Pettis County Partial Mechanic's Lien Waiver on Progress Payment Form

Pettis County Partial Mechanic's Lien Waiver on Progress Payment Form

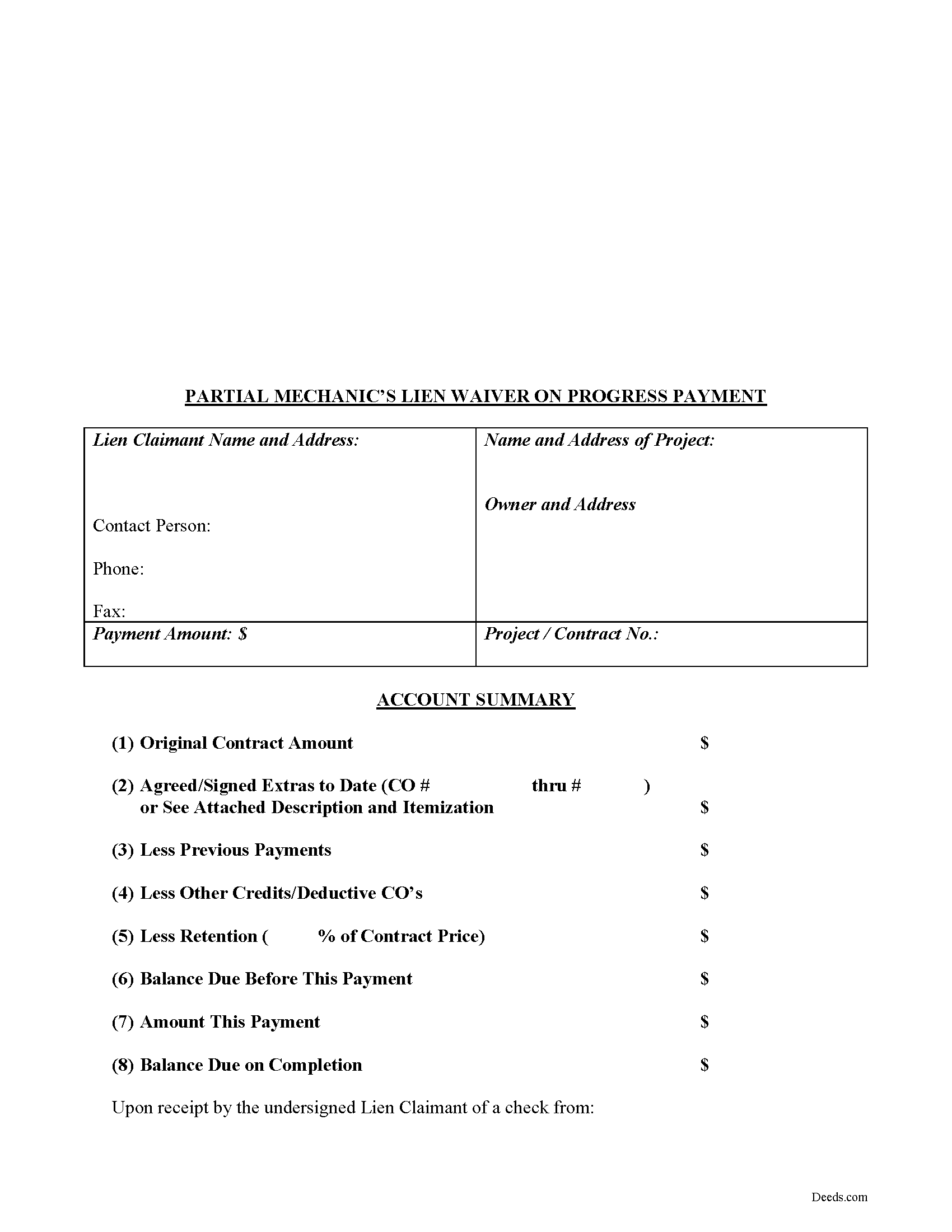

Fill in the blank Partial Mechanic's Lien Waiver on Progress Payment form formatted to comply with all Missouri recording and content requirements.

