Gallatin County Deed of Full Reconveyance - for Trust Indenture/Deed of Trust Form

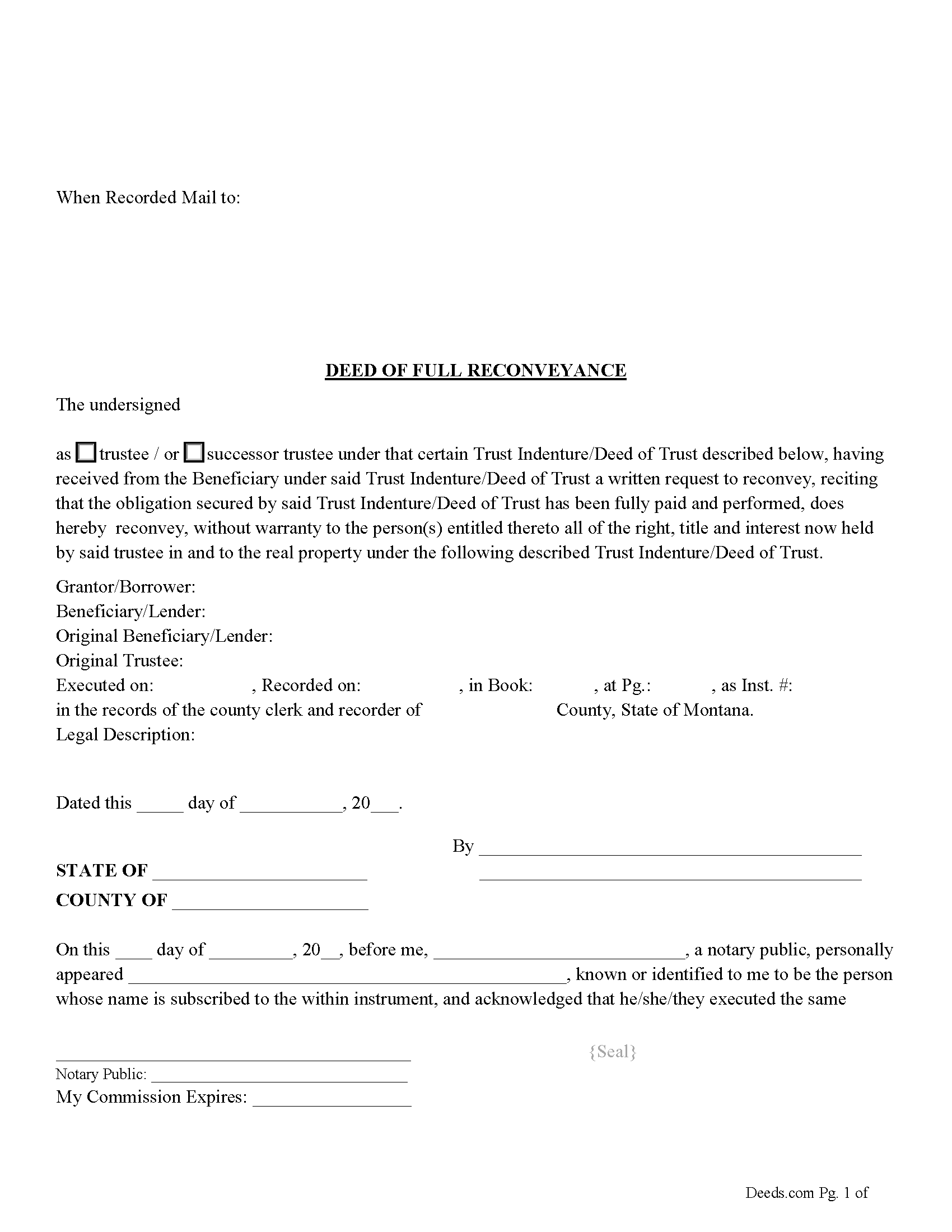

Gallatin County Deed of Full Reconveyance Form

Fill in the blank form formatted to comply with all recording and content requirements.

