Fallon County Correction Deed Form

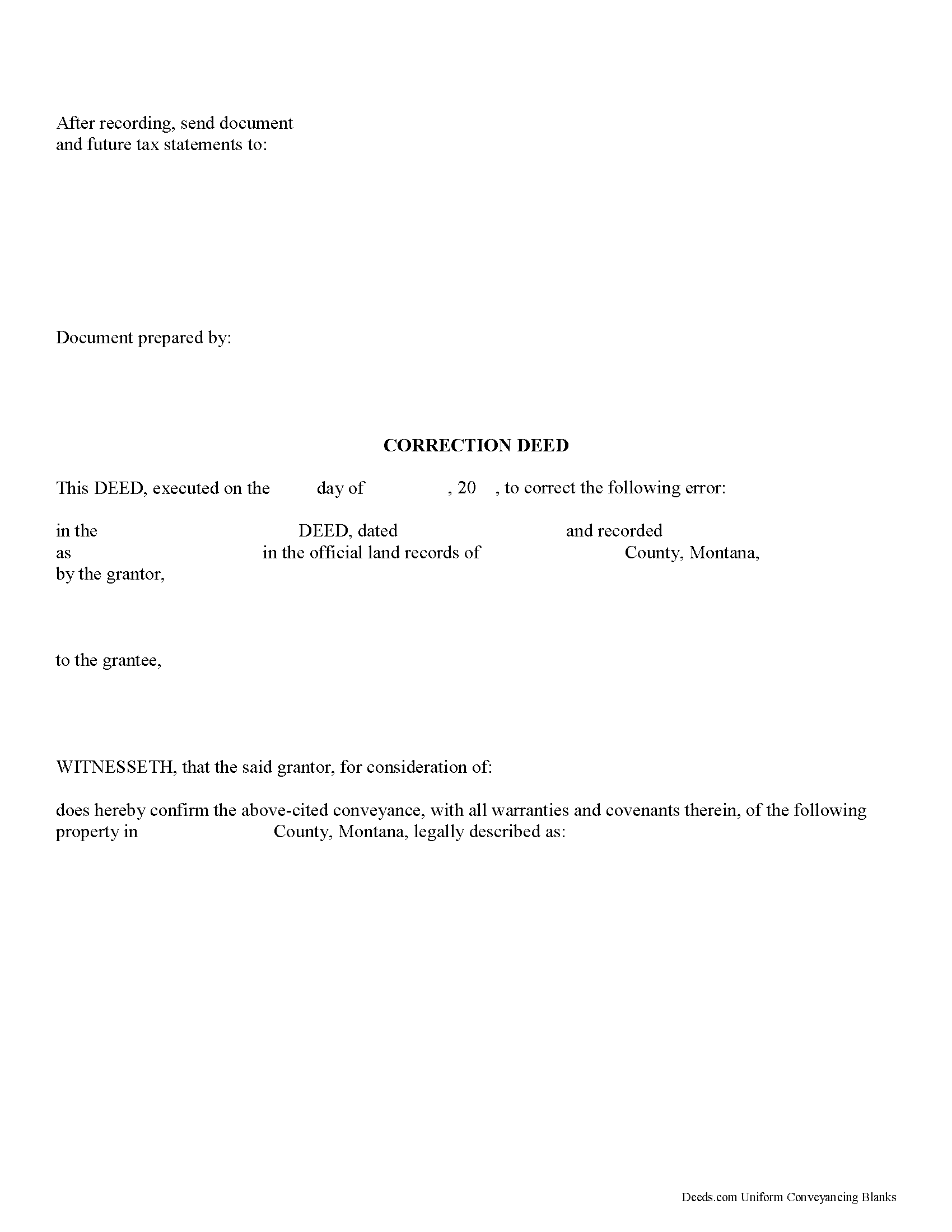

Fallon County Correction Deed Form

Fill in the blank form formatted to comply with all recording and content requirements.

