Deer Lodge County Deed of Trust and Promissory Note Form

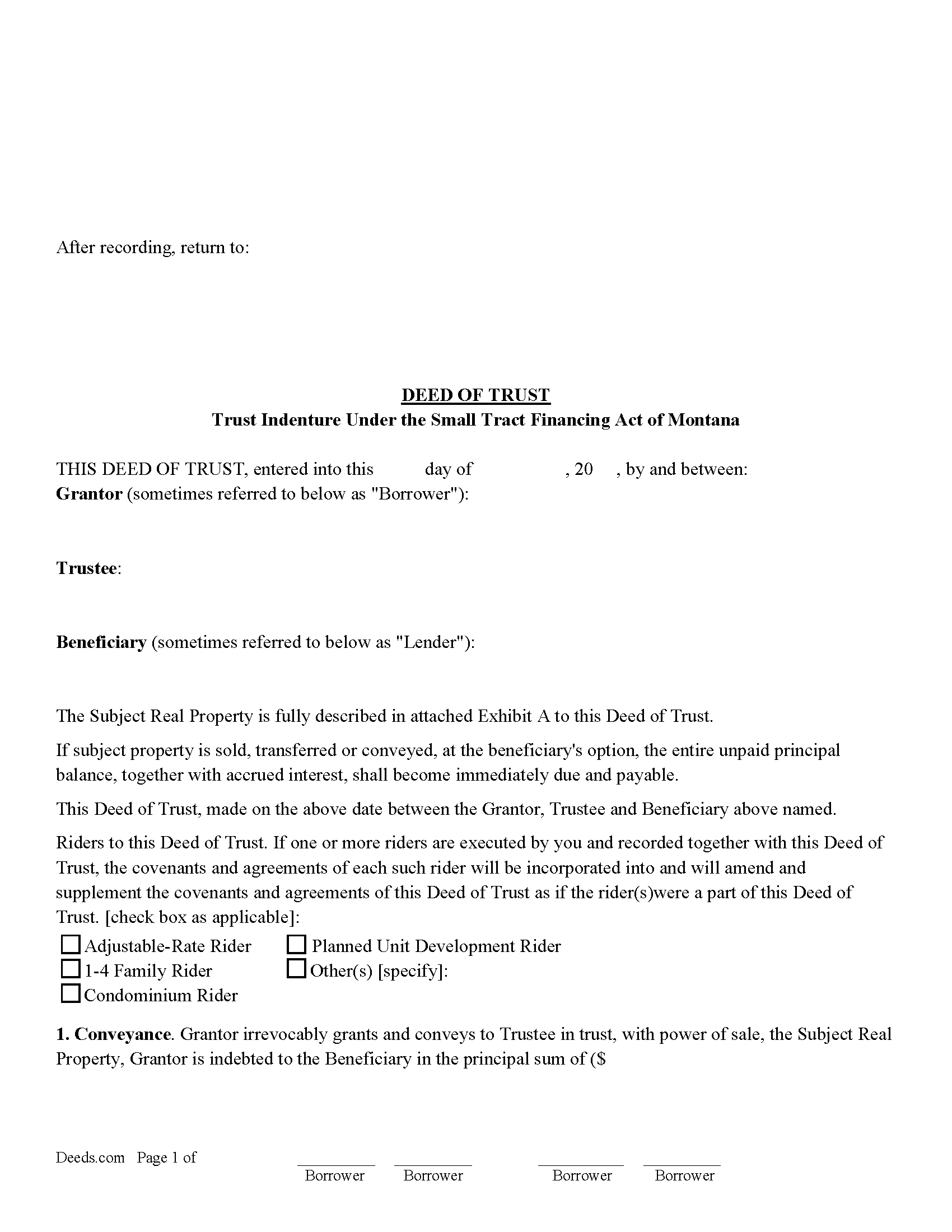

Deer Lodge County Deed of Trust Form

Fill in the blank form formatted to comply with all recording and content requirements.

