Treasure County Trustee Deed Form

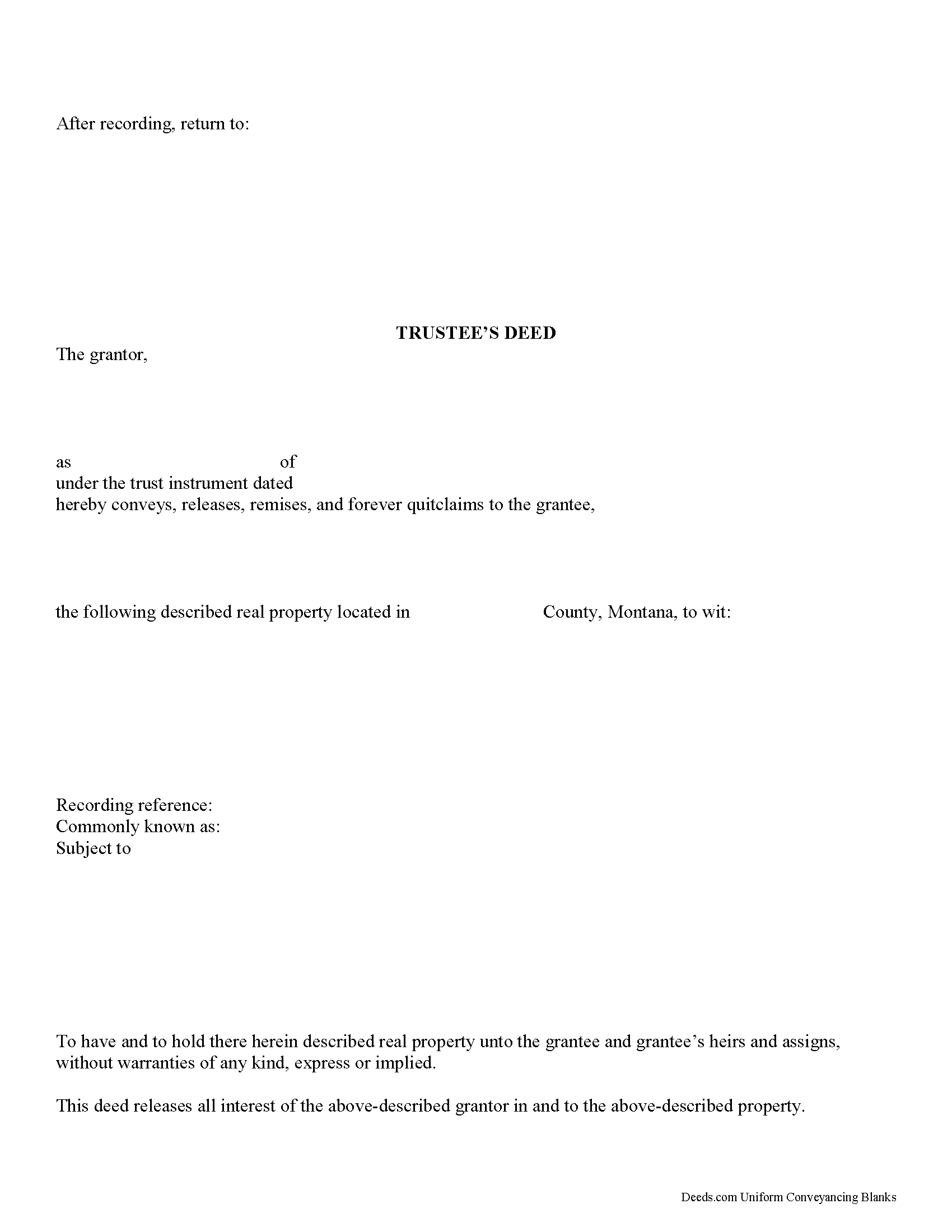

Treasure County Trustee Deed Form

Fill in the blank form formatted to comply with all recording and content requirements.

