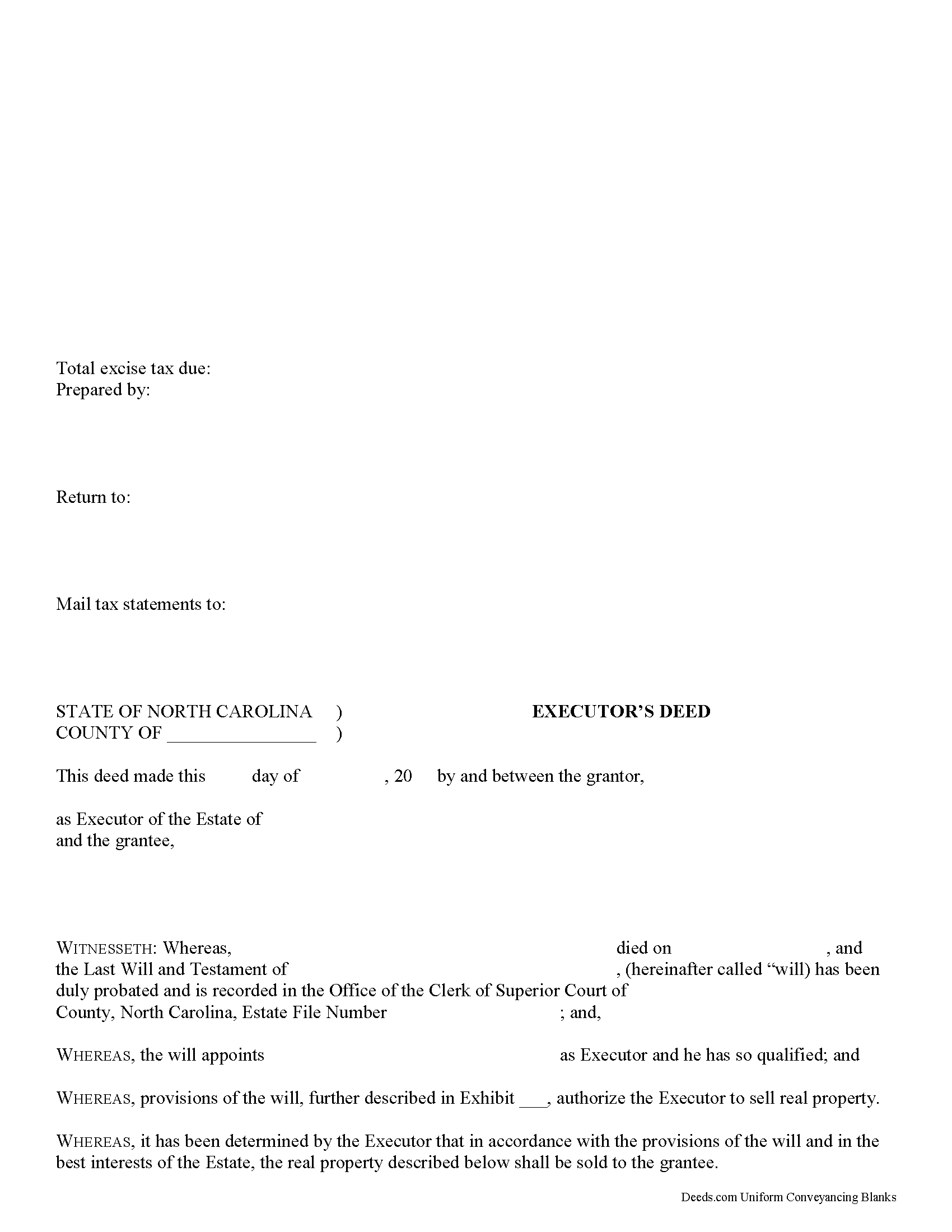

Halifax County Executor Deed Form

Halifax County Executor Deed Form

Fill in the blank form formatted to comply with all recording and content requirements.

