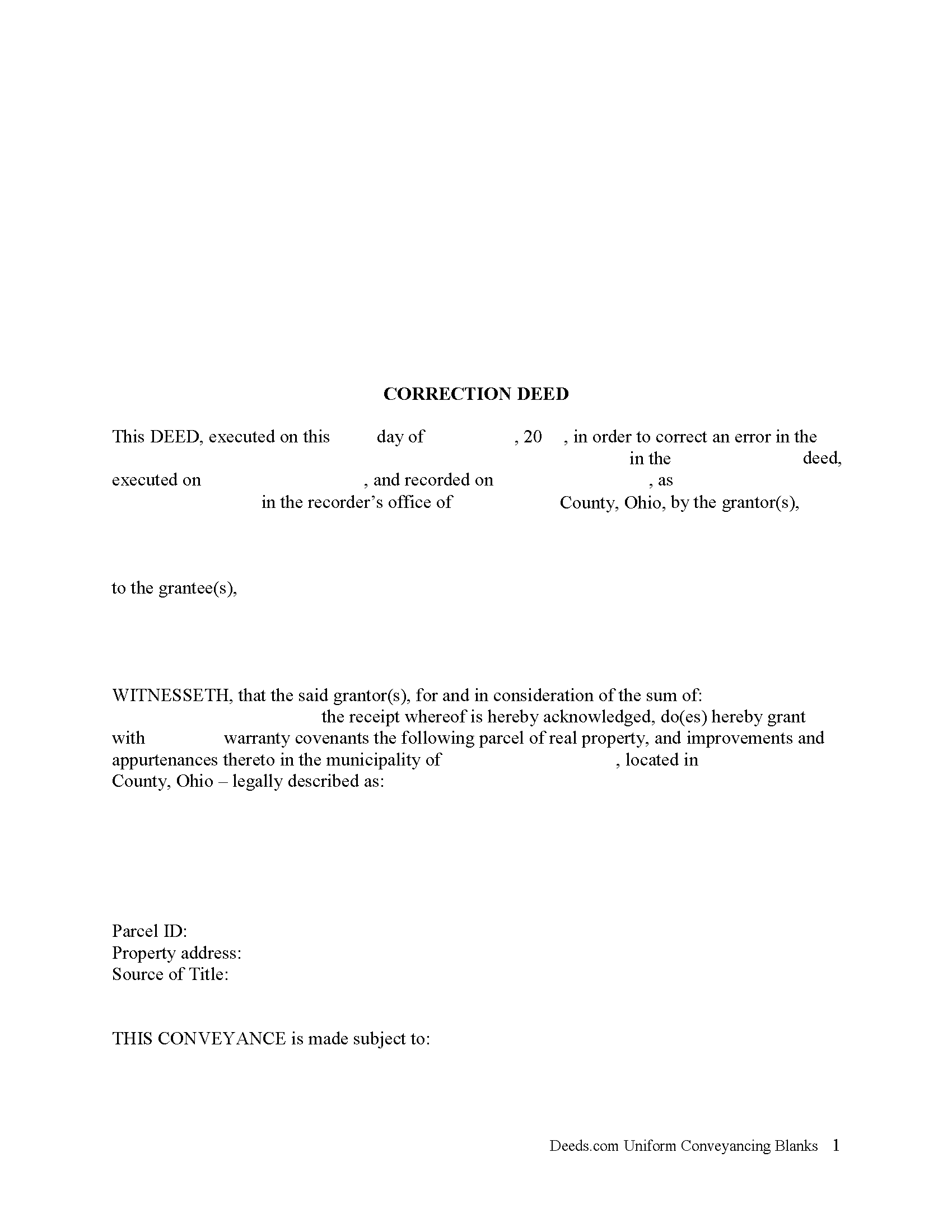

Huron County Correction Deed Form

Huron County Correction Deed Form

Fill in the blank form formatted to comply with all recording and content requirements.

