Treasure County Deed of Full Reconveyance - for Trust Indenture/Deed of Trust Form

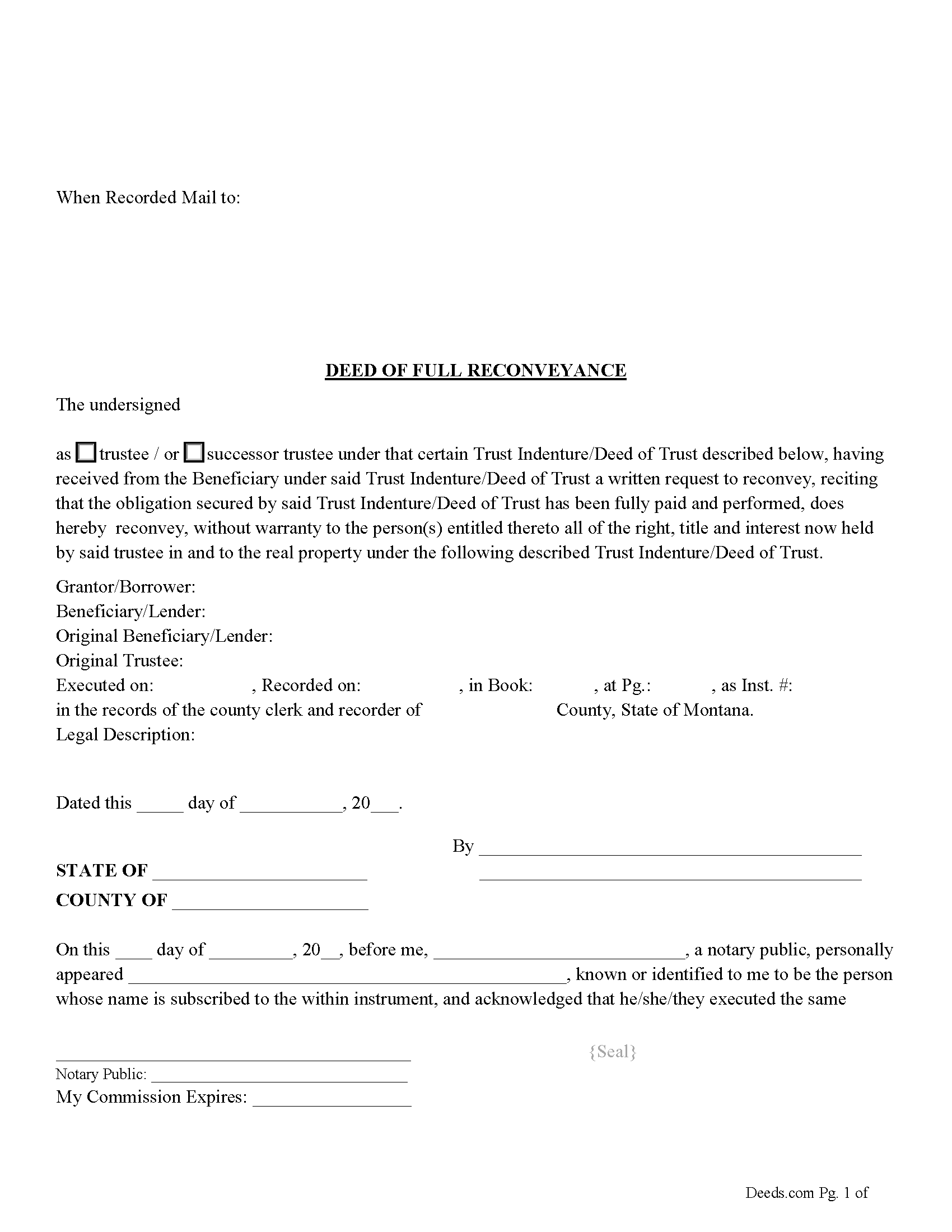

Treasure County Deed of Full Reconveyance Form

Fill in the blank form formatted to comply with all recording and content requirements.

