Lincoln County Transfer on Death Revocation Form

Lincoln County Transfer on Death Revocation Form

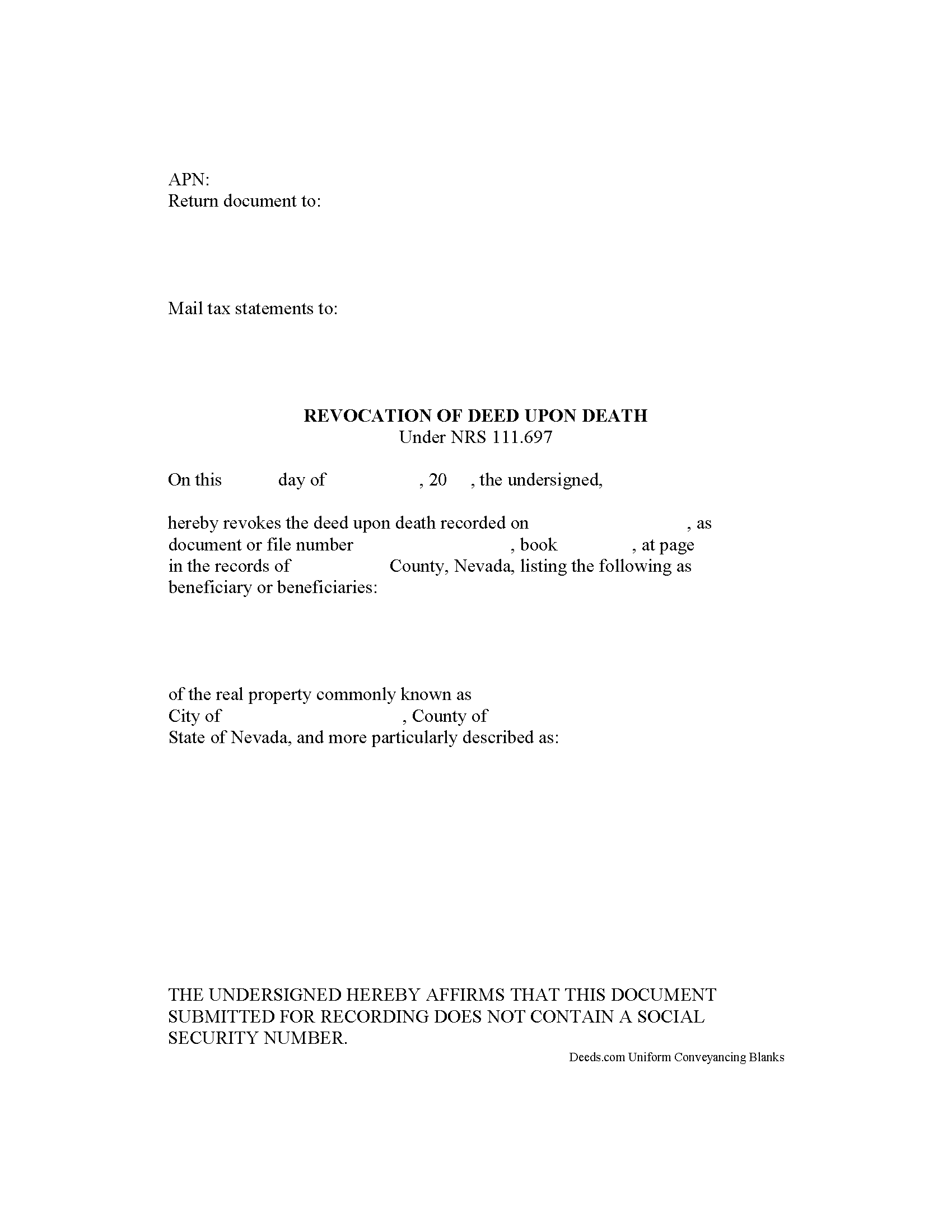

Fill in the blank form formatted to comply with all recording and content requirements.

