Clinton County Fiduciary Deed Form

Clinton County Fiduciary Deed Form

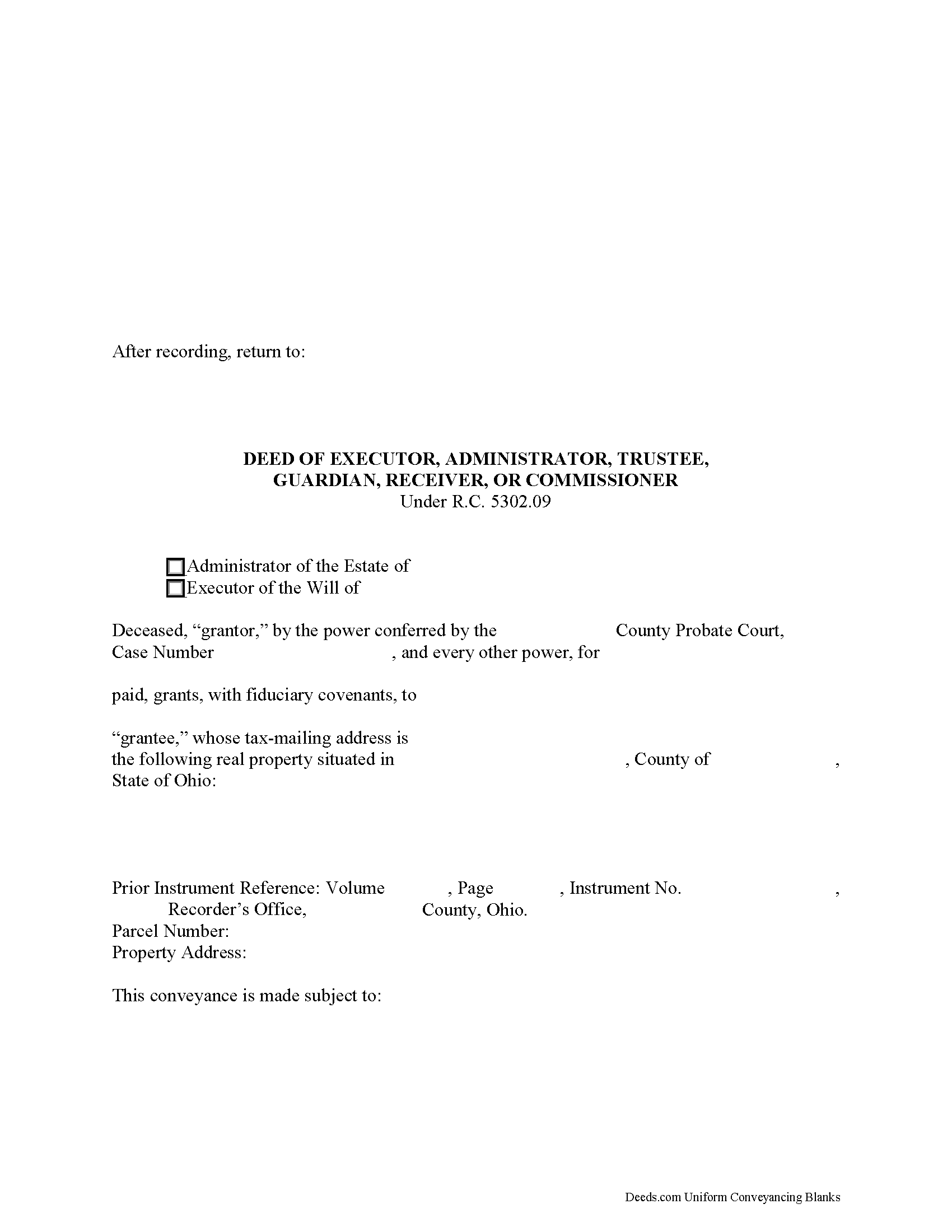

Fill in the blank form formatted to comply with all recording and content requirements.

