Champaign County Unconditional Lien Waiver Form

Champaign County Unconditional Lien Waiver Form

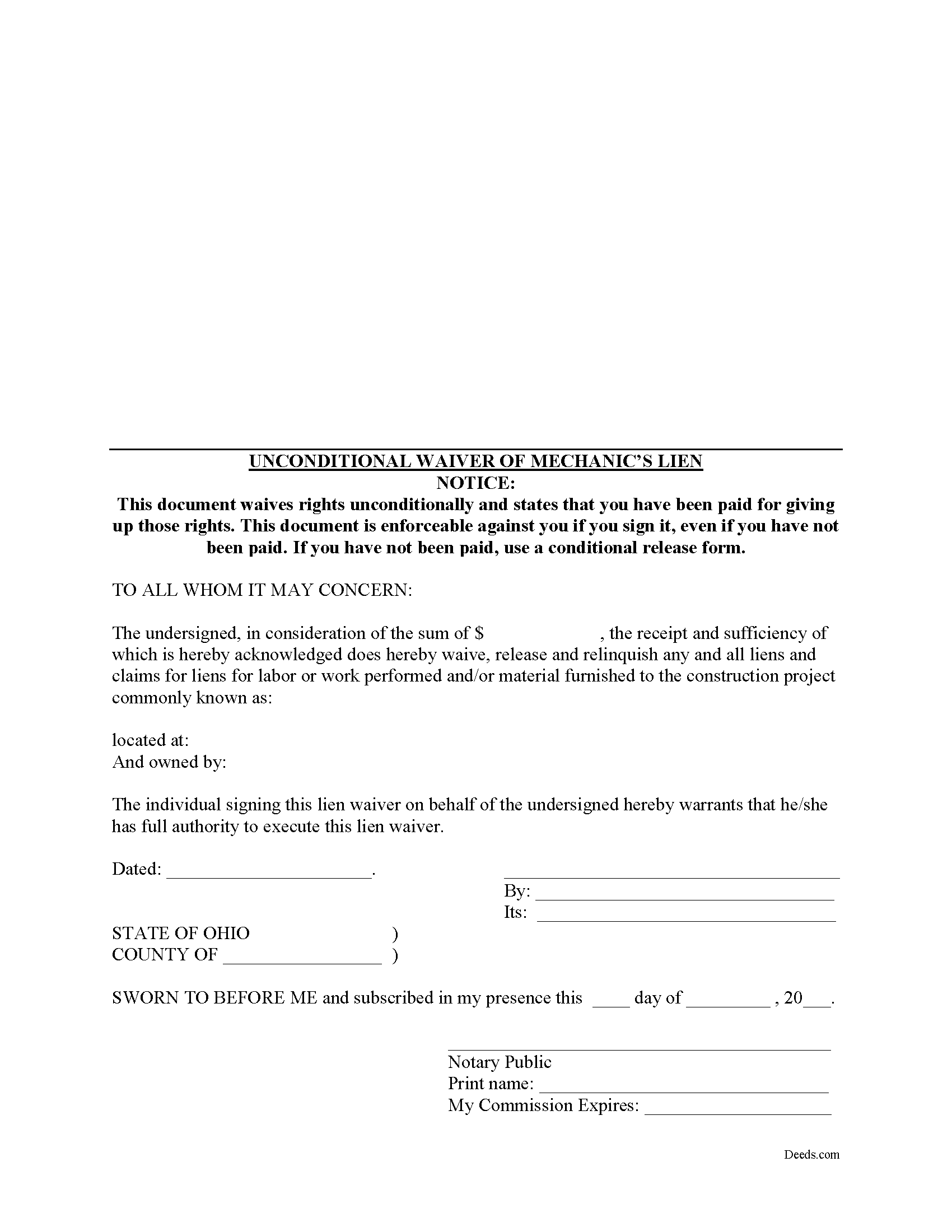

Fill in the blank Unconditional Lien Waiver form formatted to comply with all Ohio recording and content requirements.

