Henry County Partial Release of Mortgage Form

Henry County Ohio Partial Release of Mortgage Form

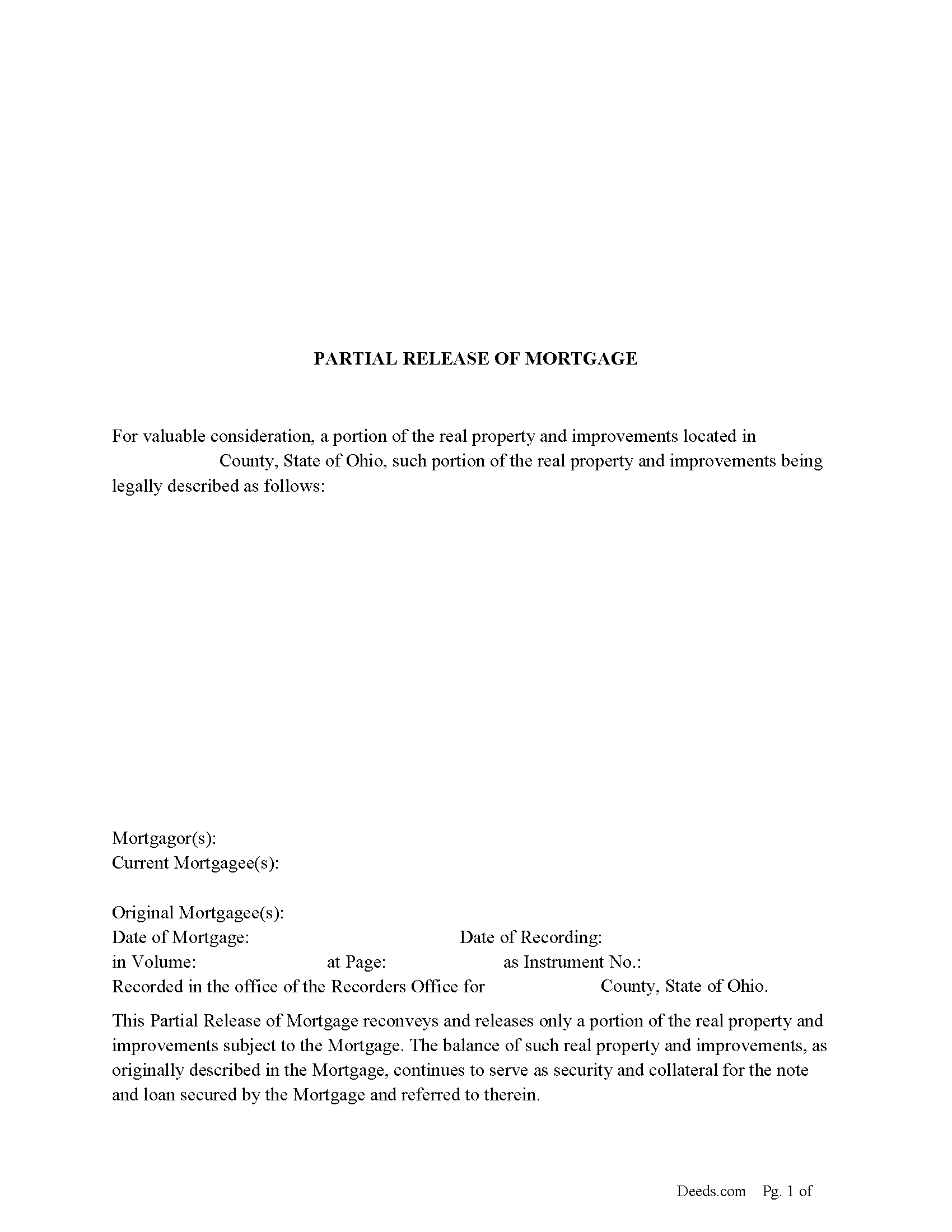

Fill in the blank form formatted to comply with all recording and content requirements.