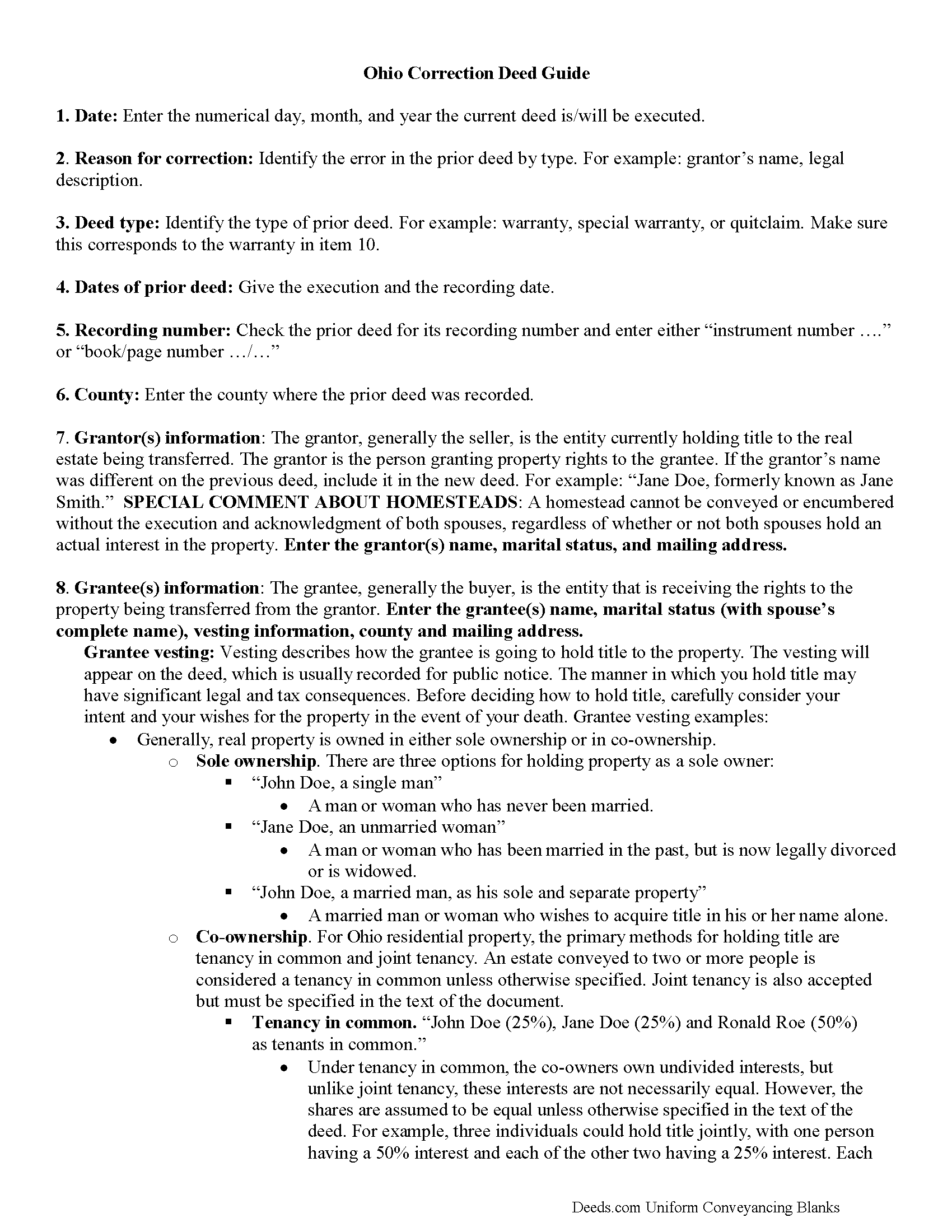

Huron County Correction Deed Guide

Line by line guide explaining every blank on the form.

