Blaine County Disclaimer of Interest Form

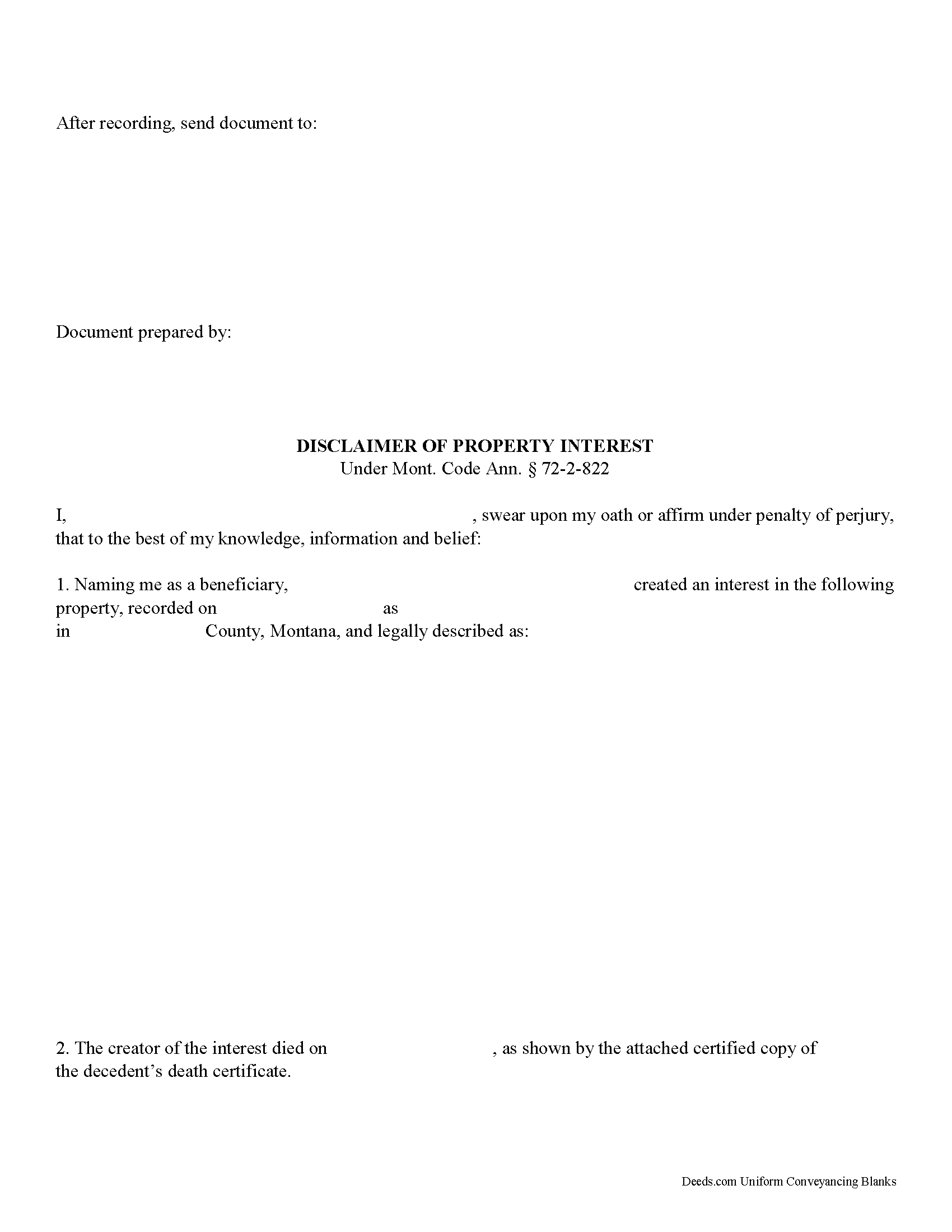

Blaine County Disclaimer of Interest Form

Fill in the blank form formatted to comply with all recording and content requirements.

