Hickory County Specific Power of Attorney for the Sale of Property Form

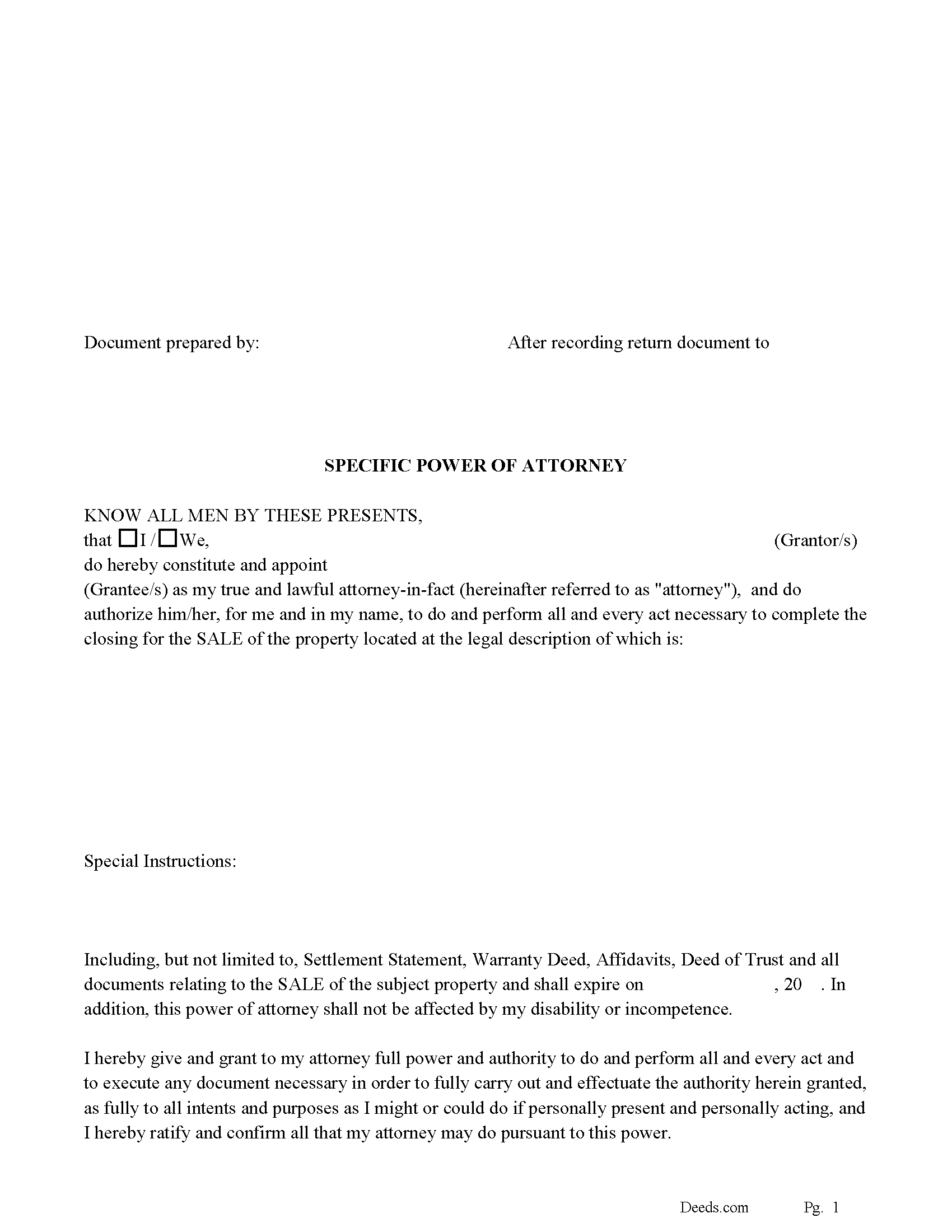

Hickory County Specific Power of Attorney for the Sale of Property

Fill in the blank form formatted to comply with all recording and content requirements.

