Stark County Correction Deed Form

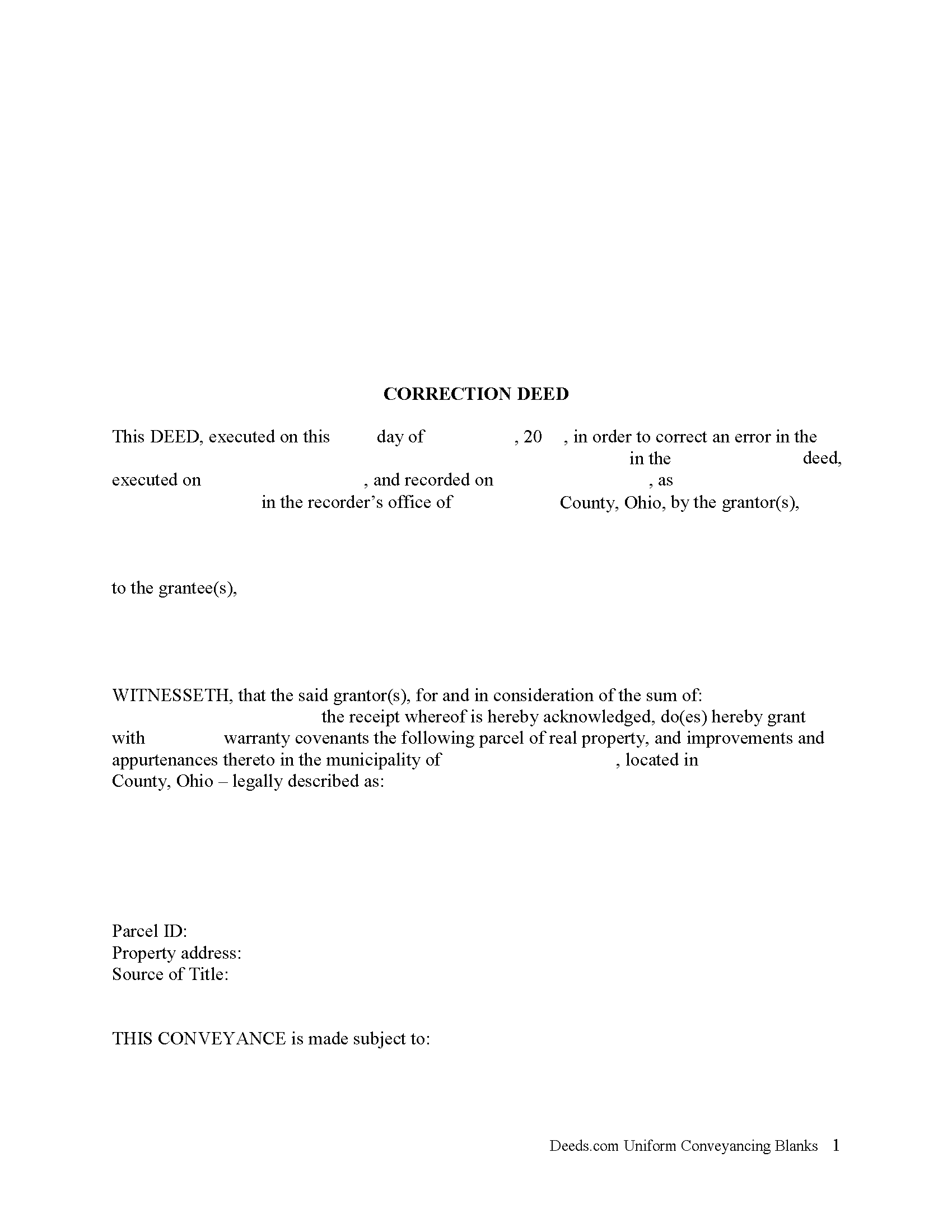

Stark County Correction Deed Form

Fill in the blank form formatted to comply with all recording and content requirements.

