Union County Trustee Deed Form

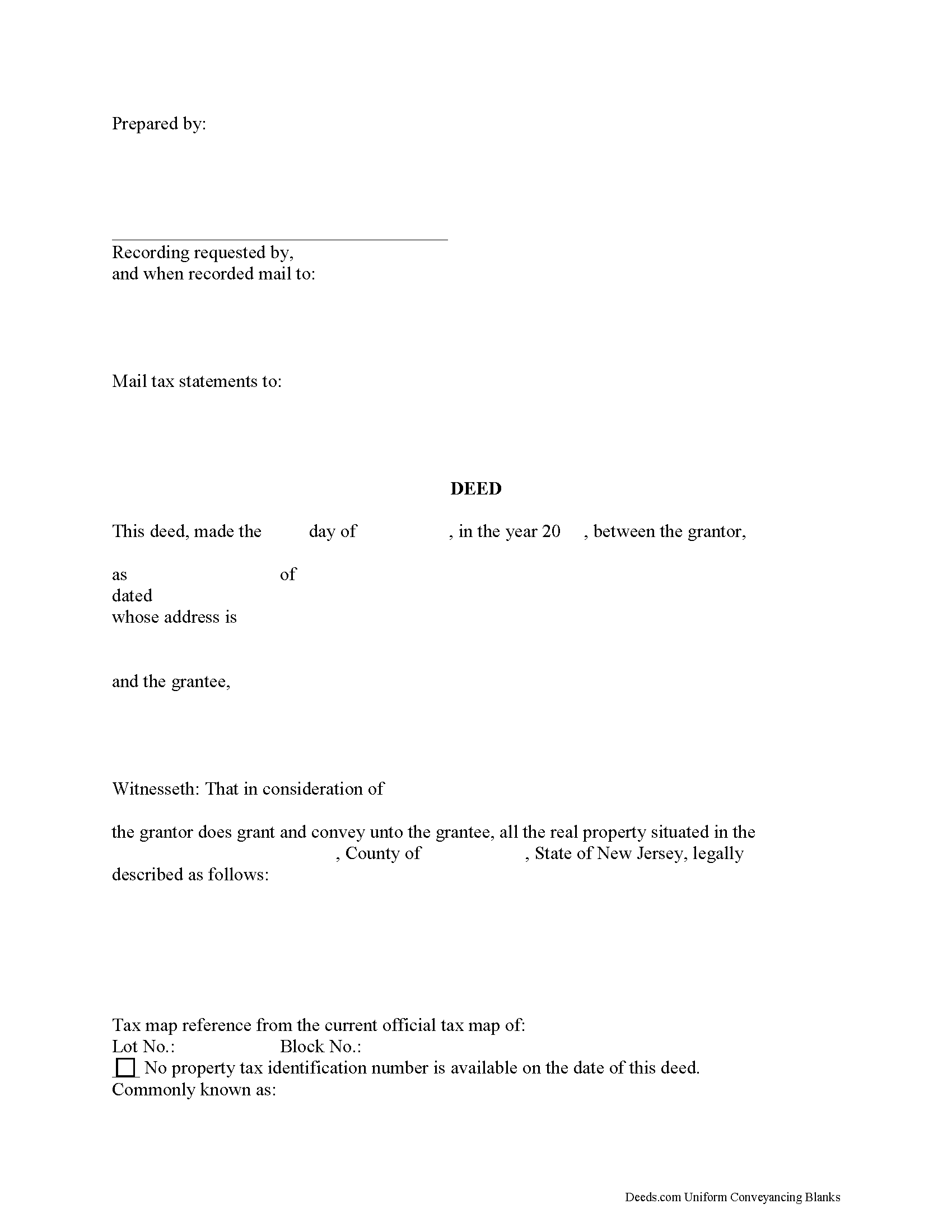

Union County Trustee Deed Form

Fill in the blank form formatted to comply with all recording and content requirements.

