Lea County Transfer on Death Deed Form

Lea County Transfer on Death Deed Form

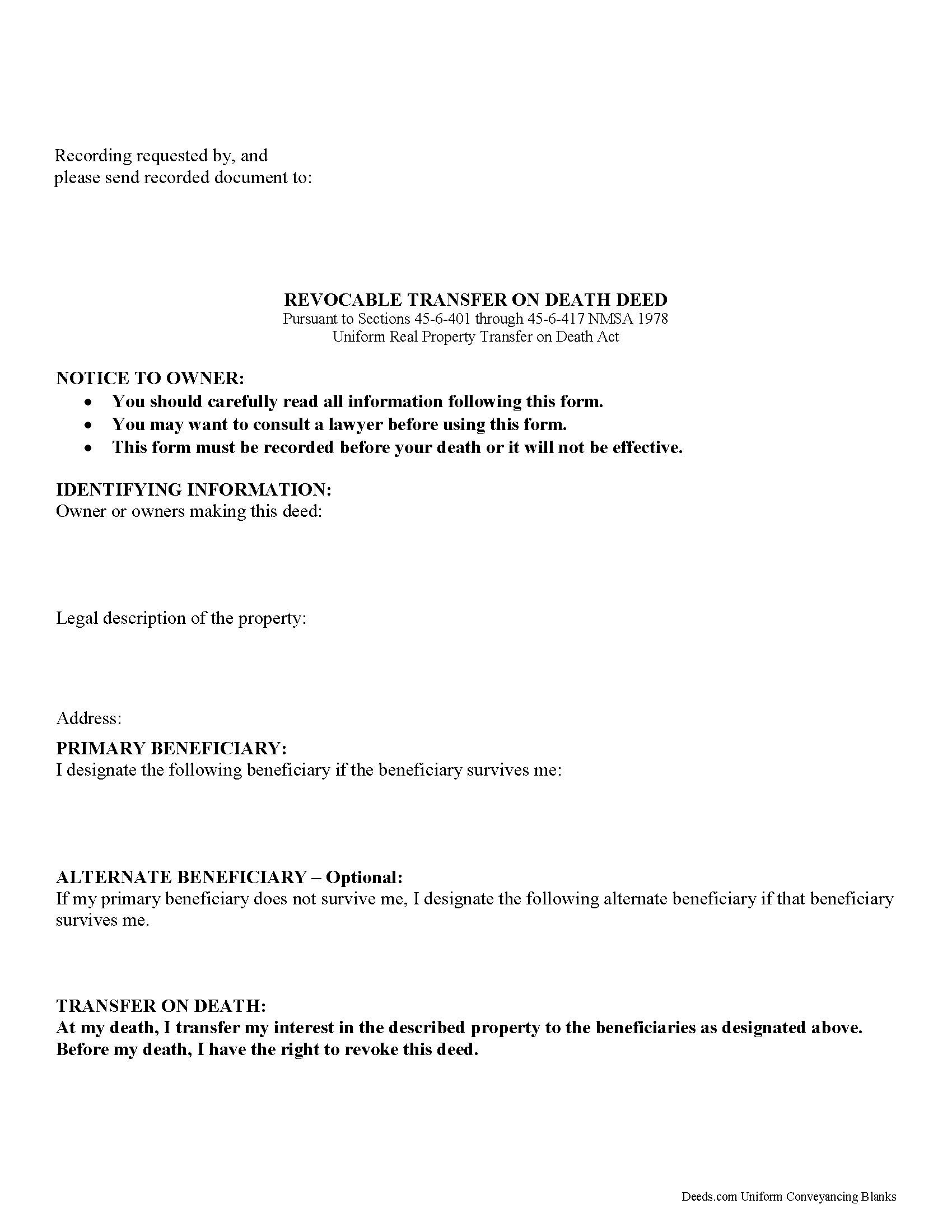

Fill in the blank form formatted to comply with all recording and content requirements.

