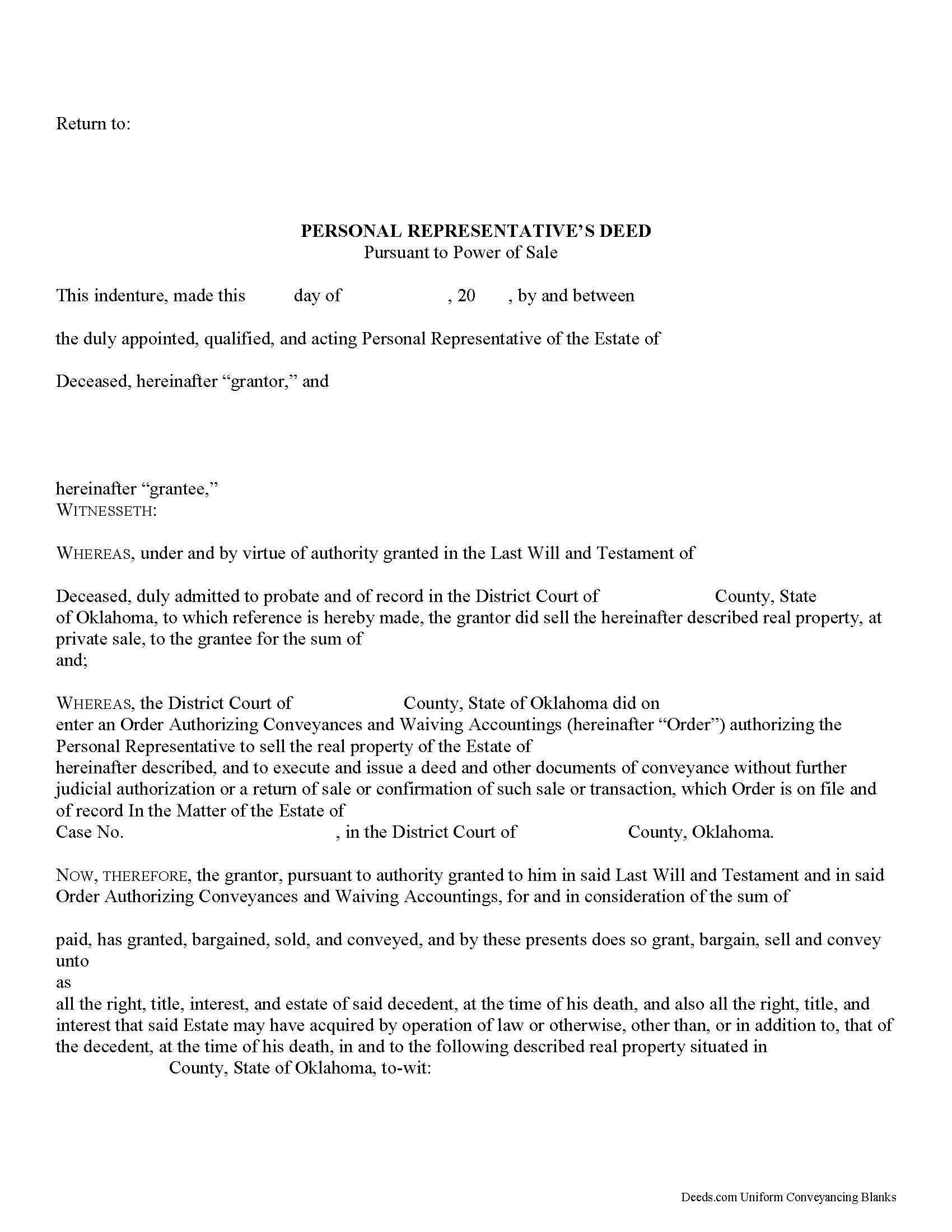

Pushmataha County Personal Representative Deed Power of Sale Form

Pushmataha County Personal Representative Deed Power of Sale Form

Fill in the blank form formatted to comply with all recording and content requirements.

Pushmataha County Personal Representative Deed Power of Sale Guide

Line by line guide explaining every blank on the form.

