Missoula County Beneficiary Deed Revocation Form

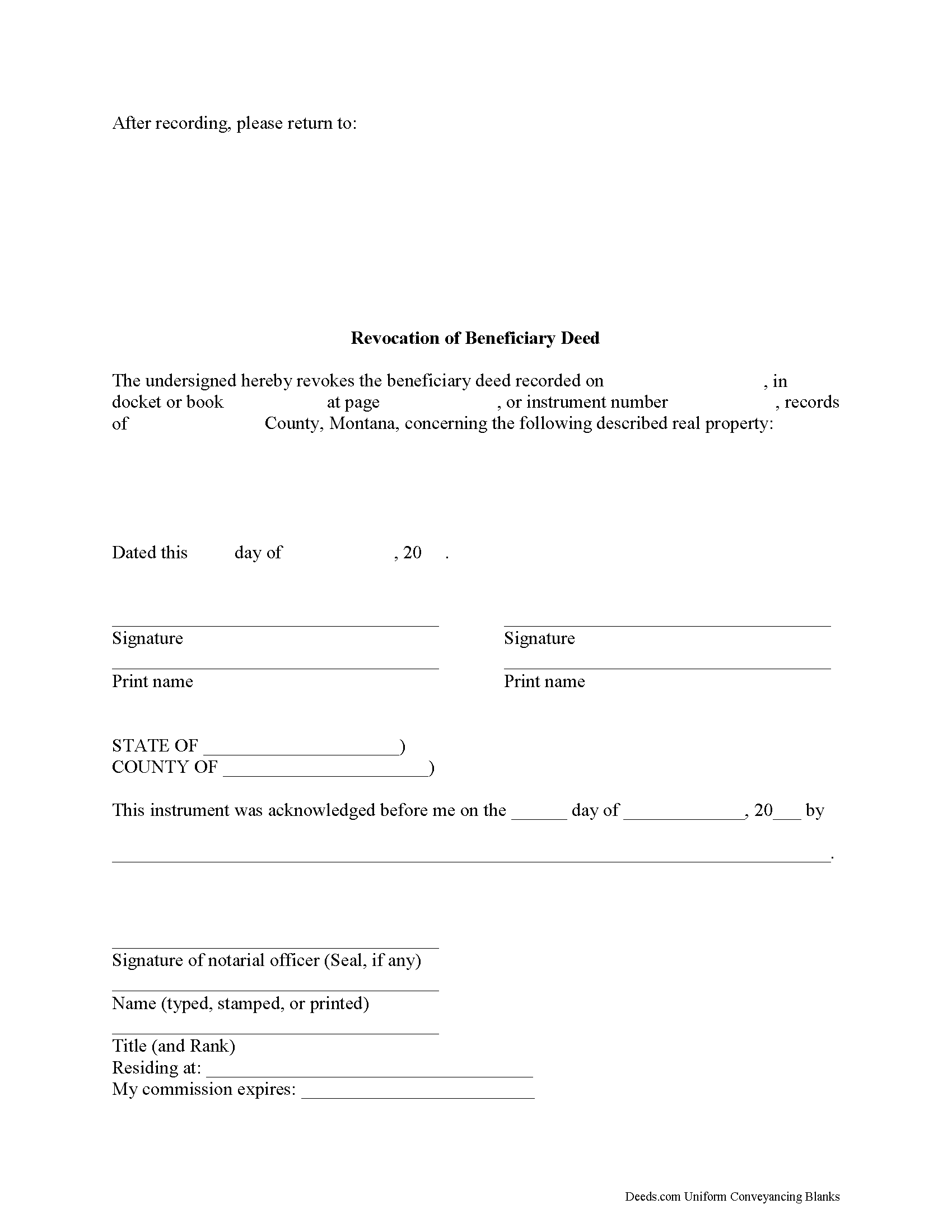

Missoula County Revocation of Beneficiary Deed Form

Fill in the blank form formatted to comply with all recording and content requirements.

