Colfax County Affidavit of Deceased Joint Tenant Form

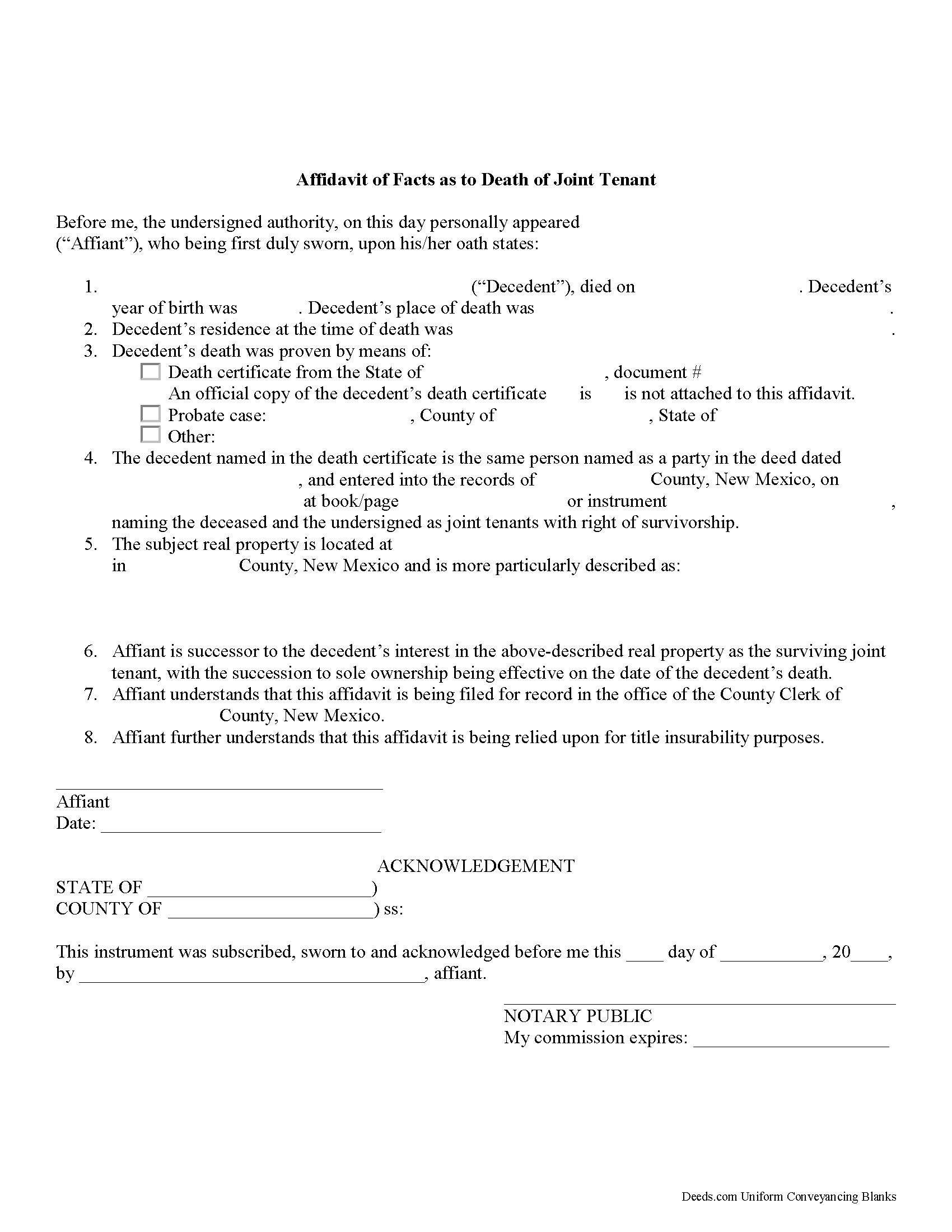

Colfax County Affidavit of Deceased Joint Tenant Form

Fill in the blank form formatted to comply with all recording and content requirements.