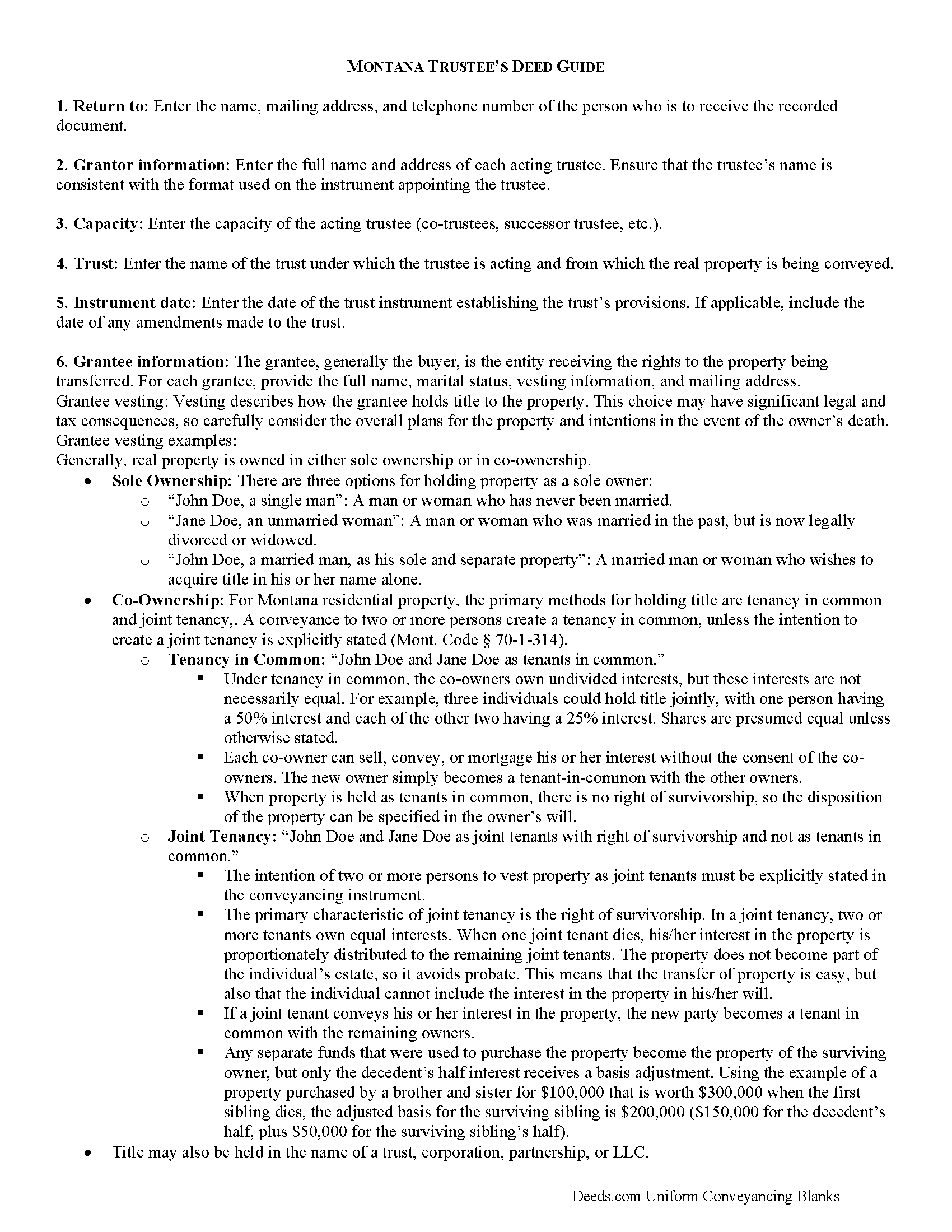

Treasure County Trustee Deed Guide

Line by line guide explaining every blank on the form.

