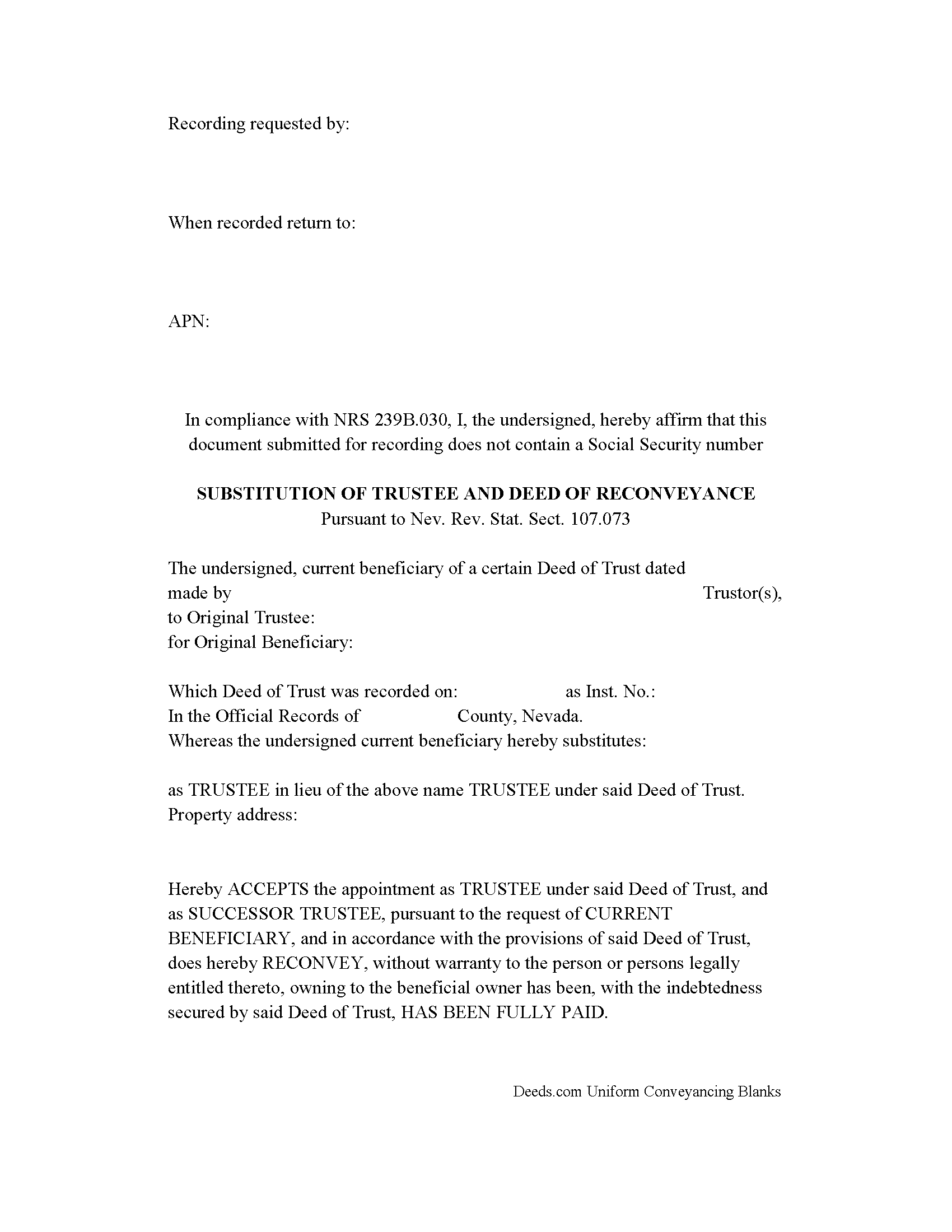

Clark County Substitution of Trustee and Deed of Reconveyance (For Deed of Trust) Form

Clark County Substitution of Trustee and Deed of Full Reconveyance Form

Fill in the blank form formatted to comply with all recording and content requirements.

