Sheridan County Special Warranty Deed Form

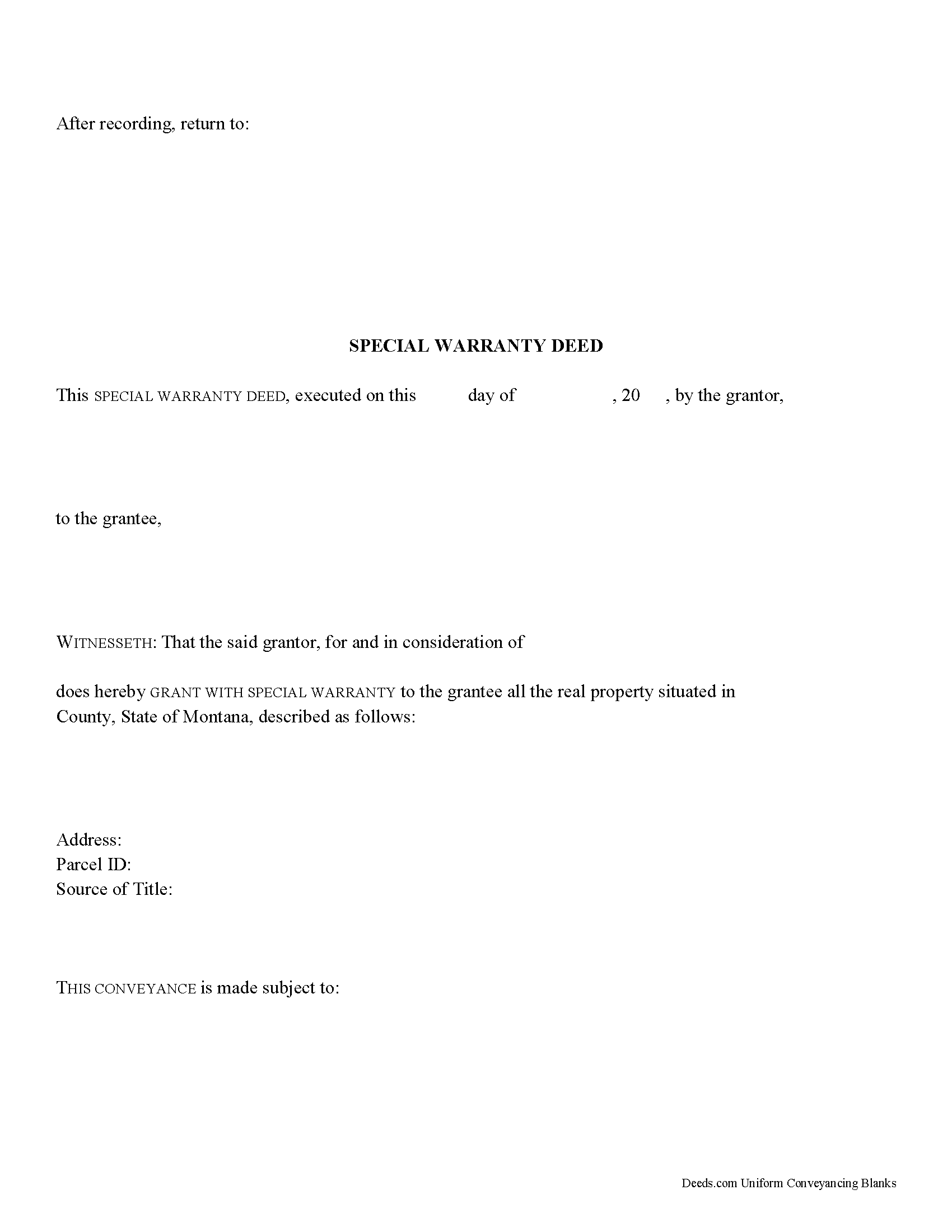

Sheridan County Special Warranty Deed Form

Fill in the blank form formatted to comply with all recording and content requirements.