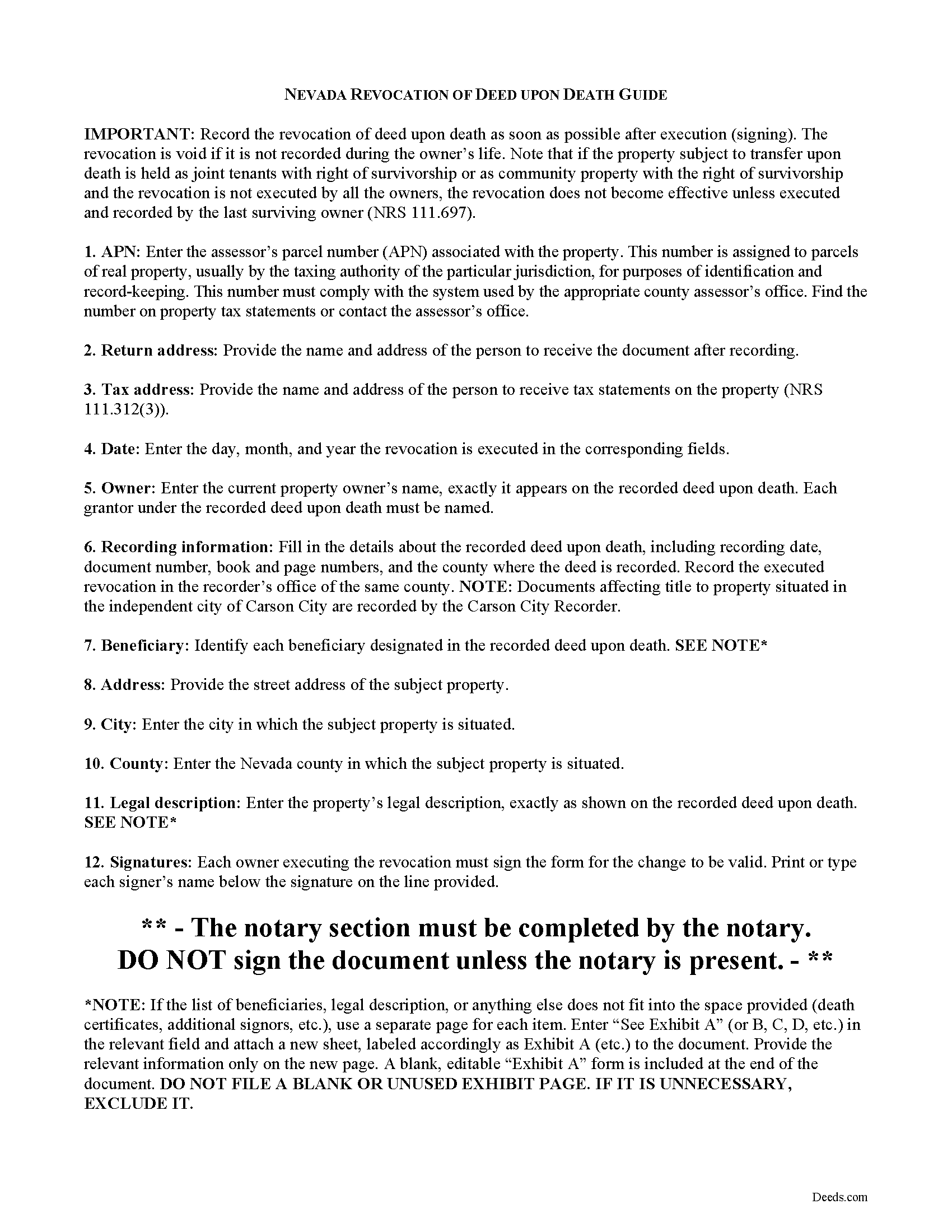

Lincoln County Transfer on Death Revocation Guide

Line by line guide explaining every blank on the form.