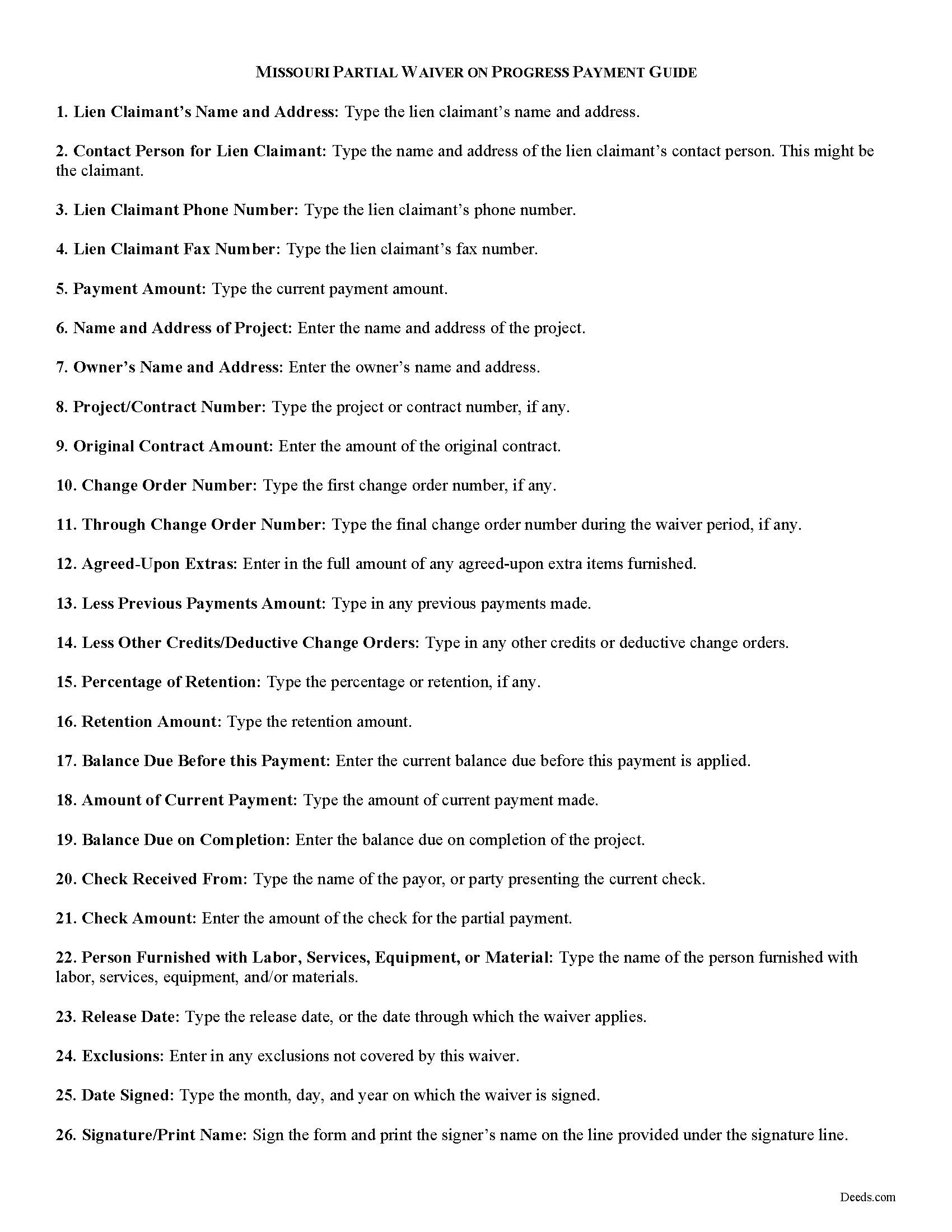

Pettis County Partial Lien Waiver Guide

Line by line guide explaining every blank on the form.