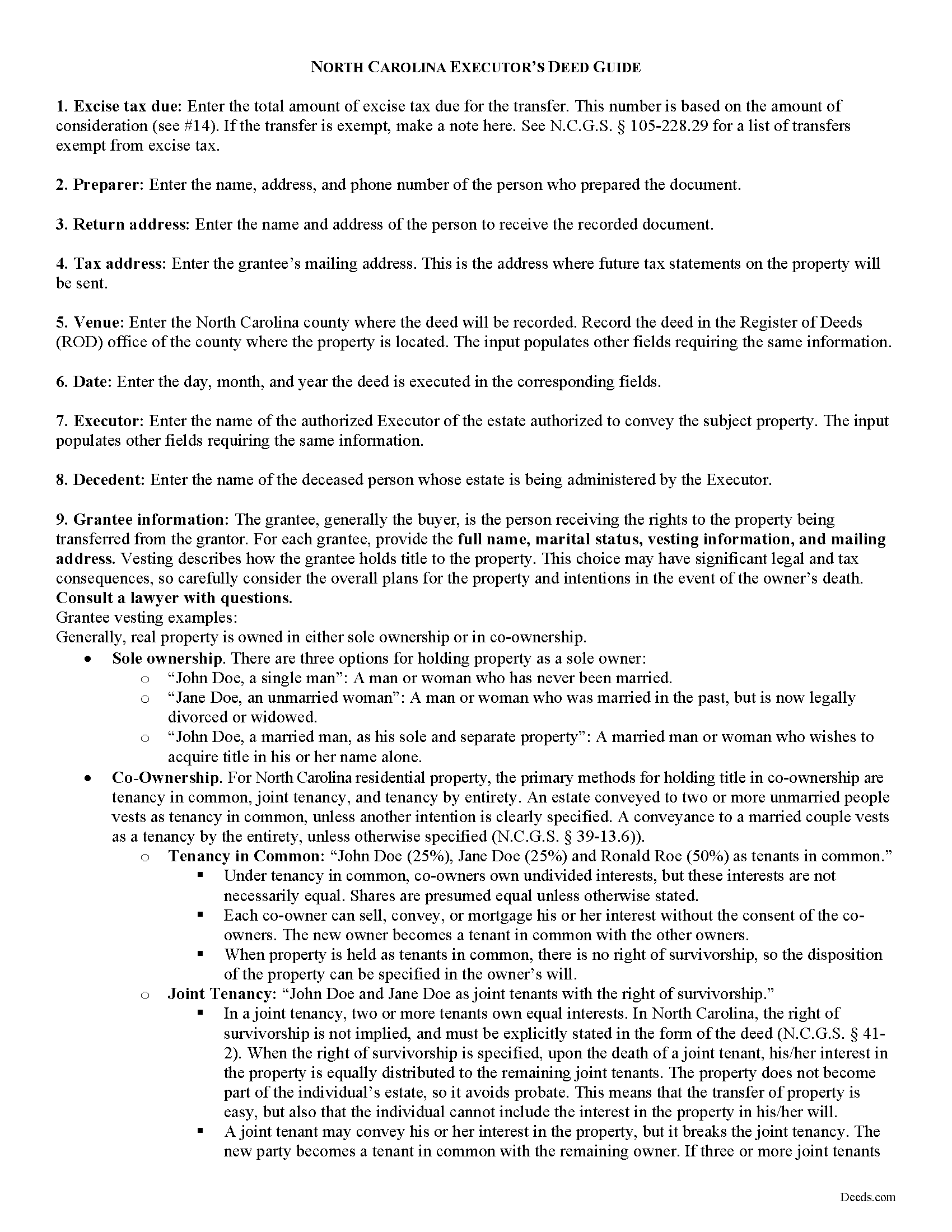

Halifax County Executor Deed Guide

Line by line guide explaining every blank on the form.

Halifax County Completed Example of the Executor Deed Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional North Carolina and Halifax County documents included at no extra charge:

Where to Record Your Documents

Halifax County Register of Deeds

Halifax, North Carolina 27839

Hours: 8:30 to 5:00 M-F

Phone: (252) 583-2101

Recording Tips for Halifax County:

- Ensure all signatures are in blue or black ink

- Both spouses typically need to sign if property is jointly owned

- Make copies of your documents before recording - keep originals safe

- Bring extra funds - fees can vary by document type and page count

- Ask about their eRecording option for future transactions

Cities and Jurisdictions in Halifax County

Properties in any of these areas use Halifax County forms:

- Enfield

- Halifax

- Hobgood

- Hollister

- Littleton

- Roanoke Rapids

- Scotland Neck

- Tillery

- Weldon

Hours, fees, requirements, and more for Halifax County

How do I get my forms?

Forms are available for immediate download after payment. The Halifax County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Halifax County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Halifax County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Halifax County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Halifax County?

Recording fees in Halifax County vary. Contact the recorder's office at (252) 583-2101 for current fees.

Questions answered? Let's get started!

Probate is the legal process of proving a decedent's (deceased person's) will, if any, valid and settling his or her estate. An executor is the personal representative named in the decedent's will to administer his or her estate.

When the estate's assets are not sufficient to pay debts, the executor may need to sell the decedent's real property. In North Carolina, title to real property vests in the decedent's heirs upon death, and a special proceeding is typically required to bring the property into the estate.