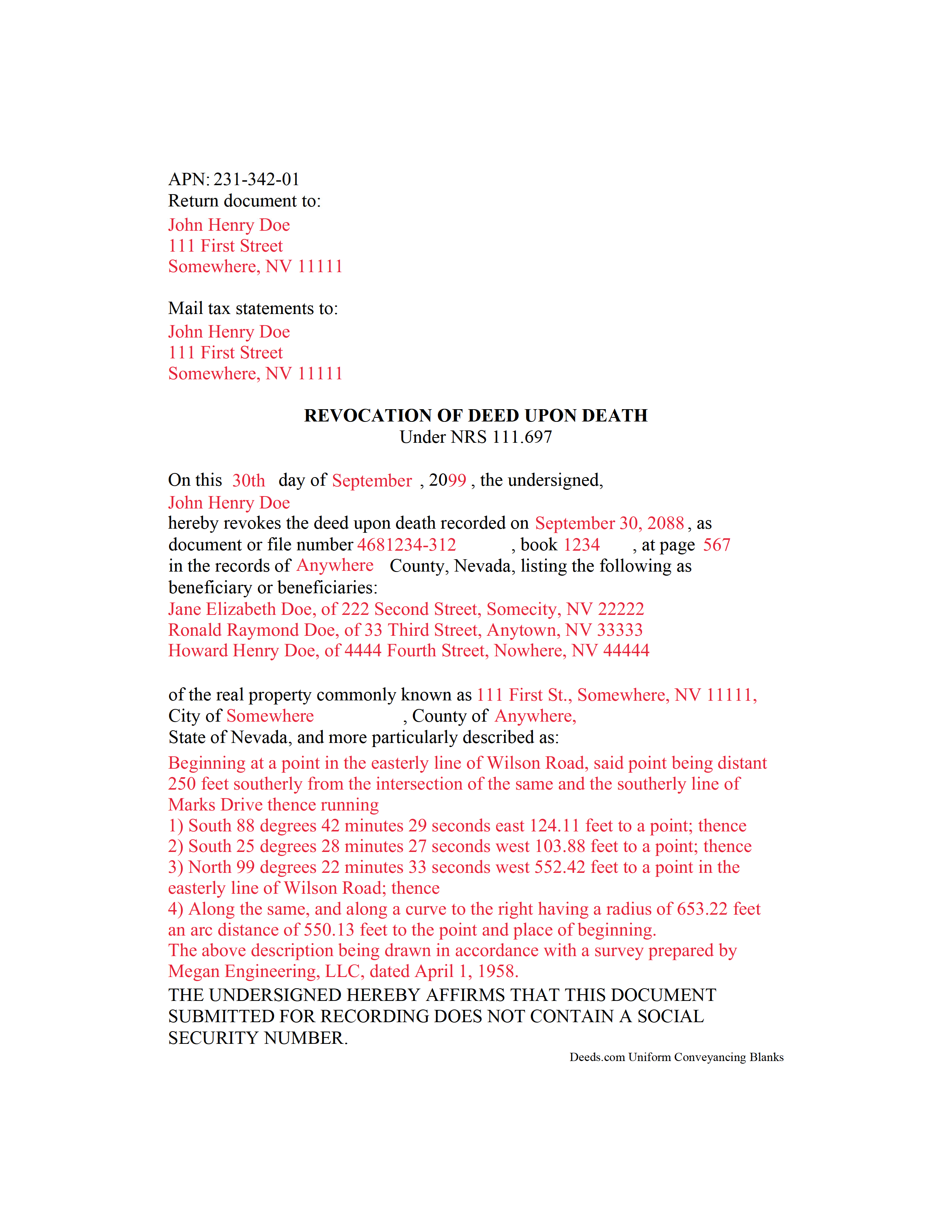

Lincoln County Completed Example of the Transfer on Death Revocation Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Nevada and Lincoln County documents included at no extra charge:

Where to Record Your Documents

Lincoln County Recorder / Auditor

Pioche, Nevada 89043

Hours: 8:00am-5:00pm M-F

Phone: (775) 962-8076 or 962-5495

Recording Tips for Lincoln County:

- Bring your driver's license or state-issued photo ID

- Documents must be on 8.5 x 11 inch white paper

- Request a receipt showing your recording numbers

Cities and Jurisdictions in Lincoln County

Properties in any of these areas use Lincoln County forms:

- Alamo

- Caliente

- Hiko

- Panaca

- Pioche

Hours, fees, requirements, and more for Lincoln County

How do I get my forms?

Forms are available for immediate download after payment. The Lincoln County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Lincoln County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Lincoln County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Lincoln County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Lincoln County?