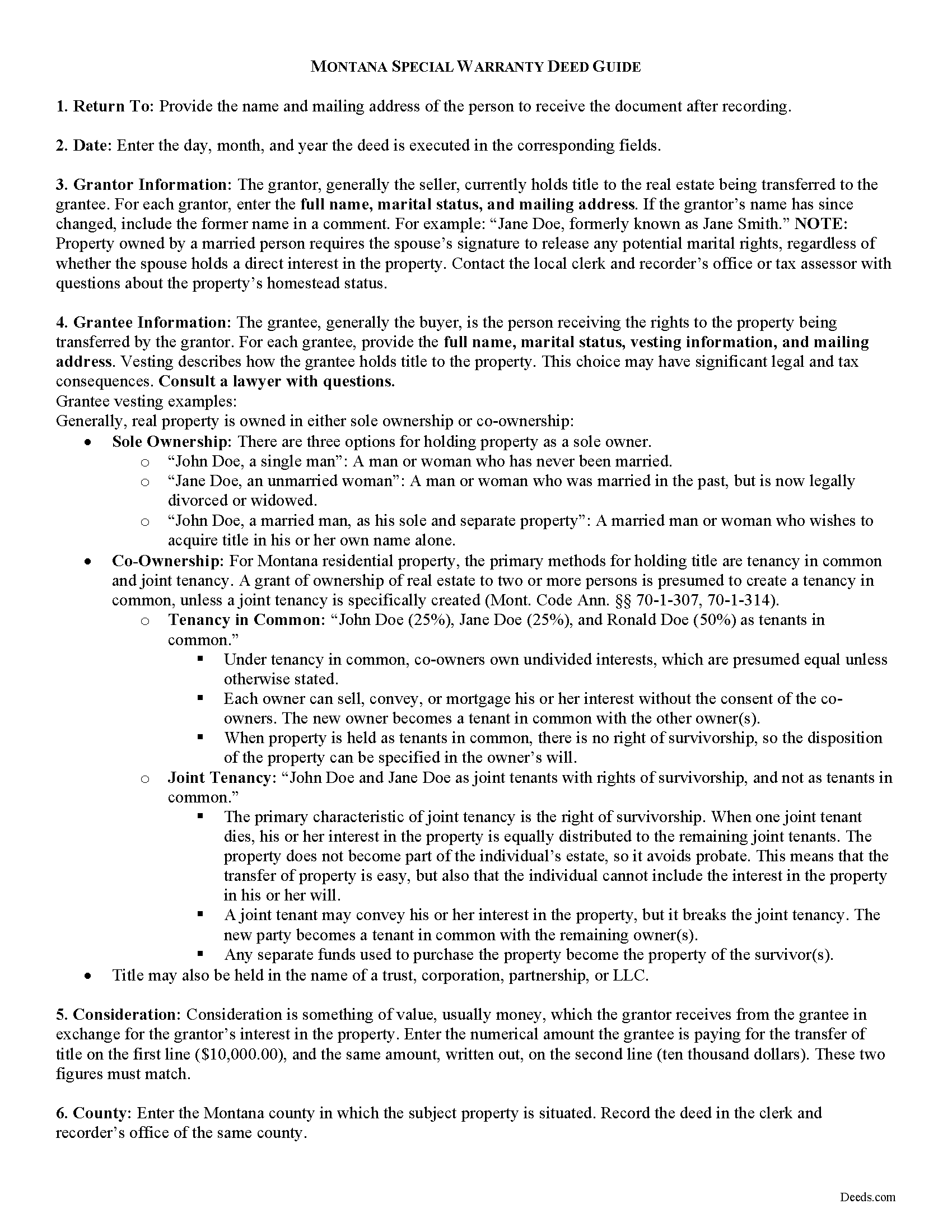

Sheridan County Special Warranty Deed Guide

Line by line guide explaining every blank on the form.