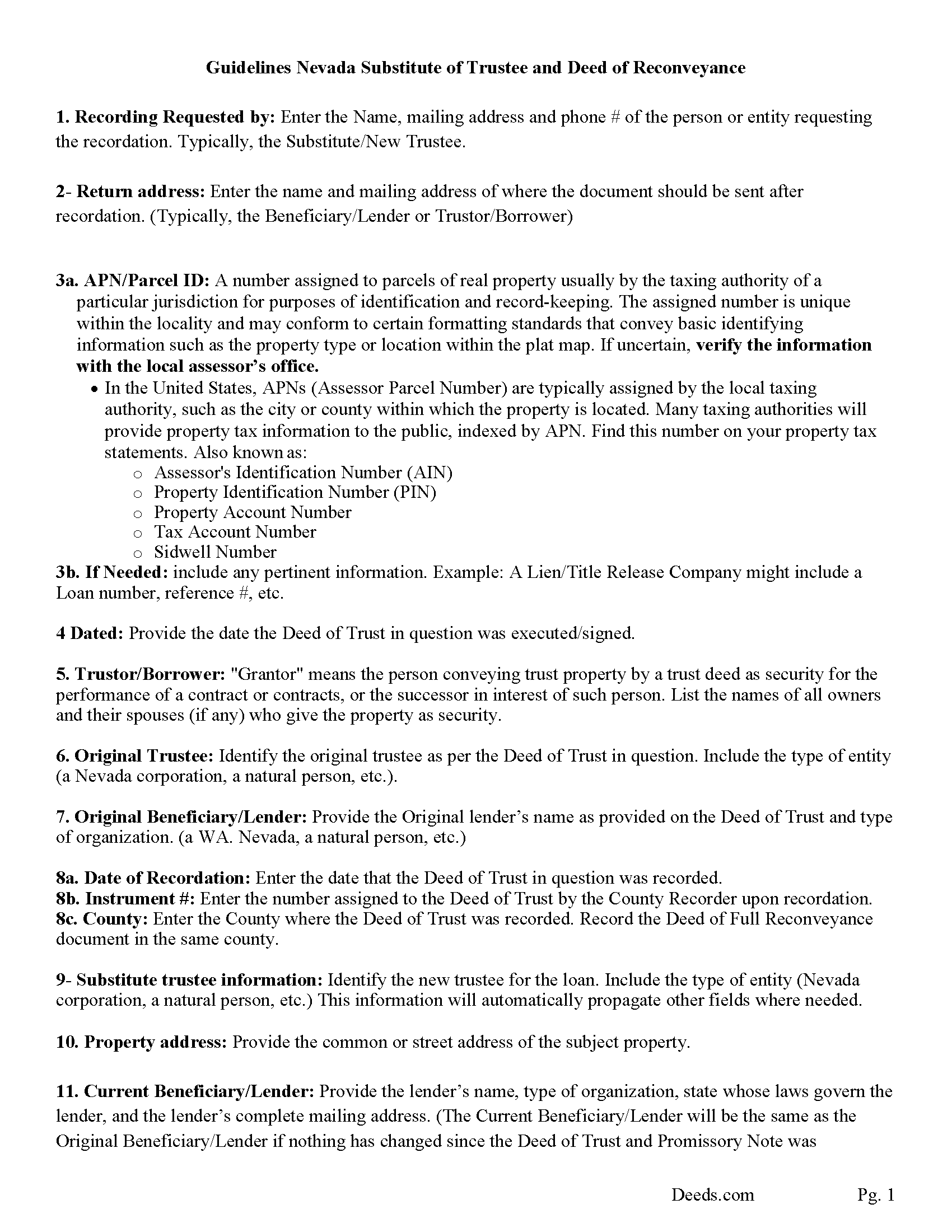

Clark County Substitution of Trustee and Deed of Reconveyance Guide

Line by line guide explaining every blank on the form.

