Madison County Ohio Limited Power of Attorney for Real Property Form

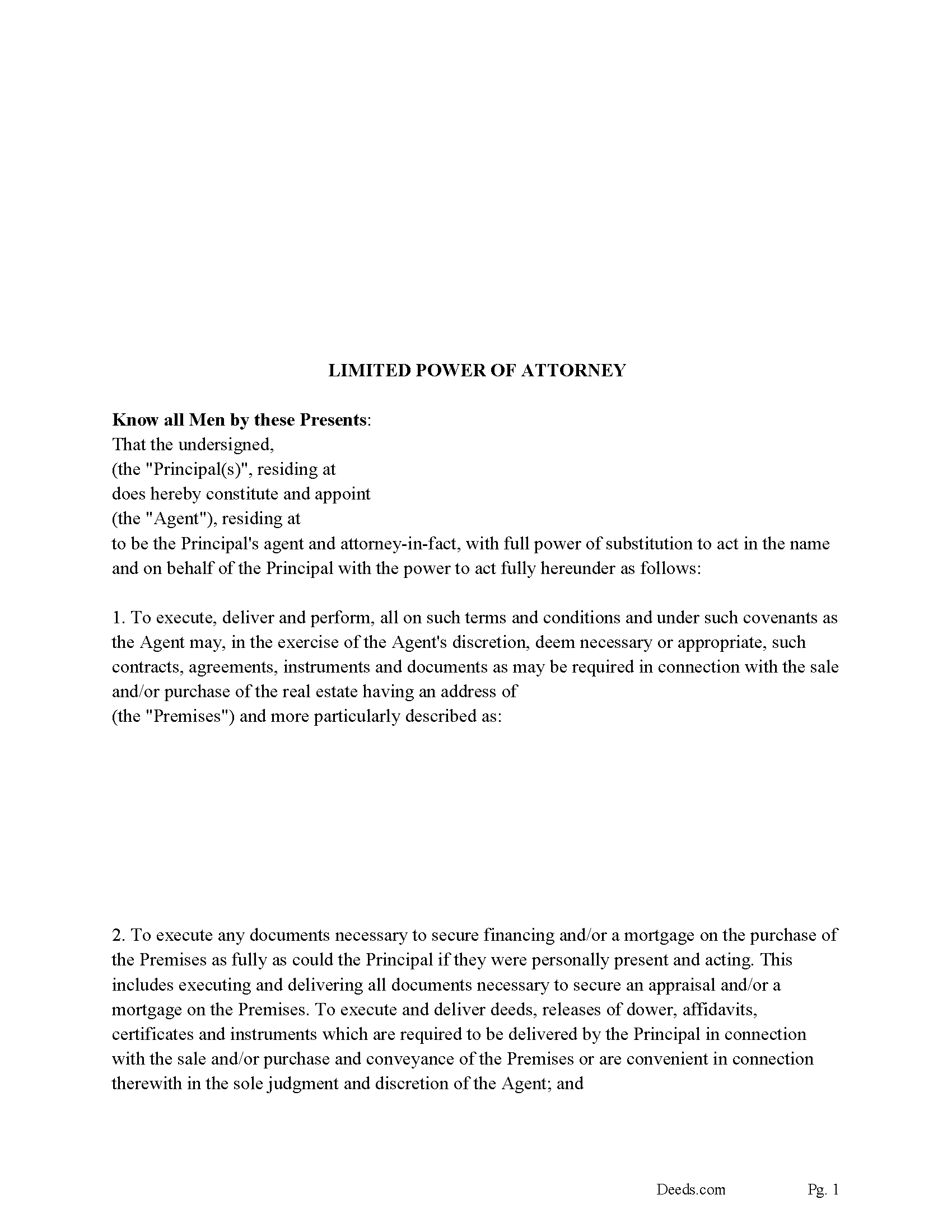

Madison County Limited Power of Attorney Form

Fill in the blank form formatted to comply with all recording and content requirements.

