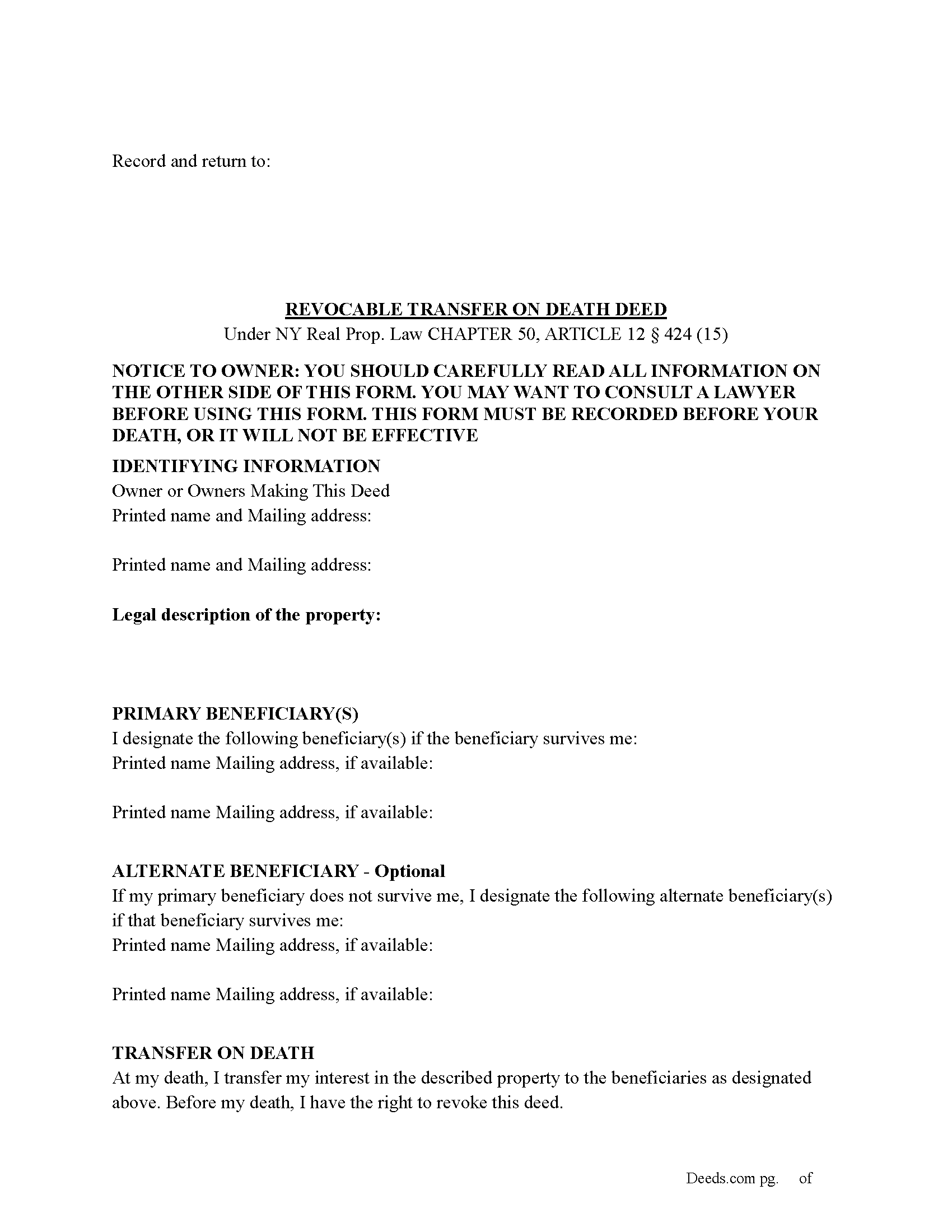

Ulster County Transfer on Death Deed Form

Ulster County Transfer on Death Deed Form

Fill in the blank Transfer on Death Deed form formatted to comply with all New York recording and content requirements.

