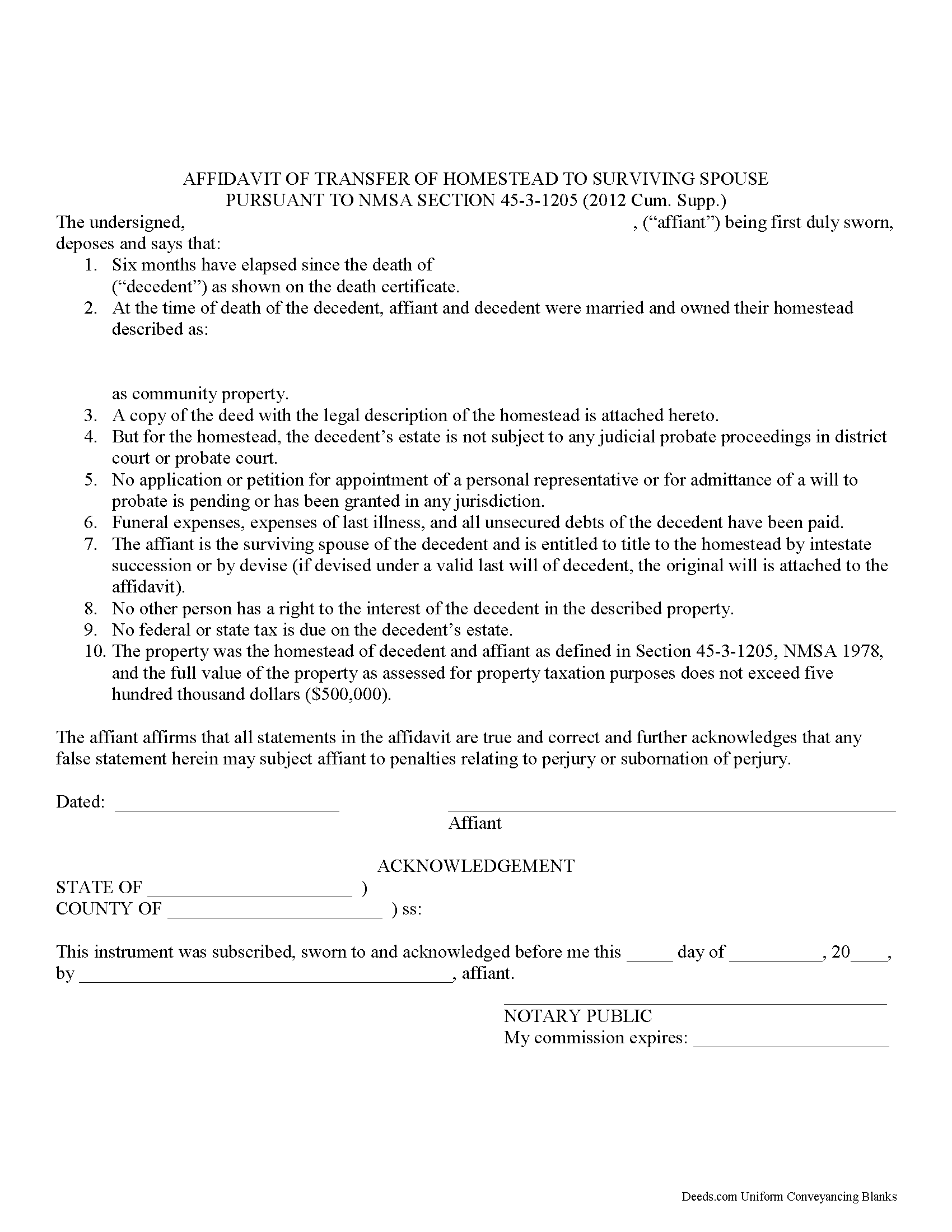

Union County Transfer of Homestead Affidavit Form

Union County Transfer of Homestead Affidavit Form

Fill in the blank form formatted to comply with all recording and content requirements.