Clinton County Fiduciary Deed Guide

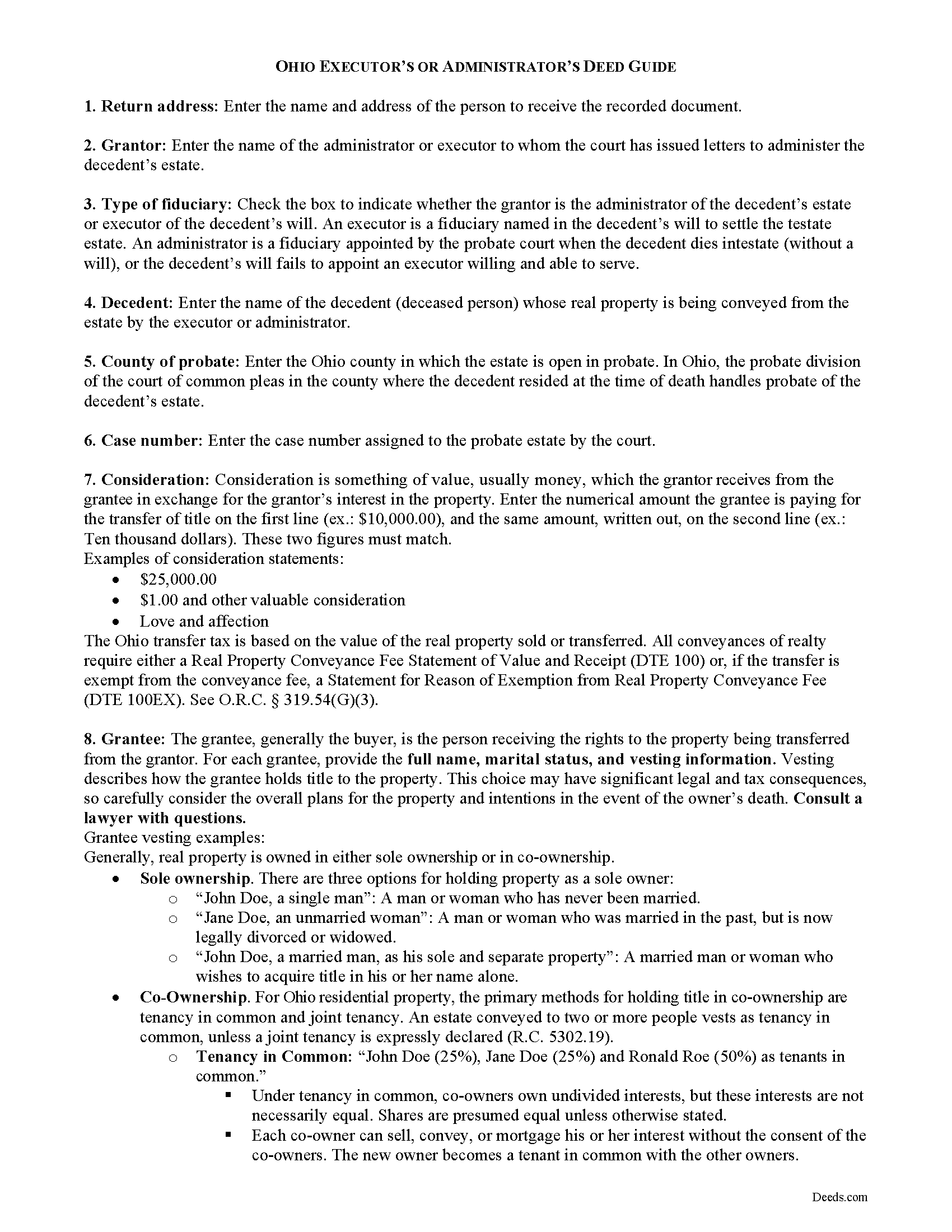

Line by line guide explaining every blank on the form.