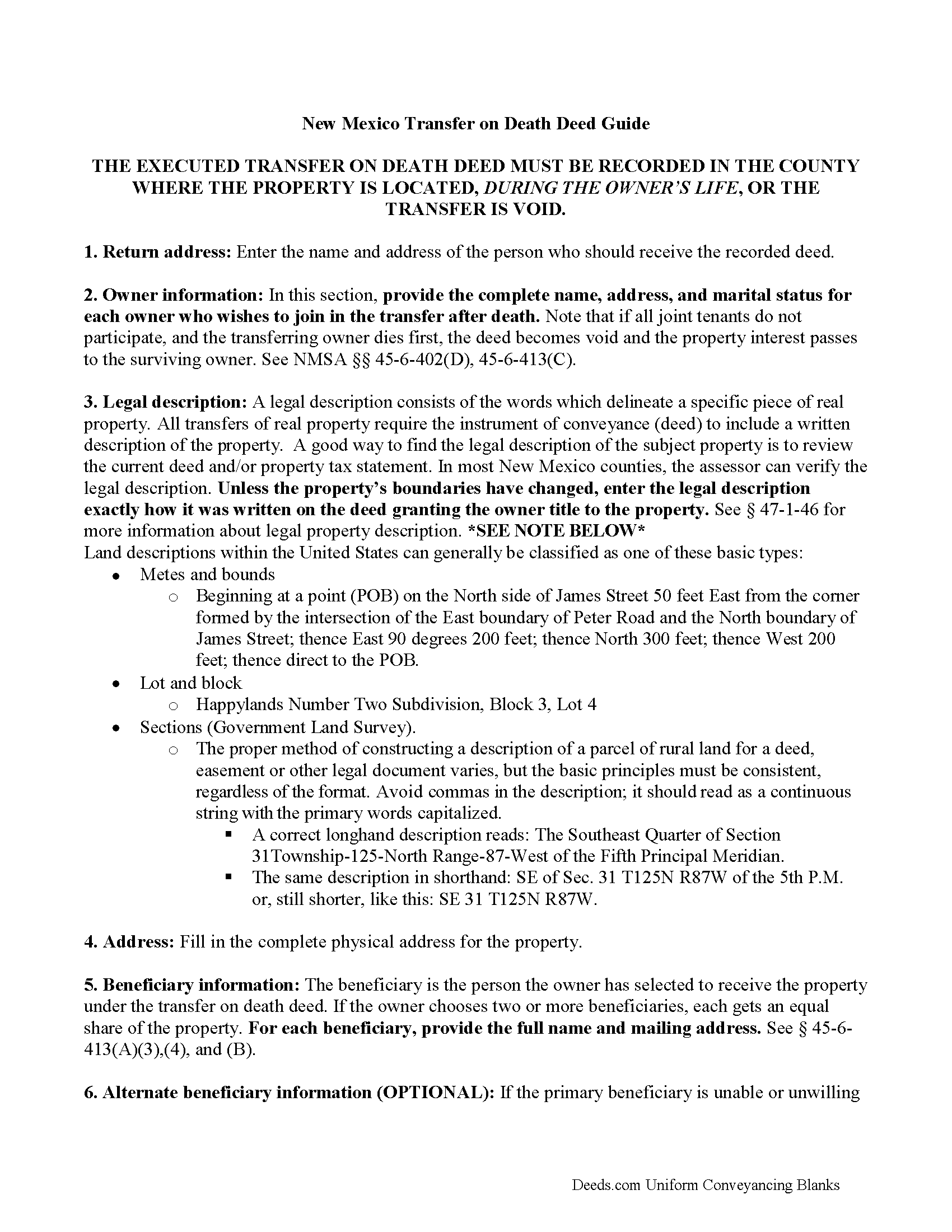

Lea County Transfer on Death Deed Guide

Line by line guide explaining every blank on the form.

