Linn County Trust Deed and Promissory Note Form

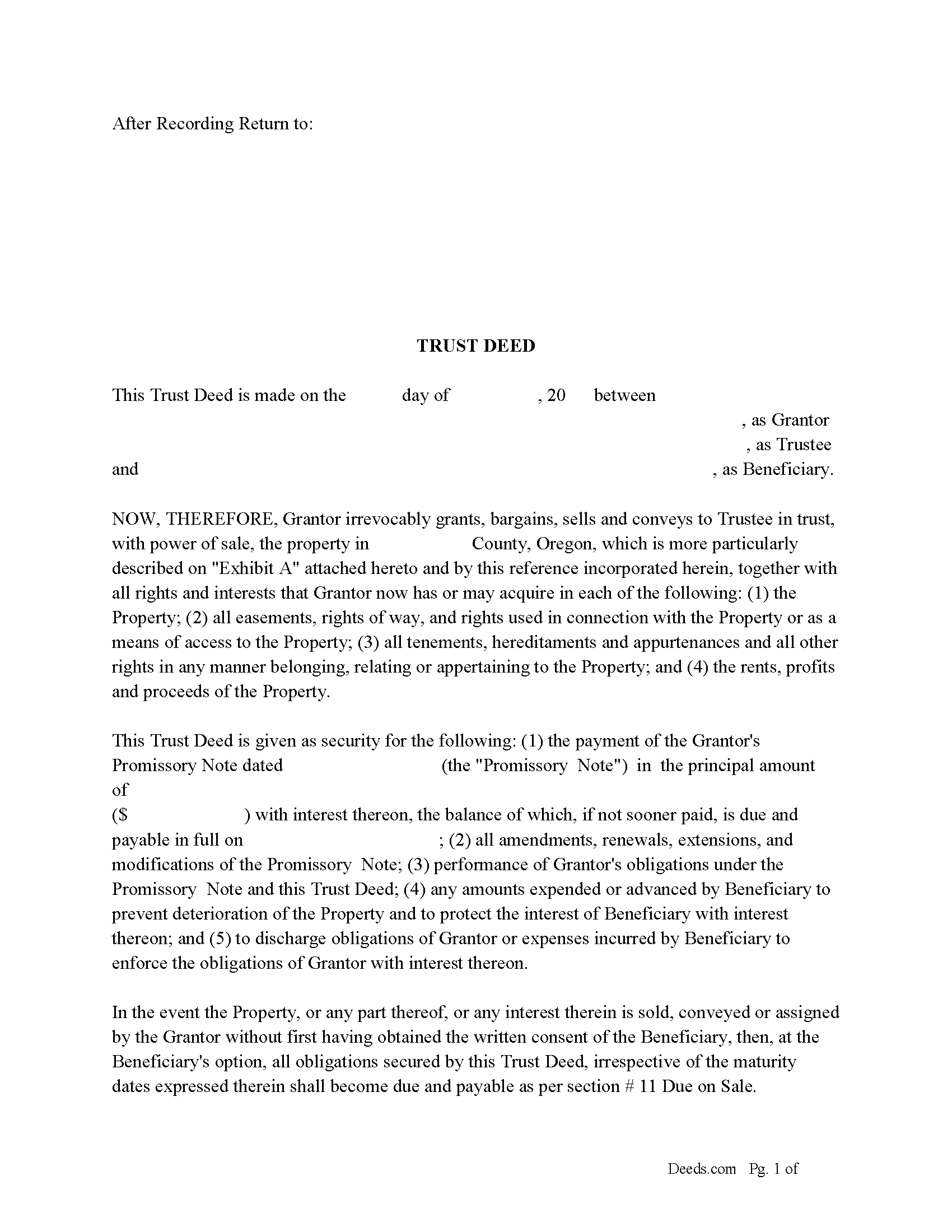

Linn County Trust Deed Form

Fill in the blank form formatted to comply with all recording and content requirements.