Clinton County Completed Example of the Fiduciary Deed Document

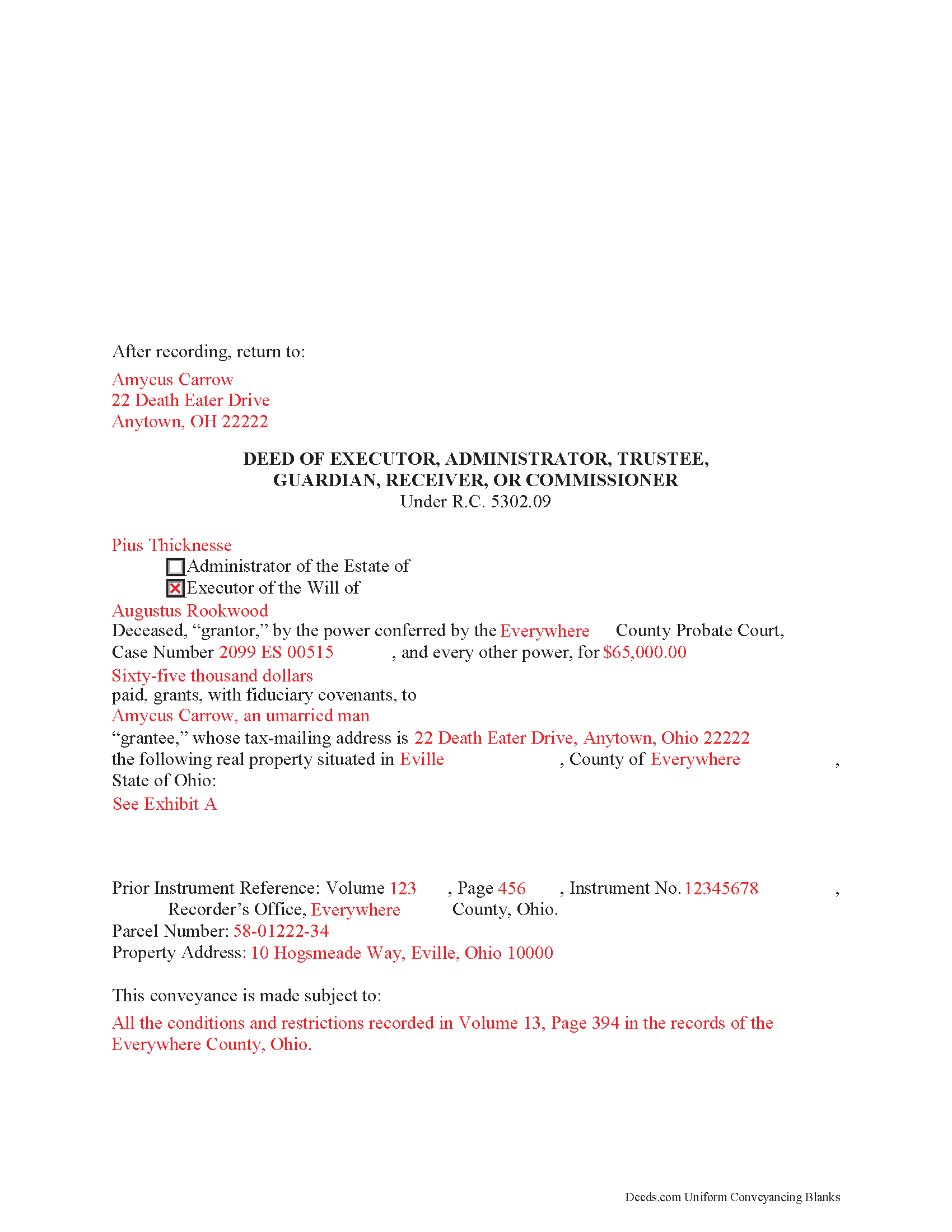

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Ohio and Clinton County documents included at no extra charge:

Where to Record Your Documents

Clinton County Recorder

Wilmington, Ohio 45177

Hours: 8:00 to 4:00 M W F; 8:00 to 12:00 T Th

Phone: 937-382-2067

Recording Tips for Clinton County:

- Bring your driver's license or state-issued photo ID

- Documents must be on 8.5 x 11 inch white paper

- Ask if they accept credit cards - many offices are cash/check only

- Ask for certified copies if you need them for other transactions

Cities and Jurisdictions in Clinton County

Properties in any of these areas use Clinton County forms:

- Blanchester

- Clarksville

- Cuba

- Lees Creek

- Martinsville

- Midland

- New Vienna

- Port William

- Reesville

- Sabina

- Wilmington

Hours, fees, requirements, and more for Clinton County

How do I get my forms?

Forms are available for immediate download after payment. The Clinton County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Clinton County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Clinton County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Clinton County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Clinton County?

Recording fees in Clinton County vary. Contact the recorder's office at 937-382-2067 for current fees.

Questions answered? Let's get started!

Ohio Fiduciary Deed for Executors and Administrators

Probate is the legal process of settling and distributing a decedent's estate according to the terms of a probated will or laws of intestate succession. In the context of estate administration, a fiduciary is either an executor (when named in a will) or an administrator (when the decedent dies without a will or does not name an executor) assigned by the court of common pleas to administer the decedent's estate.

If the estate's assets are insufficient to pay debts, the fiduciary may need to sell the decedent's property. Fiduciaries must obtain the court's permission to sell assets from the estate, unless authorized or directed by the decedent's will.