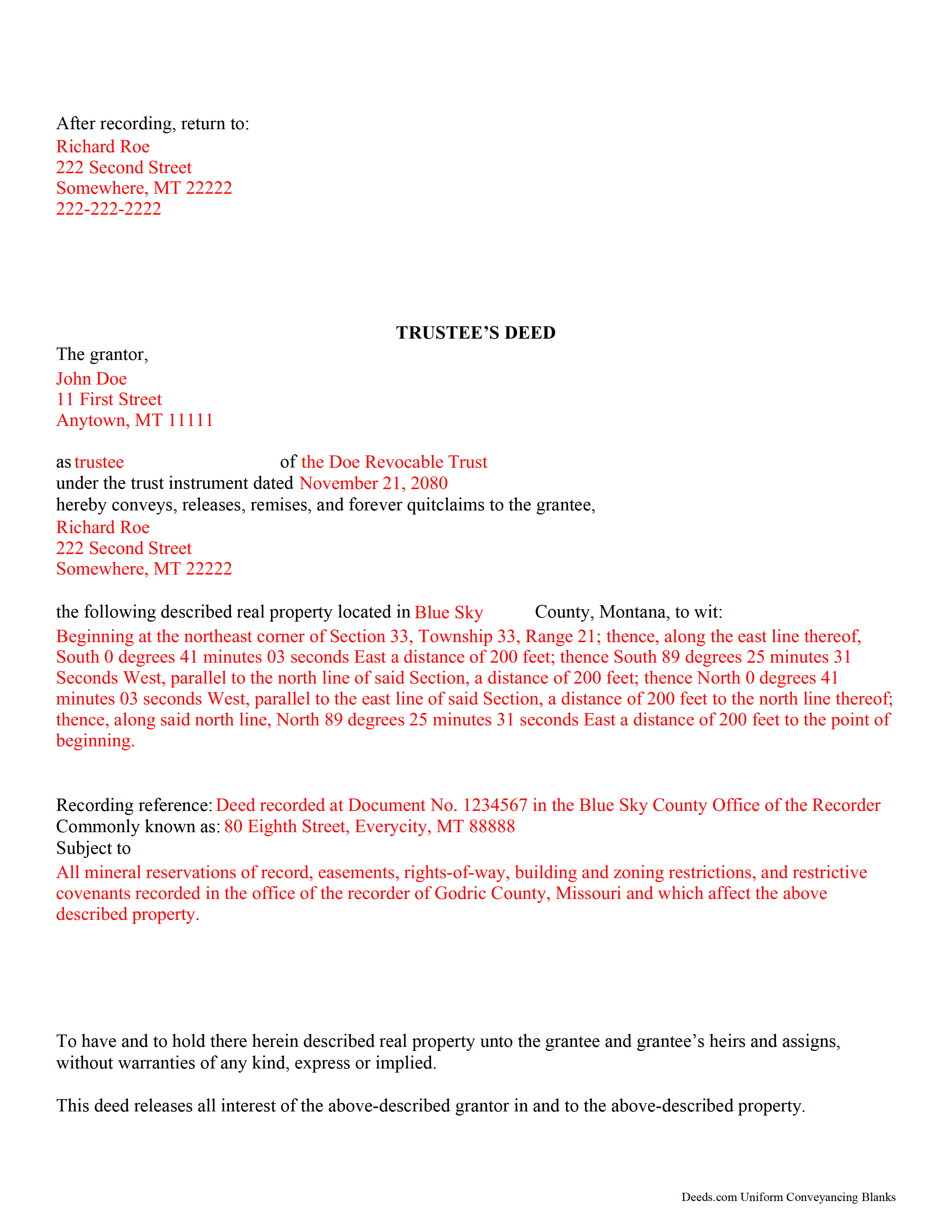

Treasure County Completed Example of the Trustee Deed Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Montana and Treasure County documents included at no extra charge:

Where to Record Your Documents

Treasure County Clerk / Recorder

Hysham, Montana 59038

Hours: 8:00 to 5:00 M-F

Phone: (406) 342-5547

Recording Tips for Treasure County:

- Bring your driver's license or state-issued photo ID

- Double-check legal descriptions match your existing deed

- Both spouses typically need to sign if property is jointly owned

- Recording fees may differ from what's posted online - verify current rates

- Check margin requirements - usually 1-2 inches at top

Cities and Jurisdictions in Treasure County

Properties in any of these areas use Treasure County forms:

- Bighorn

- Hysham

- Sanders

Hours, fees, requirements, and more for Treasure County

How do I get my forms?

Forms are available for immediate download after payment. The Treasure County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Treasure County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Treasure County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Treasure County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Treasure County?

Recording fees in Treasure County vary. Contact the recorder's office at (406) 342-5547 for current fees.

Questions answered? Let's get started!

Transferring Real Property from a Living Trust in Montana? Use a Trustee's Deed

In Montana, a trustee uses a trustee's deed to convey property held in a living trust. This trustee's deed is different from a trustee's deed to the purchaser at the trustee's sale.

A living trust is an estate planning tool that allows the trust maker to determine what happens to their assets upon death.

