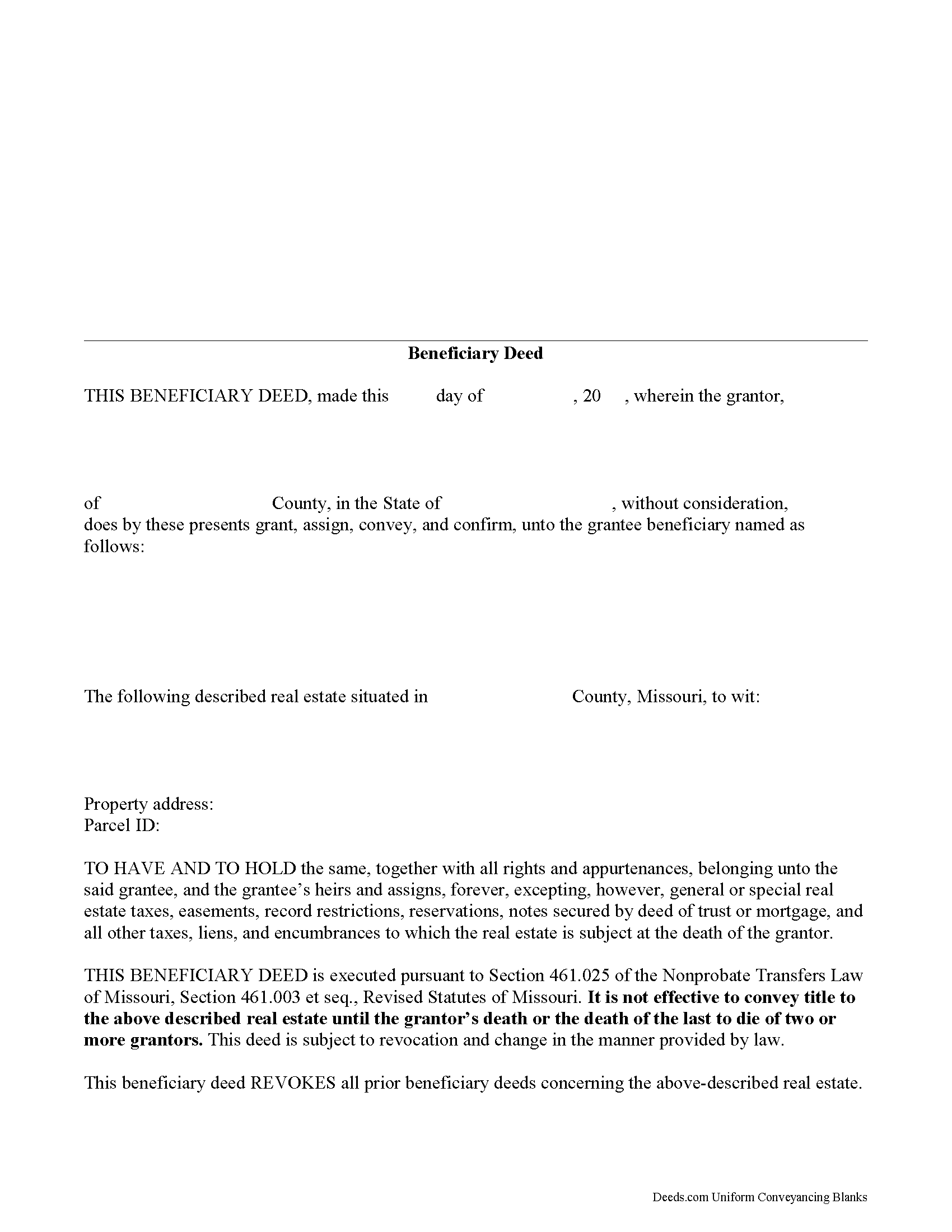

Randolph County Beneficiary Deed Form

Fill in the blank form formatted to comply with all recording and content requirements.