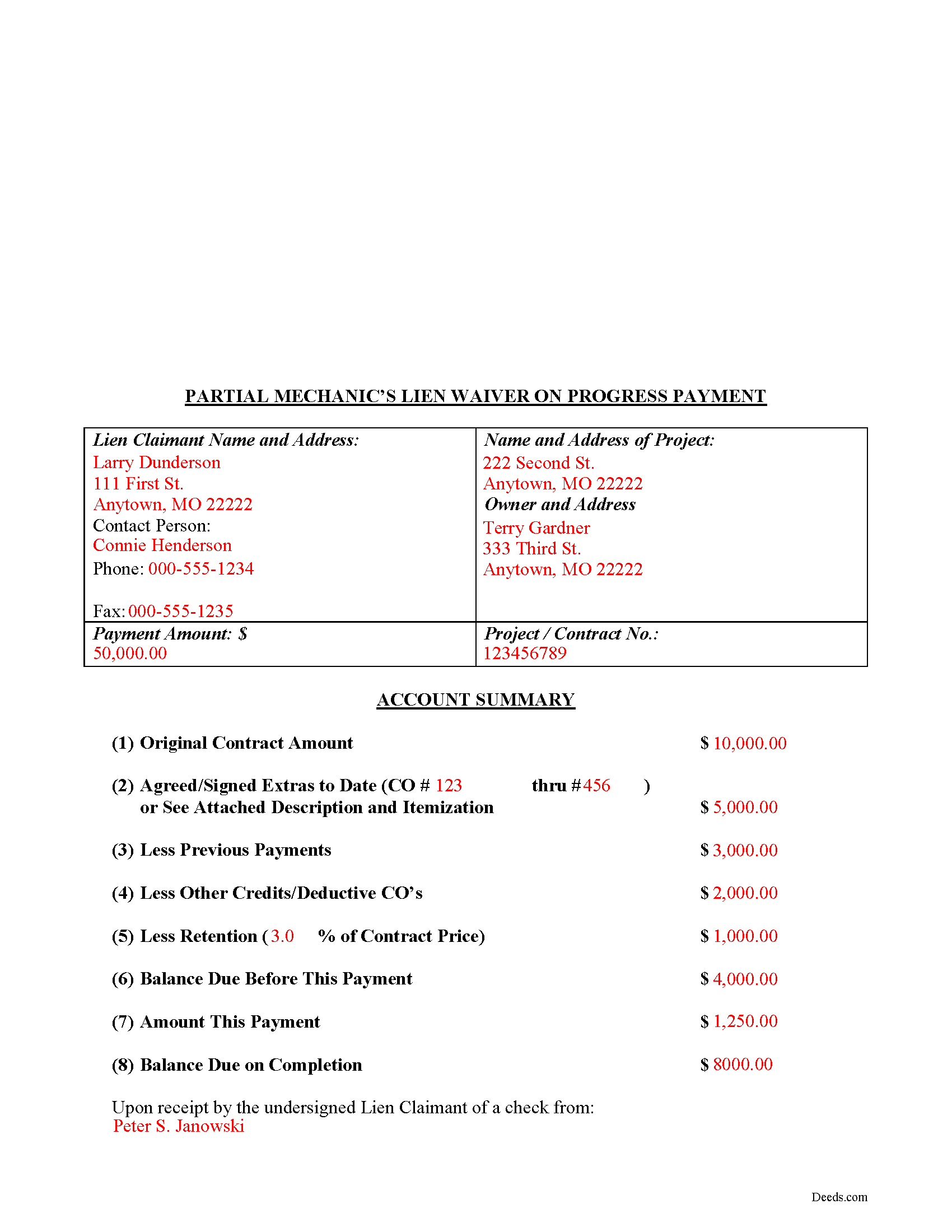

Pettis County Completed Example of the Partial Lien Waiver Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Missouri and Pettis County documents included at no extra charge:

Where to Record Your Documents

Pettis County Recorder of Deeds

Sedalia, Missouri 65301

Hours: 8:30 to 4:30 M-F

Phone: (660) 826-5000 Ext. 922

Recording Tips for Pettis County:

- Ensure all signatures are in blue or black ink

- Check that your notary's commission hasn't expired

- Double-check legal descriptions match your existing deed

- Documents must be on 8.5 x 11 inch white paper

- Request a receipt showing your recording numbers

Cities and Jurisdictions in Pettis County

Properties in any of these areas use Pettis County forms:

- Green Ridge

- Houstonia

- Hughesville

- La Monte

- Mora

- Sedalia

- Smithton

Hours, fees, requirements, and more for Pettis County

How do I get my forms?

Forms are available for immediate download after payment. The Pettis County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Pettis County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Pettis County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Pettis County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Pettis County?

Recording fees in Pettis County vary. Contact the recorder's office at (660) 826-5000 Ext. 922 for current fees.

Questions answered? Let's get started!

Lien waivers are used to facilitate payment between contractors, subcontractors, customers, and property owners. A waiver is a known relinquishment of a right. In this case, the person granting the waiver is relinquishing the right to seek a mechanic's lien for all or part of the amount due.

