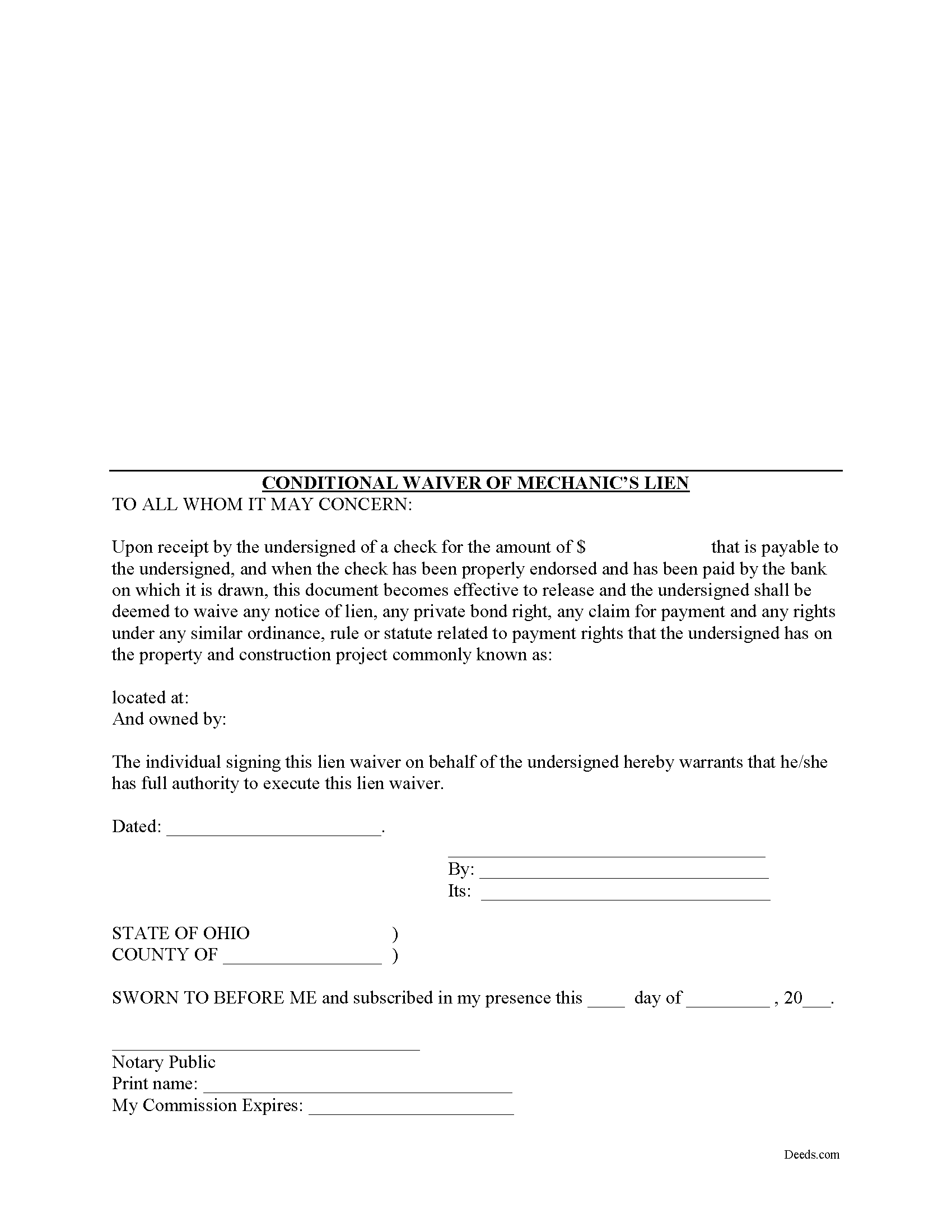

Knox County Conditional Lien Waiver Form

Knox County Conditional Lien Waiver Form

Fill in the blank Conditional Lien Waiver form formatted to comply with all Ohio recording and content requirements.