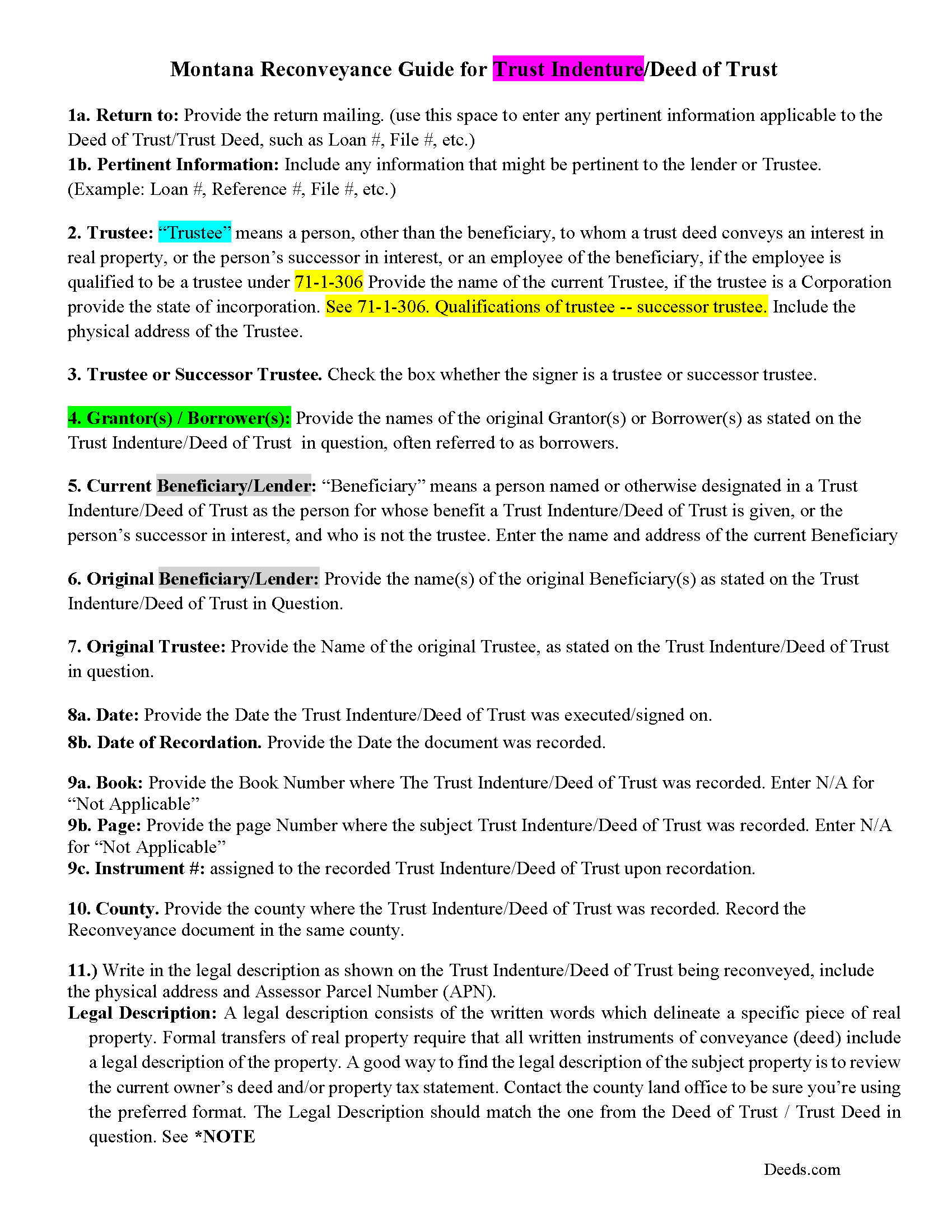

Gallatin County Deed of Full Reconveyance Guidelines

Line by line guide explaining every blank on the form.