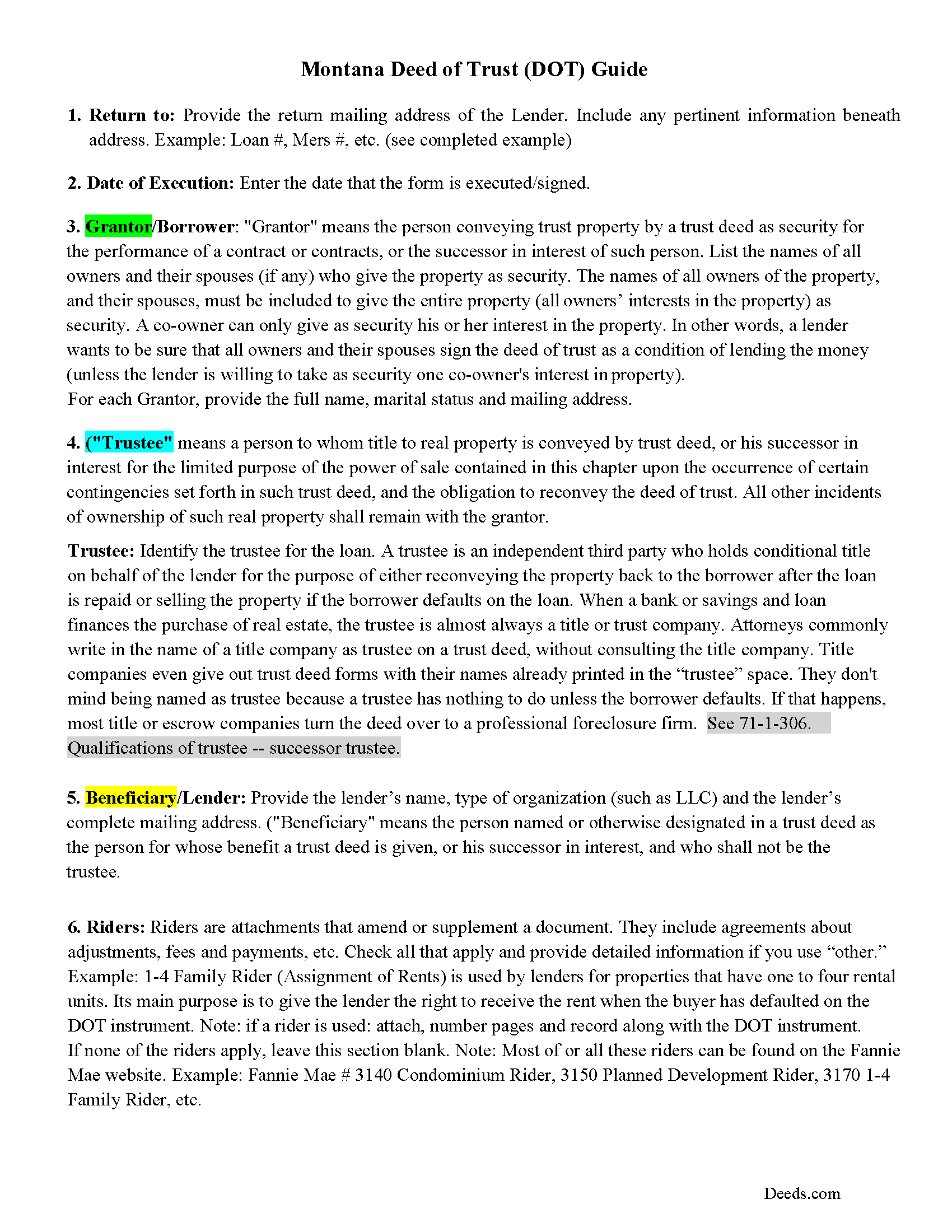

Deer Lodge County Deed of Trust Guidelines

Line by line guide explaining every blank on the form.