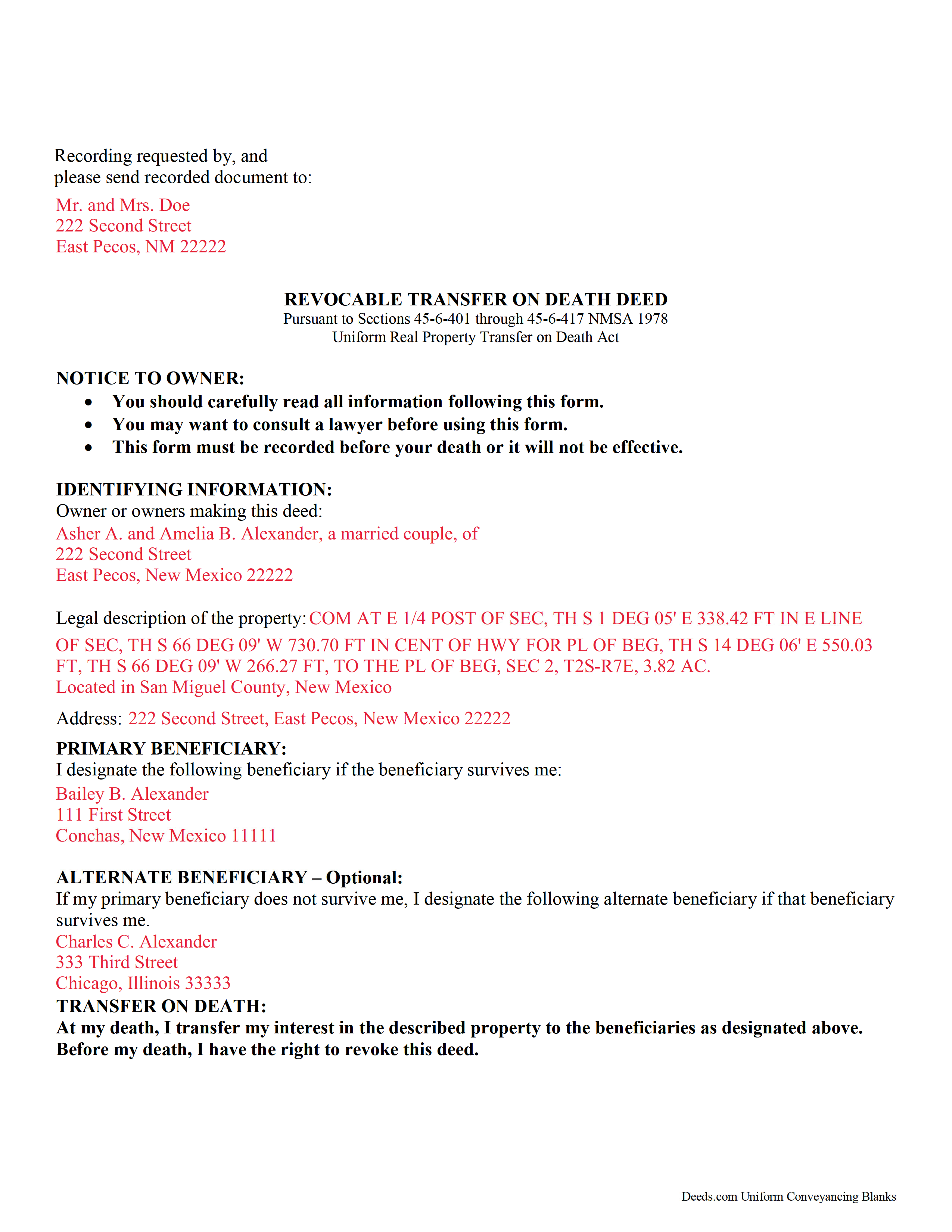

Lea County Completed Example of the Transfer on Death Deed Form

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional New Mexico and Lea County documents included at no extra charge:

Where to Record Your Documents

Lea County Clerk

Lovington, New Mexico 88260

Hours: 8:00 to 5:00 M-F

Phone: (575) 396-8619

Recording Tips for Lea County:

- Bring your driver's license or state-issued photo ID

- Ask if they accept credit cards - many offices are cash/check only

- White-out or correction fluid may cause rejection

- Avoid the last business day of the month when possible

Cities and Jurisdictions in Lea County

Properties in any of these areas use Lea County forms:

- Caprock

- Crossroads

- Eunice

- Hobbs

- Jal

- Lovington

- Maljamar

- Mcdonald

- Monument

- Tatum

Hours, fees, requirements, and more for Lea County

How do I get my forms?

Forms are available for immediate download after payment. The Lea County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Lea County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Lea County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Lea County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Lea County?

Recording fees in Lea County vary. Contact the recorder's office at (575) 396-8619 for current fees.

Questions answered? Let's get started!

On January 1, 2014, New Mexico joined with eleven other states to enact the Uniform Real Property Transfer on Death Act (URPTODA), found at Sections 45-6-401 through 45-6-417 NMSA 1978 (2014). This enhances and adds clarity to the previous transfer on death statute already in force in the state.

A transfer on death deed (TODD) under the new law is defined by the Uniform Law Commission as an instrument that provides owners of real estate in New Mexico with a simple process for the non-probate transfer of real estate. The act allows an owner of real property to designate a beneficiary who will automatically receive the property upon the owner's death, without the need to include it in the decedent's probate estate. Instead, the property passes by means of a recorded TODD. During the owner's lifetime, the beneficiary of a TOD deed has no interest in the property and the owner retains full power to transfer or encumber the property, or even to revoke the deed outright.