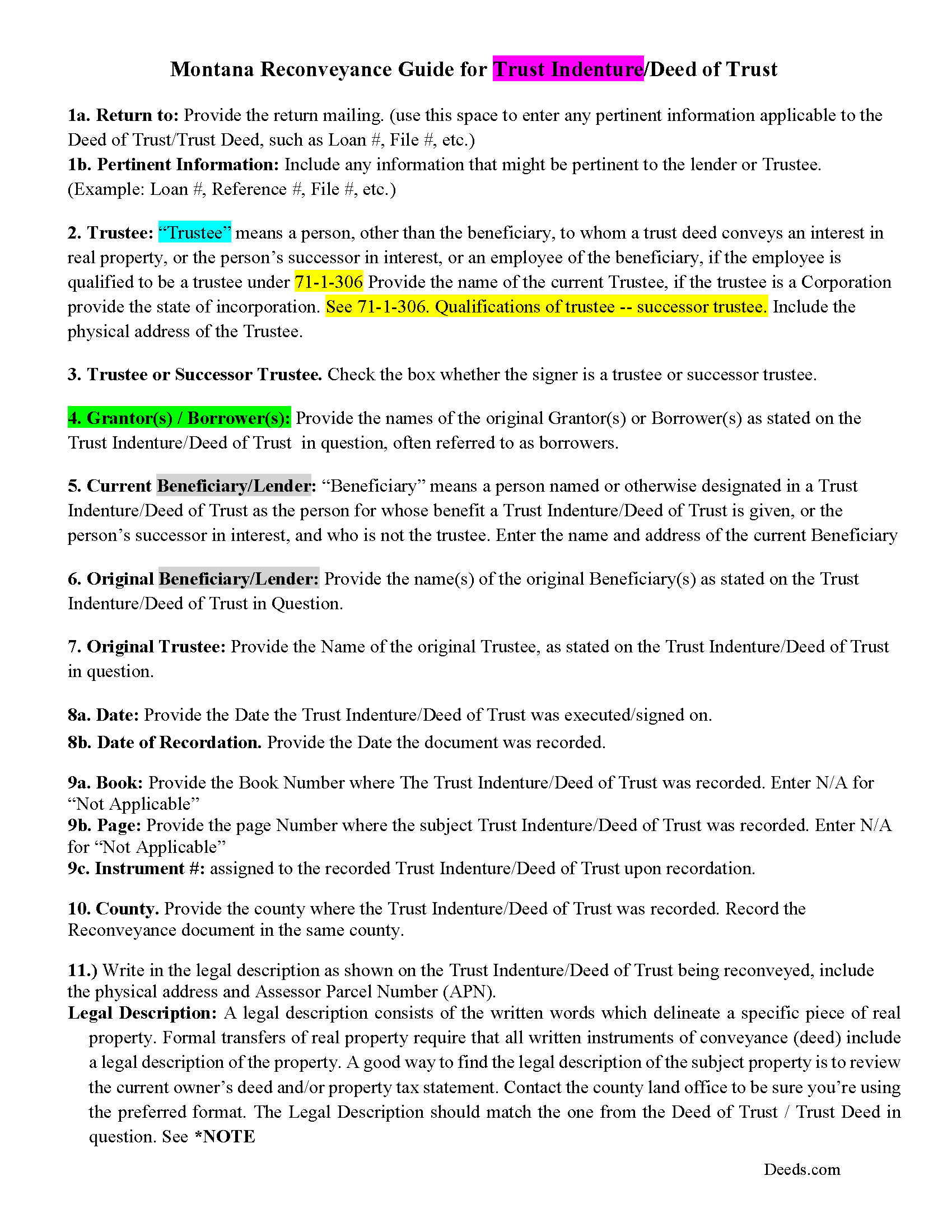

Treasure County Deed of Full Reconveyance Guidelines

Line by line guide explaining every blank on the form.