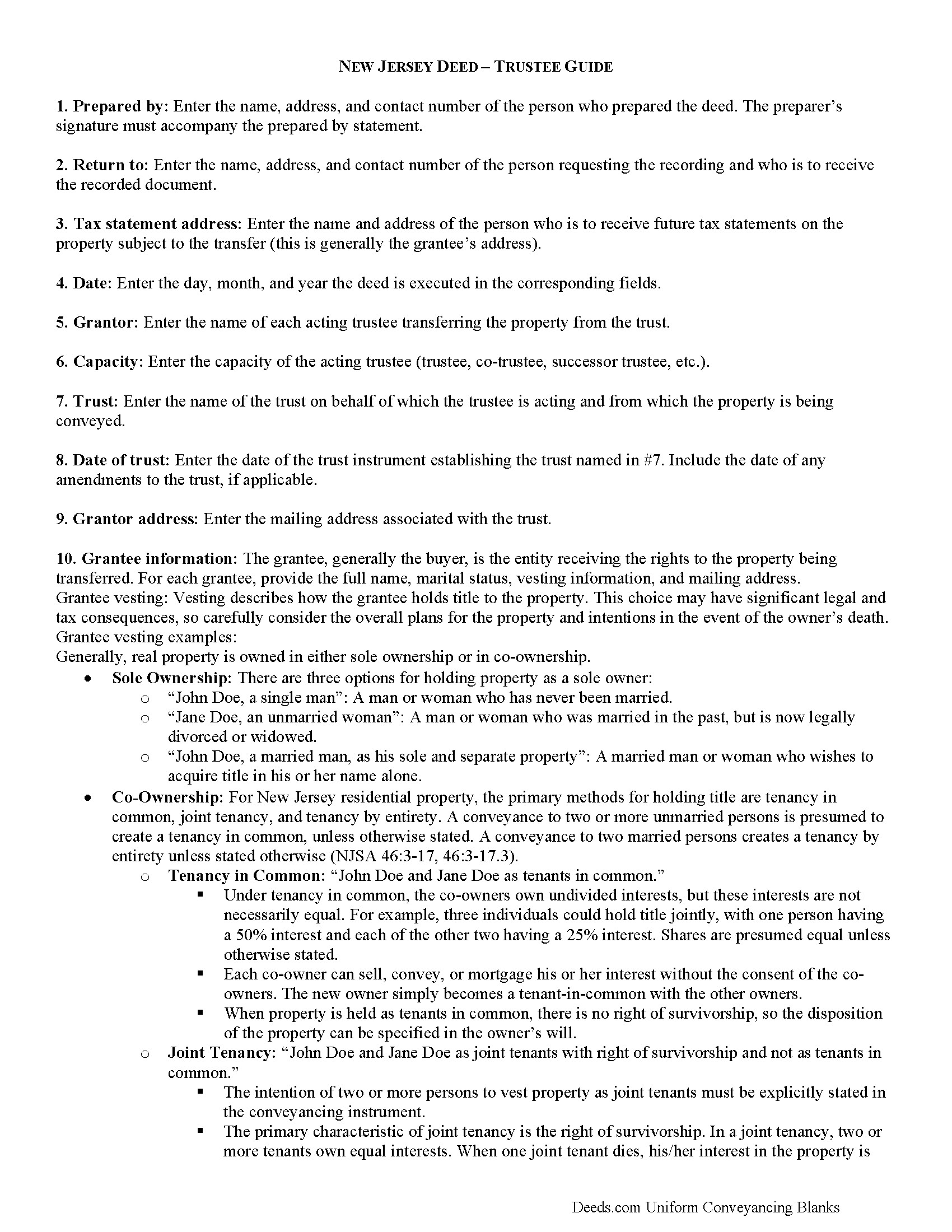

Union County Trustee Deed Guide

Line by line guide explaining every blank on the form.