Henry County Guidelines for Partial Release of Mortgage

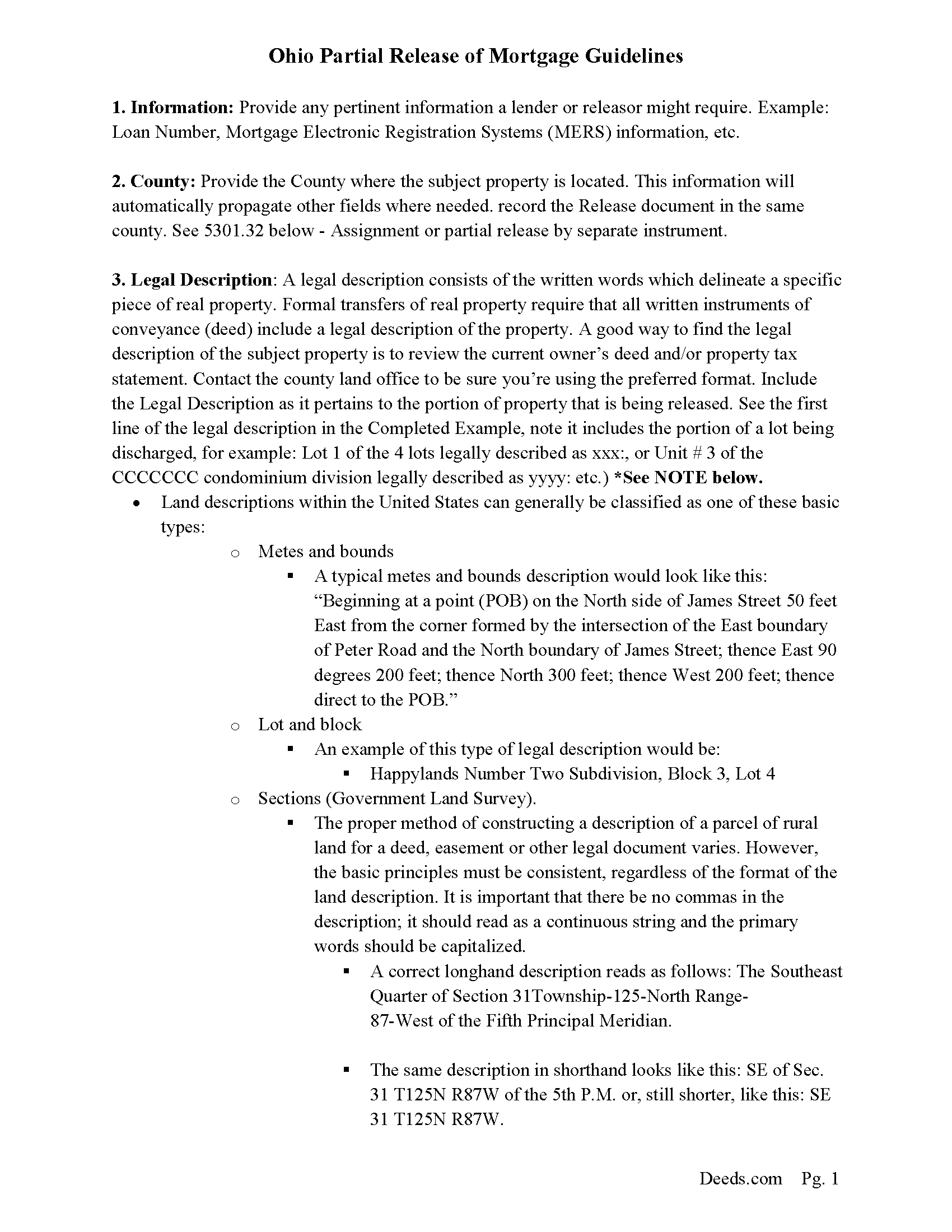

Line by line guide explaining every blank on the form.