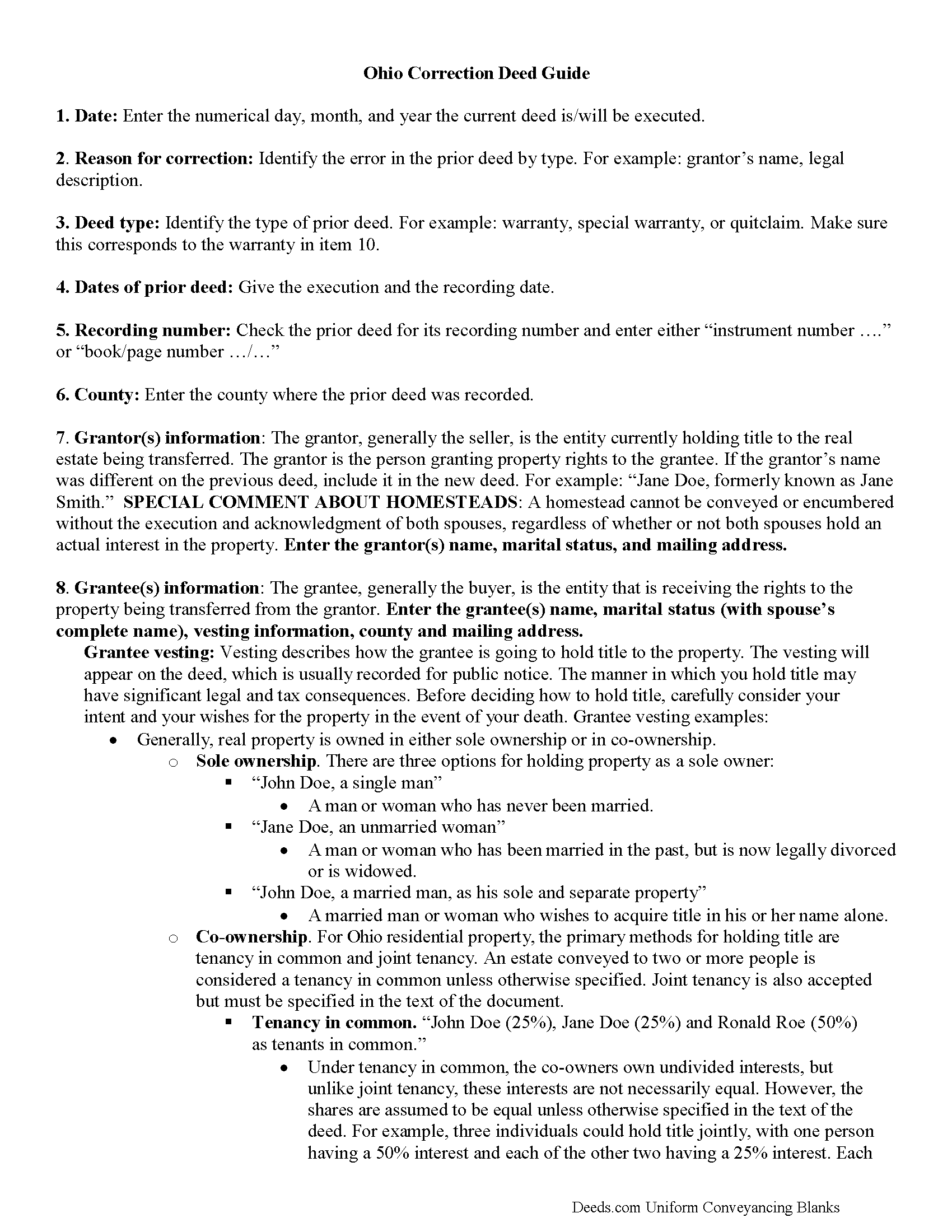

Stark County Correction Deed Guide

Line by line guide explaining every blank on the form.