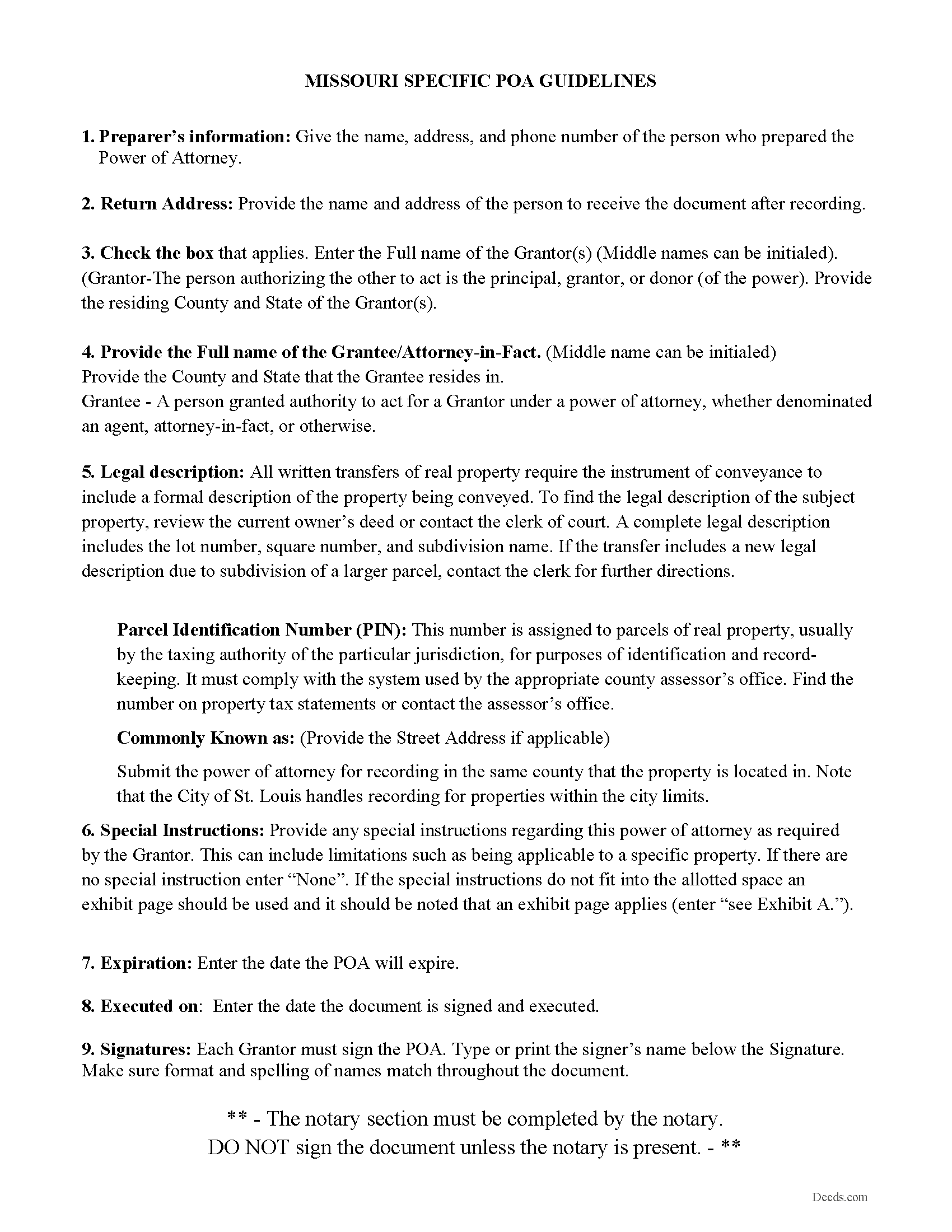

Hickory County Specific Power of Attorney Guidelines

Line by line guide explaining every blank on the form.

