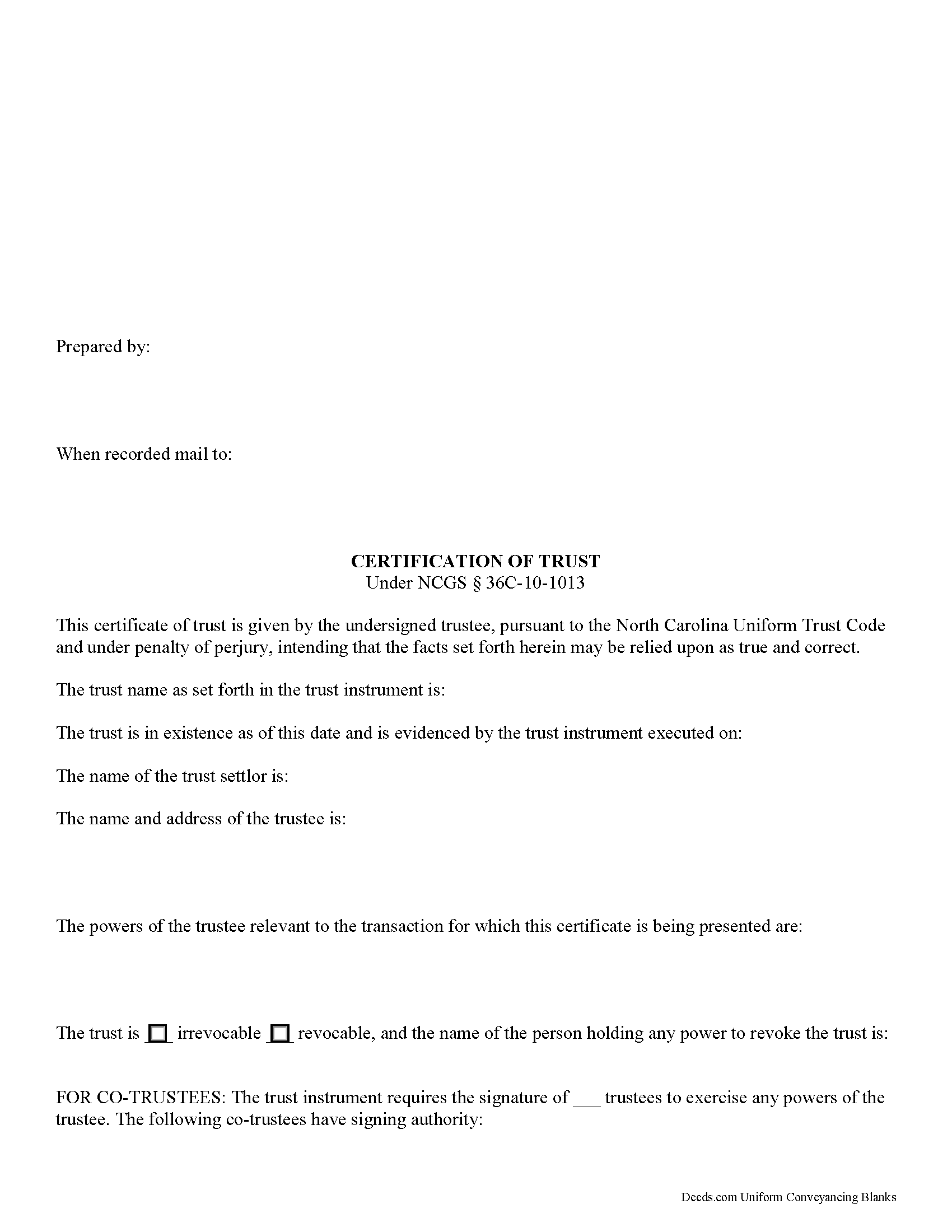

Lee County Certificate of Trust Form

Lee County Certificate of Trust Form

Fill in the blank form formatted to comply with all recording and content requirements.