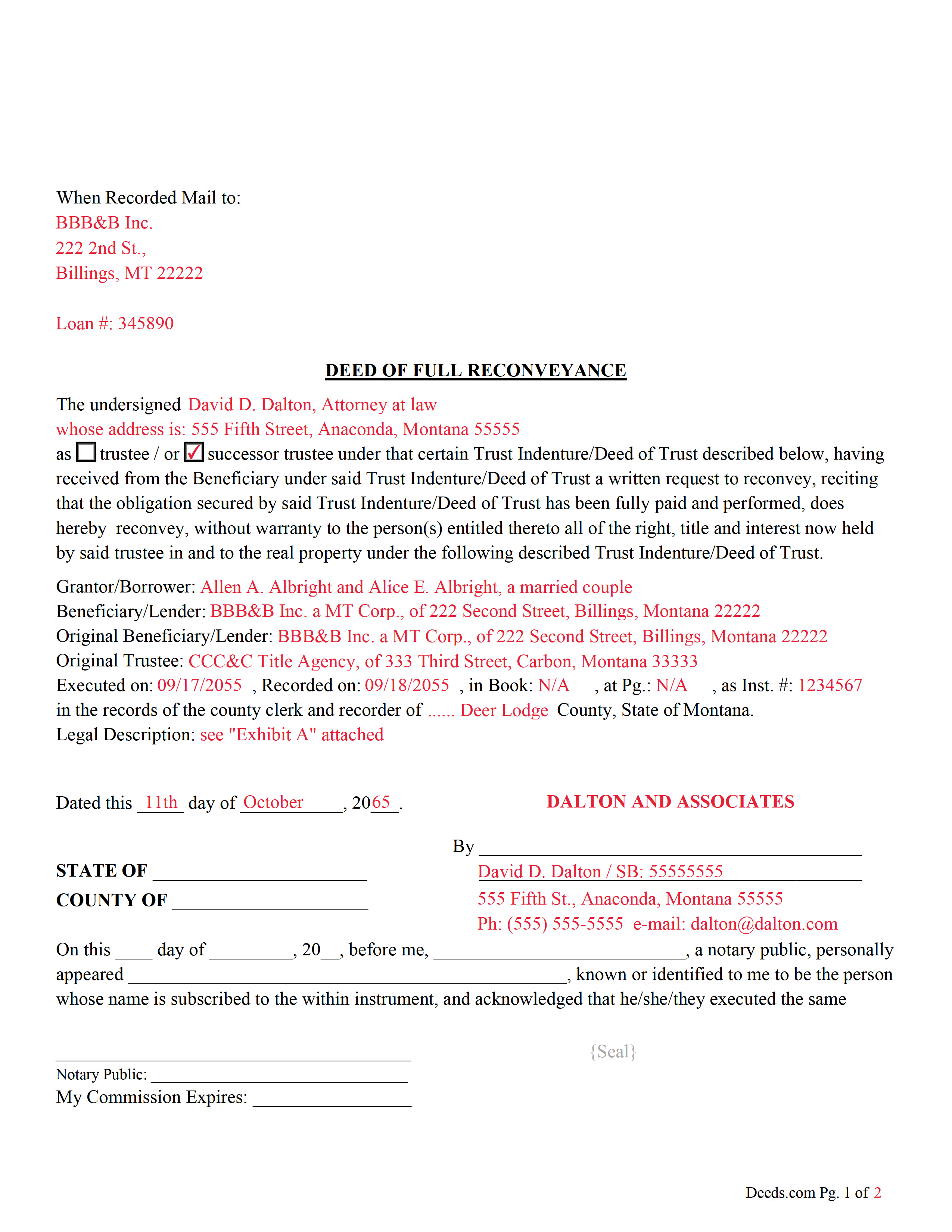

Treasure County Completed Example of the Deed of Full Reconveyance Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Montana and Treasure County documents included at no extra charge:

Where to Record Your Documents

Treasure County Clerk / Recorder

Hysham, Montana 59038

Hours: 8:00 to 5:00 M-F

Phone: (406) 342-5547

Recording Tips for Treasure County:

- Ensure all signatures are in blue or black ink

- Double-check legal descriptions match your existing deed

- White-out or correction fluid may cause rejection

- Ask about their eRecording option for future transactions

- Some documents require witnesses in addition to notarization

Cities and Jurisdictions in Treasure County

Properties in any of these areas use Treasure County forms:

- Bighorn

- Hysham

- Sanders

Hours, fees, requirements, and more for Treasure County

How do I get my forms?

Forms are available for immediate download after payment. The Treasure County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Treasure County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Treasure County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Treasure County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Treasure County?

Recording fees in Treasure County vary. Contact the recorder's office at (406) 342-5547 for current fees.

Questions answered? Let's get started!

This form is used by the trustee or successor trustee to reconvey a trust indenture/deed of trust when it has been satisfied/paid in full.

