Marion County Specific Power of Attorney for the Purchase of Property Form

Marion County Specific Power of Attorney for the Purchase of Property Form

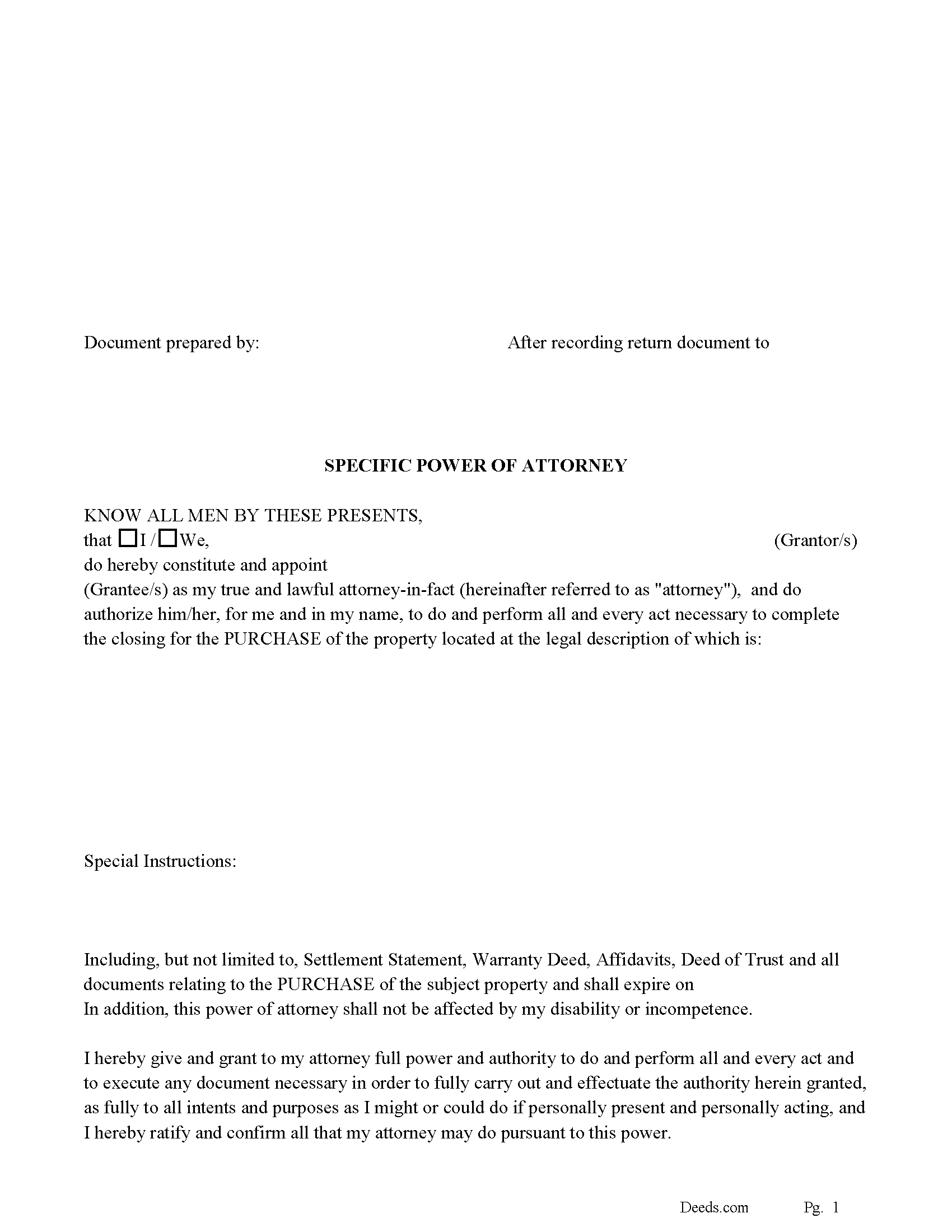

Fill in the blank form formatted to comply with all recording and content requirements.