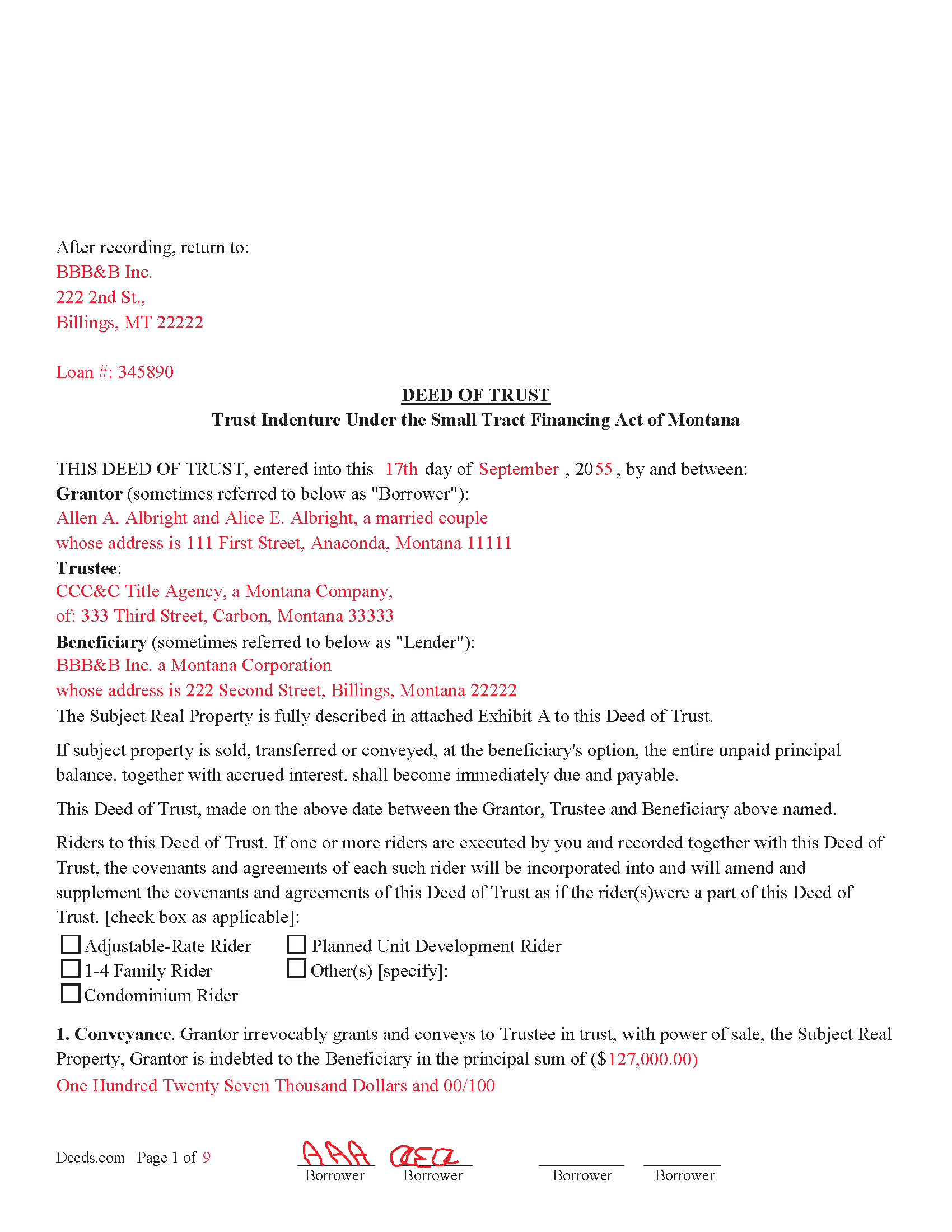

Deer Lodge County Completed Example of the Deed of Trust Document

Example of a properly completed form for reference.