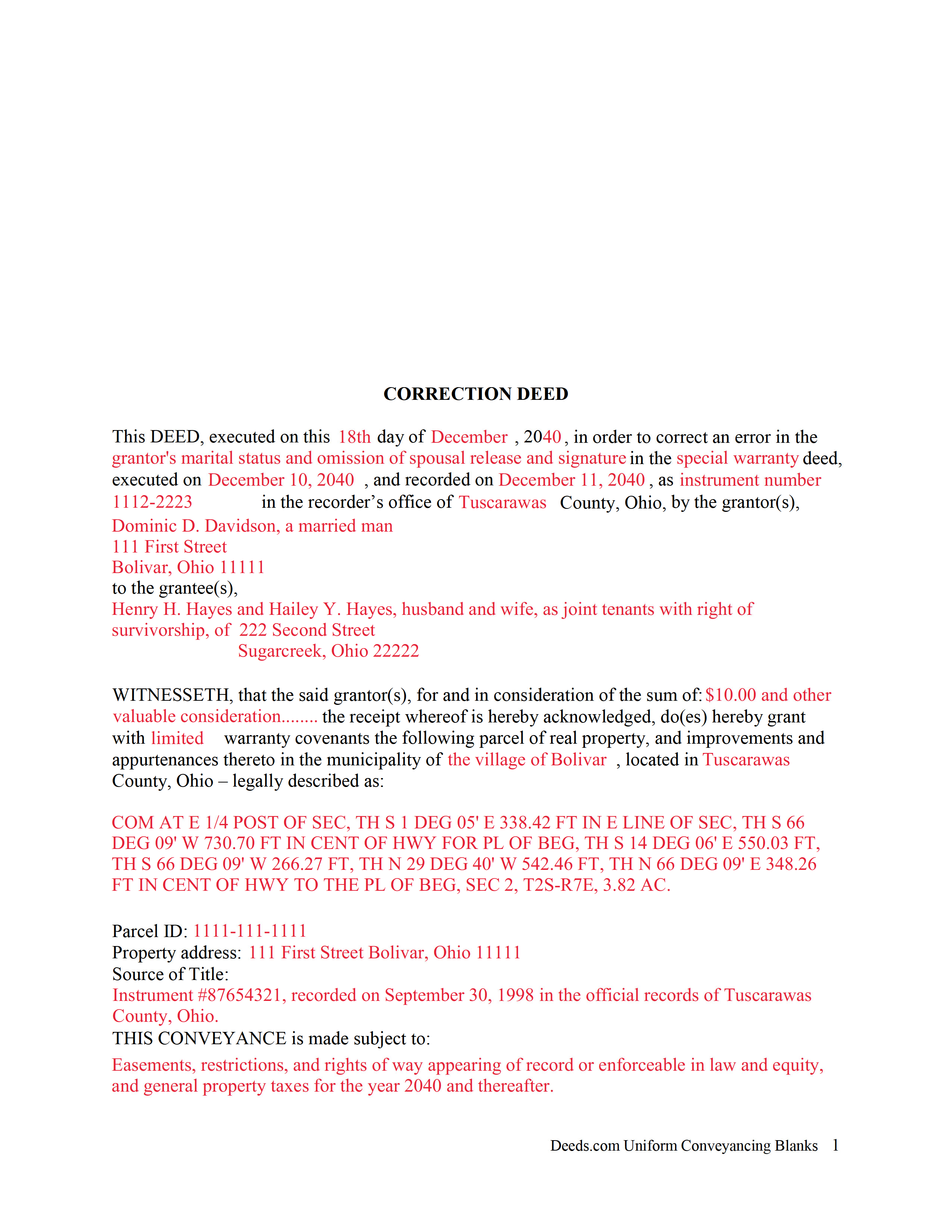

Stark County Completed Example of the Correction Deed Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Ohio and Stark County documents included at no extra charge:

Where to Record Your Documents

Stark County Recorder

Canton, Ohio 44702-1409

Hours: 8:00 to 4:30 M-F

Phone: 330-451-7443

Recording Tips for Stark County:

- Ask if they accept credit cards - many offices are cash/check only

- White-out or correction fluid may cause rejection

- Bring extra funds - fees can vary by document type and page count

- Make copies of your documents before recording - keep originals safe

- Avoid the last business day of the month when possible

Cities and Jurisdictions in Stark County

Properties in any of these areas use Stark County forms:

- Alliance

- Beach City

- Brewster

- Canal Fulton

- Canton

- East Canton

- East Sparta

- Greentown

- Hartville

- Limaville

- Louisville

- Magnolia

- Massillon

- Maximo

- Middlebranch

- Minerva

- Navarre

- North Canton

- North Lawrence

- Paris

- Robertsville

- Uniontown

- Waynesburg

- Wilmot

Hours, fees, requirements, and more for Stark County

How do I get my forms?