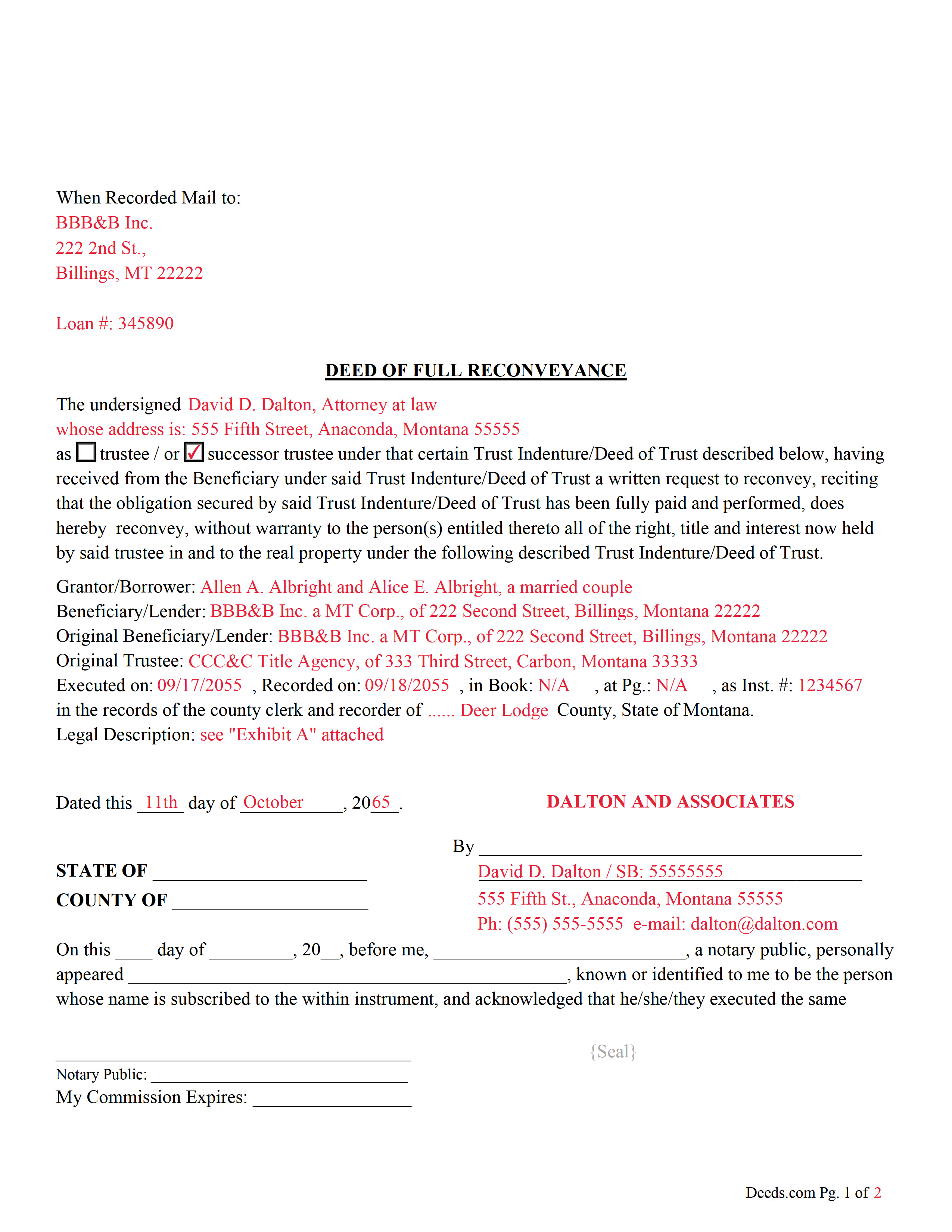

Gallatin County Completed Example of the Deed of Full Reconveyance Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Montana and Gallatin County documents included at no extra charge:

Where to Record Your Documents

Gallatin County Clerk / Recorder

Bozeman, Montana 59715

Hours: 8:00am to 5:00pm M-F

Phone: (406) 582-3050

Recording Tips for Gallatin County:

- Ask if they accept credit cards - many offices are cash/check only

- Ask about their eRecording option for future transactions

- Request a receipt showing your recording numbers

Cities and Jurisdictions in Gallatin County

Properties in any of these areas use Gallatin County forms:

- Belgrade

- Big Sky

- Bozeman

- Gallatin Gateway

- Manhattan

- Three Forks

- West Yellowstone

- Willow Creek

Hours, fees, requirements, and more for Gallatin County

How do I get my forms?

Forms are available for immediate download after payment. The Gallatin County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Gallatin County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Gallatin County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Gallatin County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Gallatin County?

Recording fees in Gallatin County vary. Contact the recorder's office at (406) 582-3050 for current fees.

Questions answered? Let's get started!