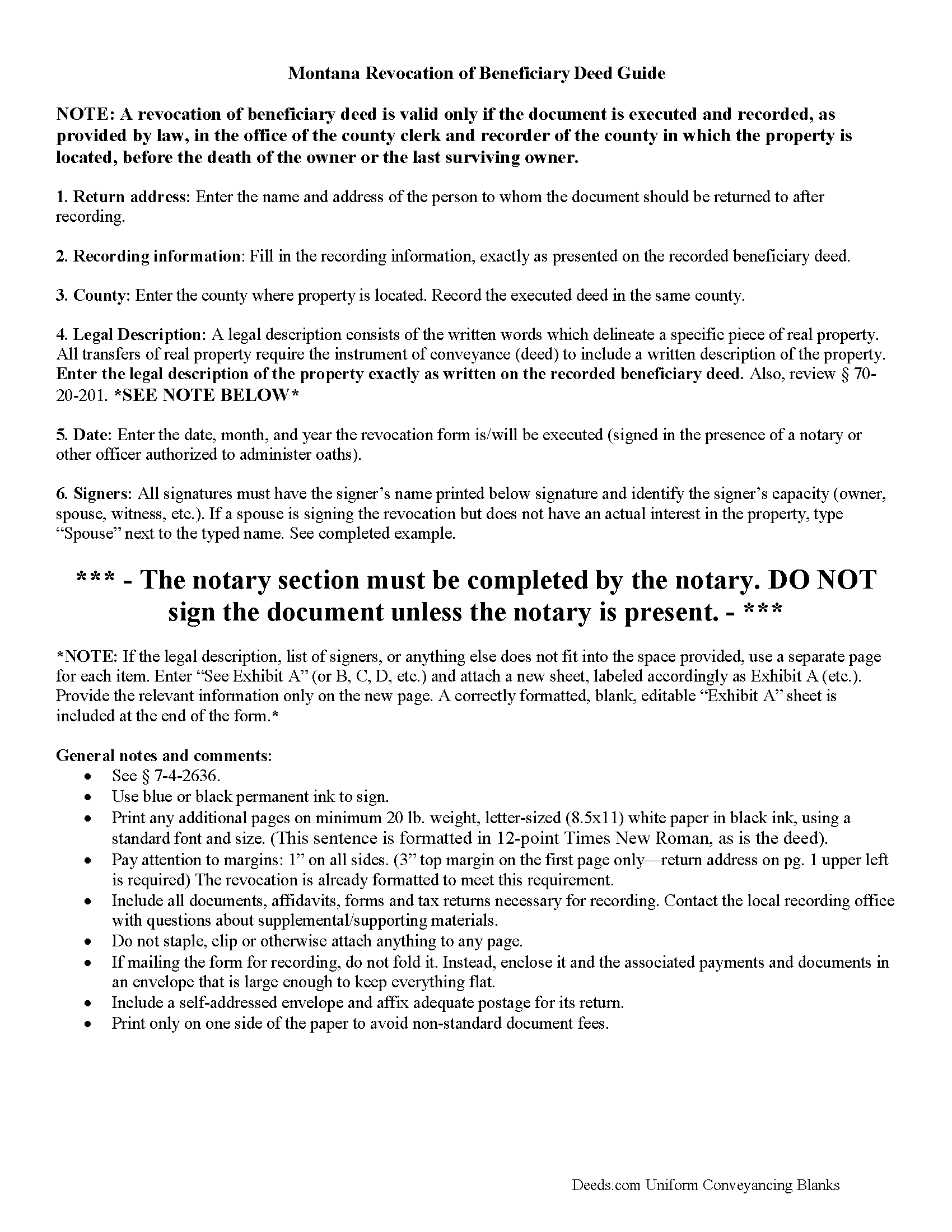

Missoula County Beneficiary Deed Revocation Guide

Line by line guide explaining every blank on the form.