Forms are available for immediate download after payment. The Stark County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Stark County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Stark County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Stark County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Stark County?

Recording fees in Stark County vary. Contact the recorder's office at 330-451-7443 for current fees.

Questions answered? Let's get started!

In Ohio, a deed can be corrected either by re-recording the prior deed with corrections made directly on it, or by recording a new deed, called correction or corrective deed. In both cases, the reason for the correction, the recording number and execution/recording dates need to be stated. The choice between the two options may depend on county preference or the nature of the defect. Correction in general is only effective when it clarifies or completes the title of the prior deed. Altering the nature of the document by means of a correction deed is not advisable.

Thus, correcting the name or missing initial in the grantor's or grantee's name, the grantee's tax address, a minor error in the acknowledgement or even in the legal description can all be achieved through a correction deed. If the grantor re-acknowledges the corrected deed, errors of omission can be resolved as well, as can the marital status and spousal release and more serious errors in the legal description.

The Ohio Bar Association publishes guidelines for title standards and advise to never use a correction deed in order to add or delete a grantee, to make major changes in the legal description, such as a changing the lot number, or to add or delete restrictive covenants or easements. Taking minimal requirements for sufficiency and definiteness as the standard for effective conveyances, they list and explain errors that may not impair the marketability of a title and indicate that "lapse of time, subsequent conveyances, the manifest or typographical nature of errors or omission, accepted rules of construction and other considerations should be relied upon to approve marginally sufficient or questionable descriptions" (Ohio Title Standards, section 3.2, 2012).

In many counties, submit all deeds to the assessor prior to recording. Sometimes, only changes to the legal description need to be approved by the auditor before they can be recorded. The statement of value form DTE 100-EX needs to accompany the correction deed and indicate the reason for exemption. Bear in mind, however, that any changes to the legal description may affect transfer tax assessment. Spend time considering the different outcomes of each option and contact the local authorities, either the recorder's or the auditor's office for specific requirements and practices.

(Ohio Correction Deed Package includes form, guidelines, and completed example)

Important: Your property must be located in Stark County to use these forms. Documents should be recorded at the office below.

This Correction Deed meets all recording requirements specific to Stark County.

Our Promise

The documents you receive here will meet, or exceed, the Stark County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Stark County Correction Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4581 Reviews )

Edward E.

December 22nd, 2024

Easy to use.

Your feedback is valuable to us and helps us improve. Thank you for sharing your thoughts!

timothy s.

March 23rd, 2020

fine job, fellas, fine job

Thank you!

Tommie G.

March 11th, 2021

I saved 225.00 with this purchase.Make sure you have an updated property description from your county tax collectors' office.In Bay county,Florida the tax office will email you an updated property description.I attached the email to the the deed.I had to change the date and they accepted a white out and ink correction on your form.

Thank you for your feedback. We really appreciate it. Have a great day!

Stephen N.

February 11th, 2021

Excellent service.

Thank you!

Jane N.

February 17th, 2022

Good morning, It seems to be easy to navigate and print out the form I needed. Great!!! Jane

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Lorna D.

September 12th, 2020

Haven't used the form yet. But hopefully it's the correct one.

Thank you!

Donald C.

January 7th, 2020

The service was VERY quick, simple and, easy. I would definetly use this service again.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Karen C.

July 28th, 2022

Easily find and print forms necessary for peace of mind.

Thank you for your feedback. We really appreciate it. Have a great day!

Diana M.

October 18th, 2020

Awesome service. Quick and easy. Complete directions on how to complete the forms with examples for further assistance.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Robert S.

November 15th, 2021

Very nice!

Thank you!

yasin a.

January 3rd, 2020

good service

Thank you!

Randy H.

May 12th, 2019

Love this has all forms you need

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Marina M.

April 16th, 2022

Very easy to choose template and download. The price seems fair. Not sure the section on the deed for 6 witnesses is necessary....

Thank you for your feedback. We really appreciate it. Have a great day!

Irma D.

June 14th, 2021

Very impressed with the Service in Miami-Dade County. THank you

Thank you!

Susan C.

January 16th, 2019

Hi When and how will I get the copy of my deed ? Thanks

Thanks for reaching out. Looks like the document you ordered has been available for you to download from your account since January 15, 2019 at 11:46 am.