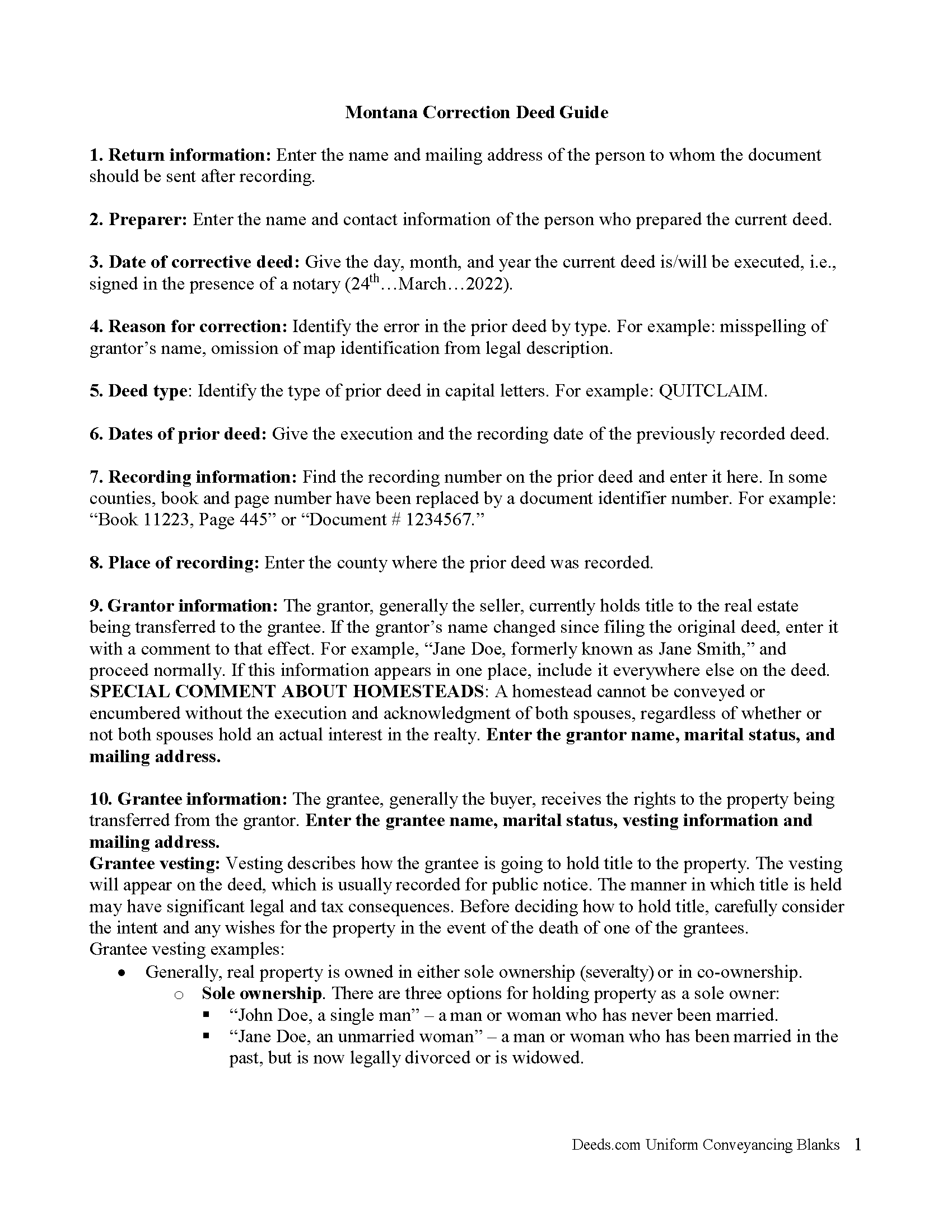

Fallon County Correction Deed Guide

Line by line guide explaining every blank on the form.