Henry County Completed Example of the Partial Release of Mortgage Document

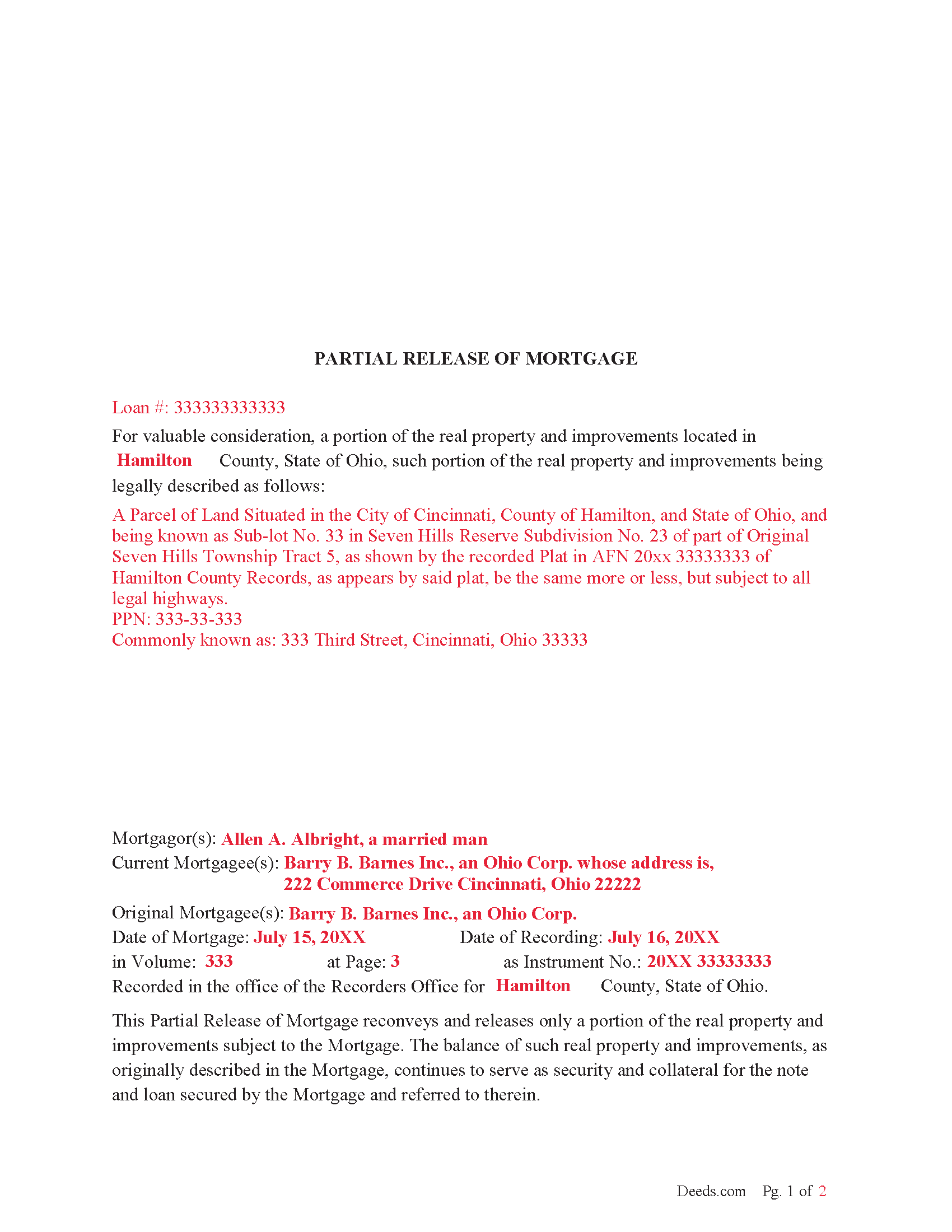

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Additional Ohio and Henry County documents included at no extra charge:

Where to Record Your Documents

Henry County Recorder

Address:

Courthouse - 660 N Perry St, Rm 202

Napoleon, Ohio 43545

Hours: 8:30am to 4:30pm Monday through Friday

Phone: (419) 592-1766

Recording Tips for Henry County:

- Ensure all signatures are in blue or black ink

- Double-check legal descriptions match your existing deed

- Request a receipt showing your recording numbers

Cities and Jurisdictions in Henry County

Properties in any of these areas use Henry County forms:

- Colton

- Deshler

- Grelton

- Hamler

- Holgate

- Liberty Center

- Malinta

- Mc Clure

- Napoleon

- New Bavaria

- Okolona

- Ridgeville Corners

How do I get my forms?

Forms are available for immediate download after payment. The Henry County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Henry County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Henry County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Henry County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Henry County?

Recording fees in Henry County vary. Contact the recorder's office at (419) 592-1766 for current fees.

Have other questions? Contact our support team

Use this form to release only a portion of the real property and improvements subject to the Mortgage. For example: A mortgage is $200,000.00 and covers 5 condominiums. The borrower says, "I have one sold and would like to put the proceeds towards the mortgage to reduce the debt". In this case the lender might think, "Yes this makes since" or let's say the borrower owes on 5 lots with a mortgage of $100,000.00 but has since paid down the mortgage to $40,000.00. and wants to sell a lot, the lender might think, "This is a good risk I will release this lot." In both cases the lender is only releasing the subject condo or lot and the full lien remains on the existing properties. This form would be considered a partial release by (separate instrument). See Oh statute 5301.32 below.

5301.31 Assignment or partial release in margin of original record.

Except in counties in which a separate instrument is required to assign or partially release a mortgage as described in section 5301.32 of the Revised Code, a mortgage may be assigned or partially released by the holder of the mortgage, by writing the assignment or partial release on the original mortgage or upon the margin of the record of the original mortgage and signing it. The assignment or partial release need not be acknowledged, but, if it is written upon the margin of the record of the original mortgage, the signing shall be attested by the county recorder. The assignment, whether it is upon the original mortgage, upon the margin of the record of the original mortgage, or by separate instrument, shall transfer not only the lien of the mortgage but also all interest in the land described in the mortgage. An assignment of a mortgage shall contain the then current mailing address of the assignee. The signature of a person on the assignment or partial release may be a facsimile of that person's signature. A facsimile of a signature on an assignment or partial release is equivalent to and constitutes the written signature of the person for all requirements regarding mortgage assignments or partial releases.