New Mexico's version of the URPTODA sets out the rules and provides forms for both the deed and its revocation. To be valid, the TODD must meet three requirements ( 45-6-409):

1) it must contain the essential elements and formalities of a properly recordable inter vivos deed;

2) it must state that the transfer to the designated beneficiary is to occur at the transferor's death; and

3) it must be recorded before the transferor's death in the public records with the clerk of the county where the property is located.

TODDs represent a potential future interest, conveying whatever rights, if any, the owner retains in the property at the time of death. So, unlike inter vivos deeds ("traditional" documents such as warranty or quitclaim deeds), a TODD does not require notice, delivery, acceptance, or consideration ( 45-6-410).

The transferor (owner) under a TODD must meet the same standards for capacity as someone who executes a will, but the deed is not affected by the terms of the deceased owner's will. For example, Mary executes and records a TODD leaving her house and land to Bob, and then leaves the same property to Joe in her will. In most cases, Bob gets the land and Joe gets nothing.

If Mary actually wanted to leave the land to Joe, she could execute and record a revocation of the transfer to Bob, then record a new TODD in Joe's name. Alternately, she could sell the land to someone else entirely, and include a statement in the deed, revoking all or part of any previously recorded TODDs. See Section 45-6-411 for more information.

TODDs also offer some flexibility to beneficiaries. If the recipient is unable or unwilling to accept the transfer, Section 45-6-414 authorizes a beneficiary to disclaim all or part of his/her interest as provided by the Uniform Disclaimer of Property Interests Act [Chapter 45, Article 2, Part 11 NMSA 1978].

Overall, New Mexico's statutory transfer on death deed is a flexible estate planning tool that allows owners of real property in the state to convey a potential future interest in real property to one or more beneficiaries. The transfer may be changed or revoked at any time during the owner's life, simply by recording the appropriate documents. Each situation is unique, so carefully review all the benefits and drawbacks of this and any other real estate decisions. Seek legal counsel for help with specific questions or complex situations.

(New Mexico TODD Package includes form, guidelines, and completed example)

Important: Your property must be located in Lea County to use these forms. Documents should be recorded at the office below.

This Transfer on Death Deed meets all recording requirements specific to Lea County.

Our Promise

The documents you receive here will meet, or exceed, the Lea County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Lea County Transfer on Death Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4578 Reviews )

Catherine C.

February 26th, 2021

This was great. Happy I found you!

Thank you!

DeBe W.

January 27th, 2024

Thanks for the quick response. That really helps when you're under a time deadline.

Your feedback is greatly appreciated. Thank you for taking the time to share your experience!

Jordan L.

February 16th, 2023

Quick and easy. Lets do it again!

Thank you!

Tracey T.

July 19th, 2019

Lots of great information. Might need to view it again but found it very helpful!

Thank you!

Beverly D.

June 4th, 2022

Deeds.com was a great experience in helping me get some important documents recorded.I would recommend them to anyone wanting documents recorded in a timely manner.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Karen P.

May 6th, 2020

Quick and easy.

Thank you!

M T.

November 4th, 2019

Really nice deed form and guide the whole process was super easy.

Thank you!

Marcia G.

June 24th, 2020

I am so happy with this service. I can not tell you. In about 30 minutes my records were recorded. Excellent!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Debbie M.

August 21st, 2019

Everything that I needed was included. I appreciate that there was a sample as well as the step-by-step directions included in the download. I would definitely recommend this site to anyone that needs it.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Kimberly M.

February 14th, 2019

Great service. Very helpful and quick. Love Deeds.com and will be using their services again.

Thank you for your feedback Kimberly, we really appreciate it!

Ernest K.

July 27th, 2020

Im an out of state realtor, but couldnt believe how quick and easy the process was. Recieved my deed within 15 min of submission. I will be referring clients to this service.

Thank you!

Traci R.

November 21st, 2019

I was disappointed in the form received. The language was not clear and for the price, one would think we would receive a Word version rather than a PDF.

Sorry to hear of your struggle Traci. We have canceled your order and payment. We do hope that you find something more suitable to your needs elsewhere. Have a wonderful day.

Carolyn M.

March 31st, 2022

Very helpful and informative. The online site walked you through step by step and if you had a question, which I did, I called with my question. Thanks again.

Thank you!

Johnny A.

December 15th, 2018

My complete name is Johnny Alicea Rodriguez And the DEED is on my half brother and mine name. Jimmy Dominguez and myself Thanks

Michael A.

July 5th, 2021

Pleasant experiences. Look forward to future contacts

Thank you!