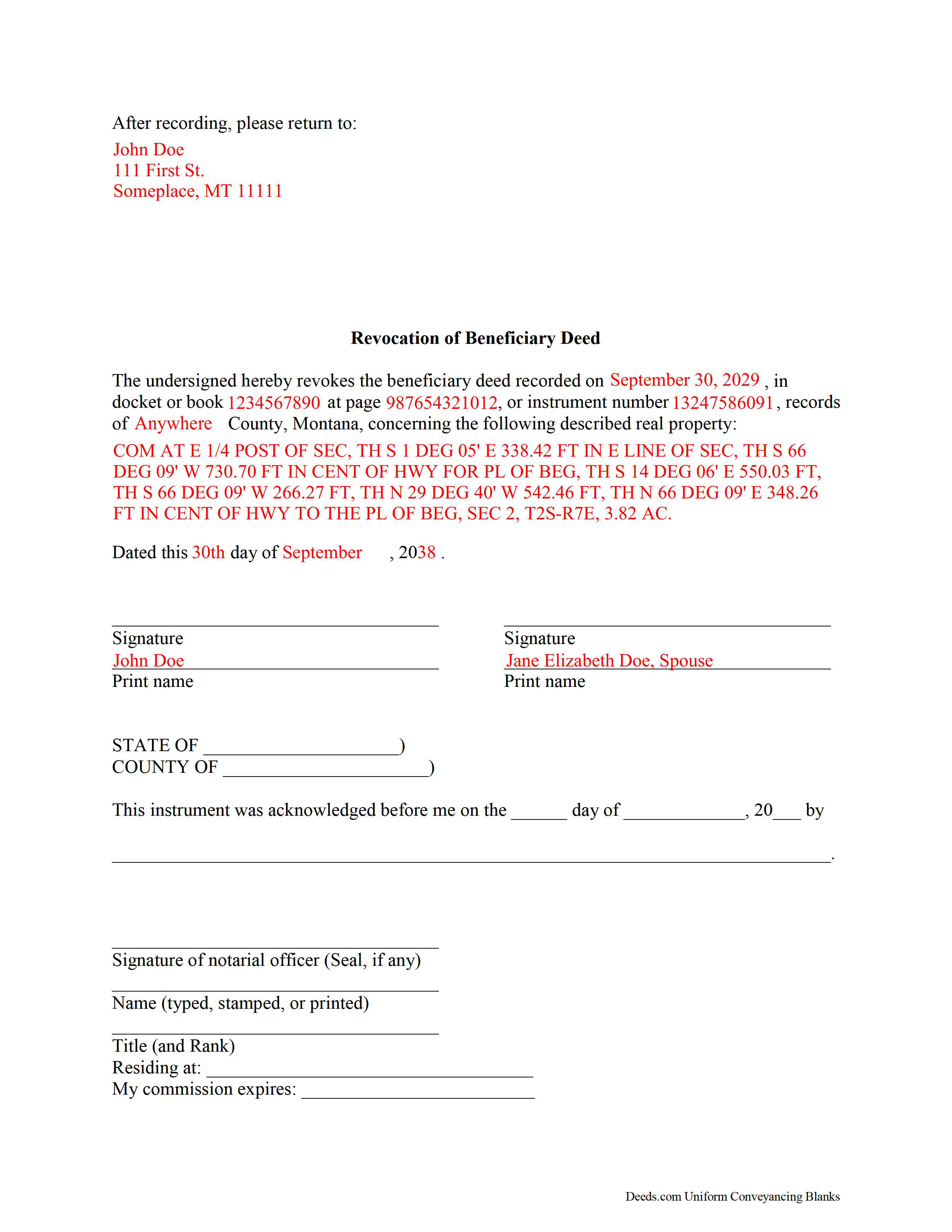

Missoula County Completed Example of the Revocation of Beneficiary Deed Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Montana and Missoula County documents included at no extra charge:

Where to Record Your Documents

Missoula County Recorder / Clerk

Missoula, Montana 59802

Hours: 8:00am-5:00pm M-F

Phone: (406) 258-4752

Address for FedEx & UPS Deliveries:

Missoula, Montana 59802

Hours: (use either address for USPS mail)

Phone:

Recording Tips for Missoula County:

- Bring your driver's license or state-issued photo ID

- Verify all names are spelled correctly before recording

- Ask if they accept credit cards - many offices are cash/check only

- Double-check legal descriptions match your existing deed

Cities and Jurisdictions in Missoula County

Properties in any of these areas use Missoula County forms:

- Bonner

- Clinton

- Condon

- Frenchtown

- Huson

- Lolo

- Milltown

- Missoula

- Seeley Lake

Hours, fees, requirements, and more for Missoula County

How do I get my forms?

