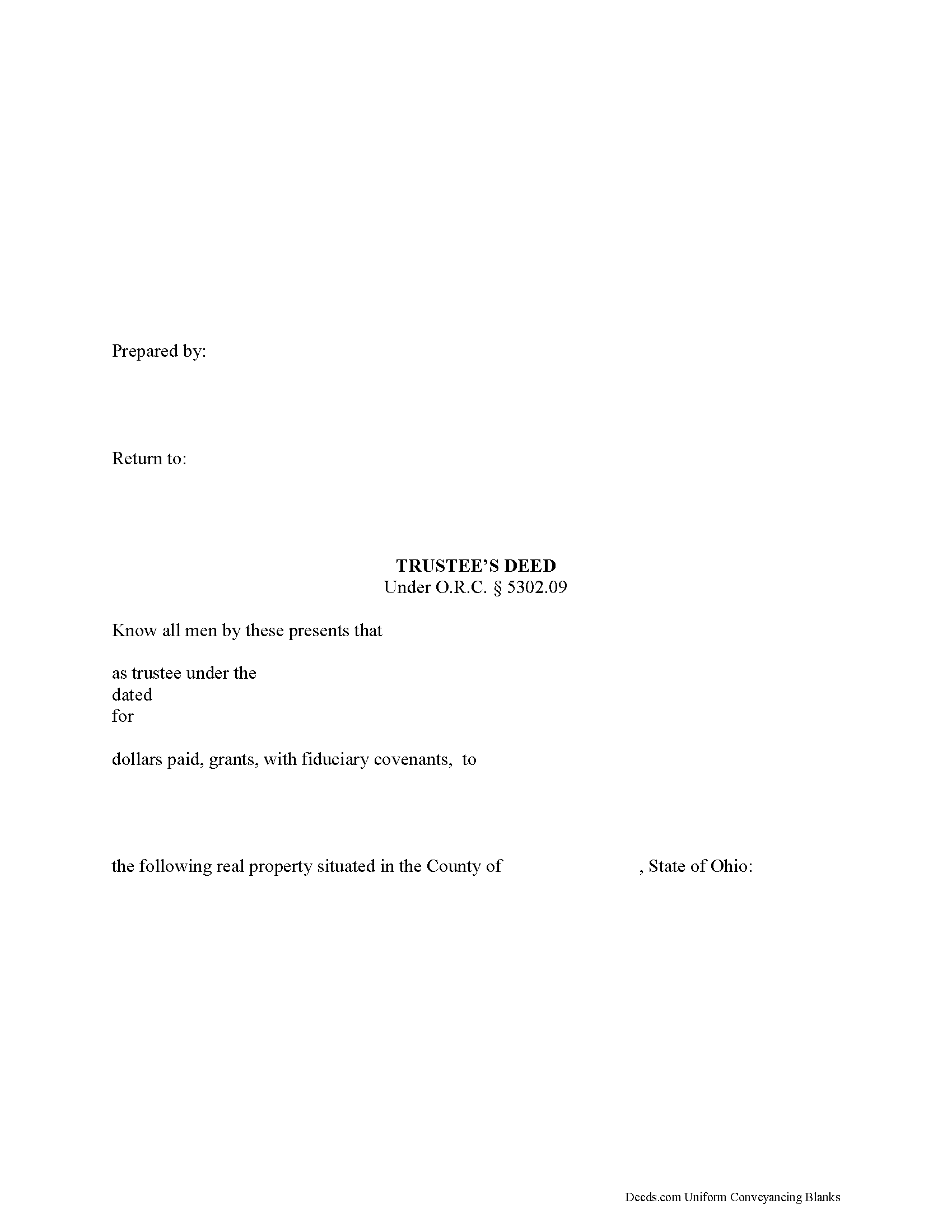

Huron County Trustee Deed Form

Huron County Trustee Deed Form

Fill in the blank form formatted to comply with all recording and content requirements.