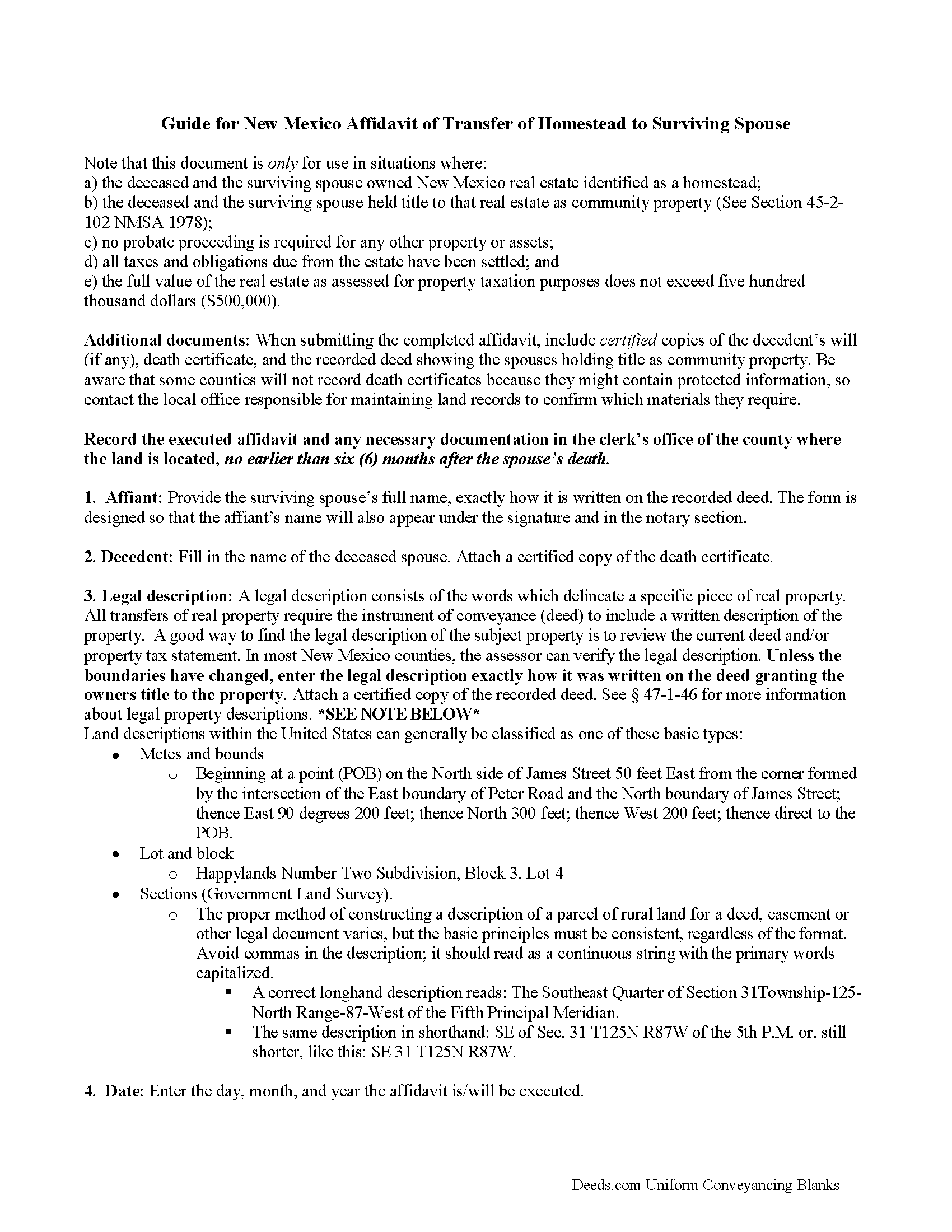

Union County Transfer of Homestead Affidavit Guide

Line by line guide explaining every blank on the form.