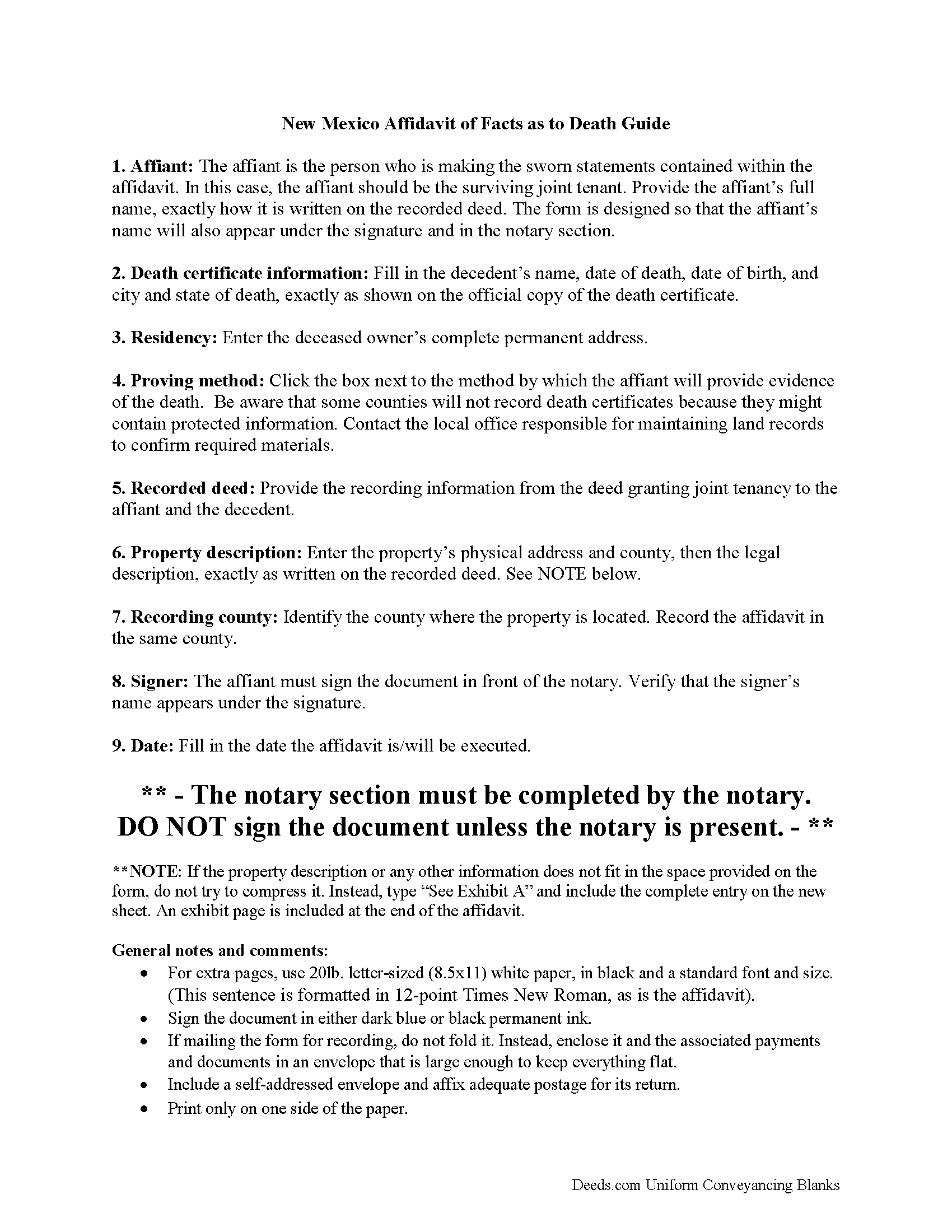

Colfax County Affidavit of Deceased Joint Tenant Guide

Line by line guide explaining every blank on the form.