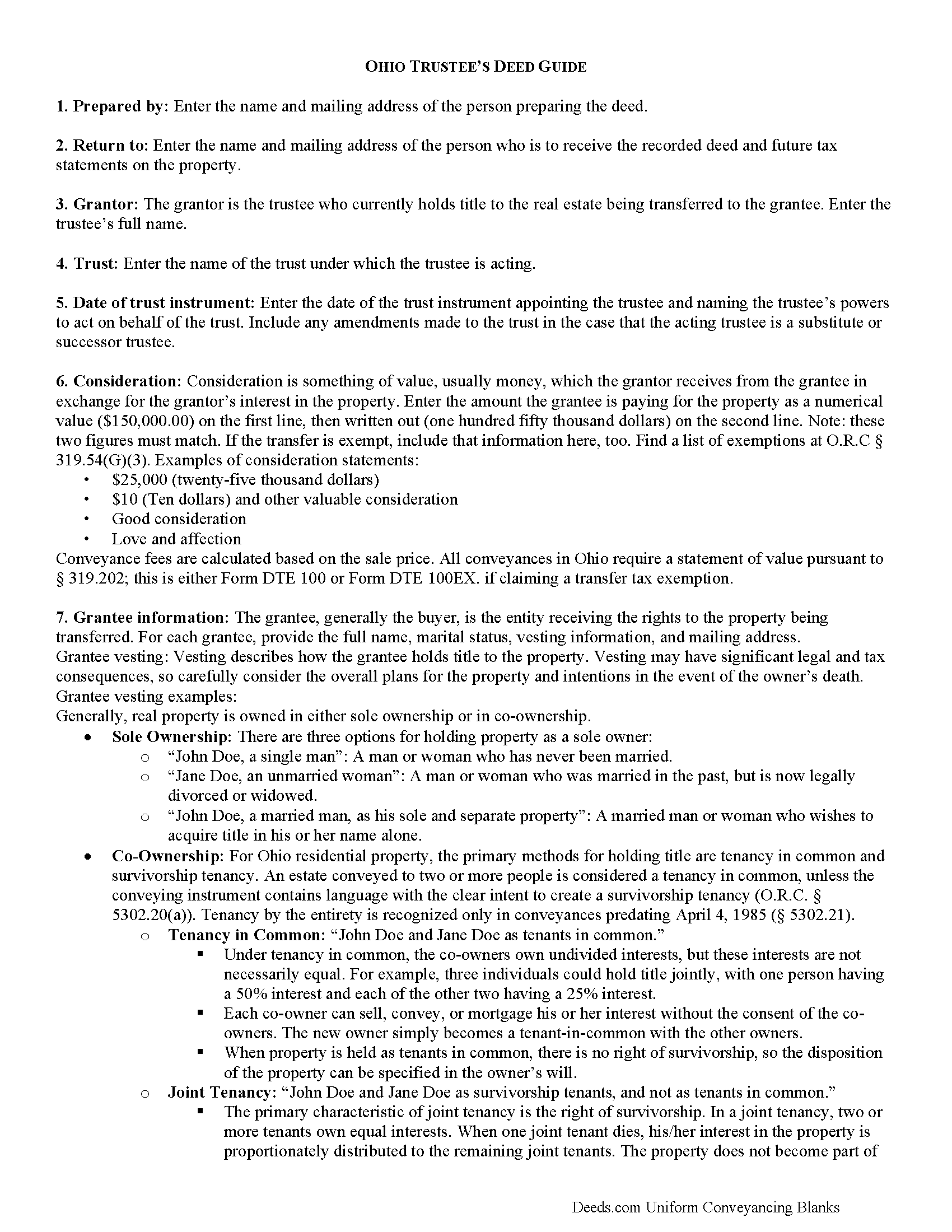

Huron County Trustee Deed Guide

Line by line guide explaining every blank on the form.