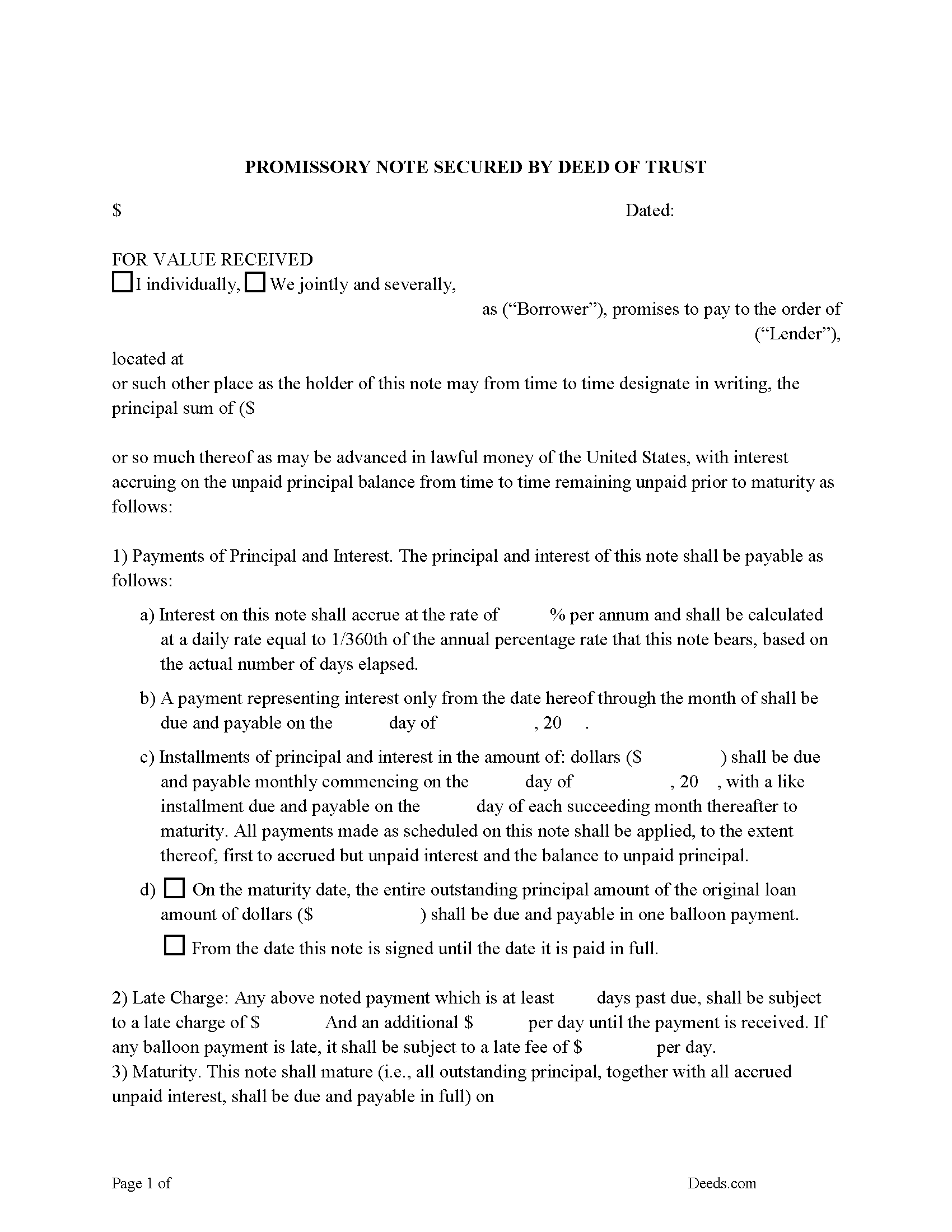

Deer Lodge County Promissory Note Form

Note that is secured by the Deed of Trust document.