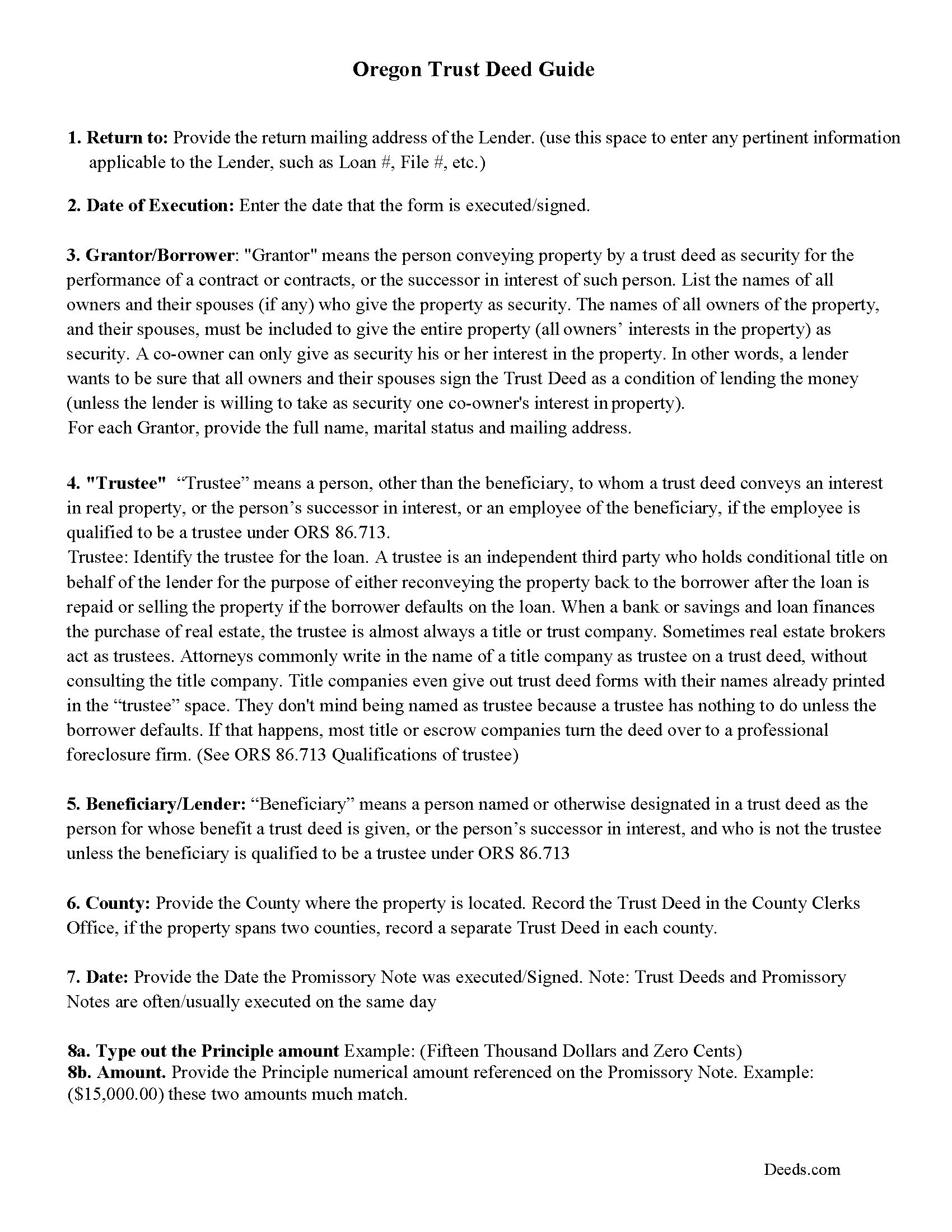

Linn County Trust Deed Guidelines

Line by line guide explaining every blank on the form.

