Sarpy County Deed of Full Reconveyance for Deed of Trust Form

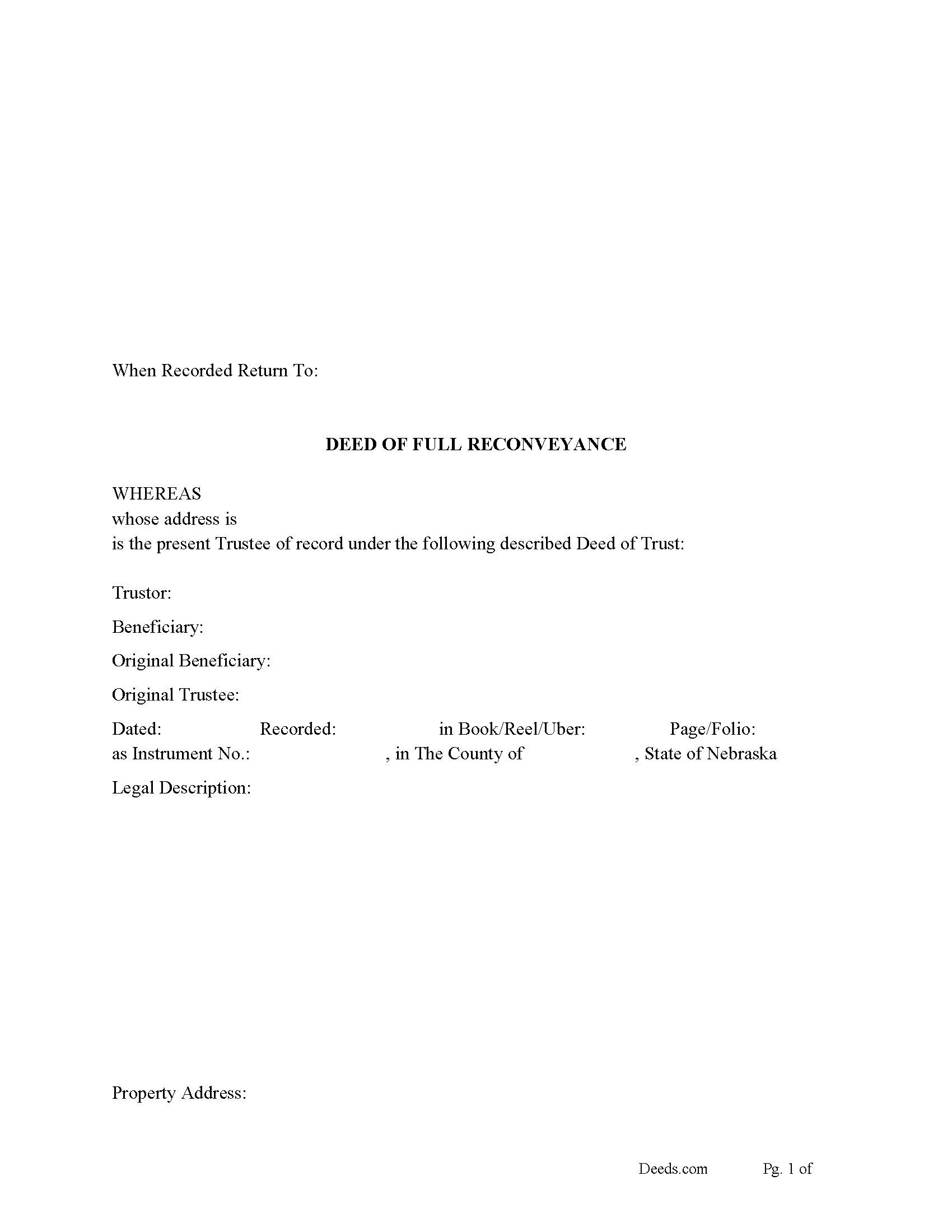

Sarpy County Deed of Full Reconveyance Form

Fill in the blank form formatted to comply with all recording and content requirements.