Recording fees in Lincoln County vary. Contact the recorder's office at (775) 962-8076 or 962-5495 for current fees.

Questions answered? Let's get started!

Revoking a Nevada Deed upon Death

Nevada's statutory transfer on death instrument for real property is called a deed upon death. It is governed by NRS 111.655-111.699 (2013), inclusive, and incorporates the Uniform Real Property Transfer on Death Act into its text. THE EXECUTED REVOCATION MUST BE RECORDED IN THE COUNTY WHERE THE LAND IS LOCATED, DURING THE OWNER'S NATURAL LIFE.

Deeds upon death offer many unique features, but one of the more unusual is their revocability. While these deeds are not affected by directions contained in a will, the statutes provide two primary ways to revoke the potential future interest.

The first option deals with re-deeding the property to someone else. Because the deed only conveys the owner's current interest at the time of death, if there is no interest, there is nothing to convey. The owner might also record several transfer on death deeds for the same property. In that case, "the deed upon death that is last recorded before the death of the owner is the effective deed." See 111.677.

The second option involves executing and recording a statutory revocation document, formally cancelling the recorded deed upon death. Owners may record a revocation form prior to selling the property to another or including it in a different deed upon death. This method is useful because it clearly sets forth the owner's intentions. See 111.697. It also reduces the potential for confusion caused by executing multiple deeds upon death.

As with other estate planning documents, please carefully consider the benefits and drawbacks associated with revoking a recorded deed upon death. Each situation is different, so contact a local attorney with specific questions or for complex circumstances.

(Nevada Revocation of TOD Package includes form, guidelines, and completed example)

Important: Your property must be located in Lincoln County to use these forms. Documents should be recorded at the office below.

This Transfer on Death Revocation meets all recording requirements specific to Lincoln County.

Our Promise

The documents you receive here will meet, or exceed, the Lincoln County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Lincoln County Transfer on Death Revocation form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4578 Reviews )

Brett B.

July 12th, 2022

easy to use

Thank you!

Michael B.

November 17th, 2020

I'm very pleased with the service provided by Deeds.com. After a format issue caused my scanner, it was a very smooth and speedy process. Highly recommended.

Thank you for your feedback. We really appreciate it. Have a great day!

Rebecca F.

November 4th, 2021

Forms were great. I wasn't able to find them anywhere. Even the county recorder didn't have them

Thank you for your feedback. We really appreciate it. Have a great day!

Alfred M.

March 12th, 2023

It was a simple process and easily understood the process was seamless and I would highly recommend this to anyone looking to do this.

Thank you for your feedback. We really appreciate it. Have a great day!

Patrick R.

August 25th, 2023

I was satisfied and would refer this website to others.

Thank you for your feedback. We really appreciate it. Have a great day!

Barbara M.

November 21st, 2020

We love this service - so easy to use and quick. It is the second time we have used Deeds.com, in two different states. Wonderful service!

Thank you for your feedback. We really appreciate it. Have a great day!

curtice c.

September 30th, 2022

I bought the Transfer on Death Deed documents. Great product and the accompanying example and guides were great.

Thank you for your feedback. We really appreciate it. Have a great day!

mark L.

April 18th, 2020

i really liked that the information i received from Deed .com concerning deed and title transfer for representative made it so i was able to find the correct forms that i needed. It was a bonus that Deed.com had the forms and instructions that i required

Thank you for your feedback. We really appreciate it. Have a great day!

James R.

July 31st, 2019

Super website. Easy to use and stuff is well organized.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Larry A.

December 17th, 2021

Provided exactly the form I was looking for at a reasonable price. Easy to do as well.

Thank you!

Deloris L.

August 25th, 2020

I downloaded documents easy. But haven't started work on them yet. Seems to be ok.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Rosemary S.

July 25th, 2020

It was quick and so very easy. Very detailed information. Love the app.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Diana T.

July 15th, 2022

Very helpful Got information and form I wanted.

Thank you for your feedback. We really appreciate it. Have a great day!

Jay R.

December 1st, 2020

First time user. Great service, a little costly though

Thank you!

Louise D.

October 21st, 2022

It was easy to complete the form and I appreciated the sample form.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!