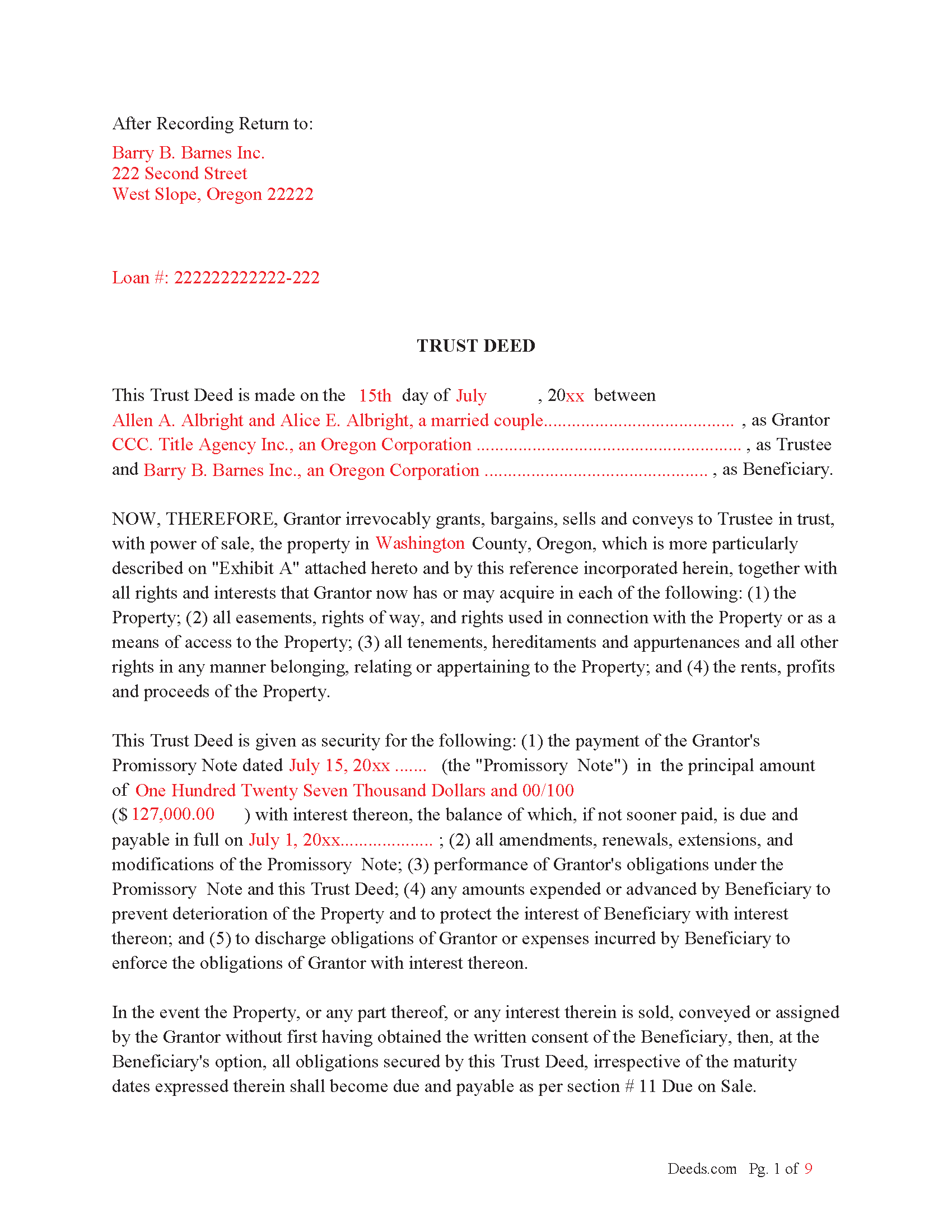

Linn County Completed Example of the Trust Deed Document

Example of a properly completed form for reference.