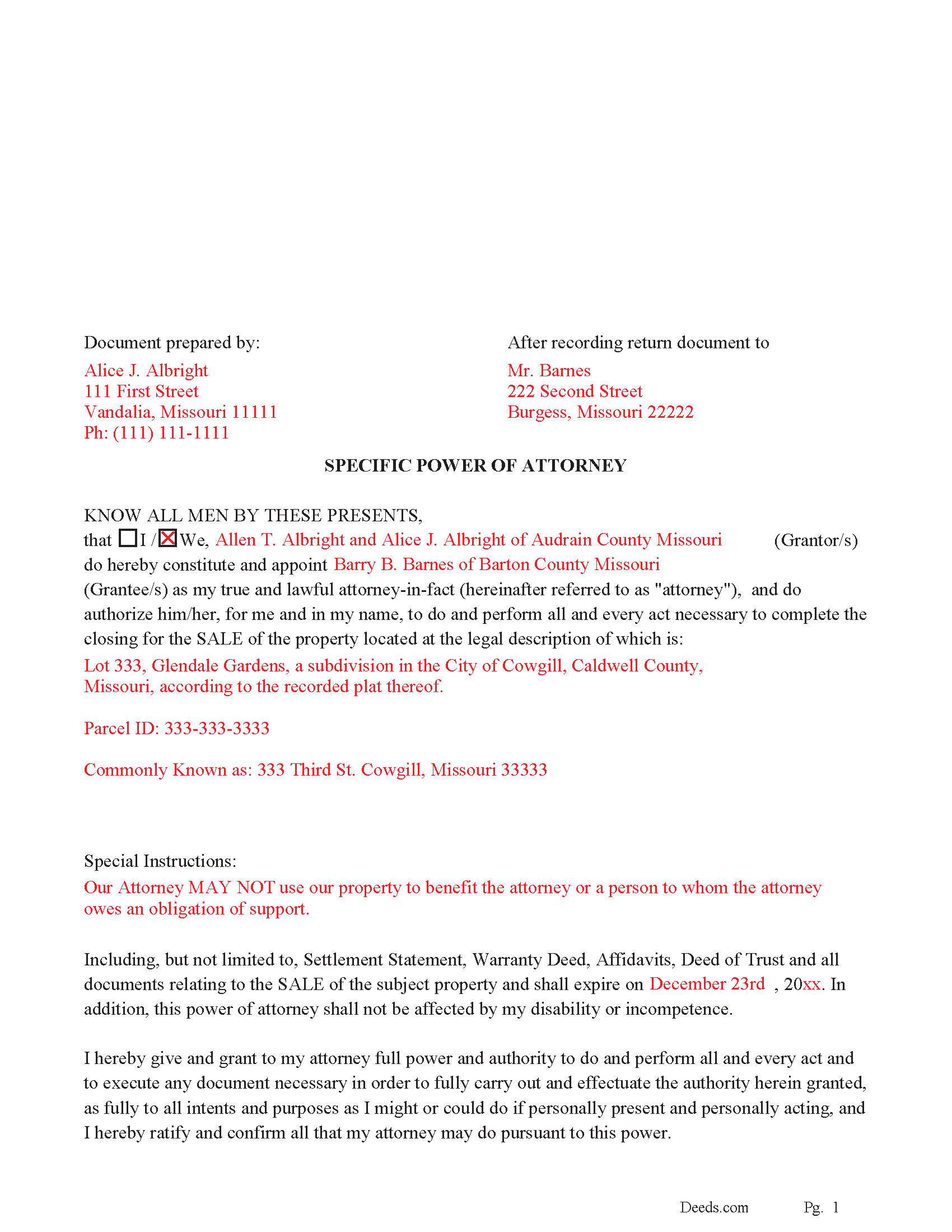

Hickory County Completed Example of the Specific POA

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Missouri and Hickory County documents included at no extra charge:

Where to Record Your Documents

Hickory County Recorder of Deeds

Hermitage, Missouri 65668

Hours: 8:00 to 4:30 M-F

Phone: (417) 745-6421

Recording Tips for Hickory County:

- Recording fees may differ from what's posted online - verify current rates

- Check margin requirements - usually 1-2 inches at top

- Bring extra funds - fees can vary by document type and page count

- Some documents require witnesses in addition to notarization

Cities and Jurisdictions in Hickory County

Properties in any of these areas use Hickory County forms:

- Cross Timbers

- Hermitage

- Pittsburg

- Preston

- Quincy

- Weaubleau

- Wheatland

Hours, fees, requirements, and more for Hickory County

How do I get my forms?