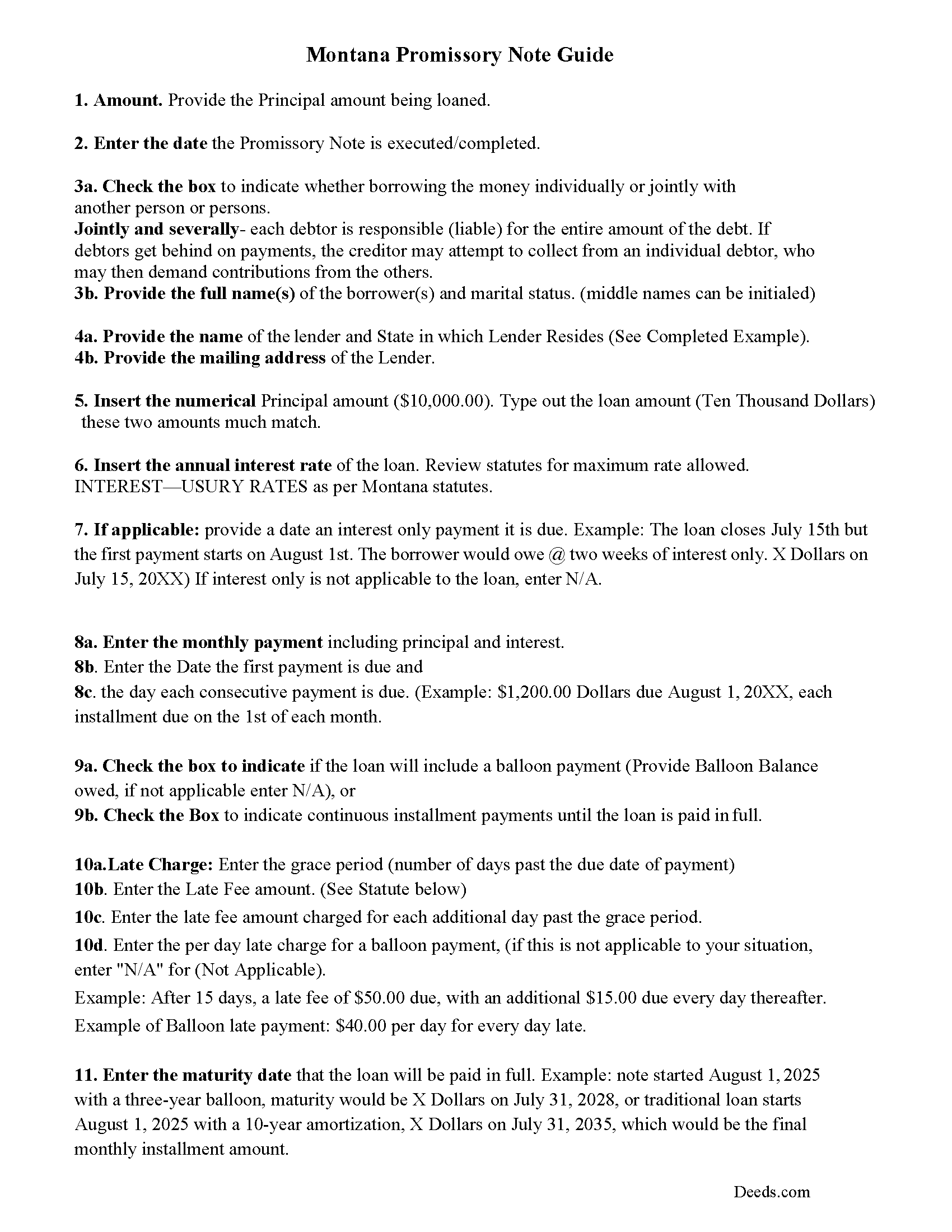

Deer Lodge County Promissory Note Guidelines

Line by line guide explaining every blank on the form.