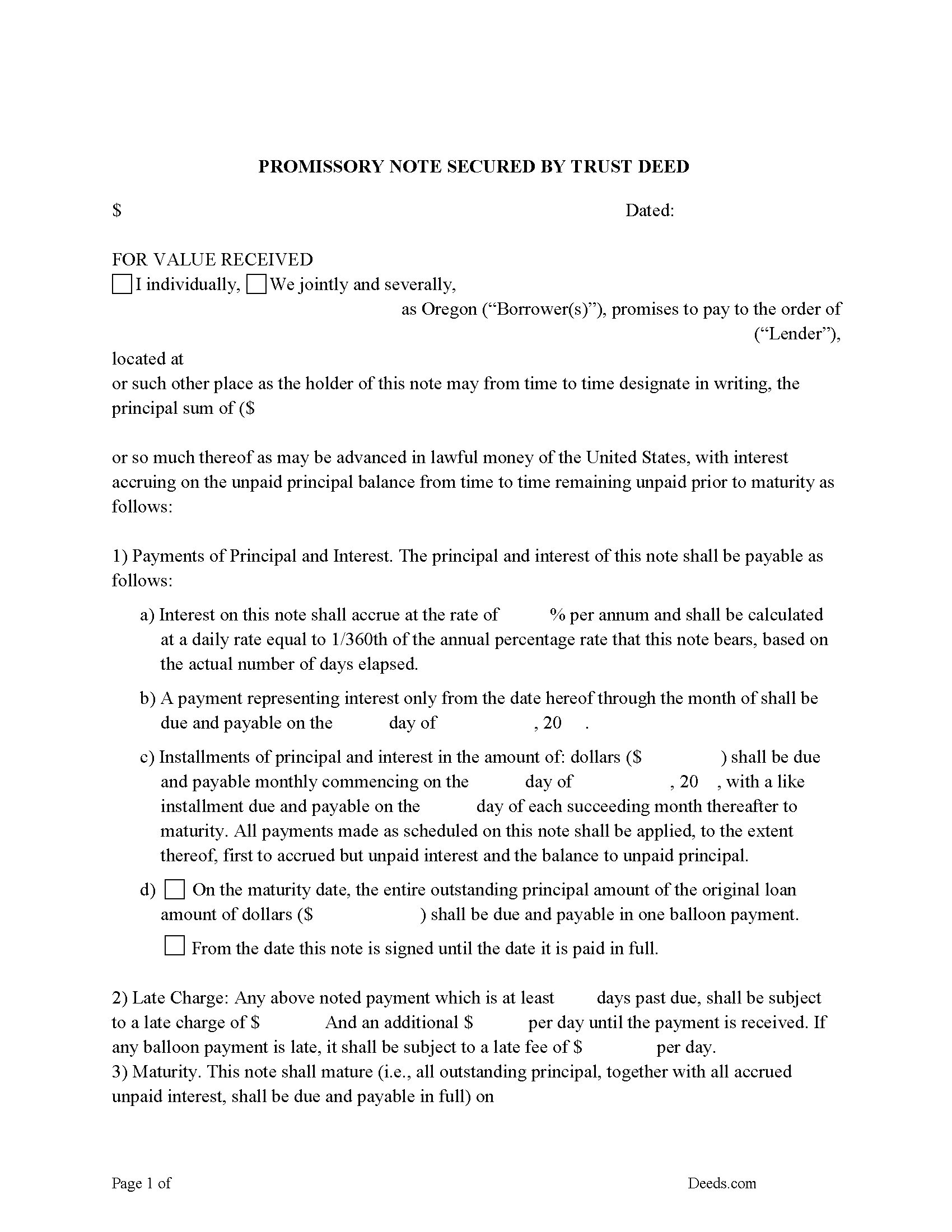

Linn County Promissory Note Form

Promissory Note secured by Trust Deed.