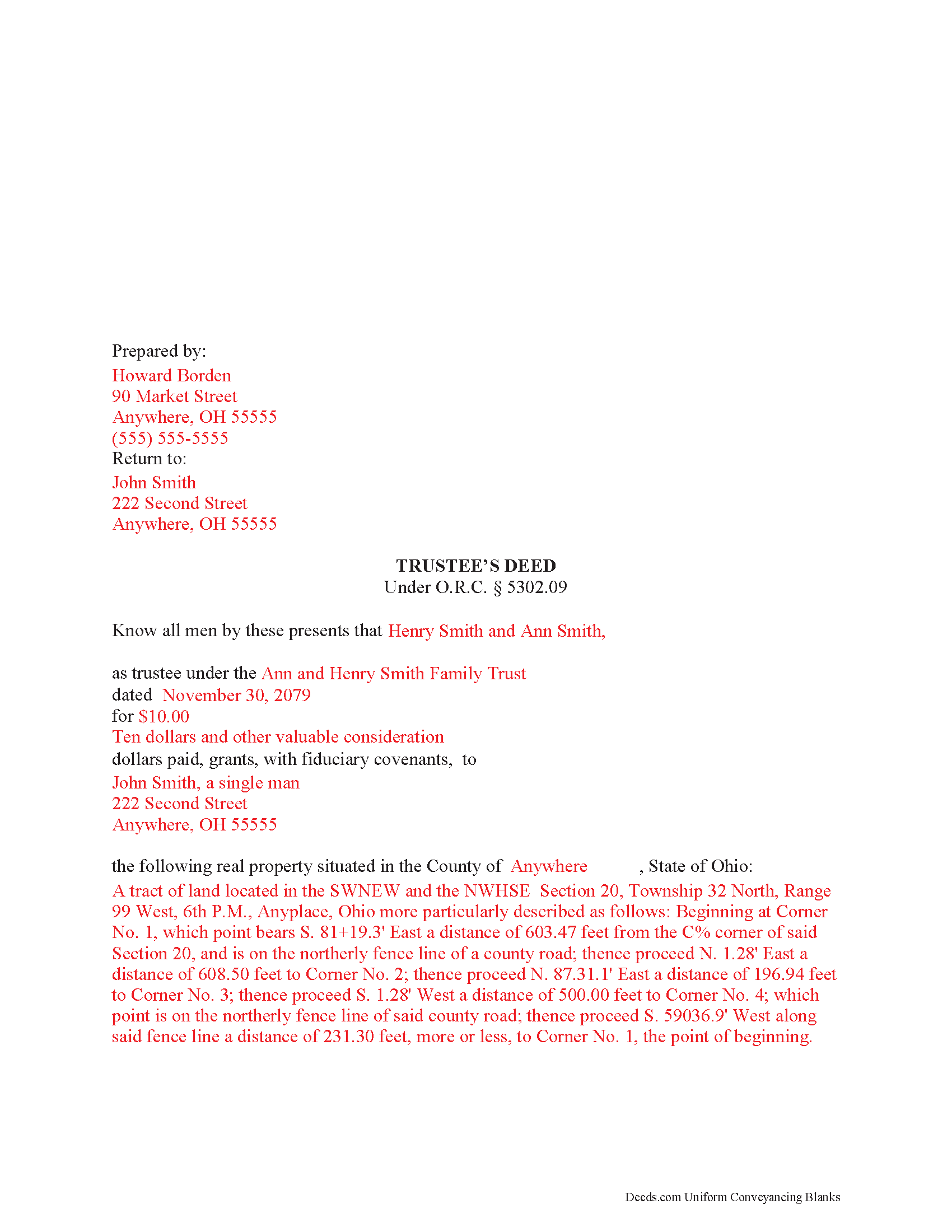

Huron County Completed Example of the Trustee Deed Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Ohio and Huron County documents included at no extra charge:

Where to Record Your Documents

Huron County Recorder

Norwalk, Ohio 44857

Hours: 8:00 a.m. - 4:30 p.m. Monday - Friday / Same-day recording until 4:20 p.m.

Phone: (419) 668-1916

Recording Tips for Huron County:

- Ensure all signatures are in blue or black ink

- Recorded documents become public record - avoid including SSNs

- Avoid the last business day of the month when possible

- Recording fees may differ from what's posted online - verify current rates

Cities and Jurisdictions in Huron County

Properties in any of these areas use Huron County forms:

- Bellevue

- Collins

- Greenwich

- Monroeville

- New Haven

- New London

- North Fairfield

- Norwalk

- Plymouth

- Wakeman

- Willard

Hours, fees, requirements, and more for Huron County

How do I get my forms?

Forms are available for immediate download after payment. The Huron County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Huron County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Huron County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Huron County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Huron County?

Recording fees in Huron County vary. Contact the recorder's office at (419) 668-1916 for current fees.

Questions answered? Let's get started!

Ohio Trustee's Deed

Ohio Revised Code Section 5302.09 outlines the general form of a deed for use by individuals serving as fiduciaries, including trustees. A fiduciary is a person who is appointed to manage someone else's assets, often for the benefit of a third party.