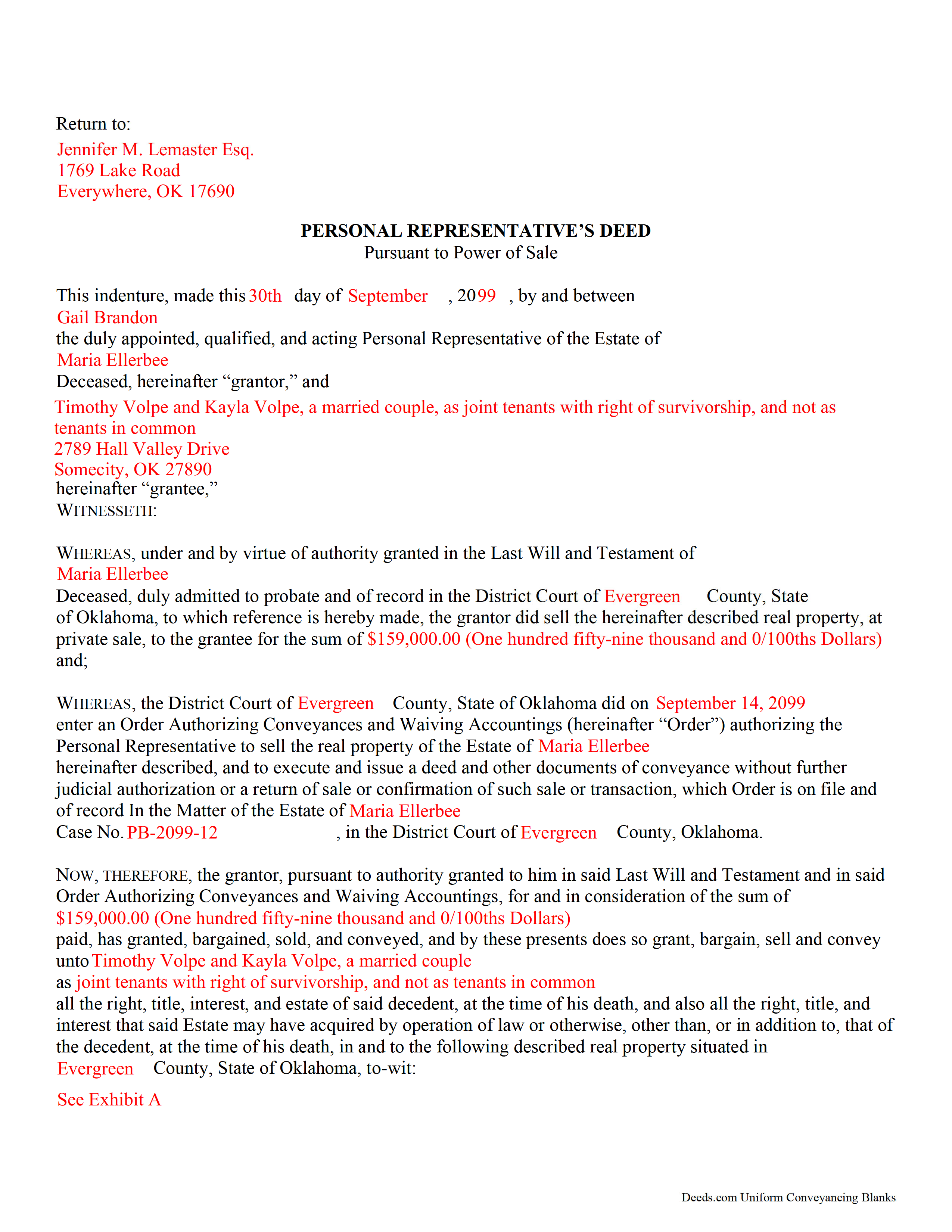

Pushmataha County Completed Example of the Personal Representative Deed Power of Sale Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Oklahoma and Pushmataha County documents included at no extra charge:

Where to Record Your Documents

Pushmataha County Clerk

Antlers, Oklahoma 74523

Hours: 8:00 to 4:30 M-F

Phone: (580) 298-3626

Recording Tips for Pushmataha County:

- Leave recording info boxes blank - the office fills these

- Avoid the last business day of the month when possible

- Multi-page documents may require additional fees per page

Cities and Jurisdictions in Pushmataha County

Properties in any of these areas use Pushmataha County forms:

- Albion

- Antlers

- Clayton

- Finley

- Moyers

- Nashoba

- Rattan

- Snow

- Tuskahoma

Hours, fees, requirements, and more for Pushmataha County

How do I get my forms?

Forms are available for immediate download after payment. The Pushmataha County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Pushmataha County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Pushmataha County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Pushmataha County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Pushmataha County?

Recording fees in Pushmataha County vary. Contact the recorder's office at (580) 298-3626 for current fees.

Questions answered? Let's get started!

A personal representative's deed given under the power of sale is a probate deed, and one of several fiduciary instruments that may be used in estate administration. This deed is required when the personal representative is directed to sell property by a decedent's will. It can only be used by PRs of a testate estate. The personal representative's (PR) deed is named after the capacity of the granting party.