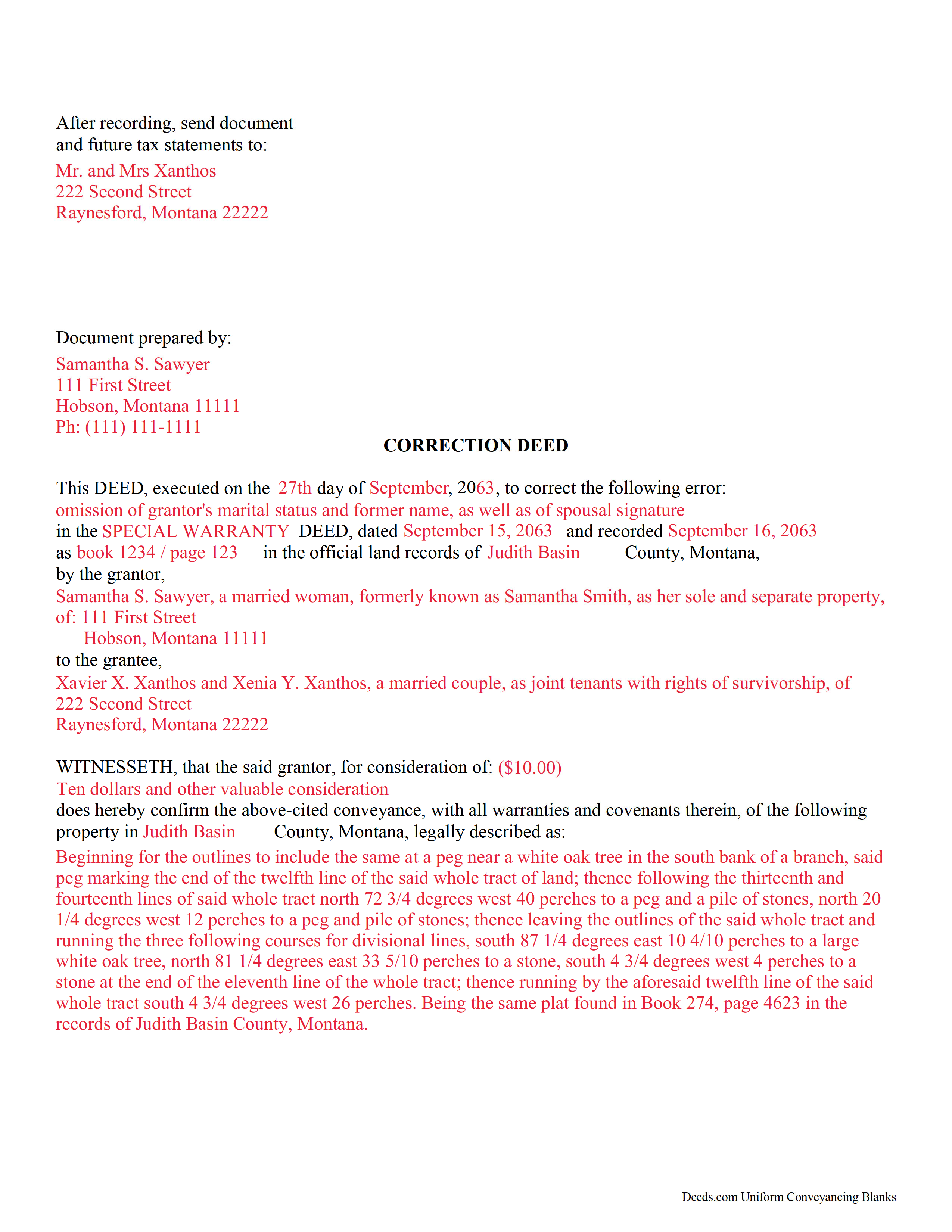

Fallon County Completed Example of the Correction Deed Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Montana and Fallon County documents included at no extra charge:

Where to Record Your Documents

Fallon County Clerk / Recorder

Baker, Montana 59313

Hours: 8:00am-5:00pm M-F

Phone: (406) 778-7106

Recording Tips for Fallon County:

- Ensure all signatures are in blue or black ink

- Bring your driver's license or state-issued photo ID

- Ask if they accept credit cards - many offices are cash/check only

- Recording fees may differ from what's posted online - verify current rates

- Ask about accepted payment methods when you call ahead

Cities and Jurisdictions in Fallon County

Properties in any of these areas use Fallon County forms:

- Baker

- Plevna

- Willard

Hours, fees, requirements, and more for Fallon County

How do I get my forms?

Forms are available for immediate download after payment. The Fallon County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Fallon County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Fallon County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Fallon County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Fallon County?

Recording fees in Fallon County vary. Contact the recorder's office at (406) 778-7106 for current fees.

Questions answered? Let's get started!

Use the correction deed to correct an error in a previously recorded deed of conveyance in Montana.

