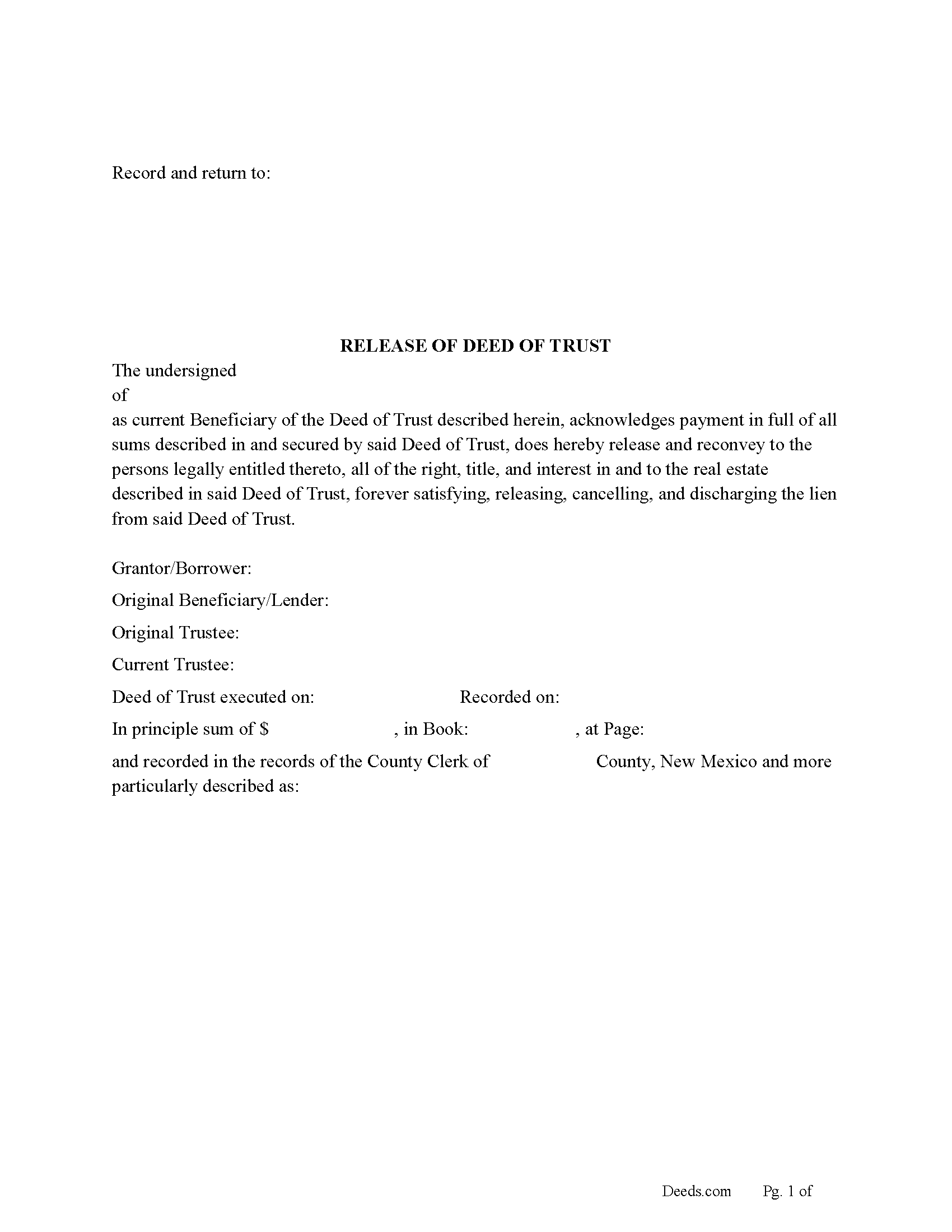

Download New Mexico Release of Deed of Trust Legal Forms

New Mexico Release of Deed of Trust Overview

In New Mexico, the Trustee or the Beneficiary/Lender can release a Deed of Trust. This form is used by the Beneficiary/Lender. NM Stat 48-7-4(C)(2018) If, at any time the obligation secured by the mortgage or deed of trust described in Subsection B of this section is fulfilled, and the balance is zero, the mortgagee or beneficiary shall cause the mortgage or deed of trust to be released of record upon written demand of the mortgagor, trustor or the successor or assignee thereof.

48-7-5. Failure to release; penalty; civil liability.]

Any person who shall be guilty of violating the preceding section [48-7-4 NMSA 1978], upon conviction before any justice of the peace [magistrate] or district court having jurisdiction of the same shall be punished by a fine of not less than ten [($10.00)] nor more than twenty-five dollars [($25.00)], and shall be liable in a civil action to the owner of such real estate for all costs of clearing the title to said property including a reasonable attorney's fee.

(New Mexico Release of DOT Package includes form, guidelines, and completed example) For use in New Mexico only.