For entering an assignment or partial release of a mortgage upon the margin of the record of the original mortgage or for attesting it, the recorder shall be entitled to the fee provided by section 317.32 of the Revised Code for recording the assignment and satisfaction of mortgages.

5301.32 Assignment or partial release by separate instrument.

A mortgage may be assigned or partially released by a separate instrument of assignment or partial release, acknowledged as provided by section 5301.01 of the Revised Code. The separate instrument of assignment or partial release shall be recorded in the county recorder's official records. The county recorder shall be entitled to charge the fee for that recording as provided by section 317.32 of the Revised Code for recording deeds. The signature of a person on the assignment or partial release may be a facsimile of that person's signature. A facsimile of a signature on an assignment or partial release is equivalent to and constitutes the written signature of the person for all requirements regarding mortgage assignments or partial releases.

In a county in which the county recorder has determined to use the microfilm process as provided by section 9.01 of the Revised Code, the county recorder may require that all assignments and partial releases of mortgages be by separate instruments. The original instrument bearing the proper endorsement may be used as the separate instrument.

An assignment of a mortgage shall contain the then current mailing address of the assignee.

(Ohio Partial Release of Mortgage Package includes form, guidelines, and completed example)

Important: Your property must be located in Henry County to use these forms. Documents should be recorded at the office below.

This Partial Release of Mortgage meets all recording requirements specific to Henry County.

Our Promise

The documents you receive here will meet, or exceed, the Henry County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Henry County Partial Release of Mortgage form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4569 Reviews )

Ute P.

February 14th, 2019

Thank you it was hard for me to pull these documents online you been a big help since I am in a different state, quick and awesome.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Terri S.

October 16th, 2019

Form was easy to complete, price was reasonable and everything worked out just fine. Would absolutely use this service again if needed, Thank you :)

Thank you for your feedback. We really appreciate it. Have a great day!

michael b.

June 26th, 2020

Your web site is very user friendly and easy to navigate I was very pleased with the experience

Thank you!

jeann p.

September 19th, 2024

The site was extremely helpful.

We are delighted to have been of service. Thank you for the positive review!

SHASTA S.

February 13th, 2020

Ordered quitclaim deed form for Knox county Illinois. It got the job done however it was not a very good format. I had to explain all to the county recorder & was worried she would reject it. I would not recommend this item.

Thank you!

Mark C.

November 29th, 2023

WOW! I am so pleased the County Registrar’s office recommended Deeds.com. From start to a very quick finish Deeds.com worked to ensure my documents were correct and they immediately filed them. The Warranty Deed was accepted by the County and registered within a hour. Deeds.com’s communication was superb. I will use this handy resource every time I am in need.

Your feedback is greatly appreciated. Thank you for taking the time to share your experience!

Nancy J.

February 14th, 2019

Forms were not to hard to fill out, Will go to Douglas County Oregon Recorders office in a few weeks and hope I filled them out correctly.

Thank you for your feedback. We really appreciate it. Have a great day!

Kimberly B.

September 22nd, 2020

Absolutely recommend Deeds.com! The process to recording your document is explained step by step. If you have any questions, you just send a message and almost instantly a staff member will reply. Super quick processing. I uploaded my document late Friday afternoon, it was reviewed by Deeds.com staff and sent to the county for recording on Monday. By Tuesday, my document was successfully recorded by the County Recorder's Office and a copy of my recorded document was available for me, as well!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Jonathan W.

March 7th, 2023

Deeds gave me the forms and the guidance that I needed. If I had paid a pro for this service it would have cost at least $300.

Thank you for your feedback. We really appreciate it. Have a great day!

Joseph P.

April 28th, 2023

I purchased the Affidavit of Surviving Joint Tenant document and found the whole package of documents to be useful and practical. Successfully recorded!!! While the fillable PDF files are good enough, I personally prefer a Word document as it is easier to modify font or spacing.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Jena S.

April 7th, 2020

I love how quick the turnaround is, my only request would be for an email notification be sent once an invoice is ready and then once a document is recorded and ready to download (only because I have a large caseload and it's very easy to forget things sometimes).

Thank you!

Clint E.

September 3rd, 2020

Good value. I like not only getting the forms, but also the instructions and examples the forms came with

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

R Rodney H.

January 29th, 2019

Excellent service--I got just the information I needed quickly and reasonably priced. I am glad to know of this service for future needs, as an individual, in this sector. Cheers, RRH

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Anna S.

July 17th, 2020

You guys are awesome, The service, expertise and quick communication were amazing. I think you guys are charging to little, but you didn't hear that from me. Thank you for making this process quick and easy.

Thank you for your feedback. We really appreciate it. Have a great day!

Brenda S.

April 9th, 2021

Awesome forms, filled them out on my computer, printed them out complete, notarized, recorded, wonderful process. THANKS

Thank you for the kind words Brenda. Have a great day!