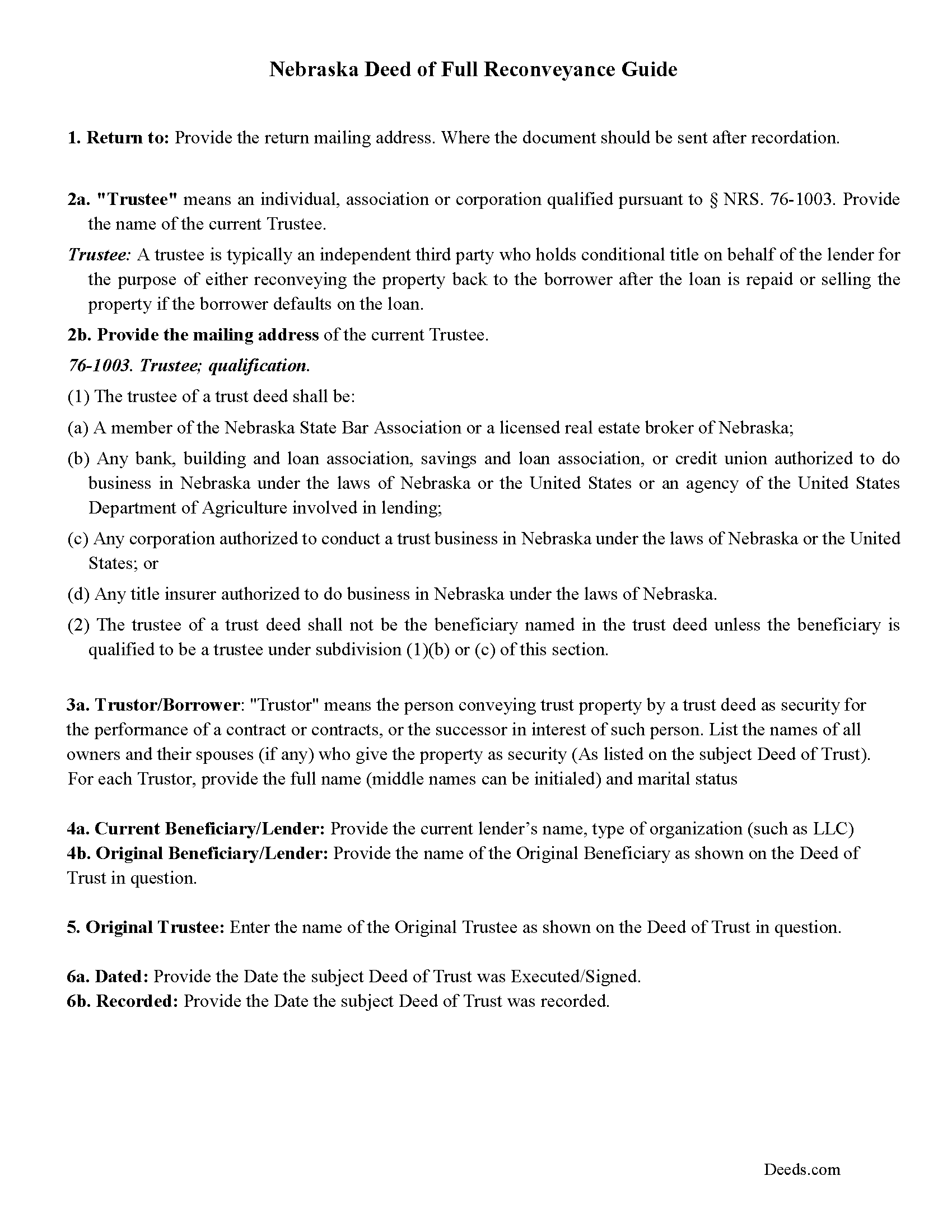

Sarpy County Deed of Full Reconveyance Guide

Line by line guide explaining every blank on the form.