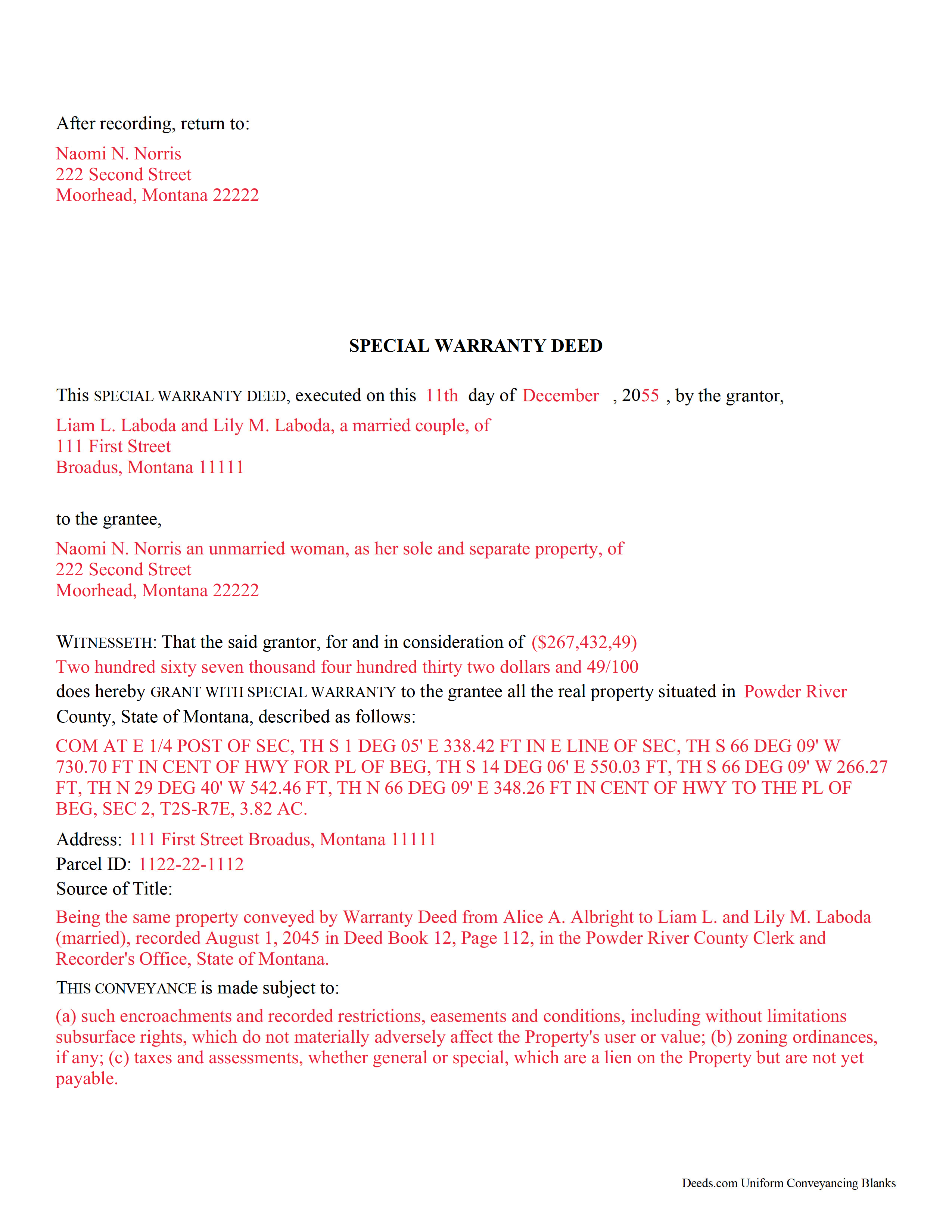

Sheridan County Completed Example of the Special Warranty Deed Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Montana and Sheridan County documents included at no extra charge:

Where to Record Your Documents

Sheridan County Clerk / Recorder

Plentywood, Montana 59254-1699

Hours: 8:00am-5:00pm Monday through Friday

Phone: (406) 765-3403

Recording Tips for Sheridan County:

- Ensure all signatures are in blue or black ink

- White-out or correction fluid may cause rejection

- Check that your notary's commission hasn't expired

Cities and Jurisdictions in Sheridan County

Properties in any of these areas use Sheridan County forms:

- Antelope

- Dagmar

- Homestead

- Medicine Lake

- Outlook

- Plentywood

- Raymond

- Redstone

- Reserve

- Westby

Hours, fees, requirements, and more for Sheridan County

How do I get my forms?

Forms are available for immediate download after payment. The Sheridan County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Sheridan County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Sheridan County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Sheridan County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Sheridan County?

Recording fees in Sheridan County vary. Contact the recorder's office at (406) 765-3403 for current fees.

Questions answered? Let's get started!

In Montana, real property can be transferred from one party to another by executing a special warranty deed. This type of deed is commonly used in commercial transactions, but is also valid for residential transfers.

Special warranty deeds are not statutory in Montana, but are still accepted forms of conveyance. The state provides a general form that may be used for a special warranty deed (Mont. Code Ann. 70-20-103). The warranties included in this type of deed are not defined by statute, except for covenants implied by the use of the word "grant." The word "grant" implies that, prior to the execution of the conveyance, the grantor did not convey the same estate or any right, title, or interest to any person other than the grantee. It also implies that, at the time of execution of the conveyance, the estate was free from encumbrances done, made, or suffered by the grantor or any person claiming under the grantor (Mont. Code Ann. 70-20-304).

A lawful special warranty deed includes the grantor's full name, mailing address, and marital status, and the grantee's full name, mailing address, marital status, and vesting. Vesting describes how the grantee holds title to the property. Generally, real property is owned in either sole ownership or in co-ownership.

For Montana residential property, the primary methods for holding title are tenancy in common and joint tenancy. A grant of ownership of real estate to two or more persons is presumed to create a tenancy in common, unless a joint tenancy is specifically created (Mont. Code Ann. 70-1-307, 70-1-314).