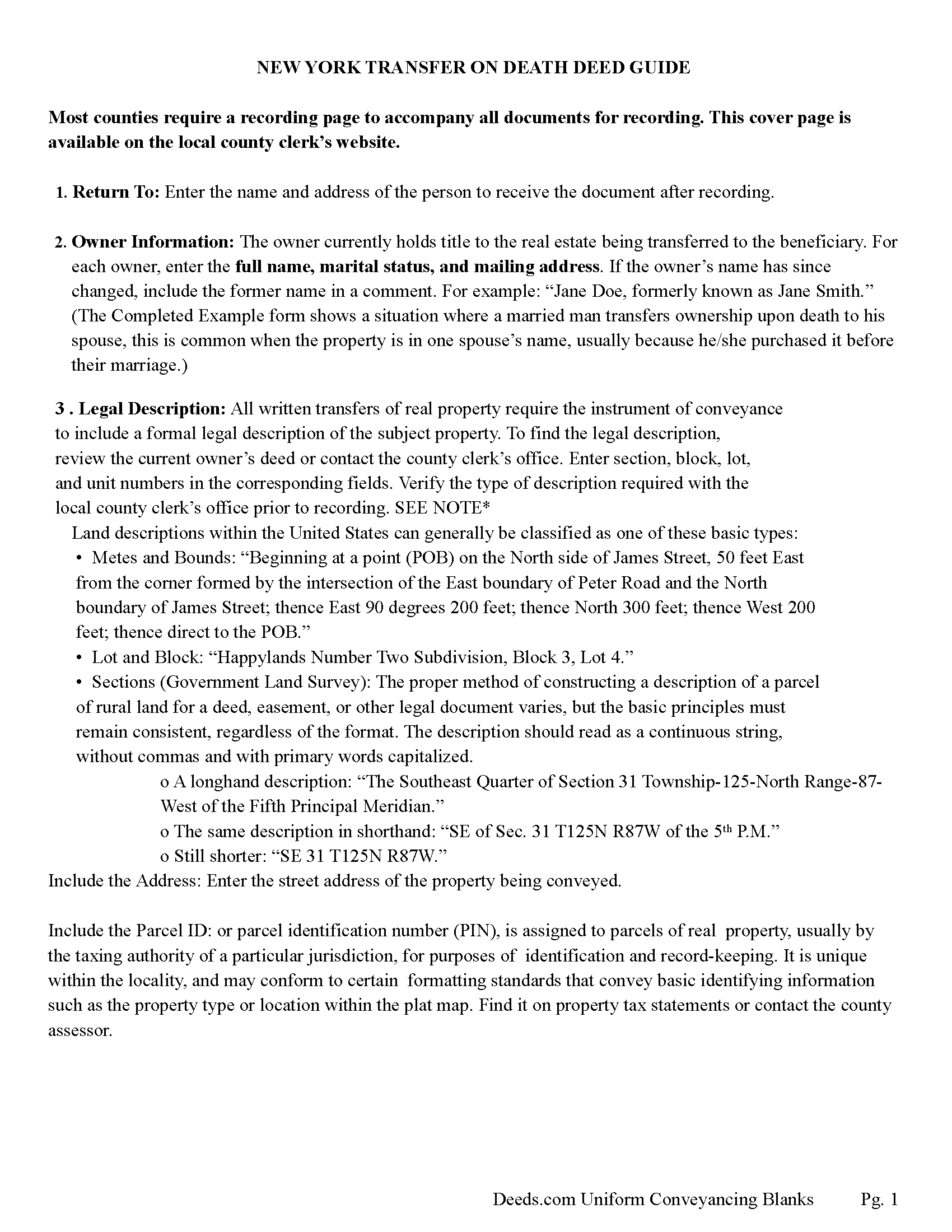

Ulster County Transfer on Death Deed Guide

Line by line guide explaining every blank on the Transfer on Death Deed form.