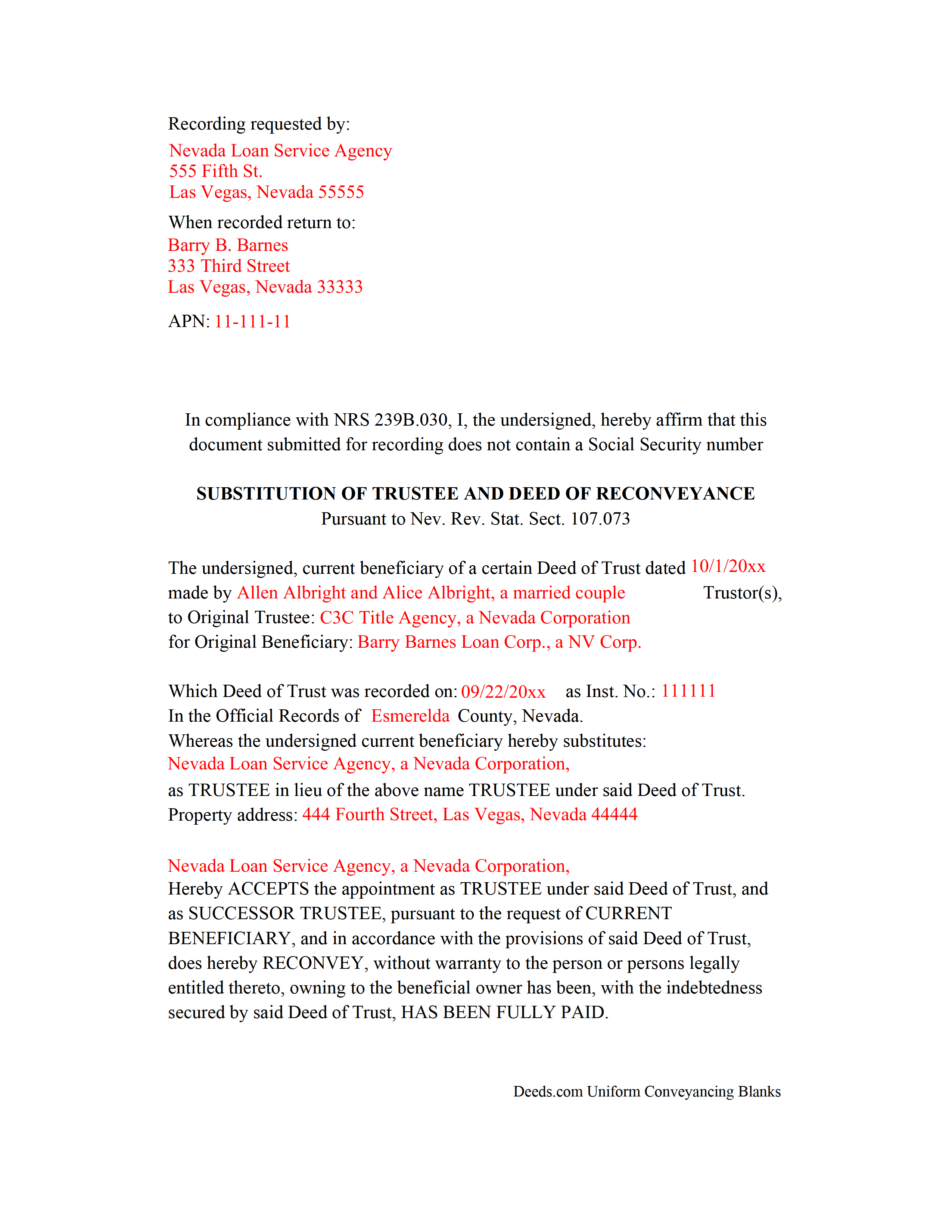

Clark County Completed Example of the Substitute and Reconveyance

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Nevada and Clark County documents included at no extra charge:

Where to Record Your Documents

Clark County Recorder's Office

Las Vegas, Nevada 89106-1510

Hours: Monday through Friday 8:00 AM to 5:00 PM

Phone: (702) 455-4336

Northwest Branch Office

Las Vegas, Nevada 89129

Hours: Monday through Thursday 8am - 5pm. Closed 12:00 - 12:30pm

Phone: (702) 455-4336

Henderson Branch

Henderson, Nevada 89015

Hours: Monday through Thursday 8am - 5pm. Closed 12:00 - 12:30pm

Phone: (702) 455-4336

Recording Tips for Clark County:

- Make copies of your documents before recording - keep originals safe

- Avoid the last business day of the month when possible

- Both spouses typically need to sign if property is jointly owned

- Check margin requirements - usually 1-2 inches at top

Cities and Jurisdictions in Clark County

Properties in any of these areas use Clark County forms:

- Blue Diamond

- Boulder City

- Bunkerville

- Cal Nev Ari

- Coyote Springs

- Henderson

- Indian Springs

- Jean

- Las Vegas

- Laughlin

- Mesquite

- Moapa

- Moapa Valley

- Nellis Afb

- North Las Vegas

- Searchlight

- Sloan

- The Lakes

Hours, fees, requirements, and more for Clark County

How do I get my forms?

Forms are available for immediate download after payment. The Clark County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Clark County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Clark County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Clark County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Clark County?

Recording fees in Clark County vary. Contact the recorder's office at (702) 455-4336 for current fees.

Questions answered? Let's get started!