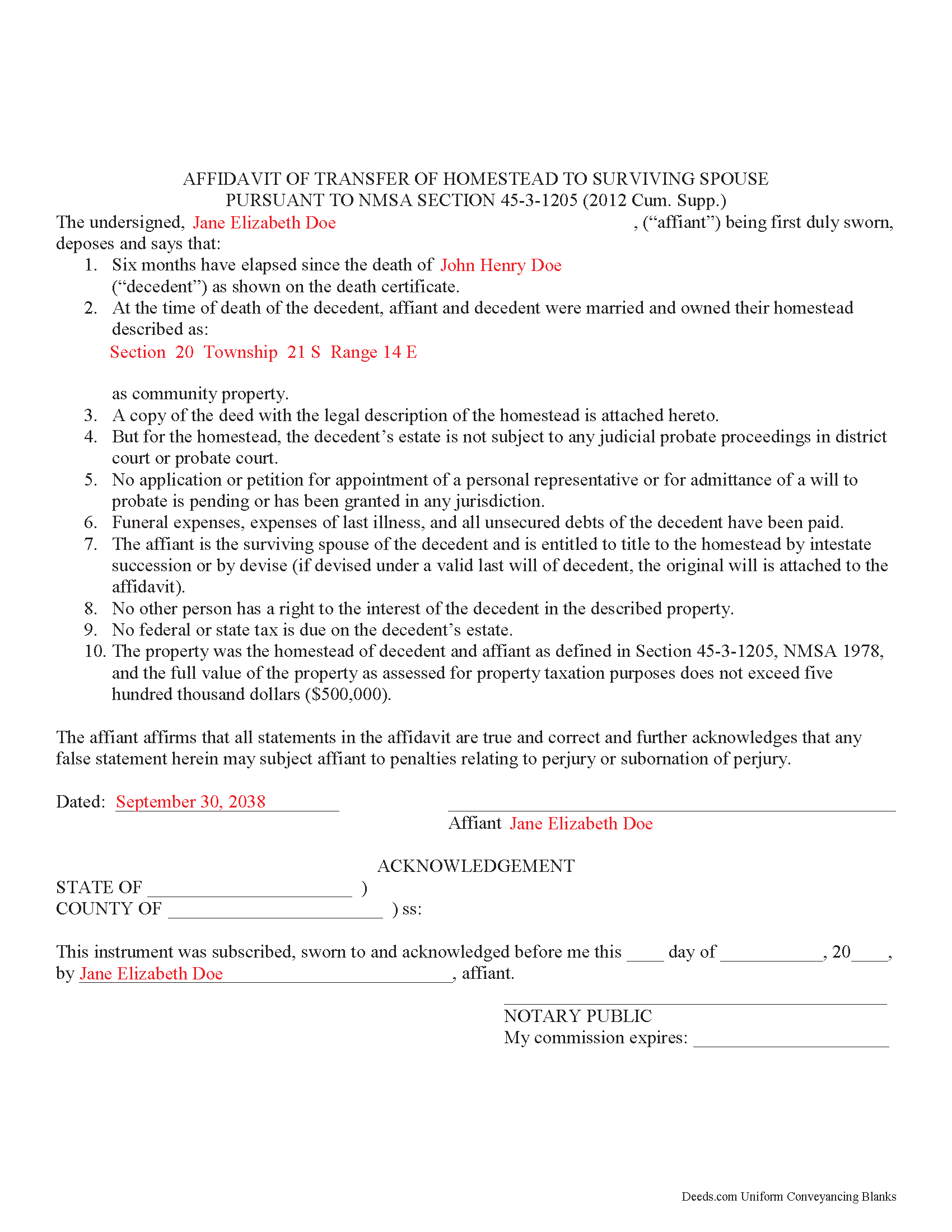

Union County Completed Example of the Transfer of Homestead Affidavit Docuement

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional New Mexico and Union County documents included at no extra charge:

Where to Record Your Documents

Union County Clerk

Clayton, New Mexico 88415

Hours: Call for hours

Phone: (575) 374-9491

Recording Tips for Union County:

- Ask if they accept credit cards - many offices are cash/check only

- Verify all names are spelled correctly before recording

- Check that your notary's commission hasn't expired

- Leave recording info boxes blank - the office fills these

Cities and Jurisdictions in Union County

Properties in any of these areas use Union County forms:

- Amistad

- Capulin

- Clayton

- Des Moines

- Folsom

- Gladstone

- Grenville

- Sedan

Hours, fees, requirements, and more for Union County

How do I get my forms?

Forms are available for immediate download after payment. The Union County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Union County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Union County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Union County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Union County?

Recording fees in Union County vary. Contact the recorder's office at (575) 374-9491 for current fees.

Questions answered? Let's get started!

Some married people purchase real estate in New Mexico for vacation or investment purposes and title it as the sole and separate property of one spouse. Others identify themselves as husband and wife, but do not specify how they wish to hold title. In many such situations, the death of one spouse initiates a case with the probate court to distribute the decedent's estate according to his/her will. This judicial proceeding might also include transferring ownership of real estate into the living spouse's name.

But what if the deceased spouse died intestate (without a will) or has arranged for all of his/her assets to pass to named beneficiaries using non-probate options such as joint ownership, transfer on death designations, or trusts? If the house qualifies as a <b>homestead</b> and is vested as <b>community property</b>, the remaining spouse might be able to gain full title rights more easily by using a transfer of homestead affidavit.