As with any conveyance of realty, a special warranty deed requires a complete legal description of the parcel. Recite the prior deed reference to maintain a clear chain of title, and detail any restrictions associated with the property. The deed should meet all state and county standards of form and content for recorded documents.

Any party transferring real property is required to file a Realty Transfer Certificate, subject to a $500 penalty. File the form with the clerk and recorder in the county where the property is located. (Mont. Code Ann. 15-7-305). The Realty Transfer Certificate includes a Water Rights Disclosure. Contact the Montana Department of Revenue with questions regarding the transfer, division, or exemption of water rights. For a valid transfer, record the deed at the clerk and recorder's office in the county where the property is located. Contact the same office to confirm accepted forms of payment.

This article is provided for informational purposes only and is not a substitute for legal advice. Contact an attorney with questions about special warranty deeds or for any issues related to transfers of real property in Montana.

(Montana SWD Package includes form, guidelines, and completed example)

Important: Your property must be located in Sheridan County to use these forms. Documents should be recorded at the office below.

This Special Warranty Deed meets all recording requirements specific to Sheridan County.

Our Promise

The documents you receive here will meet, or exceed, the Sheridan County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Sheridan County Special Warranty Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4578 Reviews )

Precious M.

June 23rd, 2020

great quick response

Thank you!

Joni S.

February 6th, 2024

Excellent service, no hassle, easy to use, affordable, best service -- hands down. I thought it would be difficult for me to record a deed in Florida while residing in California but you made it so easy. I will tell everyone about your service. Thank you.

Your feedback is greatly appreciated. Thank you for taking the time to share your experience!

brenda S.

March 1st, 2019

Excellent instructions very easy to follow!

Thank you!

Catherine P.

January 2nd, 2019

I got what I needed and you provided great templates.

Thank you!

Deborah P.

June 7th, 2021

Very good information. Easy access and easy to download. All the forms needed for TOD to be notarized and recorded with the county office. Much better than working with a Trust and the expense of lawyers, especially when several parties are involved and the owner of said property knows exactly to whom the property should go. Having forms and instructions available for the public to have their wishes recorded and confirmed makes handling final planning much easier and prevents family members from having the unnecessary task of going through court to solve property distribution issues. Thank you for this site and the forms you provide. I will recommend Deeds.com to those I know who are making final plans.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Sven S.

April 10th, 2019

great experience so far! Im using Deeds.com for e-recording. Easy to use website, document upload is a snap, you are walked through and reminded if theres something missing.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

LINDA J M.

November 18th, 2019

NO PROBLEMS. I LIKE THE DEED DOCUMENT AND INSTRUCTIONS. MADE IT EASY.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Trina P.

February 22nd, 2023

Deeds.com is a quick and effective way at finding property deeds. I had the results I needed in a couple hours without having to miss work to get to the clerks office, which is well worth the price of the service.

Thank you for your feedback. We really appreciate it. Have a great day!

Kathy R.

October 8th, 2022

I was very pleased with the quick turn around on a response to my inquiry. Further guidance was direct and I appreciate the professionalism from deeds.com.

Thank you!

Thomas D.

July 10th, 2019

The site is fine with one exception. About half the pdf files I downloaded were corrupted. I could not open them or view their contents. Fortunately, the link continued to work, so after I discovered this, I downloaded the corrupted files again, and they now seem fine. I do not know if my computer or the website caused this odd problem.

Thank you for your feedback. We really appreciate it. Have a great day!

Rosie M.

March 13th, 2025

I found exactly what I was looking for, and the documents are a complete package. Great service!

Thank you, Rosie! We're so glad you found exactly what you needed and that the documents met your expectations. We appreciate your kind words and your support! If you ever need anything else, we're here to help.

CHARMAINE G.

August 10th, 2022

Would have paid double for these forms. Thankfully there are professionals making these things, I would have surely messed it up if I tried to do it myself based on my incorrect preconceived ideas.

Thank you!

MARIA G.

July 5th, 2021

I tried 3 local attorneys and got no where , wrong information, to busy and another one was very rude. One said he'd do it then didn't. I was so stressed and tried a different online form company advertising an in person attorney within hours. They did call back but gave me the wrong answer. I needed a form used in NC and knew about it from the clerk of the court. The deadline was approaching, I looked one more time and found Deeds.com. They have the form and the much need instructions and for less than $30.00. I am so pleased and also relived!

Thank you for your feedback. We really appreciate it. Have a great day!

Thomas H.

April 15th, 2023

I had an initial problem of downloading the form. After contacting the website, I got an answer very quickly, and they fixed the problem.

Thank you for your feedback. We really appreciate it. Have a great day!

Yolanda S.

April 12th, 2021

very professional

Thank you!