In general, there are two types of waivers: partial and final. A partial waiver is used when a progress or partial payment is made and money is still due and owing. The waiver applies only to the partial payment amount and is conditioned upon the actual receipt of that money (the check clears the bank). A final waiver releases all rights immediately. Be cautious about using the correct form of waiver, as partial waivers provide more protection to the lien claimant, while final waivers offer more protection for the customer or property owner.

The waiver must include details identifying the parties, the location of the project, relevant details from the original agreement such as work requested, costs and changes, important dates, payments, and any exclusions, conditions, or agreements. It also lists the dates covered by the partial waiver. The person waiving the lien gives a sworn statement in front of a notary, signs the form, and then records it in the property records for the county where the property is located.

This article is provided for information purposes only and should not be relied upon as a substitute for the advice from a legal professional. Please speak with an attorney with questions about using a lien waiver or any other issue related to liens in Missouri.

Important: Your property must be located in Pettis County to use these forms. Documents should be recorded at the office below.

This Partial Mechanic's Lien Waiver on Progress Payment meets all recording requirements specific to Pettis County.

Our Promise

The documents you receive here will meet, or exceed, the Pettis County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Pettis County Partial Mechanic's Lien Waiver on Progress Payment form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4581 Reviews )

Sander G.

December 4th, 2019

Good but knocked off a star because the download file names are mostly numbers instead of recognizable names of the file contents (e.g., Promissory_Note_blank.pdf). Renaming would be a great help!

Thank you for your feedback. We really appreciate it. Have a great day!

James R.

August 10th, 2022

This site is a blessing in disguise-/>

Thank you!

Craig L.

May 11th, 2021

So far so good. I will let you know after a successful recordation of the deed.

Thank you!

Rechantell A.

August 1st, 2020

It was quick and easy. Trust worthy. Very satisfied and would recommend. Thank you for your services.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Lori W.

January 24th, 2020

Disclaimer letter was just what I needed. Download worked without a hitch.

Thank you for your feedback Lori, we really appreciate it. Have a fantastic day!

Joy N.

February 22nd, 2024

As a real estate professional, I've had the opportunity to use various legal form providers over the years, but none have matched the quality and user-friendliness of Deeds.com's real estate legal forms. The forms themselves are comprehensive, up-to-date, and in line with current real estate laws and regulations, which is paramount in our field. The clarity and thoroughness of the documentation ensured that I could complete with confidence, knowing that every detail was covered. I wholeheartedly recommend their services and look forward to continuing our partnership.

Your feedback is greatly appreciated. Thank you for taking the time to share your experience!

Dretha W.

January 11th, 2019

Ordered the fill in the blank form for a deed. Very professional looking but more importantly, correct for my recording office. It was recorded with no question. The guide was a big help in completed the deed.

Great to hear Dretha. We appreciate you taking the time to leave your feedback. Have a wonderful day!

James G.

March 30th, 2022

Very Happy. Forms saved me from making some very silly mistakes had I done them on my own.

Thank you!

Mark C.

November 29th, 2023

WOW! I am so pleased the County Registrar’s office recommended Deeds.com. From start to a very quick finish Deeds.com worked to ensure my documents were correct and they immediately filed them. The Warranty Deed was accepted by the County and registered within a hour. Deeds.com’s communication was superb. I will use this handy resource every time I am in need.

Your feedback is greatly appreciated. Thank you for taking the time to share your experience!

dorothy f.

March 27th, 2019

Thank you, for help.

Anytime Dorothy, have a great day.

Maricela N.

May 5th, 2021

very easy and quick to get all the forms needed! Thank you!

Thank you for your feedback. We really appreciate it. Have a great day!

John C.

May 30th, 2023

So far it's OK but have not filed it with the the county so can't say if it will be what they want

Thank you for your feedback. We really appreciate it. Have a great day!

Joshua P.

July 27th, 2022

Easy fill in the blanks form. Just FYI make sure you have a copy of whatever deed you are changing and the tax records. You will want the language to be identical.

Thank you for your feedback. We really appreciate it. Have a great day!

Matthew G.

February 19th, 2019

Second time using Deeds.com. Easy and professional

Thank you Matthew. Have a great day!

James H.

December 7th, 2020

Clear and easy instructions. Prompt processing and confirmation. I am still in the middle of submitting my document for recording, but I am confident that the Deeds.com service will deliver as promised. Definitely a valuable tool with important legal doucments.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!