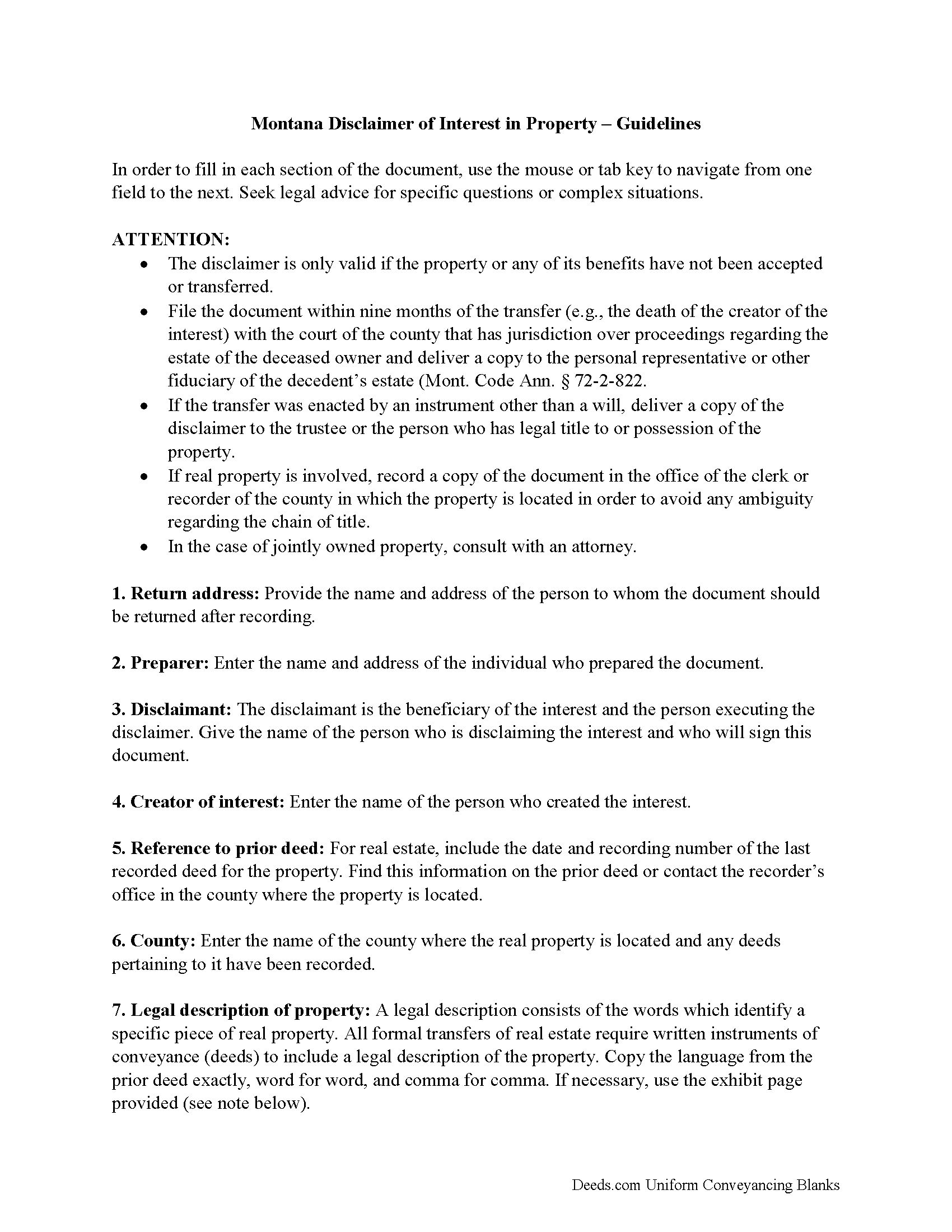

Blaine County Disclaimer of Interest Guide

Line by line guide explaining every blank on the form.