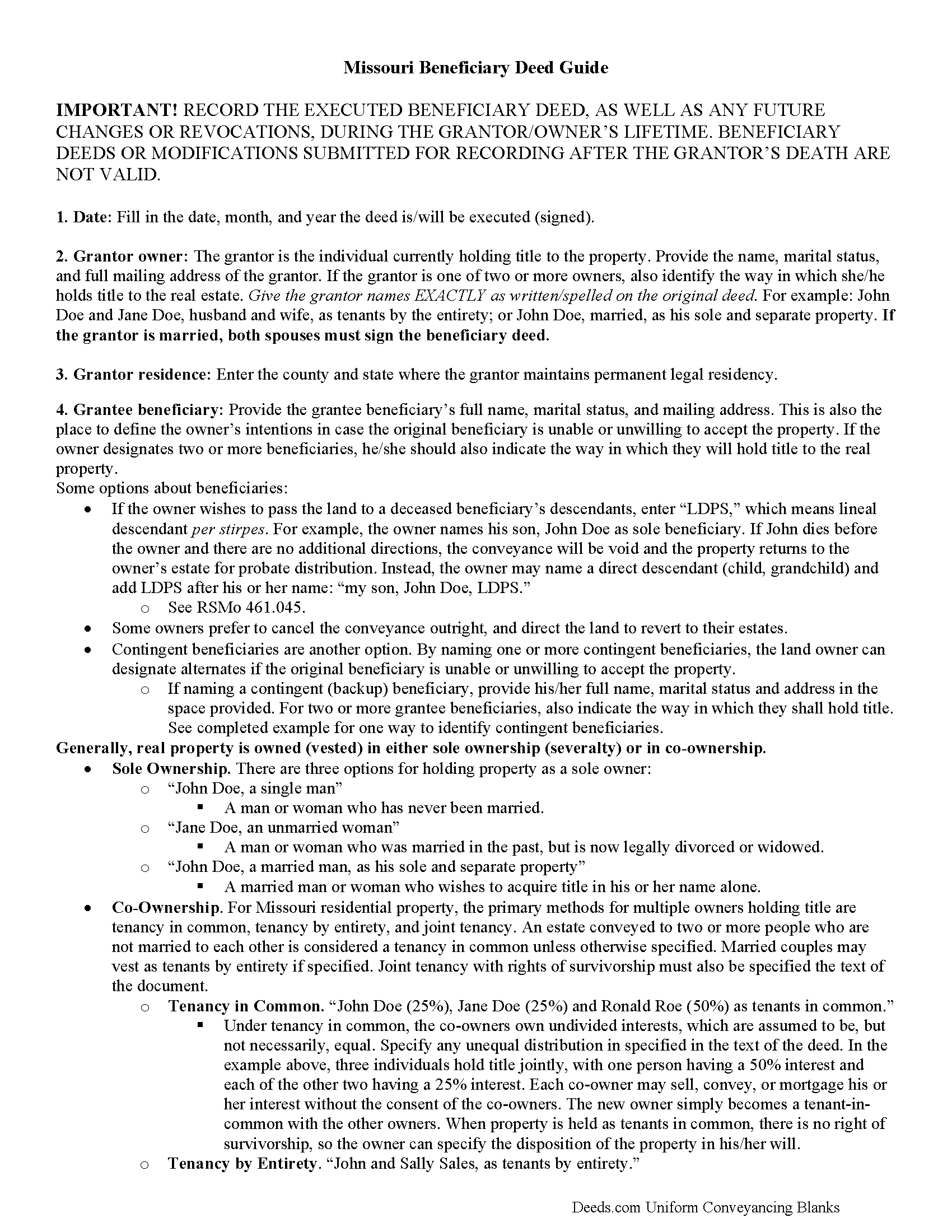

Randolph County Beneficiary Deed Guide

Line by line guide explaining every blank on the form.

