Fallon County Beneficiary Deed Revocation Form

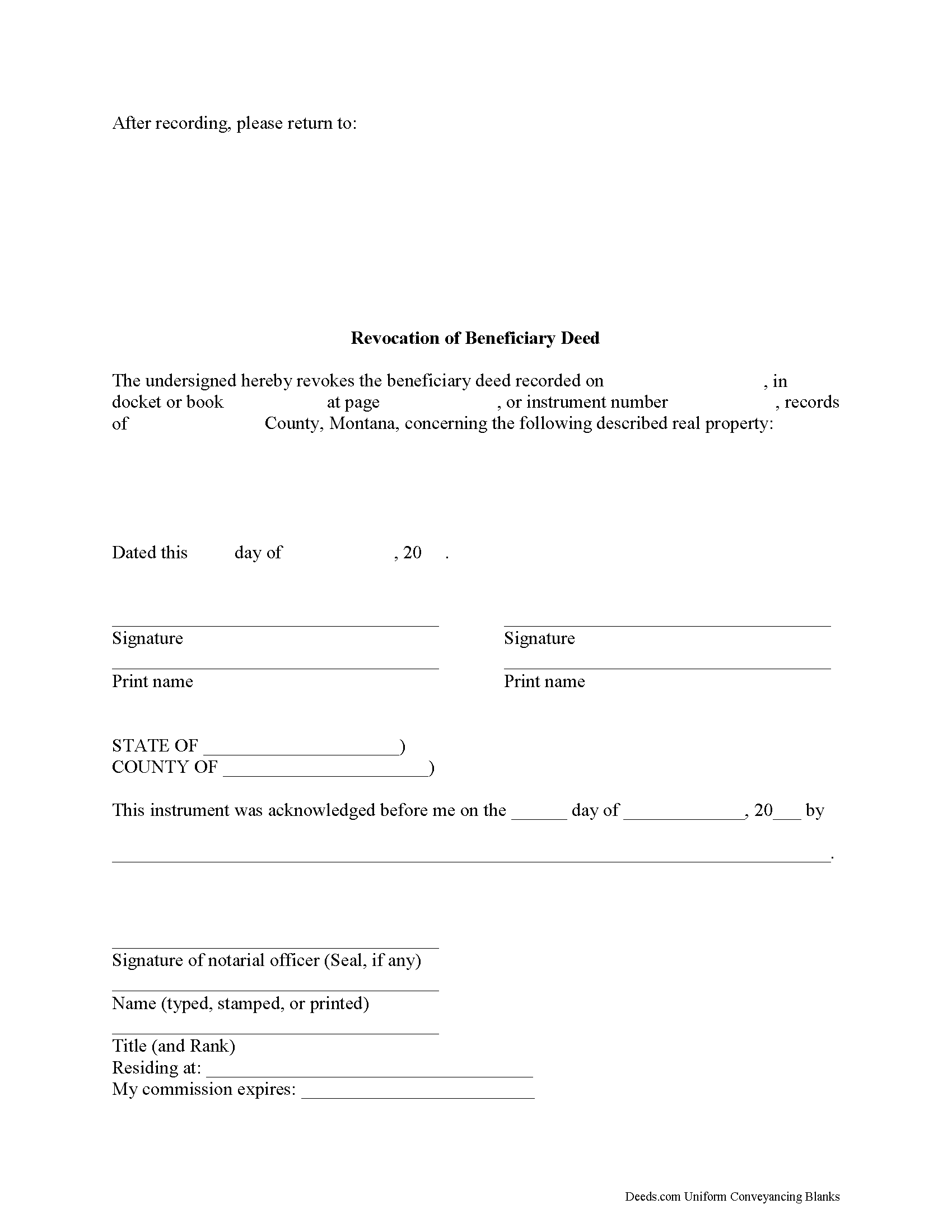

Fallon County Revocation of Beneficiary Deed Form

Fill in the blank form formatted to comply with all recording and content requirements.