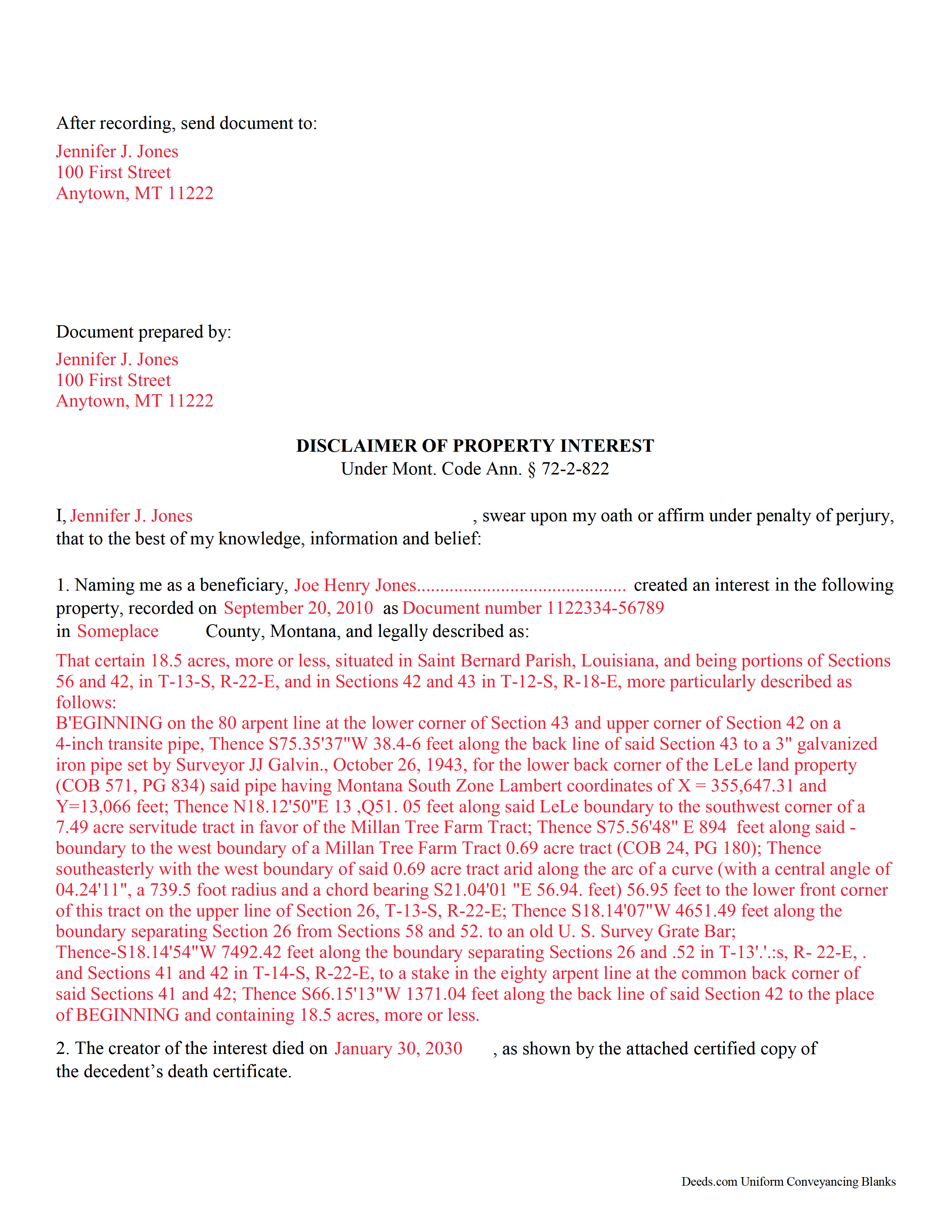

Blaine County Completed Example of the Disclaimer of Interest Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Montana and Blaine County documents included at no extra charge:

Where to Record Your Documents

Blaine County Clerk / Recorder

Chinook, Montana 59523

Hours: 8:00am-5:00pm M-F

Phone: (406) 357-3240

Recording Tips for Blaine County:

- Double-check legal descriptions match your existing deed

- Ask if they accept credit cards - many offices are cash/check only

- Request a receipt showing your recording numbers

- Ask about their eRecording option for future transactions

- Recorded documents become public record - avoid including SSNs

Cities and Jurisdictions in Blaine County

Properties in any of these areas use Blaine County forms:

- Chinook

- Harlem

- Hays

- Hogeland

- Lloyd

- Turner

- Zurich

Hours, fees, requirements, and more for Blaine County

How do I get my forms?

Forms are available for immediate download after payment. The Blaine County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Blaine County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Blaine County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Blaine County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Blaine County?

Recording fees in Blaine County vary. Contact the recorder's office at (406) 357-3240 for current fees.

Questions answered? Let's get started!

Montana Disclaimer of Property Interest

Under the Montana Code, the beneficiary of an interest in property may disclaim the gift, either in part or in full (Mont. Code Ann. 72-2-822). Note that the option to disclaim is only available to beneficiaries who have not acted in any way to indicate acceptance or ownership of the interest (72-2-822).

TITLE 72. ESTATES, TRUSTS, AND FIDUCIARY RELATIONSHIPS

CHAPTER 2. UPC -- INTESTACY, WILLS, AND DONATIVE TRANSFERS

Part 8. General Provisions Concerning Probate and Nonprobate Transfers

Disclaimer Of Interest In Property

72-2-822.Disclaimer of interest in property. (1) In this section:

(a)"Future interest" means an interest that takes effect in possession or enjoyment, if at all, later than the time of its creation.

(b)"Time of distribution" means the time when a disclaimed interest would have taken effect in possession or enjoyment.

(2)Except for a disclaimer governed by 72-2-823 or 72-2-824, the following rules apply to a disclaimer of an interest in property:

(a)The disclaimer takes effect as of the time the instrument creating the interest becomes irrevocable, or, if the interest arose under the law of intestate succession, as of the time of the intestate's death.