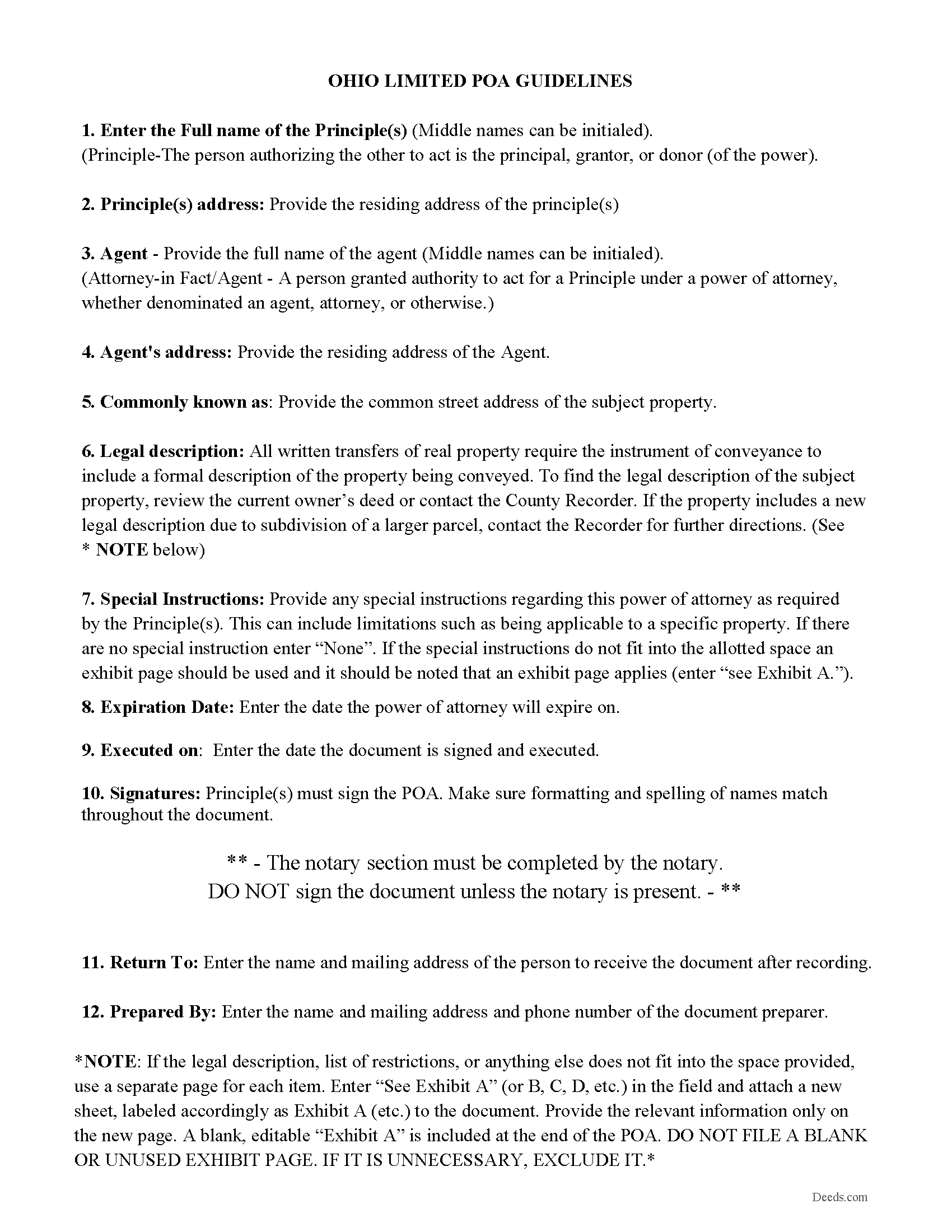

Madison County Limited POA Guidelines

Line by line guide explaining every blank on the form.