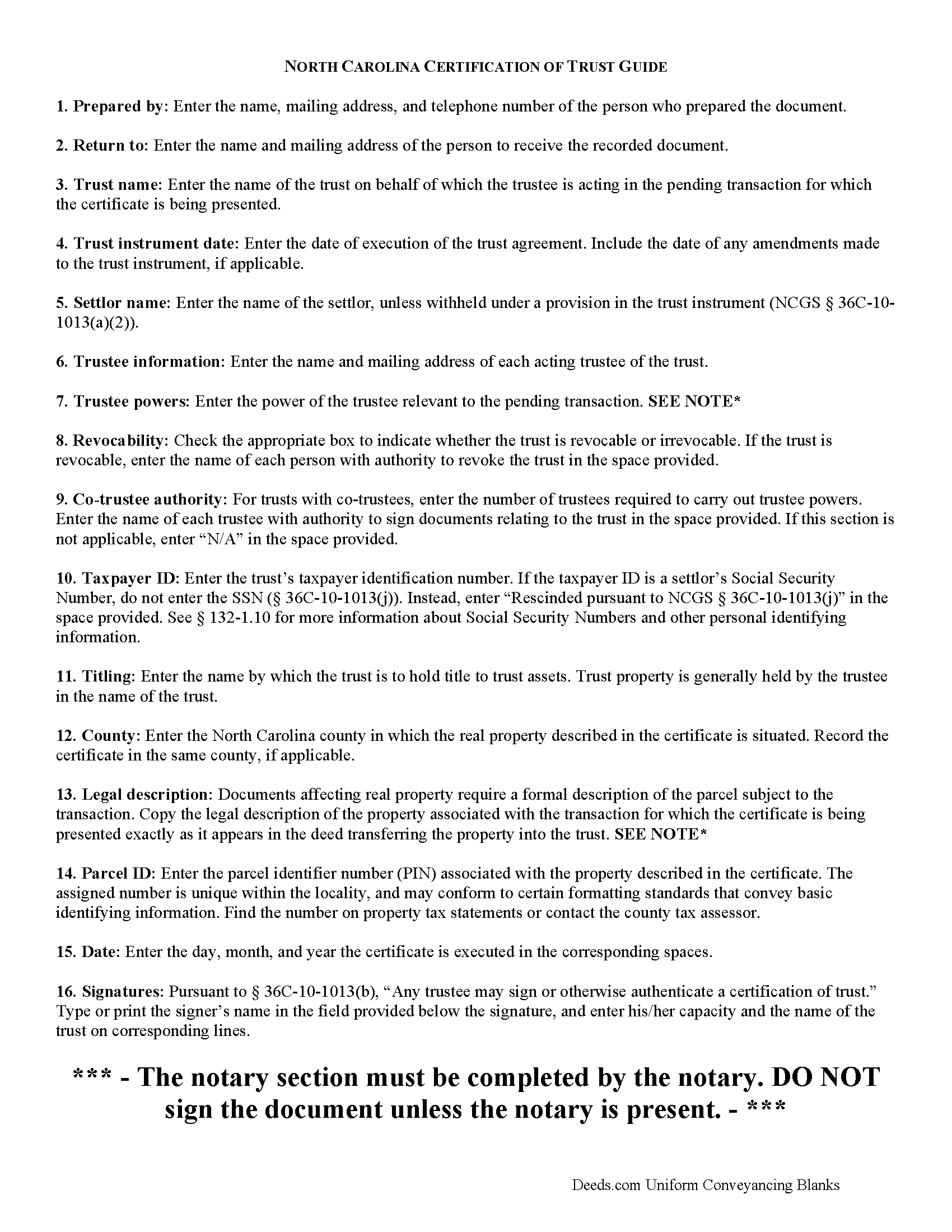

Lee County Certificate of Trust Guide

Line by line guide explaining every blank on the form.