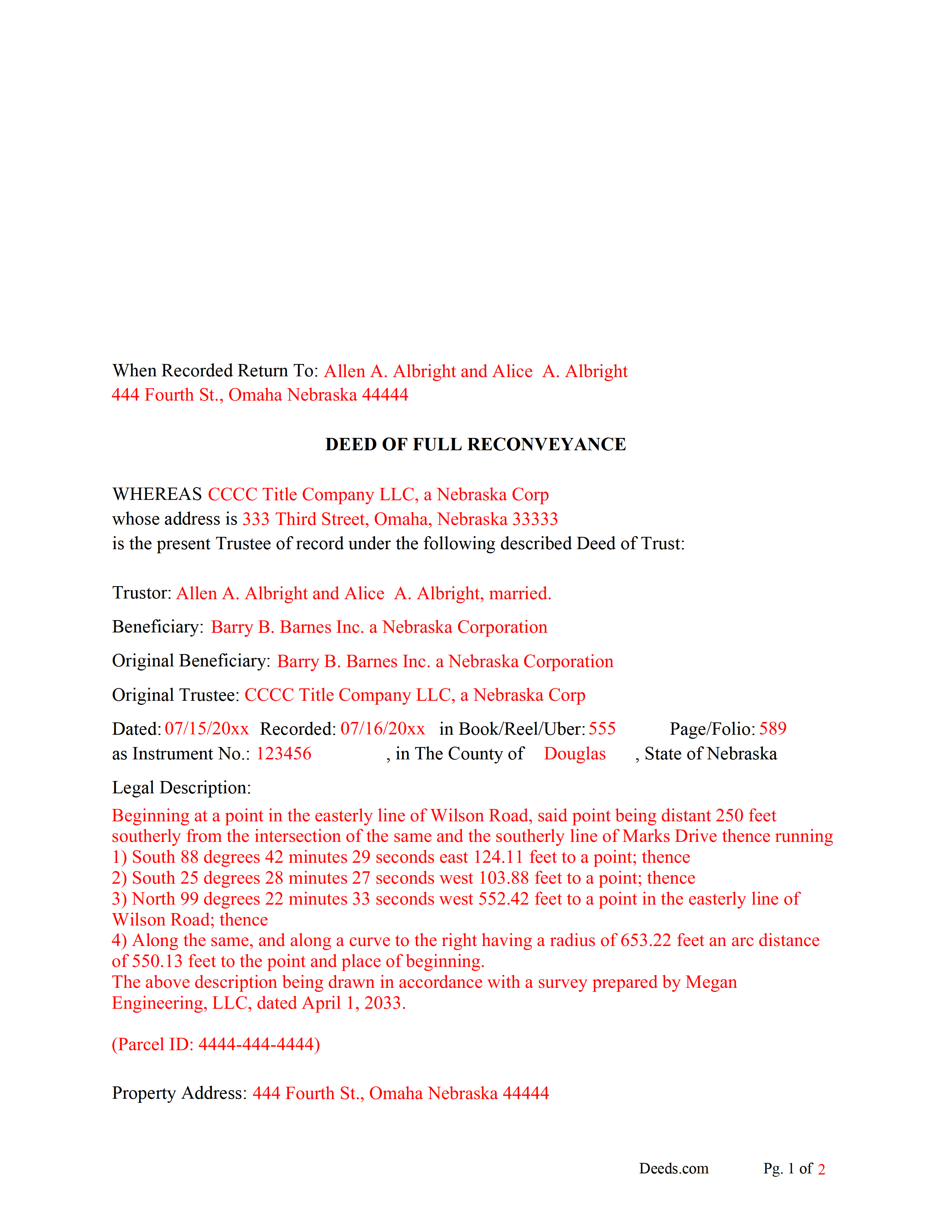

Sarpy County Completed Example of the Deed of Full Reconveyance Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Nebraska and Sarpy County documents included at no extra charge:

Where to Record Your Documents

Sarpy County Register of Deeds

Papillion, Nebraska 68046-2897

Hours: 8:00 to 4:45 M-F

Phone: (402) 593-5773

Recording Tips for Sarpy County:

- Ensure all signatures are in blue or black ink

- Check margin requirements - usually 1-2 inches at top

- Recorded documents become public record - avoid including SSNs

Cities and Jurisdictions in Sarpy County

Properties in any of these areas use Sarpy County forms:

- Bellevue

- Gretna

- La Vista

- Offutt A F B

- Omaha

- Papillion

- Springfield

- St Columbans

Hours, fees, requirements, and more for Sarpy County

How do I get my forms?

Forms are available for immediate download after payment. The Sarpy County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Sarpy County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Sarpy County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Sarpy County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Sarpy County?