The living trust relationship involves three parties: the settlor (trust maker), who establishes the trust and funds it with assets (including real property); the trustee, who holds title to the property on behalf of the trust; and the beneficiary, who has a present or future interest in the property held in trust. The settlor is able to revoke a living trust up until his death, at which point the trust becomes irrevocable.

The trust is established by a trust instrument executed by the settlor. The instrument names the trustee -- whether an individual, multiple people, or a corporate trustee --, the beneficiaries, and the trust's terms or provisions. Because the trust cannot technically hold title, property transferred into it is titled in the name of the trustee on behalf of the trust.

The trustee's power to convey trust property is codified under the Montana Uniform Trust Code at 72-38-816(2). In Montana, the trustee's deed is a type of quitclaim deed, and so contains no warranties of title.

The deed names the acting trustee as the grantor, the trust's name and the date of the instrument establishing the trust, and, after recording, transfers title to the grantee. The document should meet all requirements of form and content for documents affecting real property in the state of Montana, including the legal description of the property being conveyed. The trustee must sign the deed in the presence of a notary public before recording.

If the recipient of a trustee's deed requests it, a trustee may also confirm his authority to enter into real property transactions by providing a recorded affidavit under Mont. Code Ann. 72-38-1111.

Contact an attorney with questions regarding living trusts and trustee's deeds in the State of Montana.

(Montana TD Package includes form, guidelines, and completed example)

Important: Your property must be located in Treasure County to use these forms. Documents should be recorded at the office below.

This Trustee Deed meets all recording requirements specific to Treasure County.

Our Promise

The documents you receive here will meet, or exceed, the Treasure County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Treasure County Trustee Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4574 Reviews )

Marlin M.

March 1st, 2025

5 stars!

Thank you!

Terry M.

January 8th, 2020

Very responsive. I was notified very quickly if the deed I was looking for was available.

Thank you!

Nancy J M.

August 22nd, 2021

Site is easy to navigate and forms are as described. Too bad there is no secure payment link service (PayPal, Apple Pay, etc. So after I verify charge has hit my credit card I will delete my Deeds.com account.

Thank you!

Samuel J M.

December 14th, 2018

I needed to prepare a Correction Warranty Deed and have not done so in years. I ordered your form and modified it to fit my situation. Saved me a lot of time. Thanks.

Thank you for your feedback. We really appreciate it. Have a great day!

Jerry G.

September 21st, 2023

I found the document confusing and I don't think I can use it.

Thank you for your feedback. We recognize that do-it-yourself legal documents may not be suitable for everyone. We always advise all our customers to seek assistance from a legal professional familiar with their specific situation for any form they do not completely understand. For your convenience, we have canceled your order and processed a refund.

Lisa P.

March 17th, 2021

Wonderful forms. It's nice that they were formatted perfectly for my county, it's real easy to miss a requirement (margines, font size, and so on) and end up with a rejection or higher recording fee. Good job folks!

Thank you!

Byron M.

September 18th, 2023

Prompt service... provide thorough explanation of what is needed to complete the recording.

Thank you for your feedback. We really appreciate it. Have a great day!

Yunyan B.

November 12th, 2019

Great website, fraction of the price if doing title research elsewhere

Thank you for your feedback. We really appreciate it. Have a great day!

cosmin B.

March 19th, 2021

It's all good!!!!

Thank you!

Susan S.

October 4th, 2019

Great forms, easy to understand and use (the guide helped a lot). Recorded with no issues. Will be back when needed.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

April K.

September 25th, 2022

Great service & quick response. Thank U.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Heather M.

January 9th, 2019

Great service, convenient, fast and easy to use. Thumbs Up!!!!w

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Zina J.

October 30th, 2019

Deeds.com supplied exactly what I needed to complete a quitclaim. Deeds.com saved me $180, supplied the necessary forms, and a sample page to use as a guide. I recommend Deeds.com.

Thank you!

Shana D.

June 9th, 2022

I ordered the wrong forms because I didn't do enough research to understand what I needed. Their customer service was more understanding than I deserved.

Thank you!

Linda I.

August 16th, 2023

So far so good. It was reasonably easy to download and complete the form using information found in my closing paperwork. I haven't yet had my form notarized but plan to do so this week and submit the packet to my county auditor.

Thank you for your feedback. We really appreciate it. Have a great day!