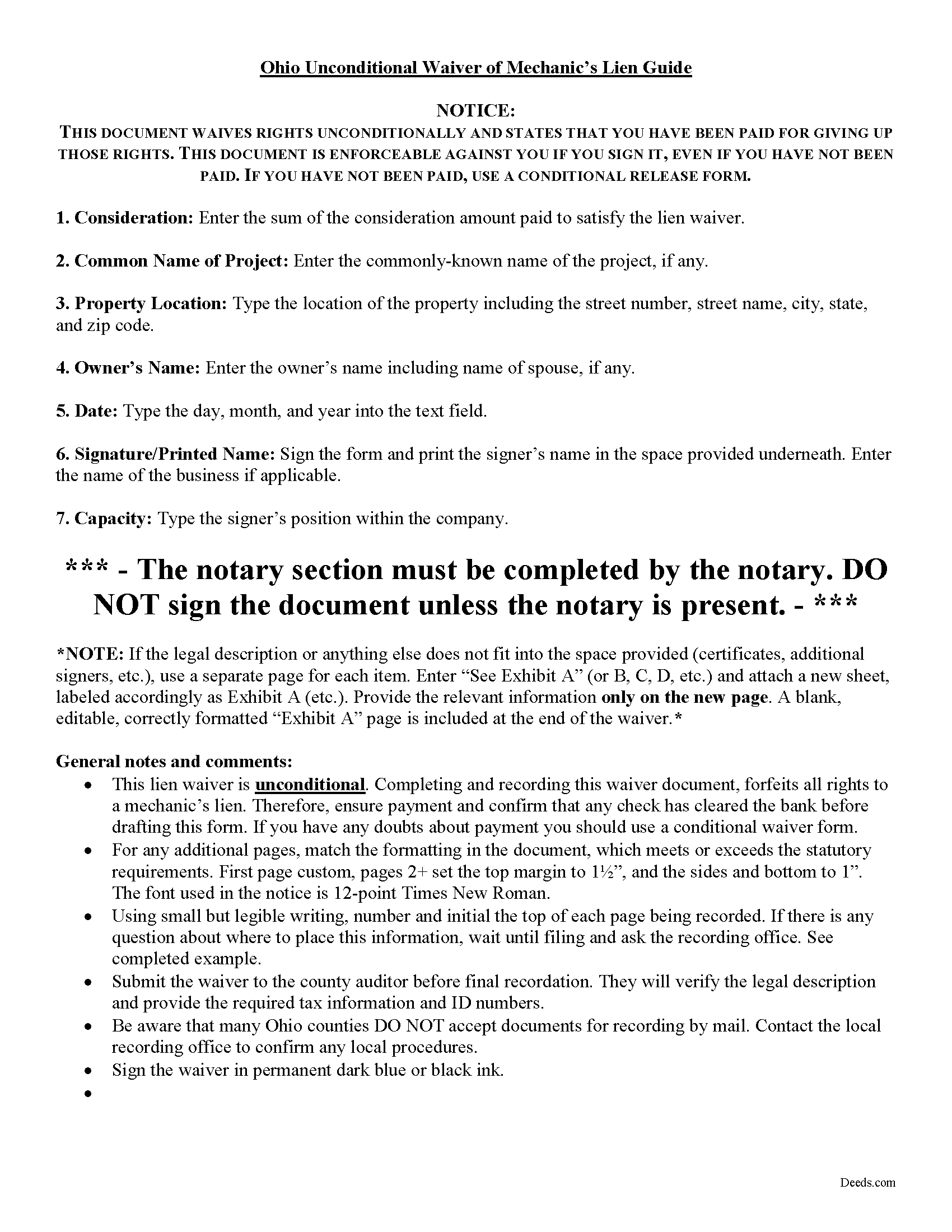

Champaign County Unconditional Lien Waiver Guide

Line by line guide explaining every blank on the form.