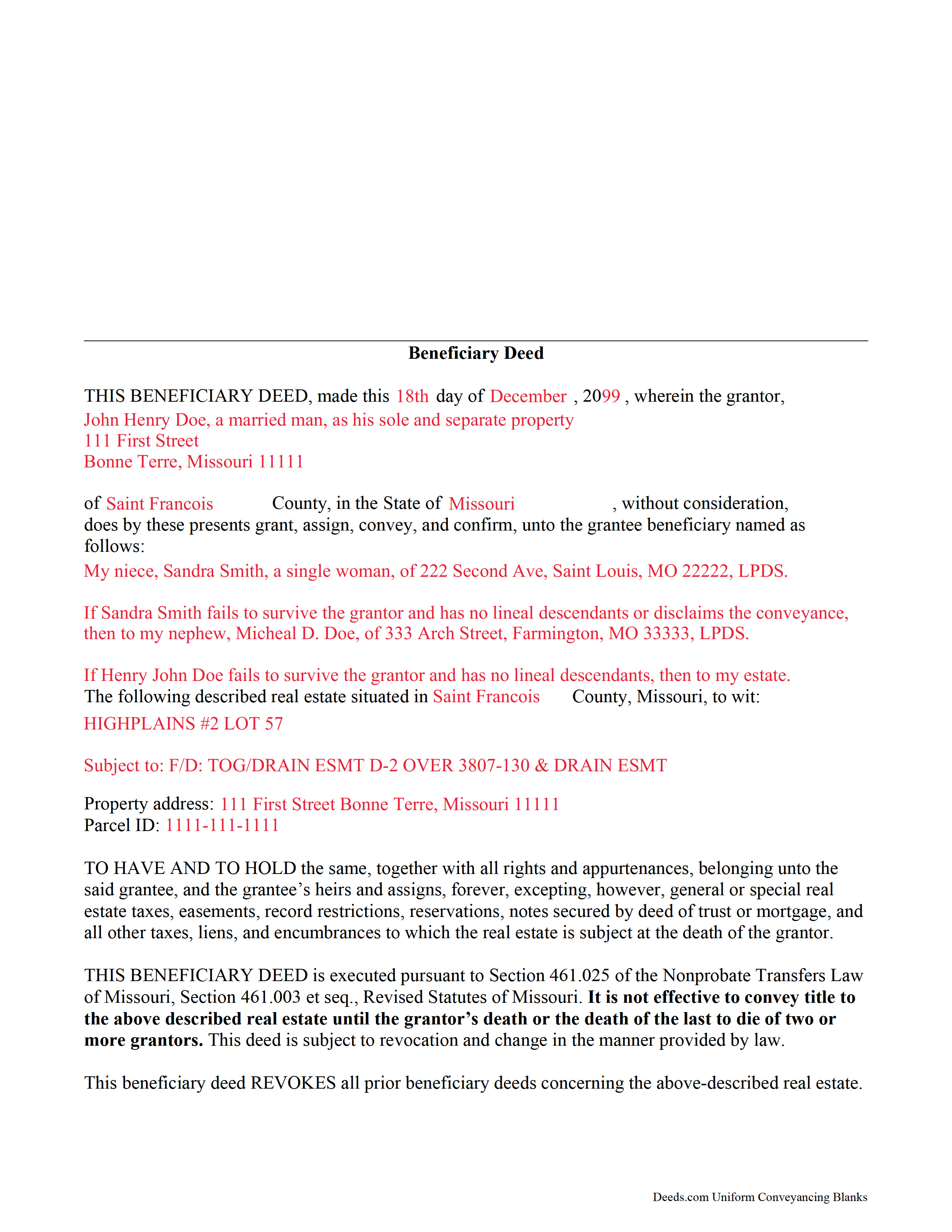

Randolph County Completed Example of the Beneficiary Deed Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Missouri and Randolph County documents included at no extra charge:

Where to Record Your Documents

Randolph County Recorder of Deeds

Huntsville , Missouri 65259-1292

Hours: 8:00 to 4:00 M-F

Phone: 844-277-6555 X 330

Recording Tips for Randolph County:

- Ensure all signatures are in blue or black ink

- Bring your driver's license or state-issued photo ID

- Ask if they accept credit cards - many offices are cash/check only

Cities and Jurisdictions in Randolph County

Properties in any of these areas use Randolph County forms:

- Cairo

- Clark

- Clifton Hill

- Higbee

- Huntsville

- Jacksonville

- Moberly

- Renick

Hours, fees, requirements, and more for Randolph County

How do I get my forms?

Forms are available for immediate download after payment. The Randolph County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Randolph County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Randolph County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Randolph County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Randolph County?

Recording fees in Randolph County vary. Contact the recorder's office at 844-277-6555 X 330 for current fees.

Questions answered? Let's get started!

Enacted in 1989, the Missouri Nonprobate Transfers Law (Sections 461.003 et seq, Revised Statutes of Missouri (2012)) allows those who own real property in Missouri the option of conveying real property after death, but without the need for probate distribution.

One distinctive feature of this useful estate planning tool is its flexibility. The grantor retains absolute ownership of and control over the Missouri real estate, with the freedom to sell, rent, mortgage, or otherwise use the land at will with no penalty for waste or obligation to inform the named beneficiary. He or she may also change details about beneficiaries or even revoke the beneficiary deed outright by executing and recording a new document containing the updated information. For the beneficiary deed and any related changes or revocations to be valid, however, the deed must be recorded during the grantor's lifetime.