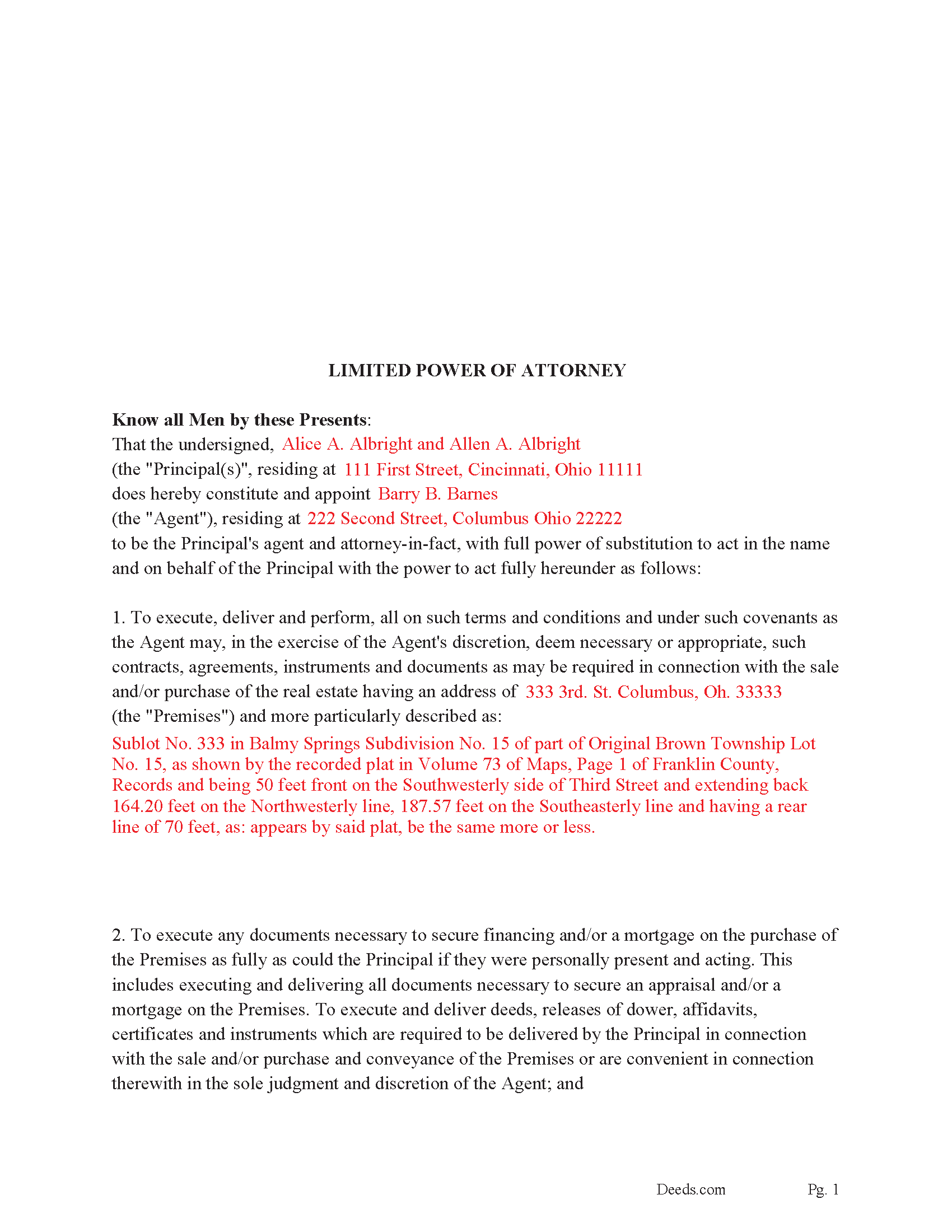

Madison County Completed Example of the Limited POA

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Ohio and Madison County documents included at no extra charge:

Where to Record Your Documents

Madison County Recorder

London, Ohio 43140

Hours: 8:00 a.m. - 4:00 p.m. Monday - Friday

Phone: 740-852-1854

Recording Tips for Madison County:

- White-out or correction fluid may cause rejection

- Double-check legal descriptions match your existing deed

- Leave recording info boxes blank - the office fills these

- Recording fees may differ from what's posted online - verify current rates

- Mornings typically have shorter wait times than afternoons

Cities and Jurisdictions in Madison County

Properties in any of these areas use Madison County forms:

- London

- Mount Sterling

- Plain City

- Sedalia

- South Solon

- West Jefferson

Hours, fees, requirements, and more for Madison County

How do I get my forms?

Forms are available for immediate download after payment. The Madison County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Madison County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Madison County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Madison County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Madison County?

Recording fees in Madison County vary. Contact the recorder's office at 740-852-1854 for current fees.

Questions answered? Let's get started!

This is a LIMITED power of attorney for real property. What is a limited power of attorney? A "limited power of attorney" gives the agent authority to conduct a specific act. For example, a person might use a limited power of attorney to sell and/or purchase a home in another state by delegating authority to another person to handle the transaction locally. Such a power could be "limited" to selling and/or purchasing a home/property or to other specified acts. This form includes a "Special Instructions" section where the principal can further define or limit the Agent's powers.