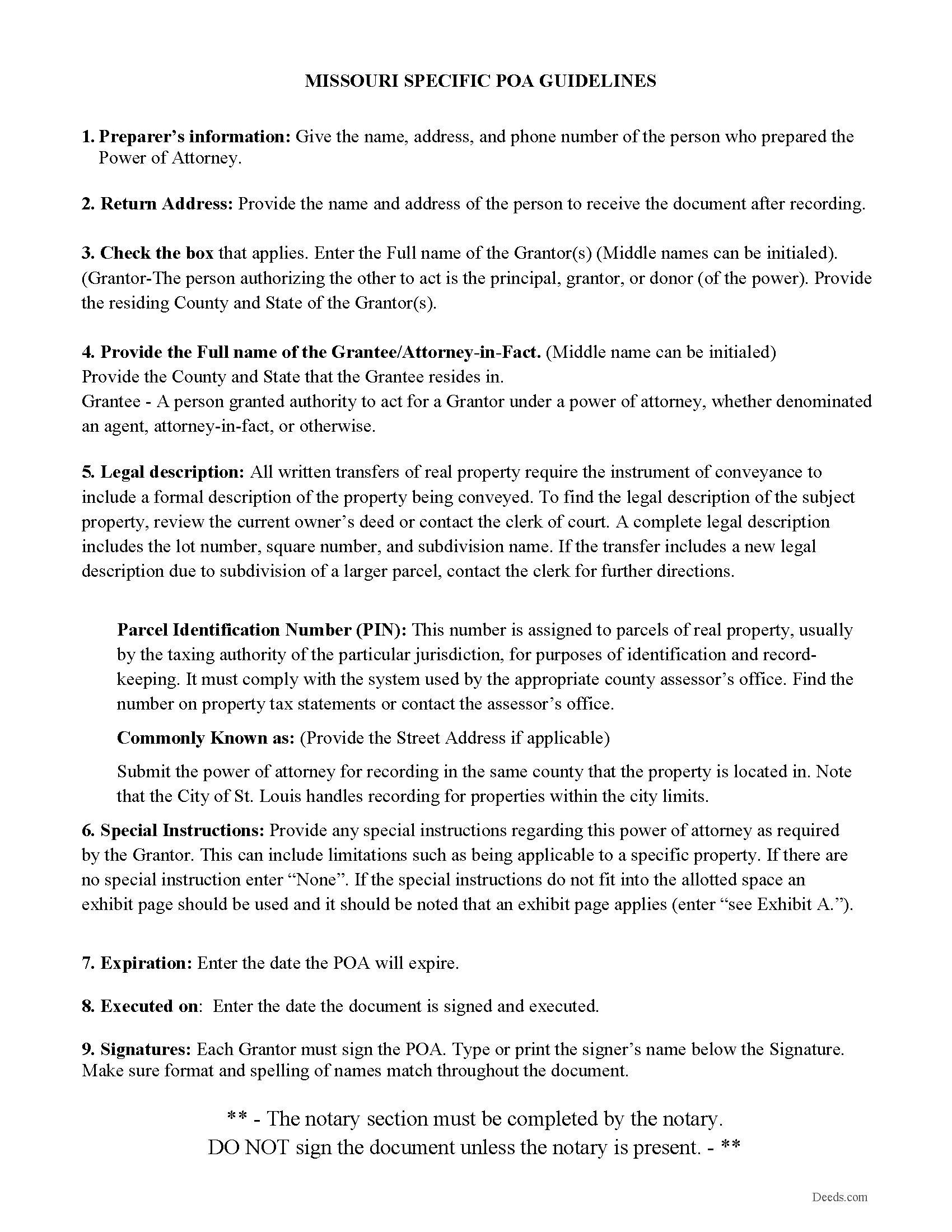

Marion County Specific Power of Attorney Guidelines

Line by line guide explaining every blank on the form.