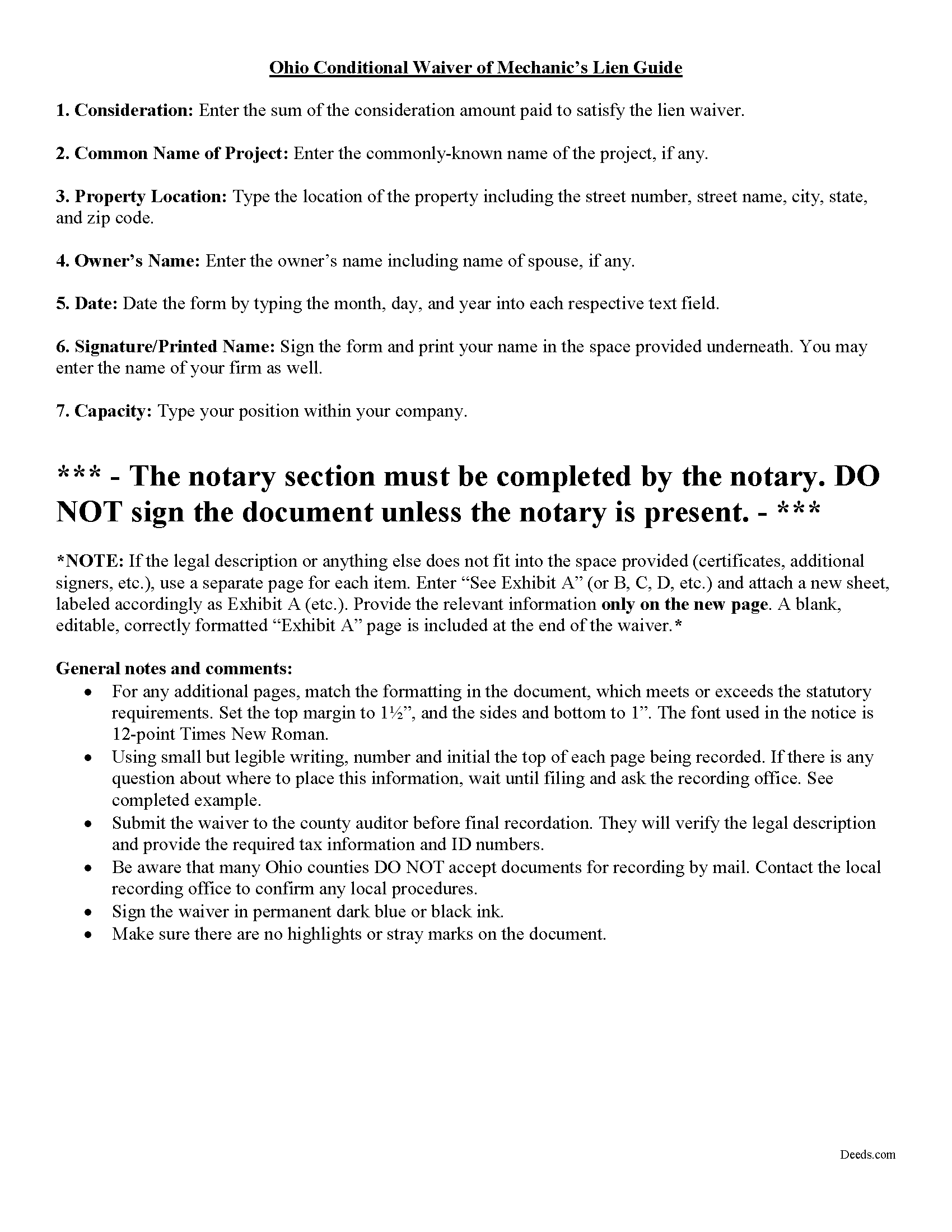

Knox County Conditional Lien Waiver Guide

Line by line guide explaining every blank on the form.