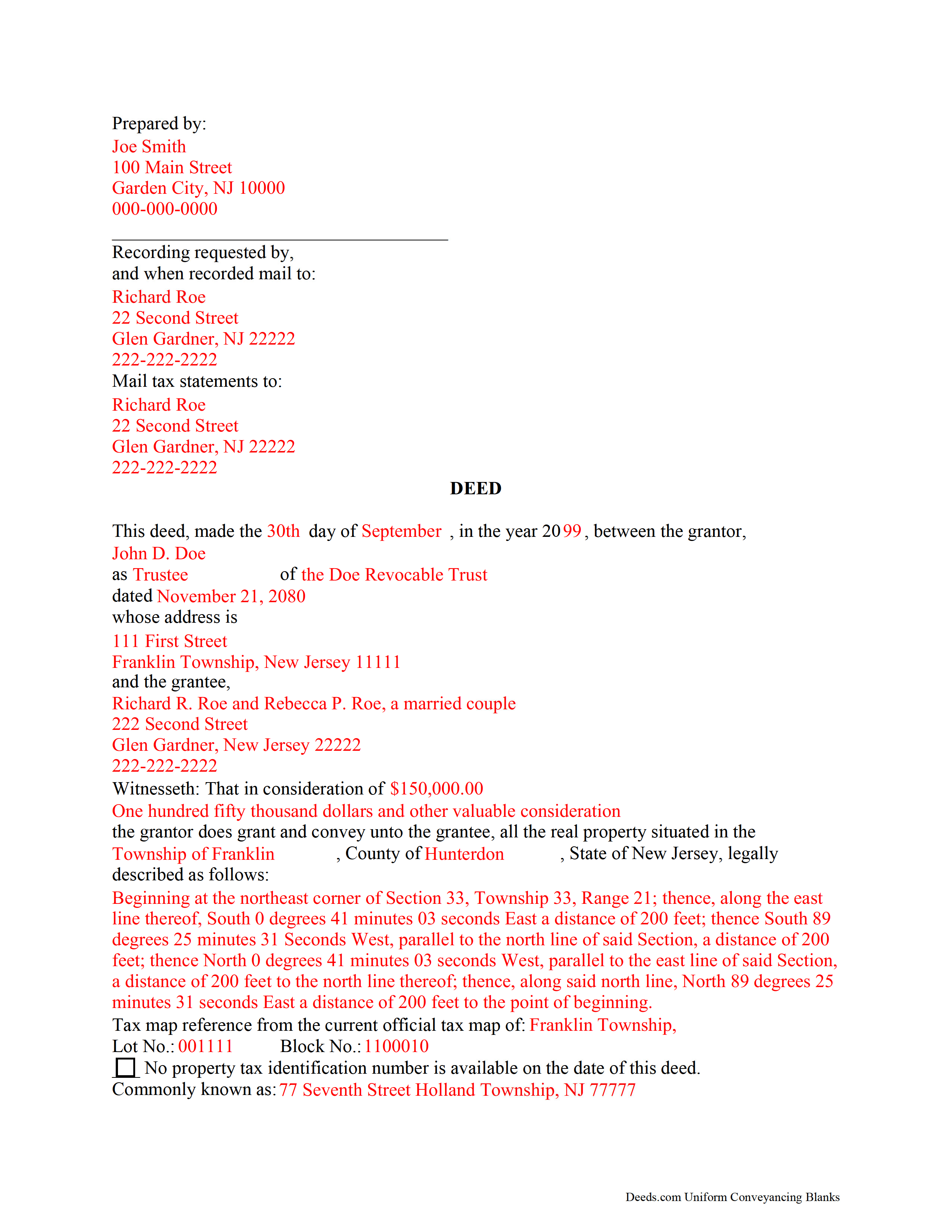

Union County Completed Example of the Trustee Deed Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional New Jersey and Union County documents included at no extra charge:

Where to Record Your Documents

Union County Clerk

Elizabeth, New Jersey 07207

Hours: 8:30 to 4:30 M-F

Phone: (908) 527-4787

Union County Annex

Westfield, New Jersey 07090

Hours: Mon, Wed, Fri 8:00 to 4:00; Tue & Thu until 7:30; Sat 9:00 to 1:00

Phone: (908) 654-9859

Recording Tips for Union County:

- Ask if they accept credit cards - many offices are cash/check only

- Check margin requirements - usually 1-2 inches at top

- Request a receipt showing your recording numbers

- Multi-page documents may require additional fees per page

Cities and Jurisdictions in Union County

Properties in any of these areas use Union County forms:

- Berkeley Heights

- Clark

- Cranford

- Elizabeth

- Elizabethport

- Fanwood

- Garwood

- Hillside

- Kenilworth

- Linden

- Mountainside

- New Providence

- Plainfield

- Rahway

- Roselle

- Roselle Park

- Scotch Plains

- Springfield

- Summit

- Union

- Vauxhall

- Westfield

Hours, fees, requirements, and more for Union County

How do I get my forms?

Forms are available for immediate download after payment. The Union County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Union County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Union County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Union County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Union County?

Recording fees in Union County vary. Contact the recorder's office at (908) 527-4787 for current fees.

Questions answered? Let's get started!

Transferring Living Trust Property in New Jersey

A trust is an arrangement whereby a settlor transfers his property to another person (trustee) for the benefit of another (beneficiary). Trusts containing real property are estate planning tools governed by the terms of the trust instrument, an unrecorded document executed by the settlor. In a living trust, the settlor generally serves as the trustee or co-trustee of the trust. Living trusts take effect during the settlor's lifetime, and also allow the settlor to determine how his assets will be administered in the event of his death. The settlor conveys real property to the trust by executing and recording a deed.