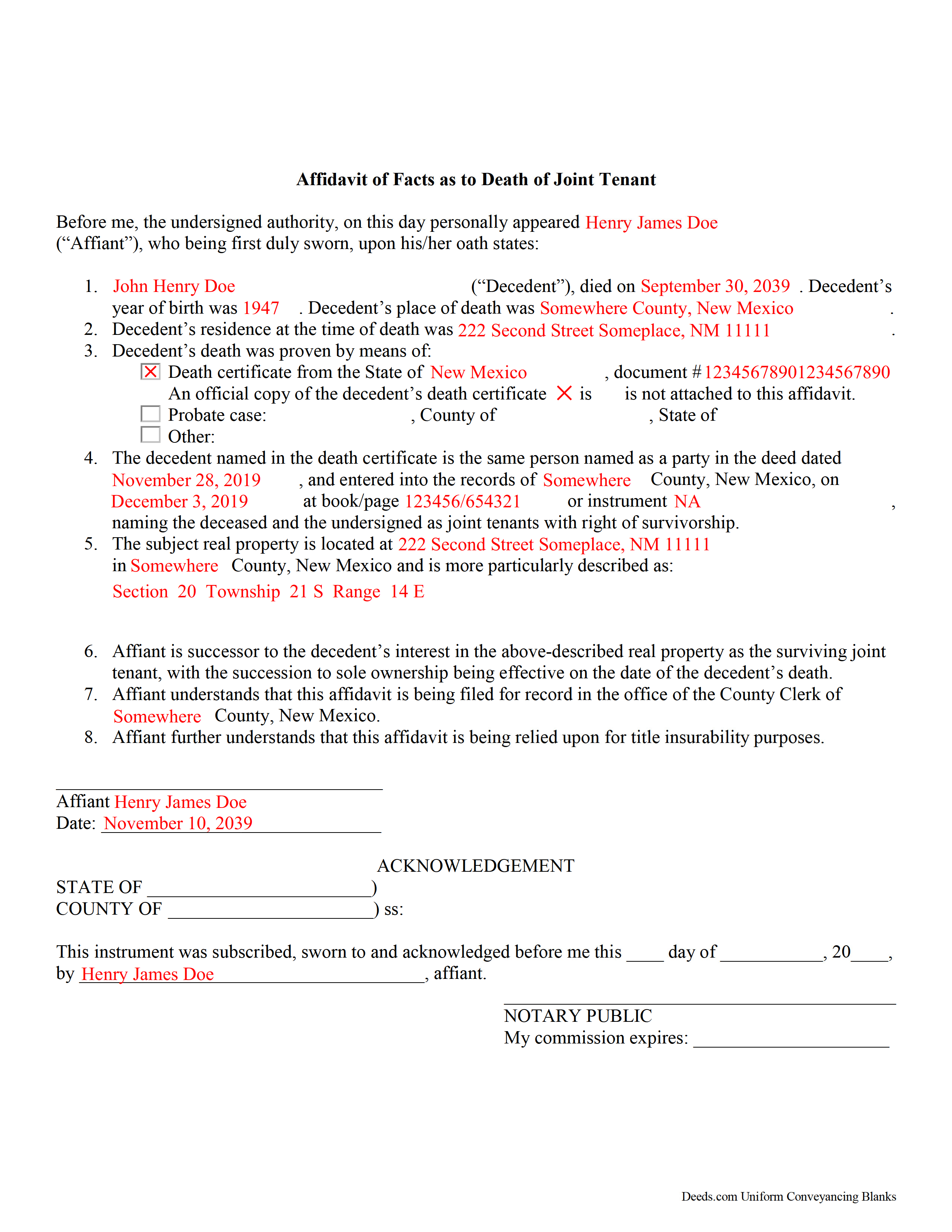

Colfax County Completed Example of the Affidavit of Deceased Joint Tenant Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional New Mexico and Colfax County documents included at no extra charge:

Where to Record Your Documents

Colfax County Clerk

Raton, New Mexico 87740

Hours: Monday-Thursday 7:00 am - 5:30pm Open during the lunch hour Closed on Fridays

Phone: (575) 445-5551

Recording Tips for Colfax County:

- Bring your driver's license or state-issued photo ID

- Verify all names are spelled correctly before recording

- Bring extra funds - fees can vary by document type and page count

- Recorded documents become public record - avoid including SSNs

- Make copies of your documents before recording - keep originals safe

Cities and Jurisdictions in Colfax County

Properties in any of these areas use Colfax County forms:

- Angel Fire

- Cimarron

- Eagle Nest

- Maxwell

- Miami

- Raton

- Springer

- Ute Park

Hours, fees, requirements, and more for Colfax County

How do I get my forms?

Forms are available for immediate download after payment. The Colfax County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Colfax County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Colfax County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Colfax County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Colfax County?

Recording fees in Colfax County vary. Contact the recorder's office at (575) 445-5551 for current fees.

Questions answered? Let's get started!

Removing a Deceased Joint Tenant from a New Mexico Real Estate Title

New Mexico's statutes define joint tenancy at 47-1-36. This law states that a "joint tenancy in real property is one owned by two or more persons, each owning the whole and an equal undivided share, by a title created by a single devise or conveyance, when expressly declared . . . to be a joint tenancy." Property titled in this manner cannot be passed in a will; instead, a deceased joint tenant's share is distributed equally amongst the survivors as a function of law until only one person holds the property in sole ownership.