When the Agent is authorized to transfer interest in real property by (a power of attorney), it (shall be signed, acknowledged, and certified as provided in section 5301.01 of the Revised Code.) (1337.01)

(No deed executed by a person acting for another, under a power of attorney, acknowledged, and recorded, is invalid or defective because he, instead of his principal, is named in such deed as such attorney as grantor; nor because his name, as such attorney, is subscribed to such deed, instead of the name of his principal; nor because the certificate of acknowledgment, instead of setting forth that the deed was acknowledged by the principal, by his attorney, sets forth that it was acknowledged by the person who executed it, as such attorney. All such deeds shall be as valid and effectual, in all respects, within the authority conferred by such powers of attorney, as if they had been executed by the principals of such attorneys, in person.) (1337.03)

(A power of attorney for the conveyance, mortgage, or lease of an interest in real property must be recorded in the office of the county recorder of the county in which such property is situated, previous to the recording of a deed, mortgage, or lease by virtue of such power of attorney.) (1337.04)

(Ohio Limited POA Package includes form, guidelines, and completed example)

Important: Your property must be located in Madison County to use these forms. Documents should be recorded at the office below.

This Ohio Limited Power of Attorney for Real Property meets all recording requirements specific to Madison County.

Our Promise

The documents you receive here will meet, or exceed, the Madison County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Madison County Ohio Limited Power of Attorney for Real Property form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4607 Reviews )

Corinna N.

October 20th, 2024

The website made it easy to find and print out the documents I needed. The whole process was straightforward and user-friendly. Highly recommend!

We are grateful for your feedback and looking forward to serving you again. Thank you!

Gerald M.

November 25th, 2021

So easy to do. The examples and guides are well worth the few $$ this cost. Highly recommend!!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Thomas D.

July 10th, 2019

The site is fine with one exception. About half the pdf files I downloaded were corrupted. I could not open them or view their contents. Fortunately, the link continued to work, so after I discovered this, I downloaded the corrupted files again, and they now seem fine. I do not know if my computer or the website caused this odd problem.

Thank you for your feedback. We really appreciate it. Have a great day!

Melvin M.

June 6th, 2019

loads of forms and instructions....for a good buy...it would help to know where to send the forms after completing them...

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Thomas W.

July 14th, 2020

Very quick and responsive. Faster than finding out by mail if you've done something incorrectly. Very satisfied with offerings and service.

Thank you for your feedback. We really appreciate it. Have a great day!

Alan C.

December 10th, 2020

I thought the instructions could have been a little better. I didn't know how to do this if the spouses are married but living in separate residences. Also I didn't understand the "Prior Instrument Reference". That should be explained better. Very sketchy instructions.

Thank you for your feedback. We really appreciate it. Have a great day!

Michael E.

December 2nd, 2020

First time user and my experience was just great! Great people to work with and would recommend to others!

Thank you!

Shane T.

March 7th, 2020

The Transfer on Death Deed form package was very good. But like anything, could use some improvements. There is not enough space to fill more than one beneficiary with any level of additional detail like "as his sole and separate property" The area for the legal description could be a bit bigger and potentially fit many legal descriptions. Or it could be made to simply say "See Exhibit A" as is likely necessary for most anyway. The guide should indicate what "homestead property" means so the user doesn't have to research the legal definition. (which turns out to be obvious, at least in my state, if you live there, it's your homestead.) It would be helpful if an "Affidavit of Death" form were included in the package for instances where the current deed hasn't been updated to reflect a widowed owner as the sole owner before recording with only the one signature.

Thank you for your feedback. We really appreciate it. Have a great day!

Charles D.

July 22nd, 2023

Good product!! I highly recommend.

Thank you!

Monica M.

September 15th, 2020

I was very impressed with the quick responses I received from my questions. Usually when forced to communicate via email, responses aren't received right away. Thank you for being on top of things.

Thank you!

Teresa R.

May 7th, 2022

FANTASTIC. Sometimes we think know something, glad I found out I was wrong before it was too late.

Thank you!

Jill R.

May 12th, 2025

So helpful and extremely responsive. Such a convenient way to record deeds.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Beverly J. A.

April 24th, 2022

Thank you for the paperwork. It was so much easier to do at home than go out and have to have people miss work.

Thank you!

Lorie C.

April 15th, 2023

Easy and effective...surely saved hundreds by avoiding a lawyer.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Julie G.

December 15th, 2020

Such a great site!! Everyone is so helpful! Thanks again! Julie

We appreciate your business and value your feedback. Thank you. Have a wonderful day!