When a promissory note secured by a Deed of Trust is paid off, the beneficiary/lender contacts the trustee and notifies him/her to reconvey title to the Trustor/borrower. If the original Trustee is unavailable or can't act, a substitute trustee is typically chosen. This form allows the lender to choose a new trustee and authorizes the new trustee to reconvey title by recording the form. This form can be exercised by the original beneficiary/lender or a secondary beneficiary/lender who may have purchased/inherited the promissory note.

Use this document when the subject "Deed of Trust" has been recorded formatted Pursuant to Nev. Rev. Stat. Sect. 107.073 (If the deed of trust has been recorded by a microfilm or other photographic process, a marginal release may not be used and an acknowledged reconveyance of the deed of trust must be recorded.) (NRS 107.073(2))

Typically, within 21 day after satisfaction of debt, the lender delivers to the (trustee or trustor/) borrower (the original note and deed of trust), (if the beneficiary)/lender (is in possession of those documents). The lender will also (execute a request to reconvey the estate in real property conveyed to the trustee by the grantor)/trustor/borrower. (NRS107.077(1))

If the Promissory Note secured, (by a Deed of Trust is made on or after October 1, 1991), (is paid or otherwise satisfied or discharged, and a properly executed request to reconvey is received by the trustee, the trustee shall cause to be recorded a reconveyance of the deed of trust.). This is required (within 45 days.) (NRS107.077(2))

(If the beneficiary fails to deliver to the trustee a properly executed request to reconvey pursuant to subsection 1, or if the trustee fails to cause to be recorded a reconveyance of the deed of trust pursuant to subsection 2, the beneficiary or the trustee, as the case may be, is liable in a civil action to the grantor, his or her heirs or assigns in the sum of $1,000, plus reasonable attorney's fees and the costs of bringing the action, and the beneficiary or the trustee is liable in a civil action to any party to the deed of trust for any actual damages caused by the failure to comply with the provisions of this section and for reasonable attorney's fees and the costs of bringing the action.) (NRS107.077(3))

(Nevada SOT and DOR Package includes form, guidelines, and completed example) For use in Nevada only.

Important: Your property must be located in Clark County to use these forms. Documents should be recorded at the office below.

This Substitution of Trustee and Deed of Reconveyance (For Deed of Trust) meets all recording requirements specific to Clark County.

Our Promise

The documents you receive here will meet, or exceed, the Clark County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Clark County Substitution of Trustee and Deed of Reconveyance (For Deed of Trust) form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4578 Reviews )

Bruce B.

April 30th, 2020

Worked great and was easy to use

Thanks Bruce, glad we could help.

Edward O.

January 28th, 2020

east too do.. hope it works thanks

Thank you!

Linda W.

January 16th, 2019

Got the forms, very straight forward. No problems completing them.

Thanks Linda!

Mary Ann H.

February 4th, 2021

The Deeds.com website was clear and easy to follow. I completed it about 20 minutes. I appreciate the convenience of doing it from home and that I will receive a copy by mail.

Thank you for your feedback. We really appreciate it. Have a great day!

Robert K.

June 13th, 2021

Very user friendly - I found the affidavit I needed right away together with the guide to filling it out.

Thank you!

Katherine W.

January 24th, 2019

I was impressed by the completeness of the package of forms PLUS instructions. Particularly helpful is the filled in sample, which enables you to see what a correct, completed deed ought to look like.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Sheneda A.

November 23rd, 2022

Great!

Thank you!

Cindy H.

October 22nd, 2021

Very easy to use and organized. When I needed the form I needed it immediately. I didn't want to get locked into a monthly subscription. Deeds.com met that need. Thanks!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Shonda S.

April 5th, 2023

This is my first time using the site for business and I must say this site made it so easy for me. I was so lost, thank you so much.

Thank you!

Pauletta C.

February 12th, 2022

worked like a charm

Thank you!

Fernando C.

April 13th, 2019

I was able to get what I needed!! Easy and fast!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Janet M.

December 17th, 2020

This site is amazing! What a time saver from driving somewhere and standing around waiting.

Thank you!

Jenine E.

April 4th, 2021

The information seems complete and accurate. The form was easy to use and save. I'll let you know if we encounter problems getting the deed processed.

Thank you for your feedback. We really appreciate it. Have a great day!

Georgia R.

March 29th, 2023

Great experience, fast and efficient, no hassle. Will use again!

Thank you for your feedback. We really appreciate it. Have a great day!

Lynd P.

January 14th, 2019

Good

Thanks Lynd.