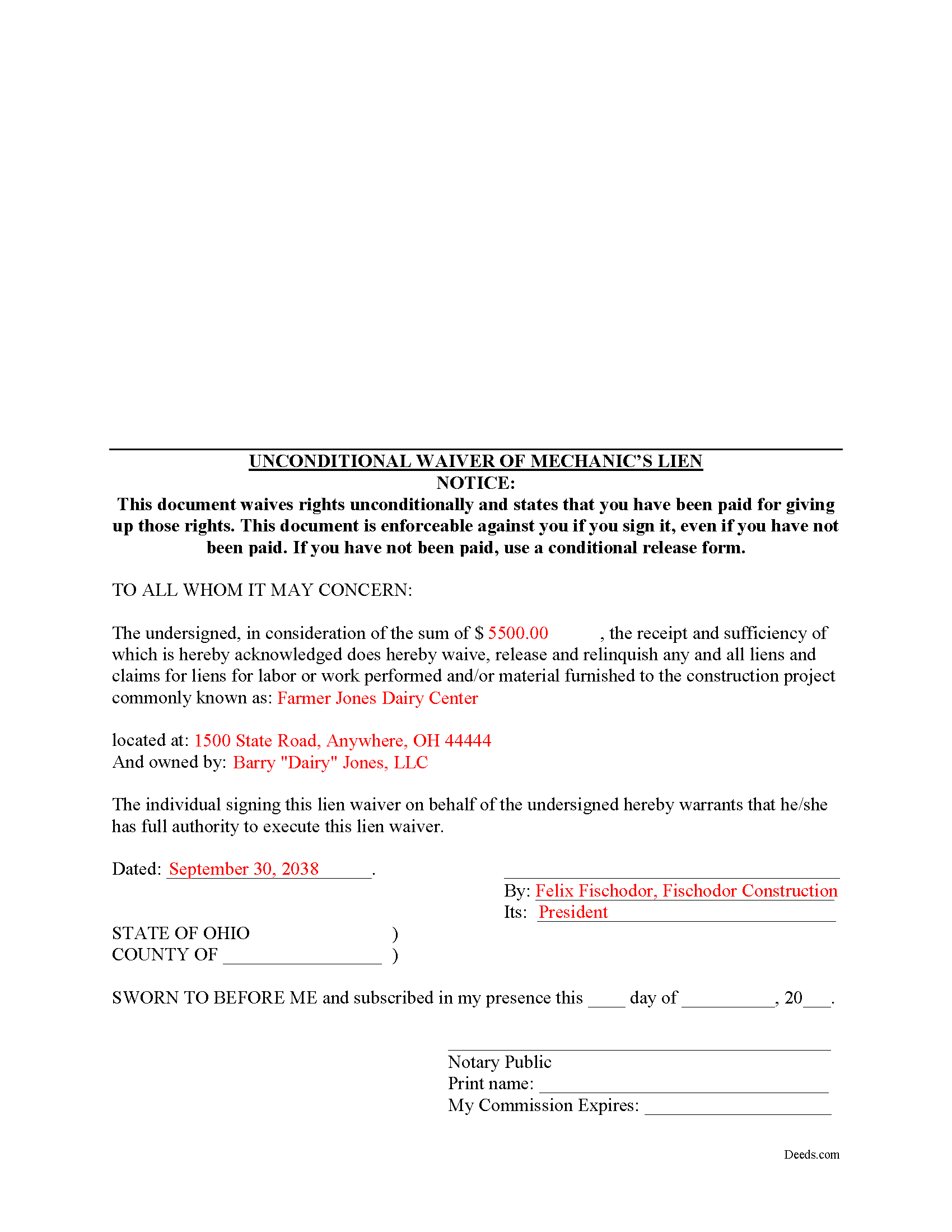

Champaign County Completed Example of the Unconditional Lien Waiver Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Ohio and Champaign County documents included at no extra charge:

Where to Record Your Documents

Champaign County Recorder

Urbana, Ohio 43078

Hours: 8:00am to 4:00pm M-F

Phone: (937) 484-1630

Recording Tips for Champaign County:

- Documents must be on 8.5 x 11 inch white paper

- Double-check legal descriptions match your existing deed

- Multi-page documents may require additional fees per page

- Bring multiple forms of payment in case one isn't accepted

Cities and Jurisdictions in Champaign County

Properties in any of these areas use Champaign County forms:

- Cable

- Christiansburg

- Mechanicsburg

- Mingo

- North Lewisburg

- Rosewood

- Saint Paris

- Urbana

- Westville

- Woodstock

Hours, fees, requirements, and more for Champaign County

How do I get my forms?

Forms are available for immediate download after payment. The Champaign County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Champaign County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Champaign County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Champaign County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Champaign County?

Recording fees in Champaign County vary. Contact the recorder's office at (937) 484-1630 for current fees.

Questions answered? Let's get started!