In some cases, the decedent's will may have authorized or explicitly directed a sale of realty by granting the executor (the PR named in a decedent's will) a power of sale. Before a deed can be recorded, the district court must authorize the sale and conveyance. The PR must apply to the court for an Order Authorizing Conveyances and Waiving Accountings.

Following such an order from the district court, use a personal representative's deed to transfer an interest in real property from a probate estate to a purchaser at private sale. The deed conveys all the right, title, interest, and estate of the decedent at the time of his death.

In addition to meeting all state and local standards for recorded documents, components of a properly executed PR deed include the recital of probate details, including the name of the court-appointed personal representative, the decedent's name, the date of the order authorizing the conveyance, the case number assigned to the probate estate, and a statement that the sale is made under the authority granted by the decedent's last will and testament.

Other requirements for a lawful deed include the full legal description of the property and statement of consideration, reflecting the value exchanged for the transfer of title. In Oklahoma, deeds commonly recite a generic consideration of "Ten and No/100ths Dollars," with the true purchase price reflected on an Affidavit of Purchase Price. This affidavit is a tool for the register's office to calculate the documentary stamp tax, a tax levied on all transfers of real estate in Oklahoma. Note any exemption from the tax under 68 O.S. 3202 on the face of the instrument.

Record the completed, signed, and notarized deed, along with a certified copy of the order of sale, signed by a judge, in the office of the register of deeds in the county wherein the property is situated.

The information provided here is not a substitute for legal advice. Consult an attorney licensed in the State of Oklahoma with questions regarding personal representative's deeds, as each situation is unique.

(Oklahoma PRD Power of Sale Package includes form, guidelines, and completed example)

Important: Your property must be located in Pushmataha County to use these forms. Documents should be recorded at the office below.

This Personal Representative Deed Power of Sale meets all recording requirements specific to Pushmataha County.

Our Promise

The documents you receive here will meet, or exceed, the Pushmataha County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Pushmataha County Personal Representative Deed Power of Sale form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4585 Reviews )

Earnest K.

January 8th, 2025

I used the "personal representative's deed." There were a few errors, after I went to record it at the county recorder's office. For #7, it should've stated "The estate of Joe Schmoe, hereby grants Mr. Personal Representative....." instead of, "I Mr. Personal Representative, as personal representative, hereby grant to personal representative...." The person at the recorder's office said you cannot state "you are granting property to yourself." Just fix that, and everything else is fine.

Your insights are invaluable to us and help us strive for better service. Thank you for taking the time to share your thoughts.

Daren K.

April 29th, 2019

Awesome, so far. Thanks

Thank you!

Carol R.

February 19th, 2023

I found the site to be useful,informative and very accessable. Thank You

Thank you!

Chuck M.

May 30th, 2019

Easy to use service. However, the product that I purchased did not meet my needs. No fault of the company.

Thank you for your feedback Chuck. We certainly don't want you to purchase something you can not use. We have canceled your order and payment. Have a wonderful day.

Thomas E.

December 18th, 2018

Great, immediate access to everything I needed to assist my client! This is truly a great resource for a Notary Public! I will surely keep my account open, and will refer others as well!

Thank you for the Kind words Thomas. We really appreciate you! Have a great day.

Gertrude M.

January 31st, 2023

Rating 5 stars

Thank you!

WILLIAM H.

April 17th, 2021

i also need a "NOTE" and this trust deed is not exactly what i wanted. it may work but not to well.

Thank you for your feedback. We really appreciate it. Have a great day!

Christine K.

March 26th, 2021

This site was fast and easy to use. I would highly recommend using them. Thank you Deeds.com!!!!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Phyllis B.

May 24th, 2022

I saved a ton of money doing it on my own versus through legal counsel. When I took it to the auditor/recorder today, there was absolutely no problems.

Thank you for your feedback. We really appreciate it. Have a great day!

Patricia R.

September 26th, 2022

Great Transaction. Easy to follow instructions!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Joyce K.

June 21st, 2019

I was very happy with this site. It included all the papers I needed, instructions, and even an example sheet to work from. The papers are now filed and done with ease. Thank you!

Thank you for your feedback. We really appreciate it. Have a great day!

Albert G.

December 7th, 2019

Download was smooth. I'll post an update after I get a change to work with the forms.

Thank you!

Jill C.

March 6th, 2023

Easy directions for document information.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Mark W.

December 19th, 2022

Great form and easy to complete. Sending a sample and instructions was very helpful. Thank you!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Richard T.

July 15th, 2021

Amazing service from competent individuals that really go above and beyond to get you documents processed.

Thank you!