While technically accurate, this description oversimplifies the situation. What happens when it's time to sell the property? Unless the local recording office cross-references death notices with real estate records, the deceased owner's name still appears on the title. This inaccuracy can create confusion during a title search and slow down the transfer process. In addition, outdated ownership information might interfere with property tax billing, which could lead to unnecessary fees and/or penalties.

The surviving owner(s) may prevent these potential issues with a simple step: when one joint tenant dies, the other(s) can execute and record an affidavit of facts as to death with the local recording office. It is possible to address this at the time of sale, but it makes sense to handle it within a short time after the owner's death because the necessary documentation is more likely to be easily accessible. This action keeps property records up-to-date, verifies the owner's interest and rights to the title, and ensures smoother transfers in the future.

Each circumstance is unique, so please contact an attorney with questions or for complex situations.

(New Mexico Affidavit of DJT Package includes form, guidelines, and completed example)

Important: Your property must be located in Colfax County to use these forms. Documents should be recorded at the office below.

This Affidavit of Deceased Joint Tenant meets all recording requirements specific to Colfax County.

Our Promise

The documents you receive here will meet, or exceed, the Colfax County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Colfax County Affidavit of Deceased Joint Tenant form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4582 Reviews )

Michael C.

January 16th, 2019

I would appreciate being able to increase the size of the blocks such as the Grantor block and the legal description block where information is enter on the form and to adjust the font. Otherwise great product,

Thank you for your feedback Michael. We do wish we could make that an option. Unfortunately, adhering to formatting requirements (specifically margin requirements) leaves a finite amount of space available on the page.

Denise L.

February 3rd, 2025

Using the Gift Deed form from Deeds.com, along with the example and instructions thy provided, saved me at least $200 in legal fees and saved me time as well!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Gladys B.

January 23rd, 2019

Good and fast service. Thank you.

Thank you for your feedback. We really appreciate it. Have a great day!

sonja E.

May 31st, 2019

It's very easy to find your way around on deeds.com, Excellent layout on this website and user friendly!

Thank you!

Adam W.

October 6th, 2021

Great stuff

Thank you!

Remi W.

April 13th, 2020

Submitting documents electronically through Deeds.com saved me time and provided the best possible service for me in the comfort of my own home. There's no faster, better way to record documents than e-recording with Deeds.com.

Thank you for your feedback. We really appreciate it. Have a great day!

Elizabeth W.

February 9th, 2023

would have been smart to give each pdf a name instead of unintelligible numbers...

Thank you for your feedback. We really appreciate it. Have a great day!

Kenny H.

January 14th, 2020

The forms are extremely helpful. They could use some updating. Promissory note "...in the form of cash, check or money order." is a bit outdated. My note is with my son and we have an automatic bank transfer set up for payments. He could Venmo me. There are many other options and likely to be more changes in the future, so I know this is difficult to maintain.

Thank you for your feedback. We really appreciate it. Have a great day!

James R.

July 31st, 2019

Super website. Easy to use and stuff is well organized.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Sharon B.

April 3rd, 2024

Downloaded pdf form was difficult to use,/modify and has too much space between sections.

Your feedback is valuable to us and helps us improve. Thank you for sharing your thoughts!

Daniel S.

July 6th, 2020

So far, so good. Waiting for the County Recorder to accept and record my document, but use of the Deeds.com system has been easy.

Thank you for your feedback. We really appreciate it. Have a great day!

Sally S.

May 3rd, 2022

it would be nice to have explanation of all the forms required. For a first time estate DPOA, I feel a bit insecure with the forms and would like a paragraph explaining specifics for each link and what to complete for the ladybird deed. Otherwise, I love the ease of purchase with immediate links available.

Thank you for your feedback. We really appreciate it. Have a great day!

Katherine D.

August 22nd, 2022

Once I found your site it was very easy to understand, order and copy the forms. It is very helpful that you included an example of a completed form. Thank you. This form helps hundreds of seniors avoid lawyers, probate and the fear of losing their homes.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Mark J.

January 28th, 2021

Straightforward, no issues.

Thank you!

kathy d.

March 20th, 2019

very easy make sense instructions. Thank you.

Thank you for your feedback Kathy. Have an amazing day!