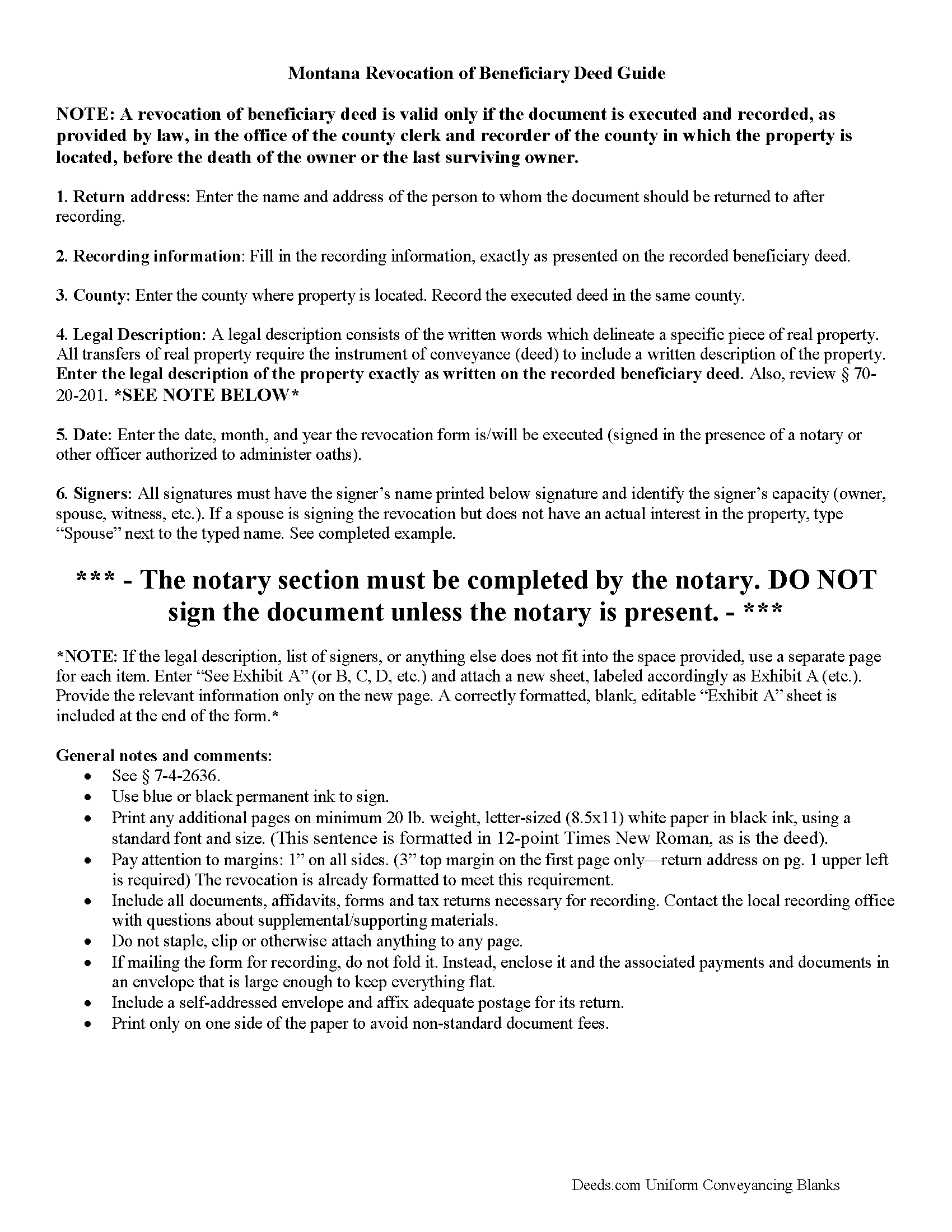

Fallon County Beneficiary Deed Revocation Guide

Line by line guide explaining every blank on the form.