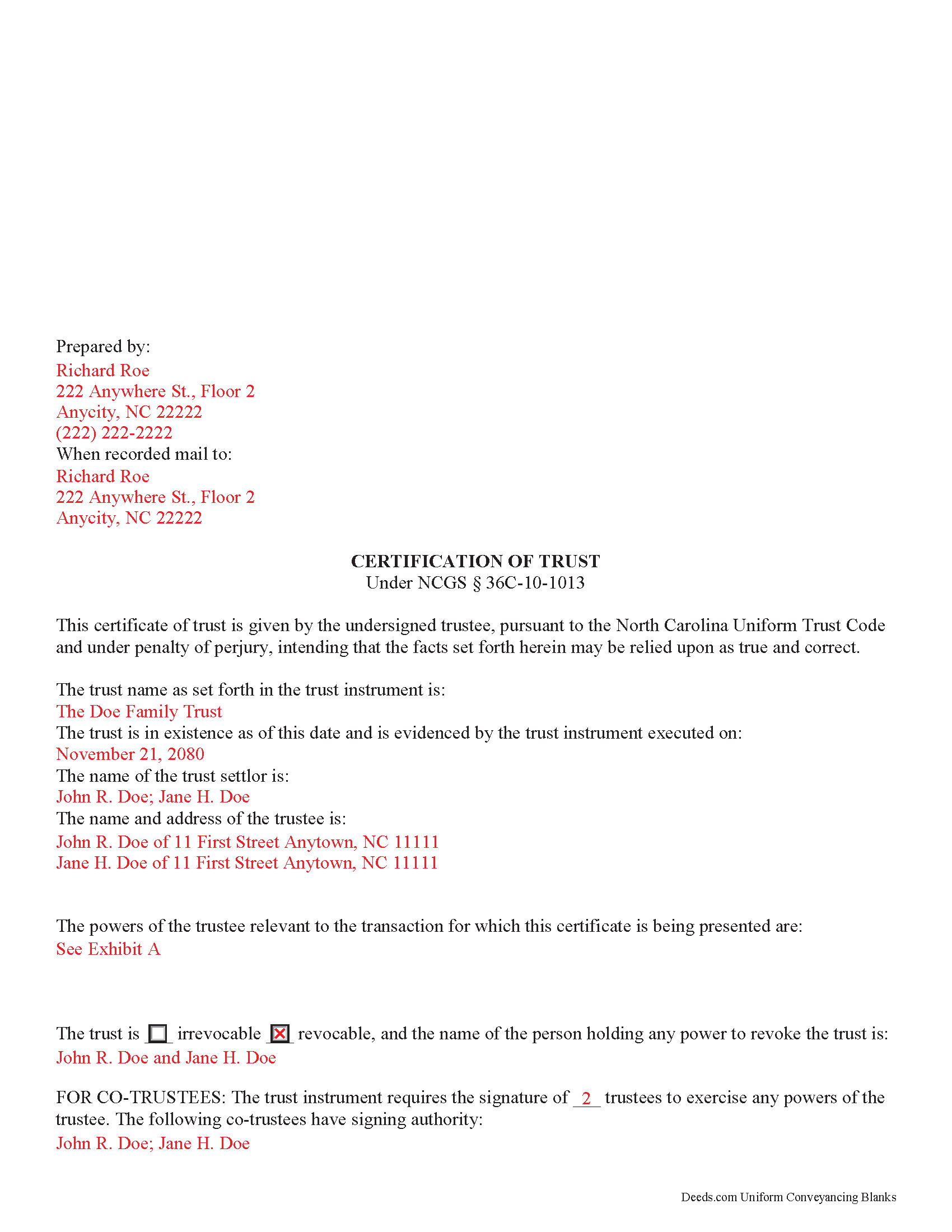

Lee County Completed Example of the Certificate of Trust Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional North Carolina and Lee County documents included at no extra charge:

Where to Record Your Documents

Lee County Register of Deeds

Sanford, North Carolina 27330

Hours: 8:00 to 5:00 M-F

Phone: (919) 718-4585

Recording Tips for Lee County:

- Double-check legal descriptions match your existing deed

- Bring extra funds - fees can vary by document type and page count

- Leave recording info boxes blank - the office fills these

- Ask about their eRecording option for future transactions

Cities and Jurisdictions in Lee County

Properties in any of these areas use Lee County forms:

- Broadway

- Cumnock

- Lemon Springs

- Sanford

Hours, fees, requirements, and more for Lee County

How do I get my forms?

Forms are available for immediate download after payment. The Lee County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Lee County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Lee County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Lee County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Lee County?

Recording fees in Lee County vary. Contact the recorder's office at (919) 718-4585 for current fees.

Questions answered? Let's get started!

North Carolina Certification of Trust

Codified under the North Carolina Uniform Trust Code, which governs testamentary and non-testamentary trusts, the certification of trust at NCGS 36C-10-1013 is a document verifying a trust's existence and a trustee's authority to act in the transaction for which the certificate is being presented.

A trust is an arrangement whereby a settlor transfers property to another person (the trustee), who holds it for the benefit of a third (the beneficiary). A testamentary trust takes effect upon the settlor's death as specified by his/her will, and a non-testamentary (inter vivos) trust takes effect during the settlor's lifetime, and functions pursuant to the terms established by the settlor in an unrecorded document called the trust instrument.