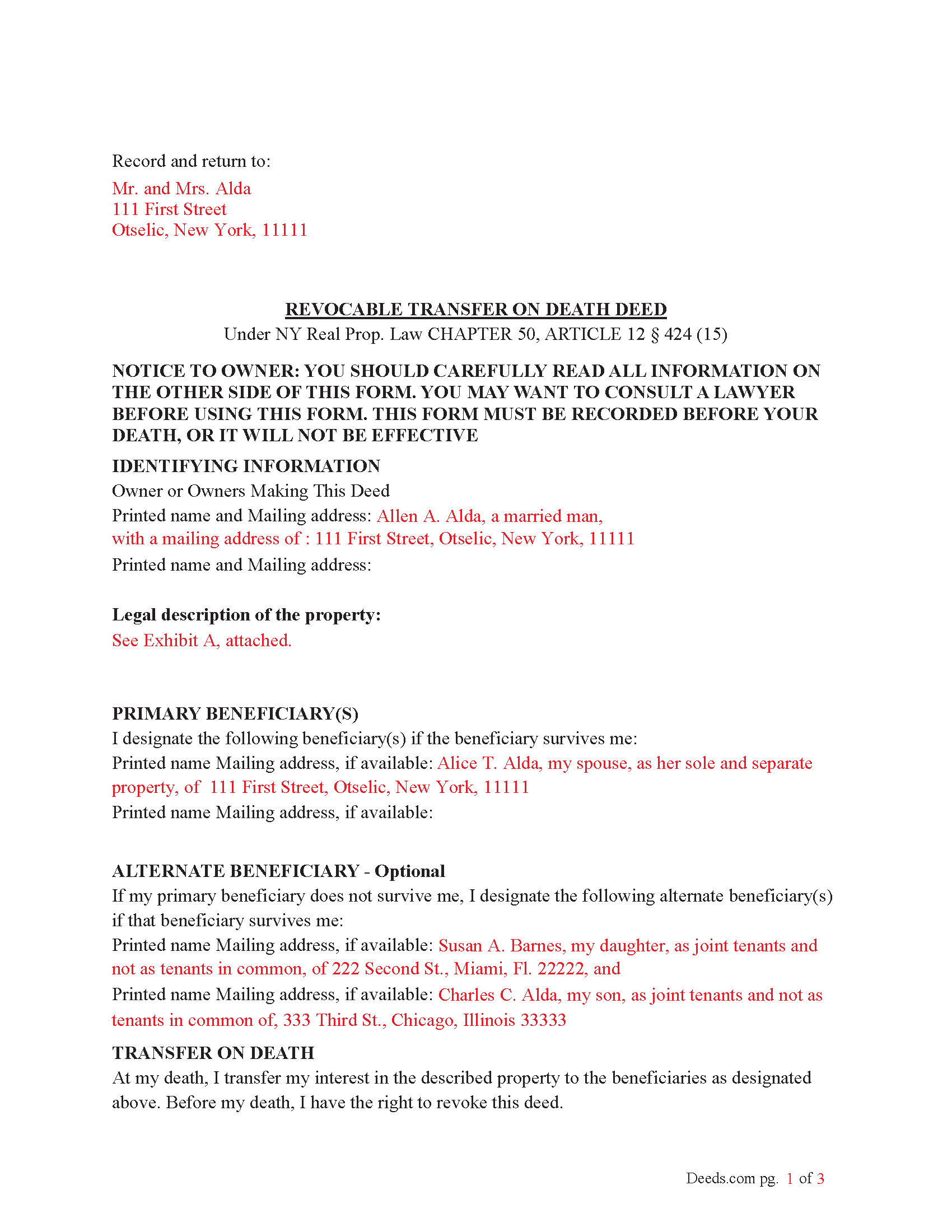

Ulster County Completed Example of the Transfer on Death Deed Document

Example of a properly completed New York Transfer on Death Deed document for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional New York and Ulster County documents included at no extra charge:

Where to Record Your Documents

Ulster County Clerk - County Office Building

Kingston, New York 12401

Hours: 9:00am to 4:45 pm M-F

Phone: (845) 340-3288

Recording Tips for Ulster County:

- Bring your driver's license or state-issued photo ID

- Documents must be on 8.5 x 11 inch white paper

- Bring extra funds - fees can vary by document type and page count

- Both spouses typically need to sign if property is jointly owned

Cities and Jurisdictions in Ulster County

Properties in any of these areas use Ulster County forms:

- Accord

- Bearsville

- Big Indian

- Bloomington

- Boiceville

- Chichester

- Clintondale

- Connelly

- Cottekill

- Cragsmoor

- Ellenville

- Esopus

- Gardiner

- Glasco

- Glenford

- Greenfield Park

- High Falls

- Highland

- Highmount

- Hurley

- Kerhonkson

- Kingston

- Lake Hill

- Lake Katrine

- Malden On Hudson

- Marlboro

- Milton

- Modena

- Mount Marion

- Mount Tremper

- Napanoch

- New Paltz

- Olivebridge

- Phoenicia

- Pine Hill

- Plattekill

- Port Ewen

- Rifton

- Rosendale

- Ruby

- Saugerties

- Shandaken

- Shokan

- Spring Glen

- Stone Ridge

- Tillson

- Ulster Park

- Walker Valley

- Wallkill

- Wawarsing

- West Camp

- West Hurley

- West Park

- West Shokan

- Willow

- Woodstock

Hours, fees, requirements, and more for Ulster County

How do I get my forms?

Forms are available for immediate download after payment. The Ulster County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Ulster County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Ulster County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Ulster County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Ulster County?

Recording fees in Ulster County vary. Contact the recorder's office at (845) 340-3288 for current fees.

Questions answered? Let's get started!