This affidavit is designed to transfer the entire shared interest to the surviving spouse without the need for probate. In general, the property must meet six conditions to qualify for a transfer of homestead affidavit under Section 45-3-1205:

1. The decedent and the surviving spouse owned New Mexico real estate identified as a homestead.

2. The decedent and the surviving spouse held title to that real estate as community property (See Section 45-2-102.

3. No probate proceeding is required for any other property or assets.

4. All taxes and obligations due from the estate have been settled.

5. The full value of the property as assessed for property taxation purposes does not exceed five hundred thousand dollars ($500,000).

6. At least six months have passed since the deceased spouse's death.

To complete the transfer, the surviving spouse must record the completed, notarized document at the clerk's office for the county where the property is located. In addition to the affidavit, attach certified copies of the deed granting ownership to the married couple (including a legal description of the homestead property), the decedent's will, if any, and the death certificate. Note that some counties in New Mexico refuse to record death certificates because they might contain protected information such as social security numbers, so contact the local recording office to verify their requirements.

Important terms:

A homestead, or family home, is the principal place of residence of the deceased or surviving spouse. It includes the house, associated buildings on the property, and enough land to support reasonable access and use. See Section 45-3-1205(C) NMSA 1978.

Community property as defined in Section 40-3-8 is a vesting option that is only available to married couples. Property acquired during marriage, by either or both spouses, is assumed to be community property unless specifically identified as separate property. Deeded property acquired by the couple, whether as tenants in common or as joint tenants or otherwise, is presumed to be held as community property.

This discussion is provided as general information. Please contact an attorney for assistance with specific questions or complex situations.

(New Mexico TOHA Package includes form, guidelines, and completed example)

Important: Your property must be located in Union County to use these forms. Documents should be recorded at the office below.

This Transfer of Homestead Affidavit meets all recording requirements specific to Union County.

Our Promise

The documents you receive here will meet, or exceed, the Union County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Union County Transfer of Homestead Affidavit form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4582 Reviews )

janelle s.

September 15th, 2020

Uncertain about use as I am new to online forms. Through use I am sure it will feel more comfortable. I like the storage of filled in info forms because I might be using I will be using them or the info in the future.

Thank you for your feedback. We really appreciate it. Have a great day!

Nathan M.

April 6th, 2020

It had the info, but when I would type into the document the items I needed in adobe all that would print out was the info I typed and none of the document information.

Thank you!

Moving Forward V.

October 13th, 2023

Great Service!

Thank you!

Elaine D.

January 15th, 2021

Easement deed contract was easy to complete, however after additional research raises some concerns because the Ohio deed does not list a requirement for witness signatures and does not provide lines or an area for witness signatures. The document does provide the necessary area for the notary information and the grantor and grantee.

Thank you for your feedback. We really appreciate it. Have a great day!

jon m.

November 7th, 2019

Great last minute forms saved me a critical time when I had no access to my own resources. Five Star Customer service.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Quanah N.

July 30th, 2022

Instruction easy to follow

Thank you!

Brooksye G.

January 15th, 2019

Very helpful. I live in Arkansas and needed information and documents for a Missouri transaction. I got everything I needed without any hassle.

Thank you Brooksye, we really appreciate your feedback.

David T.

September 6th, 2022

This is a great service and terrific value. The form package provided (blank form, example form & set of instructions) was clear and easy to follow. Being able to complete the forms using the computer to insert the needed information saved countless hours. My completed form was accepted by the Clerk & Recorder office without any issue. Well worth the investment

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

April L.

March 21st, 2020

It was easy and I will use it again.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Joel B.

August 10th, 2022

I would have liked more room in the text fields for describing the potential claim. had to use Exhibit A. Could not delete Exhibit B. Alo would like to have a custom footer - not deeds.com. Unprofessional.

Thank you for your feedback. We really appreciate it. Have a great day!

Alan S.

September 19th, 2019

Very easy. Worked well. Will be glad to use the service again.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Thomas G.

November 21st, 2024

Wasn’t what I expected

Sorry to hear that your expectations were missed. Your order has been canceled. We do hope that you find something more suitable to your expectations elsewhere. Do keep in mind that purchasing legal forms should not be an exploratory endeavor.

James S.

September 21st, 2021

The affidavit guidance was a great help and helped reduce the stress that usually comes with dealing with legalese. The Preliminary Change of Ownership that CA requires is quite complex since it covers a hoard of situations. I was left with a bit of uncertainty, but I definitely wouldn't want to try it without guidance.

Thank you for your feedback. We really appreciate it. Have a great day!

HAROLD V.

April 2nd, 2020

Great website to have your buyer's deeds done correctly! I highly recommend this website to anyone in the real estate business.

Thank you!

Rachelle S.

March 21st, 2021

Wow that was easy

Thank you!