(b)The disclaimed interest passes according to any provision in the instrument creating the interest providing for the disposition of the interest, should it be disclaimed, or of disclaimed interests in general.

(c)If the instrument does not contain a provision described in subsection (2)(b), the following rules apply:

(i)If the disclaimant is not an individual, the disclaimed interest passes as if the disclaimant did not exist.

(ii)If the disclaimant is an individual, except as otherwise provided in subsections (2)(c)(iii) and (2)(c)(iv), the disclaimed interest passes as if the disclaimant had died immediately before the time of distribution.

(iii)If by law or under the instrument, the descendants of the disclaimant would share in the disclaimed interest by any method of representation had the disclaimant died before the time of distribution, the disclaimed interest passes only to the descendants of the disclaimant who survive the time of distribution.

(iv)If the disclaimed interest would pass to the disclaimant's estate had the disclaimant died before the time of distribution, the disclaimed interest instead passes by representation to the descendants of the disclaimant who survive the time of distribution. If no descendant of the disclaimant survives the time of distribution, the disclaimed interest passes to those persons, including the state but excluding the disclaimant, and in such shares as would succeed to the transferor's intestate estate under the intestate succession law of the transferor's domicile had the transferor died at the time of distribution. However, if the transferor's surviving spouse is living but is remarried at the time of distribution, the transferor is deemed to have died unmarried at the time of distribution.

(d)Upon the disclaimer of a preceding interest, a future interest held by a person other than the disclaimant takes effect as if the disclaimant had died or ceased to exist immediately before the time of distribution, but a future interest held by the disclaimant is not accelerated in possession or enjoyment.

A disclaimer is irrevocable and binding for the disclaiming/renouncing party and his or her creditors, so be sure to consult an attorney when in doubt about the drawbacks and benefits. If the interest arises out of jointly-owned property, seek legal advice as well.

(Montana DOI Package includes form, guidelines, and completed example)

Important: Your property must be located in Blaine County to use these forms. Documents should be recorded at the office below.

This Disclaimer of Interest meets all recording requirements specific to Blaine County.

Our Promise

The documents you receive here will meet, or exceed, the Blaine County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Blaine County Disclaimer of Interest form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4582 Reviews )

Dallas S.

July 19th, 2023

Very easy

Thank you!

Richard N.

November 27th, 2020

It went well. The proof will be when I complete the forms and submit to the County Clerk.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Ginger L.

May 29th, 2022

Excellent full set of documents with example and guidelines on how to do it ourselves without paying a lawyer. Or, we save legal fees by completing it ourselves and having a lawyer review it. Love that I can save the pdf and fill it out whenever I want. Thank you for having this available!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Reliant Roofers, Inc. N.

September 20th, 2023

Great communication. Quick response. deeds.com is timely and efficient.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

ARTHEMEASE B.

November 8th, 2021

You made a very confusing process very easy. Your response was timely. I will definitely use you again.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Leslie P.

October 16th, 2021

Fantastic deed forms, formatting was spot on, nice not to have to worry about it considering how picky our clerk is. Great job you guys and gals!

Thank you for the kind words Leslie!

Johnathan D.

March 30th, 2021

Very helpful and quick responses

Thank you!

Lori F.

July 16th, 2020

These folks are so amazing! They were very kind, patient and the communication was above and beyond. Basically, THEY ROCK!

Thank you!

William S.

June 4th, 2021

Contents were well done. Could not remove and replace the "Deeds/" footer, rendering the form unusable for filing with a court and county deed records. This should be corrected.

Thank you for your feedback. We really appreciate it. Have a great day!

Dean P.

October 6th, 2021

Very fast, efficient, and convenient - thanks Deeds.com! I would recommend this service to everyone needing to record documents, especially out-of-state customers such as myself.

Thank you for your feedback. We really appreciate it. Have a great day!

Tom D.

May 4th, 2019

I have one suggestion and couple of question I would think that most TOD's would be from married couples. It would be real helpful to have a example of the I(we) block for married couples. Why would I check or not check the "property is registered (torrents)" Do I need a notarized signature of the Grantee

Thank you for your feedback. We really appreciate it. Have a great day!

jonnie F.

August 25th, 2020

Easiest and most efficient way to process your documents, this company is amazing. They help me meet the deadline on a critical inspection by processing my NOC in less then a day. Thank You.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Susan N.

July 29th, 2020

Very easy to use and I received the information in a timely manner. I will use this service again.

Thank you!

Vernon H.

March 3rd, 2020

Great process and very easy to complete

Thank you!

Elena R.

March 3rd, 2020

Very helpful forms and guide. Would use again if needed.

Thank you for your feedback. We really appreciate it. Have a great day!