In Ohio, executors and administrators use fiduciary deeds to convey real property from an estate to a purchaser pursuant to a court order. A fiduciary deed is a statutory form (R.C. 5302.09) containing fiduciary covenants that the grantor is the duly appointed, qualified, and acting fiduciary, and that he or she is authorized to make the sale and conveyance of the within described real property. Additionally, the grantor covenants with the grantee that in the proceedings of the sale, he or she has complied with statutory requirements (5302.10).

A fiduciary deed names the executing fiduciary's as grantor, and identifies the county and case number in which the decedent's estate is opened in probate. The deed states the amount of consideration the grantee is paying for the transfer of title, and titles the property in the name and manner of vesting of the grantee.

Deeds in Ohio require a recital of the grantor's source of title, including the prior instrument volume and page numbers. A full legal description of the subject parcel is required. Any restrictions on the property should also be noted. The executing fiduciary must sign the deed in the presence of a notary public before recording in the county where the subject property is located.

The information provided here is not a substitute for legal advice. Consult an attorney licensed in the State of Ohio with questions regarding fiduciary deeds, as each situation is unique.

(Ohio Fiduciary Deed Package includes form, guidelines, and completed example)

Important: Your property must be located in Clinton County to use these forms. Documents should be recorded at the office below.

This Fiduciary Deed meets all recording requirements specific to Clinton County.

Our Promise

The documents you receive here will meet, or exceed, the Clinton County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Clinton County Fiduciary Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4581 Reviews )

Chad R.

January 31st, 2020

a refreshing web based legal form site Thanks I will recommend to friend

Thank you!

Felincia L.

September 28th, 2024

The process was fast and efficient. I did get a bit confused after entering info for my package but soon realized I had completed this part of the process and only needed to leave the page and wait for review of the document and then the invoice. It was pretty simple. After payment of the invoice I was notified that the document had been submitted. A few hours later I received notice that the document was recorded by the city. It was fast!

We are motivated by your feedback to continue delivering excellence. Thank you!

Glenn N.

February 25th, 2020

Made a hard task easy! Very smooth and we were printed and ready to go

Thank you for your feedback. We really appreciate it. Have a great day!

Mary Ann H.

May 13th, 2020

Great service! Good documents. Easy to use! Thank you!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Carl T.

May 21st, 2020

Very simple to download and manage. very Impressed!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Cheryl M.

April 12th, 2020

Easy.

Thank you!

Philip C.

July 2nd, 2019

The product I purchased looks great and I added Adobe to be able to copy it, but for some reason I can't,so I will delete Adobe and then try again to copy what i paid for. I have all the PDFS' and my computer and printer are fairly new (windows 10),I should have tried to copy it first, I'll get it! Thanks

Thank you for your feedback. We really appreciate it. Have a great day!

Bernard H.

February 1st, 2019

The site is clear and easy to submit requests. I will be using again when needed. No problems and a pleasure to deal with.

Thank you for your feedback. We really appreciate it. Have a great day!

Robert T.

September 23rd, 2019

Very quick thank you.

Thank you!

David S.

August 2nd, 2019

The form was just what I needed for the Circuit Court and Land Records office. The additional information provided was very helpful as well.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Tim T.

August 24th, 2020

Fast and efficient

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Robert M.

May 30th, 2019

Got the documents needed.. simple to use!!!

Thank you Robert, we appreciate your feedback. Have a great day.

Rosa S.

June 6th, 2019

I am pleased with how easy it was to download the will. Now just have to get it filled in and filed at Tax Office. Thank you for making it simple to use.

Thank you for your feedback. We really appreciate it. Have a great day!

Pietrina P.

December 18th, 2020

Recording with Deeds.com was a seamless experience. Communications were timely, clear and professional. When I had a question, I received a prompt email reply. Overall an excellent experience

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Victor K.

January 27th, 2023

The form I needed was correct and paginated as required. It was accepted w/o penalties. I was not happy about the information which I found way too scant. One sample form does not cover enough possibilities, more would be helpful. The instruction page is a bit better but sometimes it is not clear enough - sometimes it is not clear what the numbered items in the form correspond to. There is no guidance about the process and it would take very little to provide it. Example about "description", say where to find. There is a bunch of "free forms" attached but no guide on which are needed and when. Example: at the counter I was given a paper "conveyance" form and asked to fill it - I did not know it was needed and what it did and so I had not d

Thank you for your feedback. We really appreciate it. Have a great day!