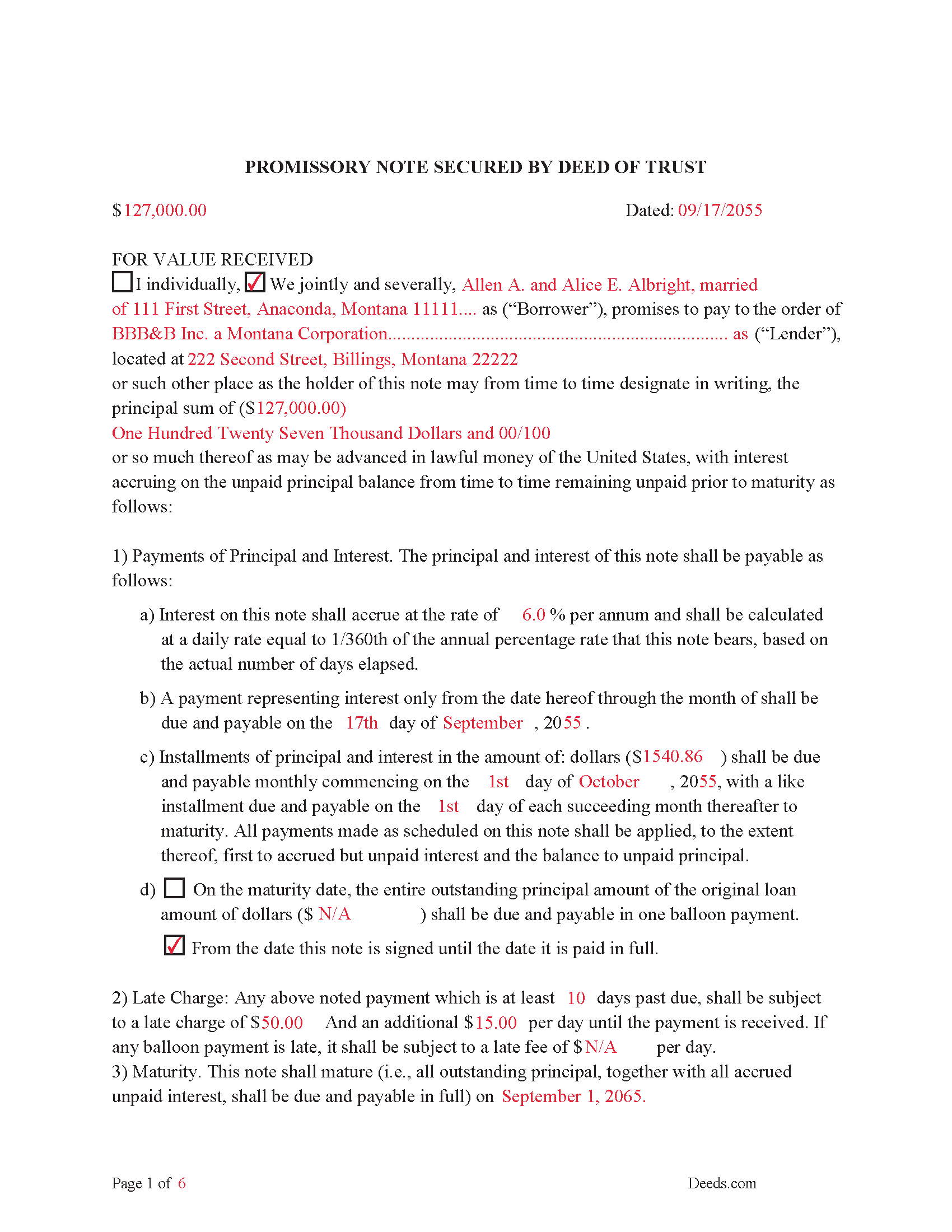

Deer Lodge County Completed Example of the Promissory Note Document

Example of a properly completed form for reference.