Trustee's deeds are used in trust administration to convey real property out of a trust. A settlor creates a trust, typically for estate planning purposes, and funds it with assets that can include both real and personal property. The trustee controls the trust's assets for the settlor, according to the terms of the trust document. If the settlor directs the trustee to transfer real property out of the trust, the trustee executes a trustee's deed; the settlor is not involved in the conveyance. This is useful because leaving the settlor's name off the transfer it maintains his/her privacy.

In Ohio, the basic trustee's deed is similar to a quitclaim deed, in that it offers no warranty of title. Depending on the situation, the trustee might add guarantees to bring the deed in line with special warranty or warranty deeds.

The trustee's deed must fulfill all requirements for instruments affecting real property in the State of Ohio (legal description, Parcel ID, prior instrument reference, etc.). In addition, it names the trustee as the grantor and provides basic information about the trust under which the trustee is acting. A memorandum of trust (O.R.C. 5301.255) is sometimes included to verify the trust's existence and the trustee's authority to act on behalf of the trust. As with other instruments, the deed requires a signature and acknowledgment in the presence of a notary. It is recorded in the county where the property is situated.

Trust law can quickly become complicated, and each situation is unique. Contact a lawyer with any specific questions and for guidance on trust law.

(Ohio Trustee Deed Package includes form, guidelines, and completed example)

Important: Your property must be located in Huron County to use these forms. Documents should be recorded at the office below.

This Trustee Deed meets all recording requirements specific to Huron County.

Our Promise

The documents you receive here will meet, or exceed, the Huron County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Huron County Trustee Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4581 Reviews )

Shelleen A.

May 11th, 2022

Very helpful.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Steven S.

December 31st, 2021

Accurate and informative, great site for deed forms.

Thank you for your feedback. We really appreciate it. Have a great day!

Beaugwynn Wigley S.

October 26th, 2021

Thanks so much for all your help! That was painless.

Thank you!

Julia M.

June 26th, 2024

I live in AZ and have an existing beneficiary deed on my property. I needed to know the process of revoking a beneficiary deed. Your site was very helpful by providing the correct form and instructions for recording it. Thank you!

Your satisfaction with our services is of utmost importance to us. Thank you for letting us know how we did!

Nanette G.

March 4th, 2020

The Website was easy to use. I live in Houston Texas and mother recently passed away in California and I need affidavit of joint tenant forms. I was provided all the forms necessary to complete the documents. I had been a legal secretary in California about 20 years ago and just need the current forms and received them all very quickly.

Thank you!

Tonni L.

June 15th, 2021

Quick and easy with great instructions and accurate documents. I plan to make this site a part of our financial planning. Highly recommend. Saved big by this DIY process. TL

Thank you for your feedback. We really appreciate it. Have a great day!

Suzanne A.

February 25th, 2024

The purchase and download from Deeds.com were pleasantly straightforward. The actual of filing not so obvious in our case.

Your insights are invaluable to us and help us strive for better service. Thank you for taking the time to share your thoughts.

Agnes I H.

January 28th, 2019

Good knowing the price right up front...and not a FREE one you pay at the end....

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Christina W.

September 4th, 2019

I stand corrected. I received my report and it was exactly what I requested.

Thank you!

Rosemary W.

February 27th, 2021

considering the current epidemic your fees save me time and parking fees. with help from DC recorder of deeds I was directed to the correct link to process my deed

Thank you for your feedback. We really appreciate it. Have a great day!

Julie A.

November 23rd, 2021

This process was so easy. I am pleased with efficiency and ease of it all.

Thank you!

Anna S.

July 17th, 2020

You guys are awesome, The service, expertise and quick communication were amazing. I think you guys are charging to little, but you didn't hear that from me. Thank you for making this process quick and easy.

Thank you for your feedback. We really appreciate it. Have a great day!

Kevin M.

April 2nd, 2022

good so far. will wait to see what happens

Thank you!

Kathy-Louise A.

February 9th, 2025

I found the process of downloading and completing the documents very user friendly. Thank you for the Declare Value instructions. It was easy to follow, though a sample of the declaration form would be very useful. I didn't know how to list my "capacity" so I left it blank so the recorder could advise me. Otherwise, thank you so much for being available for people who are capable of completing simple legal tasks without the expense of a lawyer. Thank you, thank you, thank you!!!

Your appreciative words mean the world to us. Thank you.

Barbara D.

October 9th, 2019

Appreciate this service!

Thank you!