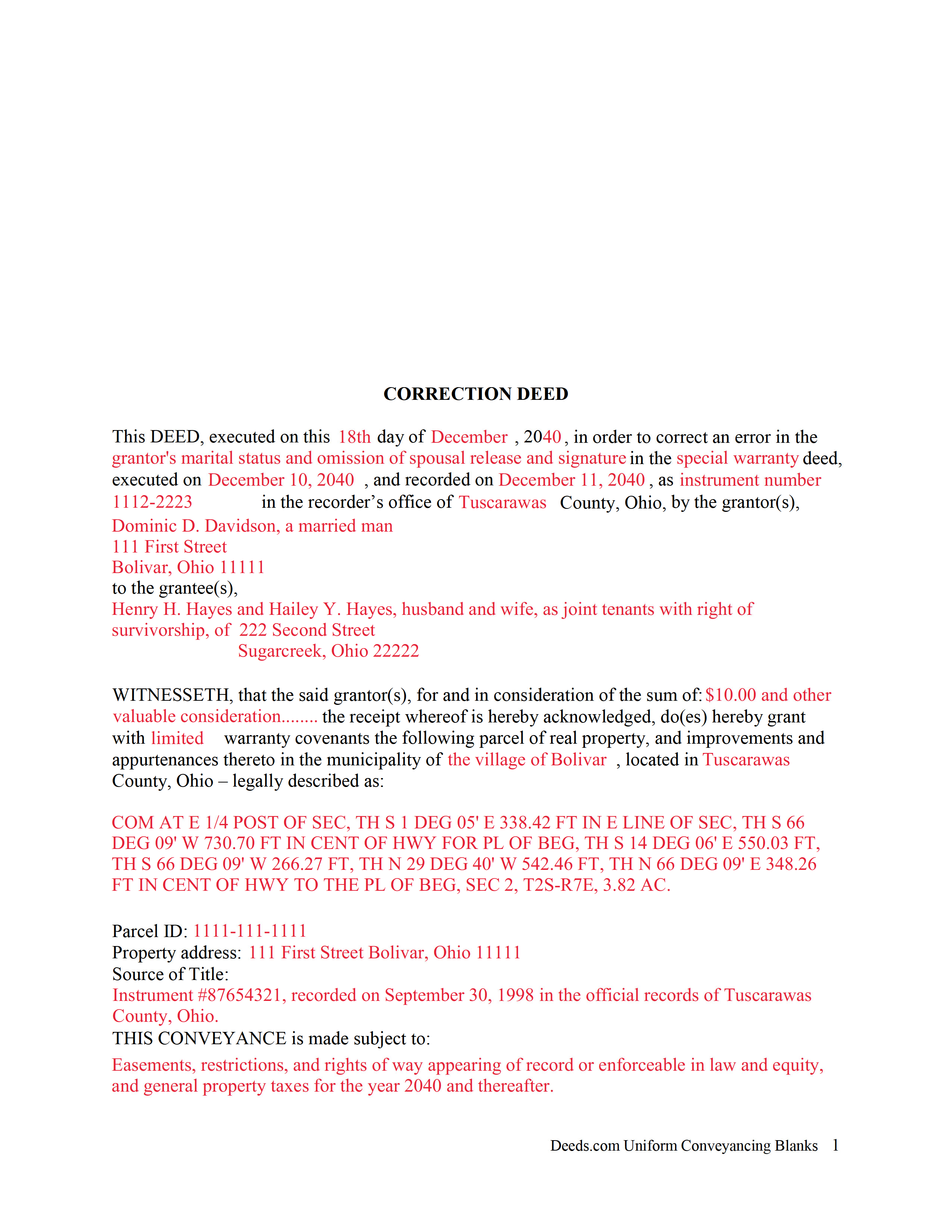

Huron County Completed Example of the Correction Deed Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Ohio and Huron County documents included at no extra charge:

Where to Record Your Documents

Huron County Recorder

Norwalk, Ohio 44857

Hours: 8:00 a.m. - 4:30 p.m. Monday - Friday / Same-day recording until 4:20 p.m.

Phone: (419) 668-1916

Recording Tips for Huron County:

- Verify all names are spelled correctly before recording

- Avoid the last business day of the month when possible

- Both spouses typically need to sign if property is jointly owned

- Request a receipt showing your recording numbers

Cities and Jurisdictions in Huron County

Properties in any of these areas use Huron County forms:

- Bellevue

- Collins

- Greenwich

- Monroeville

- New Haven

- New London

- North Fairfield

- Norwalk

- Plymouth

- Wakeman

- Willard

Hours, fees, requirements, and more for Huron County

How do I get my forms?

Forms are available for immediate download after payment. The Huron County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Huron County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Huron County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Huron County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Huron County?

Recording fees in Huron County vary. Contact the recorder's office at (419) 668-1916 for current fees.

Questions answered? Let's get started!

In Ohio, a deed can be corrected either by re-recording the prior deed with corrections made directly on it, or by recording a new deed, called correction or corrective deed. In both cases, the reason for the correction, the recording number and execution/recording dates need to be stated. The choice between the two options may depend on county preference or the nature of the defect. Correction in general is only effective when it clarifies or completes the title of the prior deed. Altering the nature of the document by means of a correction deed is not advisable.

Thus, correcting the name or missing initial in the grantor's or grantee's name, the grantee's tax address, a minor error in the acknowledgement or even in the legal description can all be achieved through a correction deed. If the grantor re-acknowledges the corrected deed, errors of omission can be resolved as well, as can the marital status and spousal release and more serious errors in the legal description.