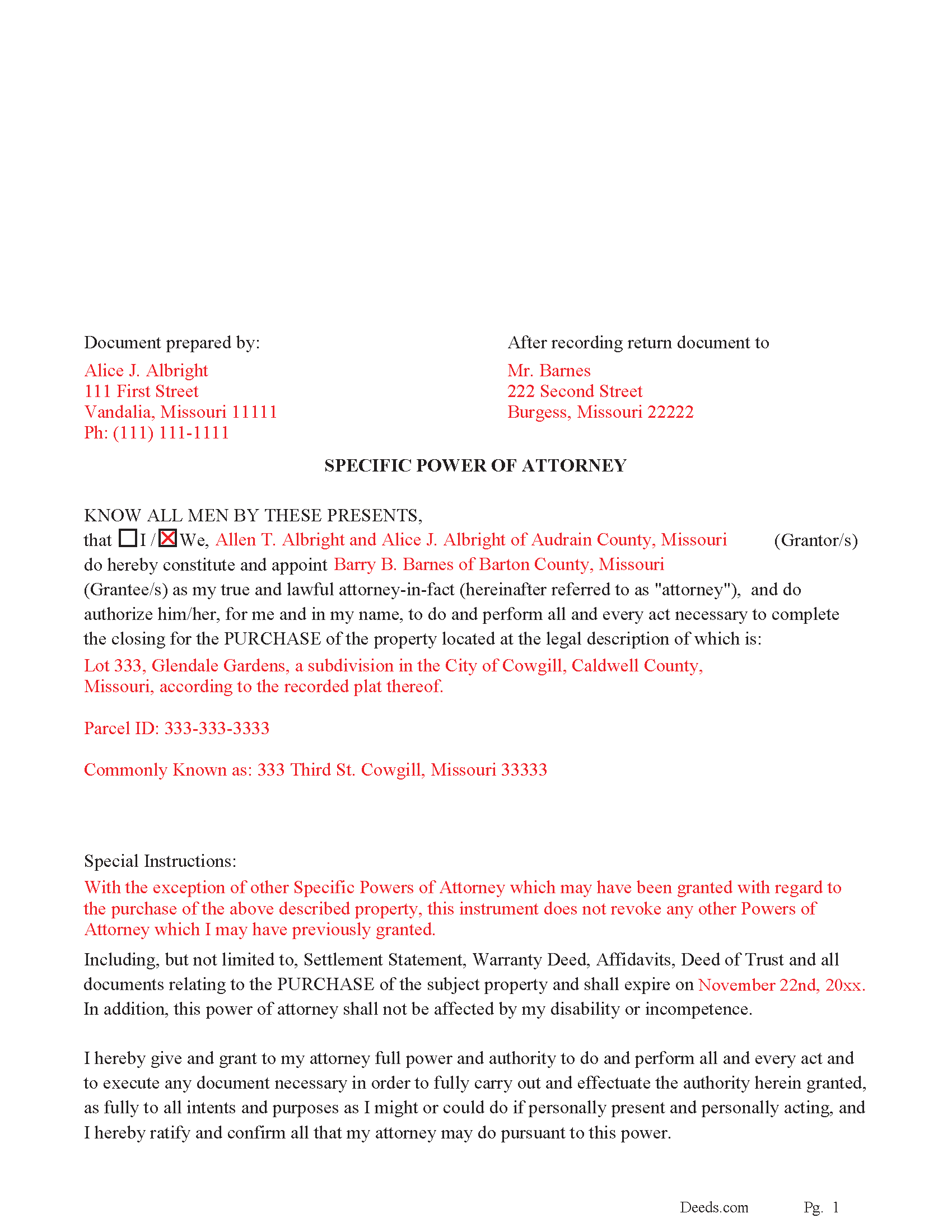

Marion County Completed Example of the Specific POA

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Missouri and Marion County documents included at no extra charge:

Where to Record Your Documents

Marion County Recorder of Deeds

Palmyra, Missouri 63461

Hours: 8:00 to 5:00 M-F

Phone: 573-769-7001

Recording Tips for Marion County:

- Check that your notary's commission hasn't expired

- Make copies of your documents before recording - keep originals safe

- Mornings typically have shorter wait times than afternoons

Cities and Jurisdictions in Marion County

Properties in any of these areas use Marion County forms:

- Hannibal

- Maywood

- Palmyra

- Philadelphia

- Taylor

Hours, fees, requirements, and more for Marion County

How do I get my forms?

Forms are available for immediate download after payment. The Marion County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Marion County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Marion County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Marion County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Marion County?

Recording fees in Marion County vary. Contact the recorder's office at 573-769-7001 for current fees.

Questions answered? Let's get started!