Recording fees in Sarpy County vary. Contact the recorder's office at (402) 593-5773 for current fees.

Questions answered? Let's get started!

When a Deed of Trust has been paid in full the beneficiary/lender is responsible to deliver (a reconveyance in recordable form duly executed by the trustee) to the trustor/borrower. (Any beneficiary who fails to deliver such a reconveyance within sixty days after receipt of such written request shall be liable to the trustor or his or her successor in interest, as the case may be, for five thousand dollars or actual damages resulting from such failure, whichever is greater.) (76-1014.01)

(If a trustee fails or refuses to execute a reconveyance required by the beneficiary, the beneficiary shall appoint a successor trustee that will execute a reconveyance.) (76-1014.01)

This form can be used by the original beneficiary/lender or current beneficiary/lender- original trustee or current trustee,

(Nebraska DOFR Package includes form, guidelines, and completed example) For use in Nebraska only.

Important: Your property must be located in Sarpy County to use these forms. Documents should be recorded at the office below.

This Deed of Full Reconveyance for Deed of Trust meets all recording requirements specific to Sarpy County.

Our Promise

The documents you receive here will meet, or exceed, the Sarpy County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Sarpy County Deed of Full Reconveyance for Deed of Trust form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4588 Reviews )

Jimmy W.

February 15th, 2022

The forms where easy to get to and I hope that they will be as easy to fill out.

Thank you!

Deborah P.

June 7th, 2021

Very good information. Easy access and easy to download. All the forms needed for TOD to be notarized and recorded with the county office. Much better than working with a Trust and the expense of lawyers, especially when several parties are involved and the owner of said property knows exactly to whom the property should go. Having forms and instructions available for the public to have their wishes recorded and confirmed makes handling final planning much easier and prevents family members from having the unnecessary task of going through court to solve property distribution issues. Thank you for this site and the forms you provide. I will recommend Deeds.com to those I know who are making final plans.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Robert B.

January 18th, 2019

Liked the fact that the forms were fill in the blank. Good to have the option of re-doing them if needed, and I needed ;)

Thank you for your feedback. We really appreciate it. Have a great day!

Lesley B.

May 6th, 2022

It was so quick and easy to access.. Thank you!!

Thank you for your feedback. We really appreciate it. Have a great day!

Joy V.

December 24th, 2018

Very helpful and efficient!

Thank you for your feedback. We really appreciate it. Have a great day!

Turto T.

February 5th, 2021

The documents were accurate and event well packaged. They contained all the information that was needed to establish revocable trusts and transfer the property into the trusts. All of this with decent price.

Thank you for your feedback. We really appreciate it. Have a great day!

Cheryl G.

January 20th, 2021

Everyhing went smoothly

Thank you for your feedback. We really appreciate it. Have a great day!

julie S.

June 24th, 2022

I love this company!! Excellent customer service and quick!! Thank you

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Miljana K.

January 20th, 2019

I was on several sites but this was the easiest and cost effective. No bait and switch like on several sites where you get a "free trial" and then they started billing you monthly for legal services. Excellent.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

ADEREMI O.

March 23rd, 2021

Your product is amazing !

Thank you for your feedback. We really appreciate it. Have a great day!

COURTNEY K.

August 7th, 2020

I could not be happier with this service! It was so easy and fast!

Thank you!

Joseph S.

November 27th, 2023

THIS IS MY FIRST EXPERIENCE WITH DEEDS.COM. I DLED THE ESTATE DEED FORM THAT I HOPE WILL GO THROUGH OK WITH THE COUNTY. IT WILL BE SOMETIME UNTIL I HAVE IT FILLED IN AND ALL THE NAMES IN, NORARIZED AND FILED. CAN I RECONTACT YOU FOLKS IF THERE IS A PROBLEM? THANK YOU, JOE SEUBERT

We are motivated by your feedback to continue delivering excellence. Thank you!

Kate J.

January 10th, 2022

Easy to use.

Thank you!

Quanah N.

July 30th, 2022

Instruction easy to follow

Thank you!

Terriana H.

December 12th, 2020

Order processed and fulfilled in the same day!

Thank you!