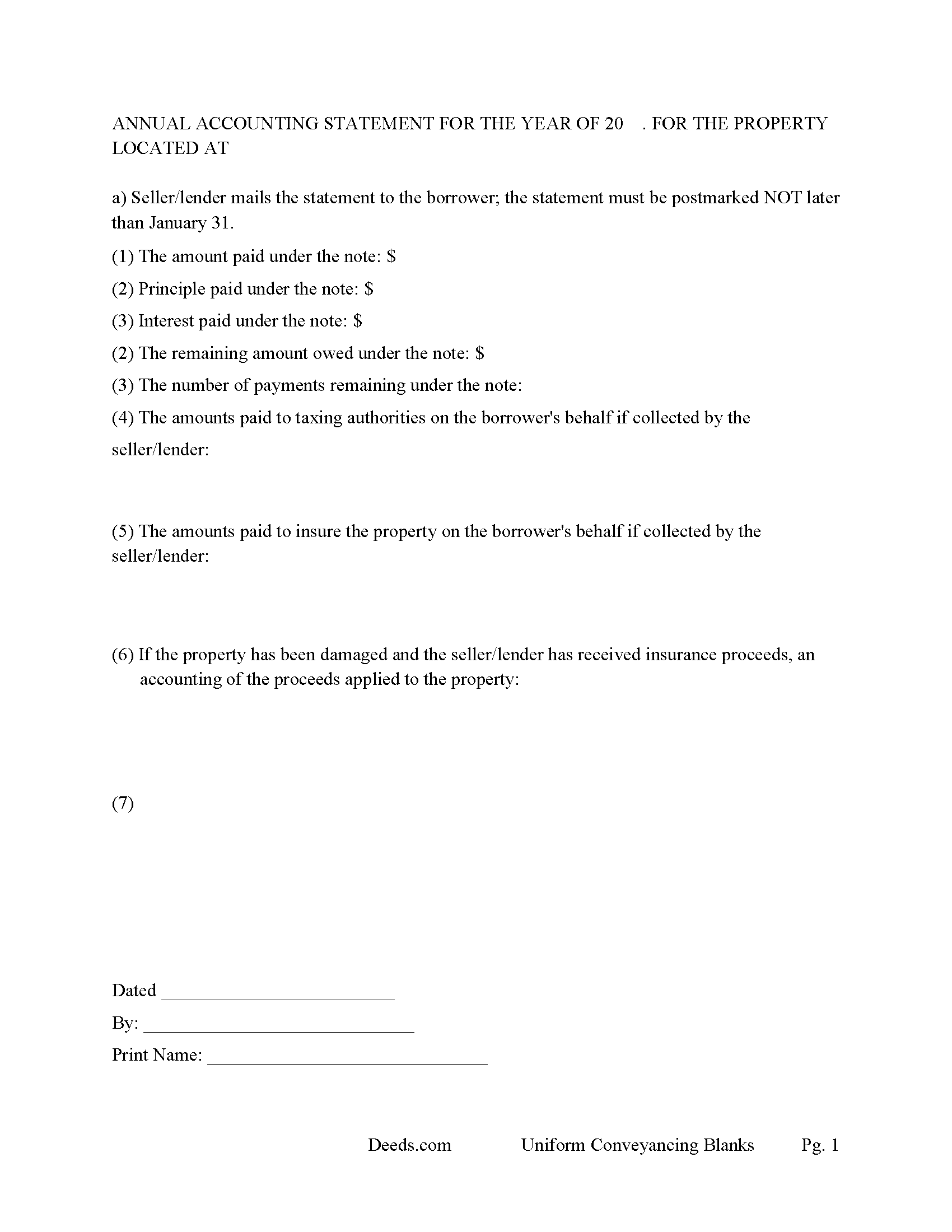

Deer Lodge County Annual Accounting Statement Form

Fill in the blank Deed of Trust and Promissory Note form formatted to comply with all Montana recording and content requirements.

All 7 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Montana and Deer Lodge County documents included at no extra charge:

Where to Record Your Documents

Anaconda - Deer Lodge Clerk/Recorder

Anaconda, Montana 59711

Hours: 8:30 to 4:30 M-F

Phone: (406) 563-4060

Recording Tips for Deer Lodge County:

- Ask if they accept credit cards - many offices are cash/check only

- Request a receipt showing your recording numbers

- If mailing documents, use certified mail with return receipt

- Some documents require witnesses in addition to notarization

Cities and Jurisdictions in Deer Lodge County

Properties in any of these areas use Deer Lodge County forms:

- Anaconda

- Warm Springs

Hours, fees, requirements, and more for Deer Lodge County

How do I get my forms?

Forms are available for immediate download after payment. The Deer Lodge County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Deer Lodge County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Deer Lodge County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Deer Lodge County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Deer Lodge County?

Recording fees in Deer Lodge County vary. Contact the recorder's office at (406) 563-4060 for current fees.

Questions answered? Let's get started!

A Deed of Trust with Trust Indenture Under the Small Tract Financing Act of Montana is the preferred form of financing in Montana for properties not exceeding 40 acres and under $500,000.00 in financing.

71-1-302 Policy- Because the financing of homes and business expansion is essential to the development of the state of Montana and because financing of homes and business expansion, usually involving areas of real estate of not more than 40 acres, has been restricted by the laws relating to mortgages of real property and because more financing of homes and business expansion is available if the parties can use security instruments and procedures not subject to all the provisions of the mortgage laws, it is the public policy of the state of Montana to permit the use of trust indentures for estates in real property of not more than 40 acres as provided in this part.

This form includes the Power of Sale clause, which allows for a non-judicial foreclosure, saving time and expense, in general:

Non-judicial foreclosure takes (130-180 days) compared to @1 year -- judicial foreclosure

In a non-judicial foreclosure Borrower has no right of redemption vs. an additional year beyond a judicial foreclosure.

Typically, no frivolous lawsuits filed to slow down a non-judicial foreclosure vs. common in a judicial foreclosure.

Typically, no deficiency judgement upon completion of sale in a non-judicial foreclosure vs. deficiency judgment used in judicial foreclosure.

71-1-304 Trust indentures authorized -- power of sale for breach in trustee

(1) A transfer in trust of an interest in real property of an area not exceeding 40 acres may be made to secure the performance of an obligation of a grantor or any other person named in the indenture to a beneficiary. However, a trust indenture may not be substituted for a mortgage that was in existence on March 5, 1963.

(2) When a transfer in trust of an interest in real property is made to secure the performance of the obligation referred to in subsection (1), a power of sale is conferred upon the trustee to be exercised after a breach of the obligation for which the transfer is security.

(3) A trust indenture executed in conformity with this part may be foreclosed by advertisement and sale in the manner provided in this part or, at the option of the beneficiary, by judicial procedure as provided by law for the foreclosure of mortgages on real property. The power of sale may be exercised by the trustee without express provision in the trust indenture.