Under N.C.G.S. 28A-15-1(c), a special proceeding before the clerk of superior court is not required for a sale by a personal representative made pursuant to authority given by a will, which permission may include a general provision granting authority to the personal representative to sell the testator's real property, or incorporation by reference of the provisions of N.C.G.S. 32-27(2).

An executor's deed is an instrument executed by the executor of the decedent's will to convey an interest in real property from a testate estate (so called when the decedent leaves a will) to a purchaser. Personal representatives' deeds typically carry limited warranties of title, commensurate with the office of a fiduciary. This means that the executor covenants that he has not placed or suffered to be placed any presently existing liens or encumbrances on the property conveyed, and warrants and defends the title against the lawful claims of all persons claiming by, through, under, or on account of decedent's estate, insofar as it is the executor's duty to do by virtue of his office, but no further.

Recitals of an executor's deed include information regarding the probated will, including the date of death, the county of probate, and the file number assigned to the decedent's estate by the clerk of superior court. In addition, the deed contains a statement that the executor named within was appointed by the decedent's will and is duly qualified to administer the estate; an explanation of the provisions of the will that authorize the executor to sell real property; and a statement that such sale is within the best interests of the estate.

A lawful deed in North Carolina states the consideration made for the transfer of title, contains an accurate legal description of the subject parcel, and recites the grantor's source of title. When properly executed and recorded, the executor's deed vests title to the within-described property in the named grantee(s). Any restrictions to the transfer should be noted in the body of the deed.

The executor's signature must be acknowledged in the presence of a notarial official before the deed can be recorded in the county where the subject property is located. An affidavit of consideration or value may be required.

Opinions differ in North Carolina on best practices when executing a fiduciary deed. Some buyers may be hesitant to accept a deed executed by the PR without court authority or without execution by the decedent's heirs. Consult a lawyer for guidance when conveying a decedent's real property. Consult an attorney licensed in the State of North Carolina with questions regarding executor's deeds, as each situation is unique.

(North Carolina ED Package includes form, guidelines, and completed example)

Important: Your property must be located in Halifax County to use these forms. Documents should be recorded at the office below.

This Executor Deed meets all recording requirements specific to Halifax County.

Our Promise

The documents you receive here will meet, or exceed, the Halifax County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Halifax County Executor Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4578 Reviews )

Susan J.

September 12th, 2019

Simple and easy to use. I was thrilled to find deeds.com during my online search for deed forms and more pleased that I could narrow it down by state and county. Thanks

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Shari N.

April 9th, 2025

Deeds.com provides a valuable resource to efficiently file documents for recordation.

We are grateful for your feedback and looking forward to serving you again. Thank you!

Vallerie M.

March 12th, 2024

Amazing! Great prompt service and follow up. I couldn’t be happier

We are grateful for your engagement and feedback, which help us to serve you better. Thank you for being an integral part of our community.

Connie P.

January 16th, 2024

Easy, fast, responsive. My document was filed and posted in just a matter of days.

Your feedback is valuable to us and helps us improve. Thank you for sharing your thoughts!

CECIL E C.

June 27th, 2019

You made it easy to attain the documents I needed. The cost was very reasonable...thanks

Thank you for your feedback Cecil, we really appreciate it.

Arnold R.

March 11th, 2022

this online service worked efficiently and as quickly as the registry allowed it to record new deeds. Thank you for providing services

Thank you for your feedback. We really appreciate it. Have a great day!

Paul N.

September 18th, 2022

Had what I needed, service was excellent.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Richard P.

April 18th, 2020

Excellent source and easy to use site.

Thank you!

Gail M.

October 27th, 2022

Great website. Once submit payment documents are immediately emailed, easy to print and clear format. Will definitely use again!

Thank you for your feedback. We really appreciate it. Have a great day!

Neira S.

January 20th, 2019

No problem with Recorders Office using your document. It is now completed and recorded.

Thank you Neira, have a wonderful day!

Becky B.

October 6th, 2021

Terrible form format

Thank you for taking the time to leave your feedback Becky. We do hope that you found something more suitable to your needs elsewhere. Have a wonderful day.

reed w.

February 26th, 2022

Great service that saved me a lot of time for under 30 bucks.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Valerie T.

June 4th, 2019

it was very helpful.

Thank you!

Gretchen D.

January 7th, 2019

Quick and easy process to get the documents, and helpful to see the example filled out.

Thank you for your feedback Gretchen, we really appreciate it. Have a great day!

Koko H.

July 12th, 2019

Five star. Prompt and easy way to obtain information. Good value.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!