Forms are available for immediate download after payment. The Missoula County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Missoula County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Missoula County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Missoula County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Missoula County?

Recording fees in Missoula County vary. Contact the recorder's office at (406) 258-4752 for current fees.

Questions answered? Let's get started!

Revoking a Montana Beneficiary Deed

A revocation of a recorded beneficiary deed must be lawfully executed and recorded during the owner's life or it has no effect.

In 2007, the Montana Legislature enacted the state's beneficiary deed law, found at Montana Code Annotated Section 72-6-121. All following parenthetical references identify the part of that section which contains additional information.

Beneficiary deeds are nontestamentary documents that convey a potential future interest in real property, but they only become effective when the owner dies (11). Until that point, the owner retains absolute title to, control over, and use of the property, including the freedom to modify or revoke the beneficiary designation, or to sell the property to someone else. This flexibility is what makes beneficiary deeds so useful; it allows the owners to respond quickly if circumstances change. Note that if the real property is owned as joint tenants with right of survivorship and if the revocation is not executed by all the owners, the revocation is not effective unless executed by the last surviving owner (6).

If an owner executes and records more than one beneficiary deed concerning the same real property, the document recorded closest to the owner's death is the effective beneficiary deed (8). Even though the recording date directs the transfer, it makes sense to execute and record a revocation because it adds an endpoint to the original deed and helps to preserve a clear chain of title (ownership history). This is important because any perceived irregularities can add unnecessary complexity to future sales of the property.

Revoking a beneficiary deed is a simple process, but it may not be appropriate in all cases. Contact an attorney with specific questions or for complex situations.

(Montana BD Revocation Package includes form, guidelines, and completed example)

Important: Your property must be located in Missoula County to use these forms. Documents should be recorded at the office below.

This Beneficiary Deed Revocation meets all recording requirements specific to Missoula County.

Our Promise

The documents you receive here will meet, or exceed, the Missoula County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Missoula County Beneficiary Deed Revocation form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4574 Reviews )

Ronney O.

December 16th, 2021

Great Experience

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Jean W.

April 21st, 2021

helpful if there was a space so one could type in the exemption # on the blank form before printing

Thank you for your feedback. We really appreciate it. Have a great day!

Sharon B.

April 3rd, 2024

Downloaded pdf form was difficult to use,/modify and has too much space between sections.

Your feedback is valuable to us and helps us improve. Thank you for sharing your thoughts!

Sheryl G.

November 27th, 2021

Simple way to complete documents with very detailed instructions. And to be able to e-file them is great too.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

MIMI T.

August 18th, 2020

Absolutely the best ever!!!

Thank you!

Robert B.

January 4th, 2021

Very easy to use.

Thank you for your feedback. We really appreciate it. Have a great day!

MARY LACEY M.

July 1st, 2024

The service provided by the staff at Deeds.com is consistently excellent with prompt replies and smooth recording transactions. I am grateful to have their service available as driving to downtown Phoenix to record documents is always a daunting prospect. Their assistance in recording our firm's documents has been 100% accurate and a pleasure.

Thank you for your positive words! We’re thrilled to hear about your experience.

Ellen D.

November 25th, 2019

Fantastic service! The forms were available to download instantly and they were perfect for my situation. Easy to use on my older computer. Thanks!

Thank you for your feedback. We really appreciate it. Have a great day!

CARRIE T.

March 10th, 2022

Thought it was pretty simple to use.

Thank you!

Cynthia E.

June 1st, 2019

good source

Thank you!

Kim L.

August 26th, 2020

Got the quit claim forms, amazing really. Easy to understand, looked great when completed, accepted without question for recording. Nice job!

Thank you!

PEGGY D.

April 1st, 2022

Very easy to find what I needed. Really liked the instructions included with the forms and also the suggestion of other forms that I might need.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Richard N.

November 27th, 2020

It went well. The proof will be when I complete the forms and submit to the County Clerk.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Jim J.

February 8th, 2019

The forms were easy to use and the fields are tabbed so that you can enter your information and then move quickly to the next entry. The Guide for the documents was very helpful.

Thanks Jim, we appreciate your feedback.

Sallie S.

January 24th, 2019

Great speedy service with access to areas beyond my reach.

Thank you Sallie, have a great day!