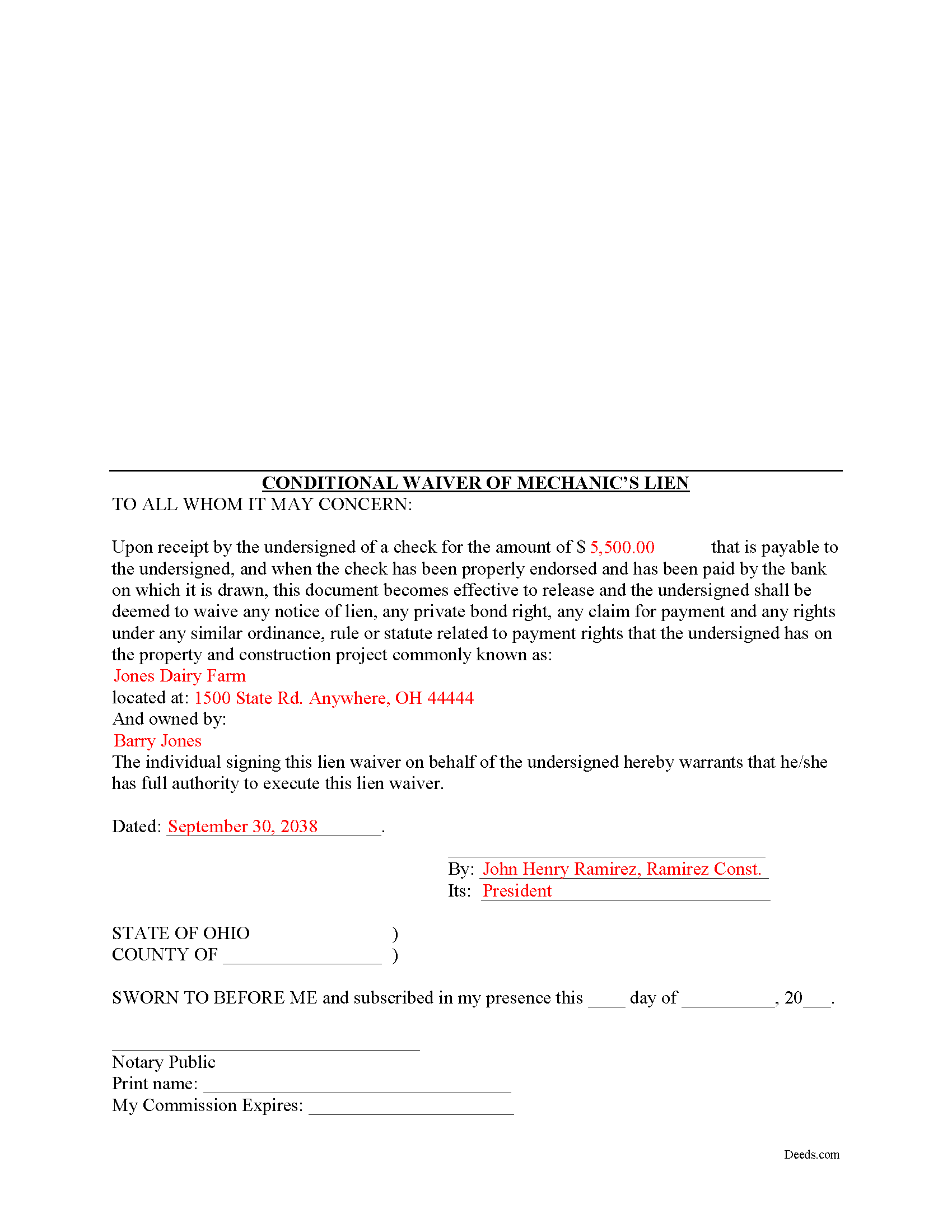

Knox County Completed Example of the Conditional Lien Waiver Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Ohio and Knox County documents included at no extra charge:

Where to Record Your Documents

Knox County Recorder

Mt. Vernon, Ohio 43050

Hours: 8:00 a.m. - 4:00 p.m. Monday - Friday

Phone: 740-393-6755

Recording Tips for Knox County:

- Both spouses typically need to sign if property is jointly owned

- Avoid the last business day of the month when possible

- Make copies of your documents before recording - keep originals safe

- Ask for certified copies if you need them for other transactions

- Mornings typically have shorter wait times than afternoons

Cities and Jurisdictions in Knox County

Properties in any of these areas use Knox County forms:

- Bladensburg

- Brinkhaven

- Centerburg

- Danville

- Fredericktown

- Gambier

- Howard

- Martinsburg

- Mount Liberty

- Mount Vernon

Hours, fees, requirements, and more for Knox County

How do I get my forms?