Forms are available for immediate download after payment. The Hickory County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Hickory County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Hickory County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Hickory County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Hickory County?

Recording fees in Hickory County vary. Contact the recorder's office at (417) 745-6421 for current fees.

Questions answered? Let's get started!

Use this form to authorize an attorney-in-fact to do and perform all and every act necessary to complete the closing for the SALE of a specific property. This form expires on a date of your choice and includes a "Special Instructions" section in which you can further limit or define the powers granted by you to your attorney-in-fact.

This POA is durable and shall not be affected by your disability or incompetence.

For use when the subject property is located in Missouri.

(Missouri SPOA-Sale Package includes form, guidelines, and completed example)

Important: Your property must be located in Hickory County to use these forms. Documents should be recorded at the office below.

This Specific Power of Attorney for the Sale of Property meets all recording requirements specific to Hickory County.

Our Promise

The documents you receive here will meet, or exceed, the Hickory County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Hickory County Specific Power of Attorney for the Sale of Property form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4582 Reviews )

Hamed T.

January 12th, 2022

Easy Process! Realy recommend them for E-Recording!

Thank you for your feedback. We really appreciate it. Have a great day!

Richard C.

February 10th, 2025

Fast, effective, and good communication. I have no complaints at all.

Thank you for your positive words! We’re thrilled to hear about your experience.

Ashley D.

March 4th, 2021

Was able to print my documents immediately. Documents included deed form, a guide, a sample document, etc. Very helpful!

Thank you for your feedback. We really appreciate it. Have a great day!

Lori S.

April 19th, 2022

The documents I created on deeds com turned out beautiful and very professional looking. The example they gave along with the instruction booklet made it very easy t create a professional looking document for our land Sale. I was very pleased with how easy it was and would recommend it to anyone needing professional documents without having to go thru an attorney or title company. I was very impressed!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

FEDERICO T.

June 21st, 2019

It was a little confusing to retrieve the documents. I was waiting for an email, but then I went toyour portal and I saw the messages and the document.

Thank you for your feedback Frederico.

Marion R.

January 30th, 2019

YOU WERE NOT ABLE TO PROVIDE SERVICE IN THE COUNTY WE NEEDED IN NEW MEXICO. YOUR RESPONSE WAS QUICK SO I APPRECIATE THAT. THANK YOU

Thank you for your feedback Marion.

SHIRLEY R.

August 22nd, 2019

This was Awesome!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Patricia W.

January 29th, 2019

The "Trustee's Deed" should have been labeled a Deed of Trust because that's what it really is. So now I just wasted $19.97 getting something I can't use.

Thank you for your feedback. Sorry to hear of your confusion. We have canceled your order and payment for the trustee's deed document.

Shari N.

March 1st, 2022

Super easy to order and save a document!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Thomas H.

August 31st, 2023

Absolute crap. I would give it 0 stars for user-friendliness.

Sorry to hear that we failed you Thomas. We do hope that you found something more suitable to your needs elsewhere.

Frank B.

March 16th, 2023

Great website, super easy to use, user friendly to navigate. Will definitely use for future needs, and will definitely refer to other customers. F. Betancourt Texas

Thank you!

Greg S.

August 19th, 2022

The Beneficiary Deed is easy to fill out, expecially with the examples/explanations provided. The only recommendation I would make is to state that the Parcel ID and the Assessor's ID are one in the same. I looked everywhere for something that mentions "Assessor's ID" in my paperwork to no avail. Upon calling the Maricopa Assessor's number in Maricopa I was told that they are the same.

Thank you for your feedback. We really appreciate it. Have a great day!

Lance G.

December 13th, 2018

You did not include the Notice of Intent to File a Lien Statement form which is necessary to properly file a mechanic's lien in Colorado. If you are going to charge people $20 to download the forms, you should include all of them not half of them.

Thank you for your feedback. We really appreciate it. Have a great day!

Cynthia S.

January 19th, 2019

Good find, provides guide to use.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Robin G.

February 1st, 2024

Very user friendly. I was totally amazed. Thank you so much.

We are delighted to have been of service. Thank you for the positive review!