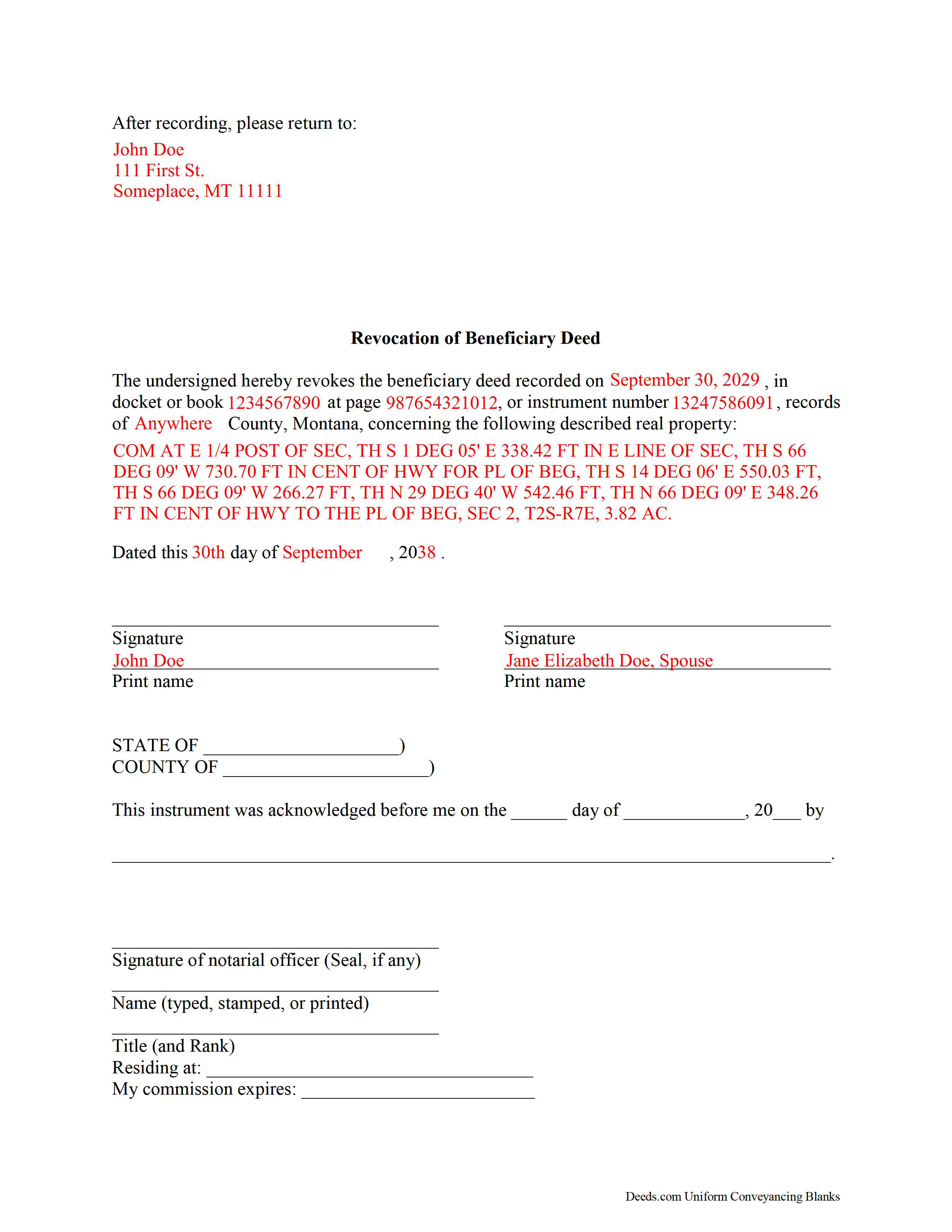

Fallon County Completed Example of the Revocation of Beneficiary Deed Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Montana and Fallon County documents included at no extra charge:

Where to Record Your Documents

Fallon County Clerk / Recorder

Baker, Montana 59313

Hours: 8:00am-5:00pm M-F

Phone: (406) 778-7106

Recording Tips for Fallon County:

- Verify all names are spelled correctly before recording

- Check that your notary's commission hasn't expired

- Bring extra funds - fees can vary by document type and page count

- Make copies of your documents before recording - keep originals safe

- Ask for certified copies if you need them for other transactions

Cities and Jurisdictions in Fallon County

Properties in any of these areas use Fallon County forms:

- Baker

- Plevna

- Willard

Hours, fees, requirements, and more for Fallon County

How do I get my forms?

Forms are available for immediate download after payment. The Fallon County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Fallon County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Fallon County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Fallon County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Fallon County?

Recording fees in Fallon County vary. Contact the recorder's office at (406) 778-7106 for current fees.

Questions answered? Let's get started!