71-1-307 Reconveyance upon performance -- liability for failure to reconvey

(1) Upon performance of the obligation secured by the trust indenture, the trustee, upon written request of the beneficiary or servicer, shall reconvey the interest in real property described in the trust indenture to the grantor. If the obligation is performed and the beneficiary or servicer refuses to request reconveyance or the trustee refuses to reconvey the property within 90 days of the request, the beneficiary, servicer, or trustee who refuses is liable to the grantor for the sum of $500 and all actual damages resulting from the refusal to reconvey.

(2) If a beneficiary or servicer has received a notice of intent to reconvey pursuant to 71-1-308 and has not timely requested a reconveyance or has not objected to the reconveyance within the 90-day period established in 71-1-308, the beneficiary or servicer is liable to the title insurer or title insurance producer for the sum of $500 and all damages resulting from the failure.

(3) In an action by a grantor, title insurer, or title insurance producer to collect any sums due under this section, the court shall award attorney fees and costs to the prevailing party.

(Montana DOFR Package includes form, guidelines, and completed example) For use in Montana only.

Important: Your property must be located in Treasure County to use these forms. Documents should be recorded at the office below.

This Deed of Full Reconveyance - for Trust Indenture/Deed of Trust meets all recording requirements specific to Treasure County.

Our Promise

The documents you receive here will meet, or exceed, the Treasure County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Treasure County Deed of Full Reconveyance - for Trust Indenture/Deed of Trust form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4578 Reviews )

Robin G.

June 2nd, 2020

Very Pleased. Was so easy and No hidden cost. Second time I have used their services. Would not use any other deed website.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Stephen B.

March 22nd, 2021

5 stars. Licensed to practice law for 25 years in multiple jurisdictions, the most dreaded part of doing what you already know how to do is researching again to make sure the legislatures have not changed the rules while you were doing something else. 22 bucks for this package is one hell of a deal and a real timesaver. Many thanks.

Thank you for your feedback. We really appreciate it. Have a great day!

Melvin L.

June 8th, 2022

So easy, very simple to use. I was very pleased with the service Deeds provided. Would definely use again.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Maribeth M.

June 25th, 2021

Usually I have trouble registering things online, even though people tell me it's easy. This time, it WAS easy and fast, and I'm grateful I didn't have to drive somewhere and stand in line. Thank you!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Peggy D.

August 26th, 2021

Very helpful in finding the information for me. Quick response. Very easy to use the forms.

Thank you for your feedback. We really appreciate it. Have a great day!

Paul W.

March 11th, 2022

Exceptionally easy site to navigate. Forms and related documents downloaded quickly and were helpful in completing the forms, which have already been filed with the County Registrar of Deeds. Many thanks for an extremely useful site!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Molly S.

November 13th, 2020

I used deeds.com to record a deed because the recording office closed due to Covid 19. It was easy to sign up and upload the documents I needed recorded and within 24 hours possibly even less, the deeds were recorded. I am very happy with the service and the $15 fee was affordable and worth every penny to get it done so quickly.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Mack H.

July 16th, 2020

I got what I was looking for! Turned out well and like I thought it would.

Thank you!

Renasha P.

October 6th, 2019

I was searching information about my boyfriend family home and received the results in a timely manner. I now have the information that we were seeking.

Thank you for your feedback. We really appreciate it. Have a great day!

Norman J.

October 3rd, 2023

I really enjoyed your service. It was great.

Thank you!

Marlene B.

February 21st, 2024

I appreciated the fact that the forms were by Texas County and I knew I had the right form. The form were fairly easy to complete. I had trouble completing the form because the property description was long and kept disappearing and I had to re-type. It would also have helped it I could have saved and not had to start over every time.

Your satisfaction with our services is of utmost importance to us. Thank you for letting us know how we did!

JESSICA B.

June 25th, 2020

easy to move through the site and create an account.

Thank you!

Elizabeth B.

October 26th, 2023

Your site provided all I needed. Thank you!

It was a pleasure serving you. Thank you for the positive feedback!

Anita B.

April 15th, 2020

Service was fast and complete. Would use again.

Thank you!

Randy F.

March 19th, 2020

SO FAR SO GOOD, DOC'S DOWNLOADED WITHOUT A PROBLEM

Thank you!