Use this form to authorize an attorney-in-fact to do and perform all and every act necessary to complete the closing for the PURCHASE of a specific property. This form expires on a date of your choice and includes a "Special Instructions" section in which you can further limit or define the powers granted by you to your attorney-in-fact.

This POA is durable and shall not be affected by your disability or incompetence.

For use when the subject property is located in Missouri.

(Missouri SPOA-Purchase Package includes form, guidelines, and completed example)

Important: Your property must be located in Marion County to use these forms. Documents should be recorded at the office below.

This Specific Power of Attorney for the Purchase of Property meets all recording requirements specific to Marion County.

Our Promise

The documents you receive here will meet, or exceed, the Marion County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Marion County Specific Power of Attorney for the Purchase of Property form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4583 Reviews )

Pamela B.

June 18th, 2023

Very easy to use. Time will tell if I have any issues getting it recorded. Beats using an attorney who won't return calls and emails like I used before. I like the form plus instructions and an example of the completed form.

Thank you for your feedback. We really appreciate it. Have a great day!

Connie E.

December 25th, 2018

Great service! Easy to download and view. Florida should have the Revocable Transfer on Death (TOD)deed, that many other States have. That's the one I really wanted. This one will do in the meantime.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Yvonne W.

December 30th, 2018

I'm not certain yet that this is all I need to do what I need to do. Marion Co. Clerk's office has not been helpful. I found this site from that site & hopefully it will help.

Thanks for the feedback Yvonne. We hope you found what you needed. Have a wonderful day!

Ellen d.

February 7th, 2019

Wonderful tool to have available on line!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Jeffrey S.

February 1st, 2024

Web site was clear to understand and easy to use. Found what I needed quickly and crossed it off my to do list. Thanks, JS

We are grateful for your feedback and looking forward to serving you again. Thank you!

Nancy A.

April 24th, 2024

This is an excellent resource. I was surprised because the price is so low I thought the products might be inferior. Not only were were the requested documents high quality, additional unrequested documents were added to my order that I didn't realize I would need until I read them. I especially appreciate that all the documents were specific to my county. I highly recommend using deeds.com.

Your satisfaction with our services is of utmost importance to us. Thank you for letting us know how we did!

Christi W.

December 9th, 2020

Very simple and made recording a breeze. Worth the fee!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Jay T.

August 6th, 2020

I filled out the deed, had it notarized, and recorded. No problems. I put this off for so long. Once I had the form it was recorded in one day.

Thank you for your feedback. We really appreciate it. Have a great day!

Michael L.

December 28th, 2018

I accidentally ordered the wrong deed package. Was looking for a quit claim deed and got a trustee deed. I immediately emailed the company, nothing back from them. I would like to exchange my purchase.

Thank you for your feedback. We replied to your message on December 20th at 2:05 pm, the reply was as follows: As a one time courtesy we have canceled your order/payment for the Trustee Deed document.

Richard A.

February 17th, 2023

Deeds.com was easy to use and provided everything needed to do a quitclaim deed!

Thank you!

Kendrick S.

May 29th, 2020

Really solid system for determining what may prevent your documents from being accepted. I love the comments section allowing for fluid communication. I only wish there were automated emails for all those communications and once documents were accepted, but I did receive a couple personally-generated emails regarding the progress instructing me to check the site.

Thank you for your feedback. We really appreciate it. Have a great day!

Jane N.

March 7th, 2019

This worked. Saved me a trip to get a copy of a deed. Cost less than the parking fee. Very convenient.

Thank you for your feedback. We really appreciate it. Have a great day!

Ryan J.

September 5th, 2024

This was an excellent experience. The jurisdiction I was registering the Deed with, entrusts Deeds.com with their filing needs. And the staff held my hand through the process, and worked to submit the best package, and the Deed was successfully recorded.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Raymond M.

January 11th, 2020

It would be really nice if you had an example of the document full size that can be examined/read before having to pay. I was gambling that it was the exact document that I needed when I paid my fee. Fortunately, it was, and I commend you for that.

Thank you for your feedback. We really appreciate it. Have a great day!

AKILAH S.

March 14th, 2024

It was a little challenging and I had to call to speak to someone a few time but I got it done and and over with so I'm happy.

It was a pleasure serving you. Thank you for the positive feedback!