(4) If a trust indenture states that the real property involved does not exceed 40 acres, the statement is binding upon all parties and conclusive as to compliance with the provisions of this part relative to the power to make a transfer, trust, and power of sale.

If the parameters of the trust indenture are not met (example: the subject property is 50 acres or $600.000.00) then it converts to a mortgage and treated as mortgage in foreclosure.

71-1-305 Trust indenture considered to be mortgage on real property A trust indenture is deemed to be a mortgage on real property and is subject to all laws relating to mortgages on real property except to the extent that such laws are inconsistent with the provisions of this part, in which event the provisions of this part shall control. For the purpose of applying the mortgage laws, the grantor in a trust indenture is deemed the mortgagor and the beneficiary is deemed the mortgagee.

71-1-321 Deeds of trust and trust deeds not invalidated The Small Tract Financing Act of Montana does not invalidate or preclude the use in this state of instruments, sometimes denominated deeds of trust, trust deeds, or trust indentures, which are not executed in conformity with this part, but in which a conveyance for security purposes is made to a trustee or trustees for the benefit of one or more lenders. Such instruments are considered to be mortgages and are subject to all laws relating to mortgages on real property. Every such instrument, recorded as prescribed by law, from the time it is filed for record is constructive notice of its contents to subsequent purchasers and encumbrancers.

(Montana DOT Package includes forms, guidelines, and completed examples) For use in Montana only.

Important: Your property must be located in Deer Lodge County to use these forms. Documents should be recorded at the office below.

This Deed of Trust and Promissory Note meets all recording requirements specific to Deer Lodge County.

Our Promise

The documents you receive here will meet, or exceed, the Deer Lodge County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Deer Lodge County Deed of Trust and Promissory Note form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4578 Reviews )

Patricia H.

October 15th, 2020

The process was so easy and result was excellent and expedient. I will definitely recommend your company for future recording needs.

Thank you!

Kevin B.

January 14th, 2025

Ordered the Ohio Land Contract forms for Jefferson County. It was an awesome purchase for $28 bucks. Easy and straight forward for someone like me with no real estate background to make my own land contract and save a couple grand hiring an attorney to copy and paste one to me. I'll be buying the same package for every county I invest in!

We are grateful for your engagement and feedback, which help us to serve you better. Thank you for being an integral part of our community.

Thomas F.

February 18th, 2021

Very convenient!

Thank you!

Hope A.

June 4th, 2021

Great Website and layout!! so easy!

Thank you!

RUTH A.

October 25th, 2024

I am so very thankful for the service that you provide for the public, thank you very much.

We deeply appreciate the trust you have placed in our services. Thank you for your valuable feedback and for choosing us.

Cherif T.

June 17th, 2019

I wish every state offered such an easy and economical download of these forms. You were reasonable in price, I received one of every form you offered along with instructions, and it made my day so easy. Why pay a lawyer a fortune for these simple (almost) everyday forms when you can do it all for less than $20. Thank you for being reasonable, well organized, and available for common use! Cherif T.

Thank you!

REBECCA B.

May 8th, 2023

Documents arrived instantly. Performed exactly as stated. Will use website again.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

PAMELA D.

March 28th, 2022

great response!! Thank you

Thank you!

Rex M.

February 21st, 2019

fulfilled all NC requirements

Thank you!

Donald C.

February 22nd, 2019

No review provided.

Thank you!

daniel b.

April 15th, 2019

nice & easy, site needs to have notification as to security of credit card info. who and how?

Thank you for your feedback. We really appreciate it. Have a great day!

Austin S.

August 13th, 2020

Everything is done in a timely manner which is very much appreciated.

Thank you for your feedback. We really appreciate it. Have a great day!

George R.

July 28th, 2020

One of the most satisfactory and easy to use websites I have come across. Being able to record documents in the court records without having to pay an atty $500 per hour and accomplish the recording in about 24 hours instead of days and even weeks i s invaluable. Worked perfectly.

Thank you!

Cathaleen P.

April 26th, 2021

Excellent service and very easy to process. Thank you!

Thank you for your feedback. We really appreciate it. Have a great day!

John W.

January 9th, 2019

The forms were easy to acquire and easy to use

Thank you for your feedback. We really appreciate it. Have a great day!