As of July 2016, New Jersey is among 31 states, together with the District of Columbia, to have enacted some version of the Uniform Trust Code, which "provides a comprehensive model for codifying the law on trusts" on a national scale [1]. The New Jersey Uniform Trust Code is codified at Title 3B, Chapter 31 of the New Jersey Statutes.

Under the Trust Code, trustees are authorized to exercise powers conferred by the terms of the trust, except where the terms of the trust limit powers and where there are express restrictions by statute (NJS 3B:31-69). Trusts may include the trustee's power to sell real property. When transferring real property from a living trust, the trustee -- who holds legal title to the property in trust -- executes a deed as the trust's representative.

In New Jersey, grantors may execute a deed with or without warranties or covenants of title. Statutory grantor's covenants for deeds in New Jersey include assurances that the grantor holds an absolute estate in fee simple at the time of the deed; that the grantor has authority to convey the land; that the grantee will possess and enjoy the land without interruption by the grantor; that the grantor has not done anything or executed any deed to encumber title to the land; and/or that the grantor will, at the grantee's reasonable request, take action to convey the land "more perfectly or absolutely" (46:4-2 et seq).

Trustees conveying real estate from a living trust in New Jersey generally execute a bargain and sale deed with covenant as to grantor's acts, but other covenants might be appropriate, depending on the circumstances. Contact a lawyer with questions about this important decision. Conveying property with a warranty deed, for example, opens the trustee to a high degree of liability, even if he has no knowledge of the quality of title prior to his appointment.

Conveyances of real property executed by a trustee must meet the same requirements for form and content for deeds in the State of New Jersey, including a legal description of the subject property and tax map reference. The deed should name the each granting trustee, as well as the name, date, and address of the trust on behalf of which the trustee(s) is/are acting. Each trustee should sign the deed in the presence of a notary public before recording the deed, along with any appropriate affidavits and a seller's residency form, in the county in which the real property is situated.

Each case is unique, so please consult an attorney for more information about transferring real property from living trusts in New Jersey.

[1] http://www.uniformlaws.org/LegislativeFactSheet.aspx?title=Trust%20Code

(New Jersey TD Package includes form, guidelines, and completed example)

Important: Your property must be located in Union County to use these forms. Documents should be recorded at the office below.

This Trustee Deed meets all recording requirements specific to Union County.

Our Promise

The documents you receive here will meet, or exceed, the Union County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Union County Trustee Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4607 Reviews )

Robert B.

January 4th, 2021

Very easy to use.

Thank you for your feedback. We really appreciate it. Have a great day!

Marci C.

November 6th, 2024

Excellent Service! Quick and easy! Will definitely be using again!

Knowing our customers are happy is our top priority. Thank you for the wonderful feedback!

Bruce H.

May 10th, 2019

The forms were easy to download, no problem great site

Thank you for your feedback. We really appreciate it. Have a great day!

Jessica F.

February 8th, 2020

Found exactly what I was looking for in a matter of minutes at a very reasonable fee.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Arturo P.

August 16th, 2021

Super easy to use! Totally satisfied. Thanks.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Mario G.

November 3rd, 2021

Very courteous staff, and helpful didn't take any time for someone to assist me on my needs Thank you so much.

Thank you for your feedback. We really appreciate it. Have a great day!

Barbara P.

August 13th, 2024

So easy and fast!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Patrick P.

March 14th, 2020

Great service! I found out how easy it was for me to record a deed. I saved about $200 using deeds.com. The sample form really helped. Thanks!

Thank you!

Douglas N.

September 13th, 2021

Great!

Thank you!

Sharon C.

October 29th, 2022

Easy process considering not too technical savvy!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Robert H.

June 23rd, 2025

Great service, easy way to get accurate documents

Thanks, Robert! We're glad you found the service easy to use and the documents accurate—just what we aim for. Appreciate you taking the time to share your experience!

Eric D.

March 21st, 2019

Very helpful and informative. It has saved me time going to get the forms at county recorder / clerk (as my county and state websites dont offer forms on their sites) and also provided help understanding the uses of the specific deed I needed to use.

Thank you Eric. Have a great day!

James S.

August 26th, 2020

unbelievable Deeds Rocks Start to finish 2=Day Recommended by Coconino County Recorders office in Arizona there were incomplete sections. I would correct and resubmit . All done Yeah!!!!!!

Thank you for your feedback. We really appreciate it. Have a great day!

Sandra K.

April 29th, 2019

Seems fairly simple with forms and instructions

Thank you for your feedback. We really appreciate it. Have a great day!

John S.

April 22nd, 2021

The website is very user-friendly. Easily to download forms.

Thank you!