The Ohio Bar Association publishes guidelines for title standards and advise to never use a correction deed in order to add or delete a grantee, to make major changes in the legal description, such as a changing the lot number, or to add or delete restrictive covenants or easements. Taking minimal requirements for sufficiency and definiteness as the standard for effective conveyances, they list and explain errors that may not impair the marketability of a title and indicate that "lapse of time, subsequent conveyances, the manifest or typographical nature of errors or omission, accepted rules of construction and other considerations should be relied upon to approve marginally sufficient or questionable descriptions" (Ohio Title Standards, section 3.2, 2012).

In many counties, submit all deeds to the assessor prior to recording. Sometimes, only changes to the legal description need to be approved by the auditor before they can be recorded. The statement of value form DTE 100-EX needs to accompany the correction deed and indicate the reason for exemption. Bear in mind, however, that any changes to the legal description may affect transfer tax assessment. Spend time considering the different outcomes of each option and contact the local authorities, either the recorder's or the auditor's office for specific requirements and practices.

(Ohio Correction Deed Package includes form, guidelines, and completed example)

Important: Your property must be located in Huron County to use these forms. Documents should be recorded at the office below.

This Correction Deed meets all recording requirements specific to Huron County.

Our Promise

The documents you receive here will meet, or exceed, the Huron County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Huron County Correction Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4581 Reviews )

MARY LACEY M.

April 17th, 2025

Deeds.com consistently provides excellent service at a fair price, and we rely and are thankful them for assisting with our recording needs.

Thank you, Mary! We truly appreciate your kind words and continued trust in Deeds.com. It means a lot to us to be part of your recording process, and we’re always here to help whenever you need us.

Robert C.

May 31st, 2023

Not easy to navigate as a first time user. I printed the first page but lost the link to the second page.

Thank you for taking the time to provide us with your valuable feedback. I'm sorry to hear that you've encountered difficulties with our website's navigation, particularly as a first-time user.

Furthermore, your comments about the website's navigation have been taken into account. We continually strive to improve our website and make it as intuitive and user-friendly as possible. Your feedback is crucial for us in achieving this goal.

Thank you again for your feedback. If you have any other suggestions or need further assistance, please don't hesitate to contact us.

Charles C.

January 30th, 2019

Using an I pad and cannot type on form that was downloaded. I do not have a computer Charles

Thank you for your feedback Charles. You might want to make sure you have the Adobe app on your Ipad: https://itunes.apple.com/us/app/adobe-fill-sign/id950099951?mt=8

William P.

April 13th, 2021

Warranty Deed was just what I needed.Easy to complete and accepted by the county.

Thank you!

SAMANTHA P.

September 19th, 2021

Very easy very clear very informative of direct information stating the obvious and the underlining of both contexts. Right place for the right Tools to establish ,verify ,correct then guidance for not only myself, but for our legacy that should and will be live on to be know. Thank you deeds.com!

Thank you!

Christine A.

December 28th, 2018

So far do good. Don't understand the billing procedure yet and have just sent a request for information. Awaiting reply. Thank you, Christine Alvarez

Thanks for the feedback. Looks like your E-recording invoice is available. It takes a few minutes for our staff to prepare documents for recording and generate the invoice.

Lacina B.

July 25th, 2020

Forms were appropriately priced, easy to download

Thank you for your feedback. We really appreciate it. Have a great day!

Christopher B.

January 13th, 2021

Process went smoothly and will use for my next recording. Only area for improvement would be to provide the ability for the user to delete and replace uploaded documents.

Thank you for your feedback. We really appreciate it. Have a great day!

Nora T.

March 10th, 2023

The forms are easy to fill in but too restricted for editing.

Thank you!

Abby H.

September 1st, 2020

Purchased the forms to make a deed. They were available immediately as promised. Easy to use. The guide and example was a big help. Will definitely use again if/when needed. Thanks.

Thank you Abby, we appreciate you. Have a great day!

Elizabeth H.

December 17th, 2020

You had just what I was looking for. It was explained well and easy to find. Will recommend you.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Donald H.

November 5th, 2019

EXCELLENT,,super good. Quick & easy

Thank you!

Ping O.

September 5th, 2019

Thank you for making this easy!

Thank you!

Marilyn S.

January 7th, 2021

I was fine. But I don't like surveys.

Thank you!

Toni C.

June 10th, 2021

The system was simple to use. The rep that answered my questions could have been a little more forthcoming, but that being said I would use the service again.

Thank you!