Forms are available for immediate download after payment. The Knox County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Knox County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Knox County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Knox County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Knox County?

Recording fees in Knox County vary. Contact the recorder's office at 740-393-6755 for current fees.

Questions answered? Let's get started!

Ohio's mechanic's lien law does not provide for a statutory lien waiver form, but Ohio courts recognize elective lien waivers under principles of contract law. The waivers identify the claimant, the party responsible for paying, the project, relevant dates, and the amount paid. Sign the completed waiver in front of a notary, then record it in the land records of the county where the project is located.

In general, a lien waiver is used to release an owner's property from a lien claim, either in full or in part, and either conditional, meaning the payment must clear the bank prior to waiving lien rights, or unconditional, meaning that the claimant waives the lien immediately, regardless of whether or not the payment clears the bank.

For instance, if the customer owes $5,000.00 on a construction job and remits a partial payment of $2,500.00, the payor may request a waiver that states he or she has paid that amount and in turn the claimant will give up the right to a lien for $2,500.00 of the total amount. If the check has not yet cleared the bank, use a conditional waiver that is only effective upon actual receipt of payment.

Each case is unique, and the lien law is complicated so contact an attorney familiar with Ohio mechanic's liens with specific questions or for complex situations.

Important: Your property must be located in Knox County to use these forms. Documents should be recorded at the office below.

This Conditional Lien Waiver meets all recording requirements specific to Knox County.

Our Promise

The documents you receive here will meet, or exceed, the Knox County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Knox County Conditional Lien Waiver form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4585 Reviews )

Sterling H.

September 17th, 2024

I liked being able to drill down to state and county. Just simply the search for all property records

We welcome your positive feedback and are thrilled to have met your expectations. Thank you for choosing our services.

Molly A.

April 12th, 2020

Super easy to download and Deeds dot com had the documents I was looking for and set up in a manner that the County Government office would accept. Nice! Thank you, Deeds!

Thank you for your feedback. We really appreciate it. Have a great day!

Darlo M.

November 19th, 2022

The process for getting the forms I needed was easy through Deeds.com I would use them again!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Peggy L.

November 16th, 2020

Exactly what I needed and so nice to not have to pay a lawyer

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

William G.

January 11th, 2021

I am very pleased with Deeds.com. They responded back very quickly, checked my forms, gave an example for a correction, and submitted the forms over the weekend. What more could you ask?

Thank you!

Kathyren O.

April 25th, 2019

Very helpful and I will be using your services in the near future. Thank you Kathyren Oleary

Thanks Kathyren, we really appreciate your feedback.

Abdel M.

August 8th, 2023

Easy to use and they are very responsive.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Robert H.

June 23rd, 2025

Great service, easy way to get accurate documents

Thanks, Robert! We're glad you found the service easy to use and the documents accurate—just what we aim for. Appreciate you taking the time to share your experience!

Willie T.

March 8th, 2019

Great

Thank you for your feedback. We really appreciate it. Have a great day!

George Y.

June 24th, 2021

Thought it was great, no issues. Very convenient especially dealing with difficult municipalities and a post COVID world. Thanks

Thank you for your feedback. We really appreciate it. Have a great day!

Elizabeth C.

September 23rd, 2020

Very happy, thank you!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Javel L.

November 28th, 2019

The idea is great. I was not able to have my deed retrieved. Would have needed a verifies copy anyway.

Thank you for your feedback. We really appreciate it. Have a great day!

Bobbi W.

February 16th, 2019

Site was super easy to use. After frustrating search for the item I needed I found it here!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Cleatous S.

December 9th, 2020

The deed form is hard to fill in. There is no way to fill in the county in the "reviewed by" section. Also, there is no place for the Grantee's address on the form. I had to include it in the fill-in space for the legal description.

Thank you!

Donald P.

November 12th, 2019

Very fast and efficient. Easy to fill out but was upset the latest tax exemptions ruled in 2014 did not seem to be included. Exclusion of sale to blood relatives, etc. _ the one I needed.

Thank you for your feedback. We really appreciate it. Have a great day!