This form is used by the trustee or successor trustee to reconvey a trust indenture/deed of trust when it has been satisfied/paid in full.

71-1-307 Reconveyance upon performance -- liability for failure to reconvey

(1) Upon performance of the obligation secured by the trust indenture, the trustee, upon written request of the beneficiary or servicer, shall reconvey the interest in real property described in the trust indenture to the grantor. If the obligation is performed and the beneficiary or servicer refuses to request reconveyance or the trustee refuses to reconvey the property within 90 days of the request, the beneficiary, servicer, or trustee who refuses is liable to the grantor for the sum of $500 and all actual damages resulting from the refusal to reconvey.

(2) If a beneficiary or servicer has received a notice of intent to reconvey pursuant to 71-1-308 and has not timely requested a reconveyance or has not objected to the reconveyance within the 90-day period established in 71-1-308, the beneficiary or servicer is liable to the title insurer or title insurance producer for the sum of $500 and all damages resulting from the failure.

(3) In an action by a grantor, title insurer, or title insurance producer to collect any sums due under this section, the court shall award attorney fees and costs to the prevailing party.

(Montana DOFR Package includes form, guidelines, and completed example) For use in Montana only.

Important: Your property must be located in Gallatin County to use these forms. Documents should be recorded at the office below.

This Deed of Full Reconveyance - for Trust Indenture/Deed of Trust meets all recording requirements specific to Gallatin County.

Our Promise

The documents you receive here will meet, or exceed, the Gallatin County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Gallatin County Deed of Full Reconveyance - for Trust Indenture/Deed of Trust form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4578 Reviews )

Duncan M.

January 24th, 2019

Forms are fine, but the inability to download a completed form is not. Nor is the ability to convert to another format. Everytime I went to download, the form erased. I didn't have a printer available, so everything I did was to waste.

Thank you for your feedback Duncan. The blank forms should be downloaded first and then completed on your computer.

Mark M.

November 5th, 2020

Deeds was easy to use and worked as specified; they got the recording I needed done finished in one day!

Thank you for your feedback. We really appreciate it. Have a great day!

Sara W.

November 9th, 2020

Got the legal forms, they worked. Nothing exciting but that probably a good thing.

Thank you Sara, we appreciate you.

Kathy B.

November 24th, 2020

Works easy enough and good directions on the form, however no help when I got locked out. Had to do a completely new account name and email address.

Thank you!

Susan P.

May 25th, 2021

Very easy to use, responsive help when the document was initially rejected and very fast service (recorded the deed within 24 hours).

Thank you for your feedback. We really appreciate it. Have a great day!

Edward M.

February 15th, 2021

Great Forms, Detailed explanation on how to fill them out properly. No Issues at all. Very e-z to use site and forms. Thanks

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Samantha A.

April 19th, 2023

This company is a super time saver for our firm and our client! Their website was easy to use and their staff was fast and efficient. Their fees are very reasonable. I would most certainly use their services again.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Edward B.

September 22nd, 2023

I was looking for a certain form I needed. Deeds.com had the necessary form and I was able to purchase it with little effort on my part. This was a good customer experience.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Jennifer J.

March 21st, 2022

I have to admit this process was a scary one but you have made it very clear and simple to follow along with. I felt their virtual hand holding, that is how user friendly it is. Thank you for being top notch.

Thank you!

STACIA V.

July 19th, 2019

I filled out the forms that were somewhat easy. I was surprised that it was recorded by the county recording office. I just hope that it really worked. I think it did. I will find out later this year.

Thank you!

Daron S.

July 2nd, 2019

A download in word format would be a lot better than the pdf download.

Thank you for your feedback. We really appreciate it. Have a great day!

James B.

May 6th, 2019

All required forms readily available at fair price. Easy to create account. Immediately acquired documents upon order.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

MATUS C.

March 28th, 2021

Quick, easy way to get the forms I needed

Thank you for your feedback. We really appreciate it. Have a great day!

CHERI I.

August 4th, 2021

I was so pleased with how easy this form was to download and print! Thank you and I am sure we will use you again in the future!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Kevin M.

January 31st, 2022

Thought I knew what I was doing but it turns out I was in way over my head. Thankfully customer service pointed me in the right direction to get the help I needed.

Glad to hear you are seeking the assistance you need. Have a wonderful day.