Ohio's mechanic's lien law does not provide for a statutory lien waiver form, but Ohio courts recognize elective lien waivers under principles of contract law. The waivers identify the claimant, the party responsible for paying, the project, relevant dates, and the amount paid. Sign the completed waiver in front of a notary, then record it in the land records of the county where the project is located.

In general, a lien waiver is used to release an owner's property from a lien claim, either in full or in part, and either conditional, meaning the payment must clear the bank prior to waiving lien rights, or unconditional, meaning that the claimant waives the lien immediately, regardless of whether or not the payment clears the bank.

For instance, if the customer owes $5,000.00 on a construction job and remits a partial payment of $2,500.00, the payor may request a waiver that states he or she has paid that amount and in turn the claimant will give up the right to a lien for $2,500.00 of the total amount. If the check has not yet cleared the bank, use a conditional waiver that is only effective upon actual receipt of payment. If the payment is confirmed, use the unconditional waiver form.

Claimants should exercise extreme caution when using an unconditional waiver. Do not be intimidated by a demand for an unconditional waiver if there is any question about the payment. This is a common trick in the construction industry with devastating consequences, and may lead to forfeiting lien rights without ever being paid. If a claimant waives lien rights too early, the only remedy might be a time-consuming and expensive lawsuit.

Each case is unique, and the lien law is complicated, so contact an attorney familiar with Ohio mechanic's liens with specific questions or for complex situations.

Important: Your property must be located in Champaign County to use these forms. Documents should be recorded at the office below.

This Unconditional Lien Waiver meets all recording requirements specific to Champaign County.

Our Promise

The documents you receive here will meet, or exceed, the Champaign County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Champaign County Unconditional Lien Waiver form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4581 Reviews )

Dianne C.

July 13th, 2023

Love it

Thank you!

Joyce D.

January 27th, 2019

Good after I figured out the form process. Hopefully I won't be charged for two as I redid the request thinking I might have made a mistake in the first request.

Thank you for your feedback Joyce. We have reviewed your account and there have been no duplicate orders submitted. Have a great day!

sharon s.

October 22nd, 2020

great site for downloading forms

Thank you!

Kelly S.

May 19th, 2020

Fast, easy, responsive.

Thank you!

dorothy f.

March 27th, 2019

Thank you, for help.

Anytime Dorothy, have a great day.

DENNIS K.

July 22nd, 2020

I am a civil engineer, not an attorney. I deal with easements on a regular basis but not so much on the "recording" side of things. I normally prepare the graphic exhibits that accompany the dedication language but I am not the one who provides that language. Your forms solved that issue for me. Thanks.

Thank you!

Bobette B.

September 26th, 2019

Worked well with clear guide!

Thank you!

Judy K.

February 23rd, 2021

Your customer service is superb. I ordered the wrong form, and you were so quick to resolve my problem. I will be using your site again.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

GERALD P.

September 19th, 2019

Product is as advertised. Most beneficial is including detailed instructions and examples. Most other options did not include instructions.

Thank you for your feedback. We really appreciate it. Have a great day!

Diane P.

July 22nd, 2022

Form was very easy to use and was processed/ recorded with no issue. Thank you it saved me from having to contact an attorney.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Will C.

April 8th, 2019

I was very happy with my interaction. The county didn't supply the book and page which was what I needed. The tech refunded my money since I didn't get the info I needed. I will use Deeds.com again.

Thank you for your feedback. We really appreciate it. Have a great day!

Theodore K.

September 8th, 2021

This does the job but we are not able to save this in our account and if you don't pay for Adobe and only have Adobe reader, I cannot save any information on the form online in my account. I do understand why they do this because they would lose money. A huge issue is that when I got to the end of the document and was adding an Exhibit A, as I typed, the page kept jumping back up the to top and I couldn't see what I was typing. I had to type a little then scroll back down and when I would type more, it would jump up again. This was a real problem.

Thank you for your feedback. We really appreciate it. Have a great day!

Jennifer R.

January 8th, 2022

The recording service has been very easy to use. It is efficient and no hassle.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Luis C.

May 10th, 2019

Excellent forms but the instructions are not to clear.

Thank you for your feedback. We really appreciate it. Have a great day!

Tonia H.

October 6th, 2021

Could not be happier with the forms received. Everything went smooth from completing them to getting them recorded. No easy feat with our recorder, always seems to be an issue but not this time... Very Happy!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!