To use the Transfer on Death (TOD) Deed under New York’s Real Property Law (RPP) CHAPTER 50, ARTICLE 12 § 424 (effective July 19, 2024), follow these steps:

1. Complete the TOD Deed

Designate a beneficiary: Clearly name the individual or entity (such as a charity or trust) who will inherit your property upon your death.

Include contingent beneficiaries if desired (NOT required). These are backup beneficiaries who would inherit the property if your primary beneficiary cannot (e.g., if they predecease you). Ensure the deed is filled out correctly, including the legal description of the property.

2. Execute the TOD Deed: The TOD deed must be signed by the property owner (the transferor) in the presence of two witnesses and a Notary Public. The witnesses should not be the beneficiaries themselves, as this could raise legal issues.

3. Record the TOD Deed: The completed deed must be recorded with the County Clerk's office where the property is located during your lifetime. Recording the deed is crucial because, without it, the transfer will not be valid upon your death.

4. Retain Ownership During Lifetime: After recording the TOD deed, you retain full control of the property during your lifetime. You can still sell, mortgage, or revoke the TOD deed at any time.

If you change your mind, you can revoke the TOD deed by filing a revocation form or executing a new TOD deed, which automatically invalidates the previous one.

5. Upon Your Death: Upon your death, the property automatically transfers to the designated beneficiary without going through probate.

Key points about when it takes effect:

Timing of Transfer: The deed only takes effect upon the death of the property owner. Until then, the owner retains full control over the property and can revoke or change the TOD deed at any time.

Recording Requirement: For the TOD deed to be valid, it must be recorded with the county clerk during the property owner's lifetime. If the deed is not recorded before death, it will not be effective.

Probate Avoidance: By using a TOD deed, the property passes directly to the named beneficiary without going through probate, simplifying the transfer process and reducing legal costs.

Important: Your property must be located in Ulster County to use these forms. Documents should be recorded at the office below.

This Transfer on Death Deed meets all recording requirements specific to Ulster County.

Our Promise

The documents you receive here will meet, or exceed, the Ulster County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Ulster County Transfer on Death Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4587 Reviews )

Frank S.

December 21st, 2022

Pretty easy to register. Menu layout is too follow.

Thank you!

Betty S.

May 2nd, 2022

Thank you for the excellent and complete layout of all forms needed to complete the Affidavit of Death and Heirship, including the notarial officer and an example of how these forms should be completed. This method definitely saves time and money and an answer to my family's Prayers.

Thank you for your feedback. We really appreciate it. Have a great day!

Wesley R T.

December 9th, 2020

Great service and easy use

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Joan H.

March 30th, 2021

Your service was fine but as a newly widowed senior, I wish your price was lower.

Thank you for your feedback. We really appreciate it. Have a great day!

Theresa J.

March 27th, 2023

The beginning of the process was very simple. In the middle now waiting for the invoice to move forward.

Thank you for your feedback. We really appreciate it. Have a great day!

Rocio S.

March 4th, 2019

Great Help - very satisfied with the service - would recomend 100%

Thank you for the kind words Rocio. Have a wonderful day!

Anne W.

April 8th, 2021

3 stars for ease of use on the website. Subracted 2 stars for the forms being PDFs that you are unable to complete online, they have to be printed. Very inefficient.

Thank you for your feedback. We really appreciate it. Have a great day!

Kathie C.

August 13th, 2024

This was the first time I have used Deeds.com and I must say that I am extremely impressed. The person that handled my packages was amazing and extremely helpful. I am recommending that our firm starts using Deeds.com and we do a lot of e-recordings. Thank you so much for making this a great experience and for all of your efforts in making it so great!!!

Your feedback is greatly appreciated. Thank you for taking the time to share your experience!

ronnie y.

May 22nd, 2019

well worth the money thank you

Thank you!

Diane D.

July 2nd, 2020

Document site was very easy to access and pull up what I needed.

Thank you!

Fred A.

April 15th, 2019

Very nice forms offer, very thoughtful to include other related forms that may be necessary. The site was easy to use, and very fast. Thank You.

Thank you!

Beverly M.

January 5th, 2019

GREAT FORMS. THANK YOU.

Thank you!

Brian J.

September 4th, 2025

make filing doc so simple and fast saves time and money

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Susan H.

September 1st, 2020

Best idea ever for completing an on-line government form. And it came with instructions!!!!! Thank you, Gadsden County.

Thank you!

Emily P.

March 25th, 2020

Used the quitclaim form and the erecording service. Very smooth transaction, everything worked as it should.

Thank you for your feedback. We really appreciate it. Have a great day!