Revoking a Montana Beneficiary Deed

A revocation of a recorded beneficiary deed must be lawfully executed and recorded during the owner's life or it has no effect.

In 2007, the Montana Legislature enacted the state's beneficiary deed law, found at Montana Code Annotated Section 72-6-121. All following parenthetical references identify the part of that section which contains additional information.

Beneficiary deeds are nontestamentary documents that convey a potential future interest in real property, but they only become effective when the owner dies (11). Until that point, the owner retains absolute title to, control over, and use of the property, including the freedom to modify or revoke the beneficiary designation, or to sell the property to someone else. This flexibility is what makes beneficiary deeds so useful; it allows the owners to respond quickly if circumstances change. Note that if the real property is owned as joint tenants with right of survivorship and if the revocation is not executed by all the owners, the revocation is not effective unless executed by the last surviving owner (6).

If an owner executes and records more than one beneficiary deed concerning the same real property, the document recorded closest to the owner's death is the effective beneficiary deed (8). Even though the recording date directs the transfer, it makes sense to execute and record a revocation because it adds an endpoint to the original deed and helps to preserve a clear chain of title (ownership history). This is important because any perceived irregularities can add unnecessary complexity to future sales of the property.

Revoking a beneficiary deed is a simple process, but it may not be appropriate in all cases. Contact an attorney with specific questions or for complex situations.

(Montana BD Revocation Package includes form, guidelines, and completed example)

Important: Your property must be located in Fallon County to use these forms. Documents should be recorded at the office below.

This Beneficiary Deed Revocation meets all recording requirements specific to Fallon County.

Our Promise

The documents you receive here will meet, or exceed, the Fallon County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Fallon County Beneficiary Deed Revocation form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4574 Reviews )

Michael L.

September 5th, 2020

Pretty good stuff, not exactly clear on the deed transfer costs and all

Thank you for your feedback. We really appreciate it. Have a great day!

Jeffery H.

October 18th, 2023

Very easy to use. Thanks for your quick response on my document submissions and follow up and guidance on specific questions.

Thank you for your positive words! We’re thrilled to hear about your experience.

Donald B.

November 21st, 2021

Pretty good forms, they would probably be better if I read the directions but...

Thank you!

Alvera A.

May 6th, 2023

Very easy to find my documents, download and print them!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Michael R.

July 5th, 2022

Very simple to use and everything included

Thank you for your feedback. We really appreciate it. Have a great day!

Viola G.

November 2nd, 2023

no as easy as anticipated but convenient.

We are grateful for your feedback and looking forward to serving you again. Thank you!

Elizabeth P.

October 20th, 2020

Perfect quitclaim form. Easy to fill in with the required information and all the required information has a place (no easy feat in our county!). It is helpful that they include exhibit pages for larger blocks of information (our legal is 2 pages long). Great job folks!

Thank you for the kind words Elizabeth. Have an amazing day!

Charles C.

July 8th, 2021

Easy to use. Good price. I like that it came with instructions and an example.

Thank you for your feedback. We really appreciate it. Have a great day!

Mark M.

May 24th, 2020

This Service Provider is amazing!! Needed Notice of Commencement recorded in Broward County, FL.. They got it done..super fast. High;y recommend.

Thank you for your feedback. We really appreciate it. Have a great day!

JOHN R.

March 15th, 2023

This is an Outstanding Website for easy access in expediting my property investment needs. Thank you for this much needed online service.

Thank you!

ronnie y.

May 22nd, 2019

well worth the money thank you

Thank you!

Jerry O.

July 10th, 2020

Everything I needed including detailed instructions to transfer the deed on my house from me alone to me and my wife as joint owners with right of survivorship. Formatting was compliant and blanks for all information required were provided in all the right places. 5 stars

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

John R.

October 22nd, 2020

5stars for prompt and fast! Website needs work. Hard to navigate for first time users and hard to find where to pay. Emails are more clear than the "message center". Not sure what happened to my other documents, lol

Thank you for your feedback. We really appreciate it. Have a great day!

Tanya H.

July 21st, 2020

Could not be happier with deeds.com forms. The guide helped more than one can imagine, great resource.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

April L.

November 13th, 2019

The warranty deed forms I received worked fine.

Thank you!