Correcting an error in a recorded deed helps prevent problems that might arise when the current owner tries to sell the property. The best method for correction is to prepare and record a new document, a so-called correction deed. This document does not convey title; instead, it confirms the prior conveyance of the property.

Apart from supplying the correct information, the new deed must state the reason for correcting, and it must reference the prior deed by title, date, and recording number. The original grantor must sign again, thus confirming the conveyance to the same grantee. Generally, corrective deeds are used to address minor errors in a deed, such as typos, accidentally omitted suffixes or middle initials in names, and other minor omissions. When in doubt about the gravity of an error, consult with a lawyer.

For certain changes, a correction deed may not be appropriate. Adding or removing a grantee, for example, or altering the manner in which title is held, or making material changes to the legal description, especially deleting a portion of the originally transferred property, may all require a new deed of conveyance instead of a correction deed. When correcting the legal description, both grantor and grantee should sign the corrective instrument to avoid any doubt regarding the conveyed property.

(Montana CD Package includes form, guidelines, and completed example)

Important: Your property must be located in Fallon County to use these forms. Documents should be recorded at the office below.

This Correction Deed meets all recording requirements specific to Fallon County.

Our Promise

The documents you receive here will meet, or exceed, the Fallon County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Fallon County Correction Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4574 Reviews )

Suzanne D.

January 7th, 2019

Information found, thank you. I own Ground Rent on property and needed to know name of property owner and address for mailing bill.

Thank you!

Wes C.

March 26th, 2022

The forms are easy to use and the examples and guidance are easy to understand and follow.

Thank you for your feedback. We really appreciate it. Have a great day!

chris a.

February 17th, 2021

It was easy to complete the deed but on the third page I only need one signature in stead of 3 I need to delete 2 or put n//a in those blocks I will continue to use your services and have recommended it to others

Thank you for your feedback. We really appreciate it. Have a great day!

Larry A.

December 17th, 2021

Provided exactly the form I was looking for at a reasonable price. Easy to do as well.

Thank you!

Jacinto A.

April 22nd, 2019

The forms are exactly what was needed. But wish I was able to click on the preview form to make sure it was the correct forms

Thank you for your feedback Jacinto.

Christine L.

April 18th, 2019

I would like the ability to edit the document.

Thank you for your feedback Christine.

Samuel M.

October 8th, 2020

it was convenient to have a starting place, however, though the property is in Colorado, the probate is in Iowa, so I had to create my own document because you locked my capacity to edit the form I paid for. If I pay for it, I should be able to edit everything including non fill in text. I could not open it in word, as I normally could.

Thank you for your feedback. We really appreciate it. Have a great day!

Harry B.

July 9th, 2019

I received exactly what I was looking for on Deeds.com. Not only that, but this website provided instructions for form completion, and an example of a completed form. I'm certainly glad I chose this website.

Thank you for your feedback. We really appreciate it. Have a great day!

HEATHER M.

September 27th, 2024

The guide I needed was very easy to understand and the template was easy to complete. I had a property attorney review the deed before I had it registered and she was impressed. She said she couldn't have written it better herself! Definitely worth the money instead of paying high dollar attorney fees for a simple task.

Your feedback is greatly appreciated. Thank you for taking the time to share your experience!

Peter K.

September 10th, 2019

Site was very easy to use. Lots of information provided...if the deed gets registered without a problem...you'll get a 10! and if it doesn't...I'll let you know!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Shihei W.

December 12th, 2024

Loved every step of the process, from the detail explanation of the services/products provided, to the inclusive packet that comes with my purchase of the trust certification form.

Your feedback is greatly appreciated. Thank you for taking the time to share your experience!

Melody P.

February 23rd, 2021

Thanks again for such excellent service, and always a pleasure!

Thank you!

Elizabeth R.

April 20th, 2023

It was easy to download and save the Revocation of Beneficiary of Deed form. The example and instructions helped a lot. When I went to file with the county clerk's office, she read through it carefully and said "perfect" when she was through. Thank you for making it so easy!

Thank you!

Lester A.

May 29th, 2020

Couldnt have been easier. Docs recorded the next day!

Thanks Lester, glad we could help.

Preston P.

January 12th, 2023

Filled my need for the documents needed. thank you, I am sure I will return soon.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!