This flexibility is possible because the transfer of ownership is incomplete. There is no statutory obligation to notify grantees of their beneficiary status, so there is typically no consideration (something of value, usually money) paid for the potential future interest in the real estate. The transfer of ownership rights is completed when the grantor dies and the beneficiary records the appropriate documentation.

Overall, Missouri beneficiary deeds are a simple and effective estate planning tool for individuals who want to pass on real property rights outside of the probate process. Even so, it is essential to review how executing a beneficiary deed might impact taxes, as well as eligibility for local, state, and federal benefits and asset-based programs.

(Missouri BD Package includes form, guidelines, and completed example)

Important: Your property must be located in Randolph County to use these forms. Documents should be recorded at the office below.

This Beneficiary Deed meets all recording requirements specific to Randolph County.

Our Promise

The documents you receive here will meet, or exceed, the Randolph County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Randolph County Beneficiary Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4582 Reviews )

Sterling H.

September 17th, 2024

I liked being able to drill down to state and county. Just simply the search for all property records

We welcome your positive feedback and are thrilled to have met your expectations. Thank you for choosing our services.

Kim C.

October 5th, 2020

Very user-friendly and easy to obtain exactly what I needed. I am impressed by the sample forms as well. I will definitely be using Deeds.com again!!

Thank you for your feedback. We really appreciate it. Have a great day!

Linda K.

July 5th, 2019

This service was easy, quick, and to the point. It was a lifesaver! Downloaded quickly and without issues. I was able to fill out a soecifice form for my state and county, which saved me from making errors from a universal form.

Thank you for your feedback. We really appreciate it. Have a great day!

Jamie W.

September 27th, 2019

Very fast service. Wish I knew about this earlier.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Daniel C.

May 30th, 2024

This is a wonderful service and your staff is very responsive through the chat. My one suggestion is that there be an added sentence to your instructions that sates that once you upload there is nothing more to do as in a "submit" or "Finished uploading" button. After uploading instinct says there is something to click to let you all know that we have finished with our uploads.

Your feedback is valuable to us and helps us improve. Thank you for sharing your thoughts!

Kenny H.

January 14th, 2020

The forms are extremely helpful. They could use some updating. Promissory note "...in the form of cash, check or money order." is a bit outdated. My note is with my son and we have an automatic bank transfer set up for payments. He could Venmo me. There are many other options and likely to be more changes in the future, so I know this is difficult to maintain.

Thank you for your feedback. We really appreciate it. Have a great day!

Connie C.

February 18th, 2021

I thought the process was fairly easy. The price was reasonable. I had a slight problem, some of the words were missing from one page of the documents when I printed it. However, after I saved it to my computer, I was able to print the page in full.

Thank you for your feedback. We really appreciate it. Have a great day!

Kimberly R.

January 8th, 2019

Very easy to use. Very informative. I think this is a very good service and is worth the $19 especially if you value time.

Thank you for your feedback. We really appreciate it. Have a great day!

Jeanette S.

January 2nd, 2020

Easy to use and instructions were very clear. If possible, it would be nice to be able to download the entire package at one time - it was a little cumbersome to download each item separately. (Of course, I didn't know which of the items I needed, so downloaded them all)

Thank you for your feedback. We really appreciate it. Have a great day!

Joe S.

May 7th, 2021

My first experience with deeds.com was excellent. My task was handled promptly and efficiently. Count on me as a repeat customer.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

irene w.

February 11th, 2021

Just found this site, what a great resource ! Thank you so much for providing affordable help to those of us navigating estate planning mazes. The forms were all very easy to download, even on our rather ancient computer, and the accompanying explanations were in clear, understandable English designed to explain, with appropriate cautions to avoid problems.

Thank you for your feedback. We really appreciate it. Have a great day!

Mark S.

January 31st, 2021

Excellent service, quick and very efficient! Thanks for your great service!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Narcedalia G.

December 4th, 2023

Easy to use quick responses with accurate information and great customer service. No need to say more!

Your feedback is greatly appreciated. Thank you for taking the time to share your experience!

chris h.

March 30th, 2021

so far so good

Thank you!

James K.

May 15th, 2024

Looks like a very professional site. I just don’t know what it would cost using this site.

Thanks for the kind words about the website James, sorry to hear that you could not find pricing information, we will try harder.