As the trust's administrator, the trustee handles the trust's assets and sees to the trust's affairs. Upon entering into a transaction involving the trust, a trustee can present a certification of trust to establish his authority to do so. The certificate contains the essential information about the trust that is necessary for the business at hand, allowing the trust instrument (containing the full scope of the trust's assets, the trustee's obligations, and identity of the beneficiary) to remain private.

Any trustee may execute a trust certificate ( 36C-10-1013(b)). In it, the trustee confirms that "the trust has not been revoked, modified, or amended in any manner that would cause the representations contained in the certification of trust to be incorrect" ( 36C-10-1013(c)). Recipients of a trustee's certificate may rely upon the statements contained within the document as correct without further inquiry ( 36C-10-1013(f)).

A certification of trust in North Carolina must state that the trust exists, and provide the date of the trust instrument. Unless withheld under a provision of the trust instrument, the document names each settlor, or person who contributes property to the trust ( 36C-1-103(17)). The certificate identifies the trust as either revocable or irrevocable, and gives the name of anyone holding a power to revoke the trust.

It also includes the name and address of the trust's currently acting trustee, along with a description of the trustee's powers relevant to the transaction for which the certificate is presented. If the trust has multiple trustees, the certificate shows how many trustees are required to exercise trustee powers, and which trustees have the authority to sign documents relating to the trust. It also specifies how trust assets will be titled (usually in the name of the trustee as representative of the trust).

Recipients of a certificate can request excerpts from the trust document designating the trustee and conferring the relevant powers necessary for the pending transaction unto the trustee ( 36C-10-1013(e)). Requesting that the trustee provide the entire trust instrument opens the recipient of a certification of trust up to certain liabilities under 36-10-1013(h). Note that this excludes the right to obtain a copy of the trust instrument in a legal proceeding involving the trust ( 36-10-1013(i)).

The certificate should also include the trust's taxpayer identification number, unless this number is the social security number of a settlor. If the taxpayer ID is rescinded from the document, however, it "shall be certified by the trustee to the person acting in reliance upon the certification of trust in a manner reasonably satisfactory to that person" ( 36C-10-1013(j)).

For transactions involving real property held in trust in North Carolina, the certification should meet all form and content requirements for real estate documents, including a legal description of the property subject to the transaction. The document may be recorded with the register of deeds in the county where the real property is located (36-10-1013(j)).

Talk to a lawyer with any questions regarding trusts and certifications of trust in North Carolina.

(North Carolina COT Package includes form, guidelines, and completed example)

Important: Your property must be located in Lee County to use these forms. Documents should be recorded at the office below.

This Certificate of Trust meets all recording requirements specific to Lee County.

Our Promise

The documents you receive here will meet, or exceed, the Lee County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Lee County Certificate of Trust form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4578 Reviews )

Jay G.

June 14th, 2019

Impressed by their expeditious response to my request which was facilitated by their fabulous software.

Thank you!

Randall M.

March 31st, 2022

These forms worked fantastic!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Jared D.

April 29th, 2020

Yes it was awsome experience,thank you

Thank you!

charles c.

October 14th, 2020

Great service, well worth the $15 fee. Especially helpful was the review of my documentation and the quick responses. Recommending it to associates who might need this service.

Thank you for your feedback. We really appreciate it. Have a great day!

Merry K.

January 5th, 2024

I am a WA State Attorney and just made my first purchase. The experience was flawless, and I appreciate the sample and the guide, too. The price was extremely reasonable. This was a huge time-saver for me - thank you!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Roberta J B.

February 17th, 2021

User friendly

Thank you!

Melissa S.

April 13th, 2020

Not what I can use.

Thank you!

Erica W.

July 21st, 2020

Very easy and convenient. I will use this service again!

Thank you!

Nello P.

January 4th, 2021

very satisfied, useful, and of great assistance

Thank you!

Holly K.

November 4th, 2022

This is the simplest way to record a deed ever. Just uploaded the deed and the professionals at deed.com did the rest. Within 8 hours, I had my recorded deed back. The price is fantastic. It would have cost me more in gas to drive to the county where I had to record the deed.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Joe B.

August 29th, 2022

Fantastic service -- very clear

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Kevin M.

April 1st, 2020

Easy to navigate. Comprehensive

Thank you!

Nick V.

July 21st, 2020

Turn time was great. Highly recommend.

Thank you!

sharon s.

October 22nd, 2020

great site for downloading forms

Thank you!

Kathleen Z.

April 22nd, 2019

Very simple. By creating the deed and filing it myself, I am saving a legal fee of $300!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!