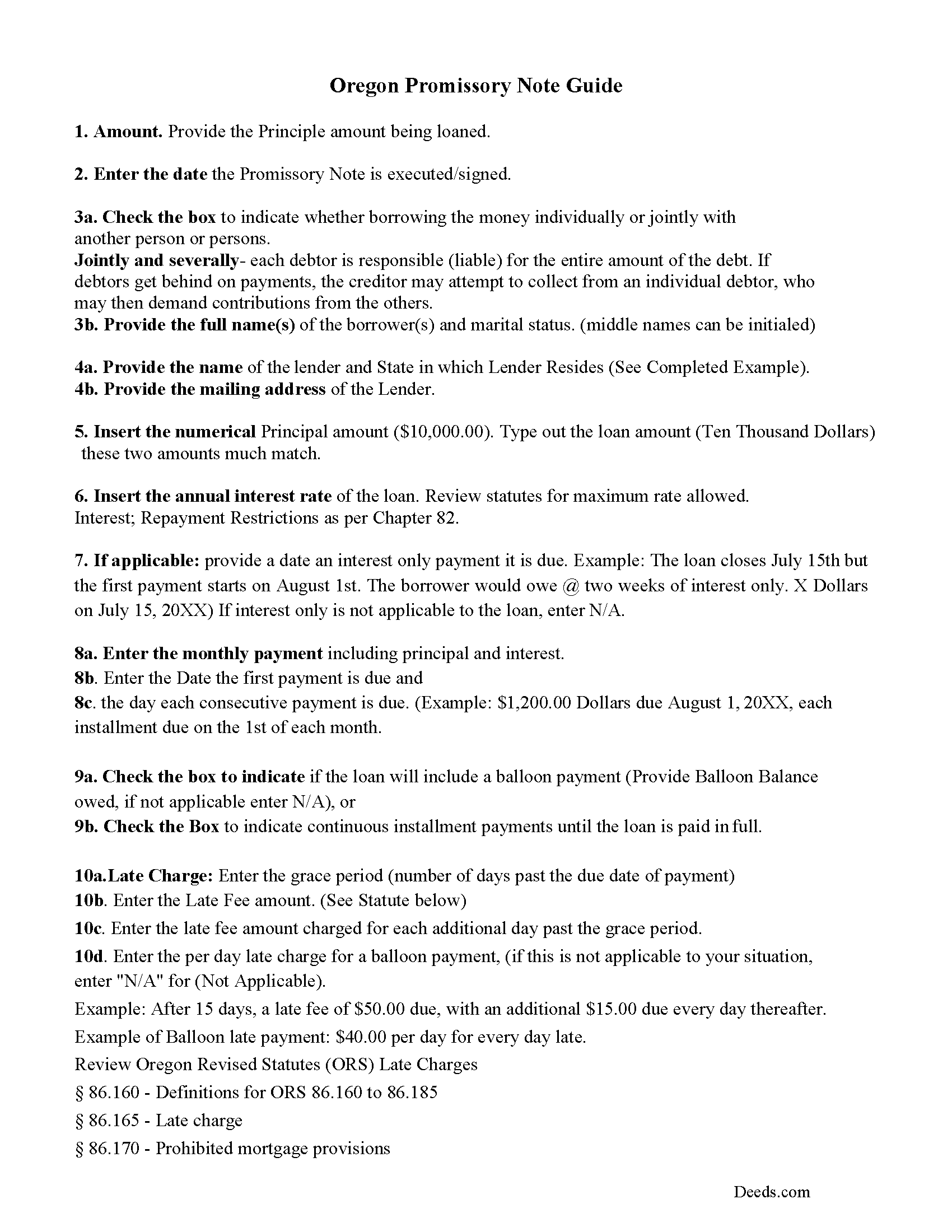

Linn County Promissory Note Guidelines

Line by line guide explaining every blank on the form.

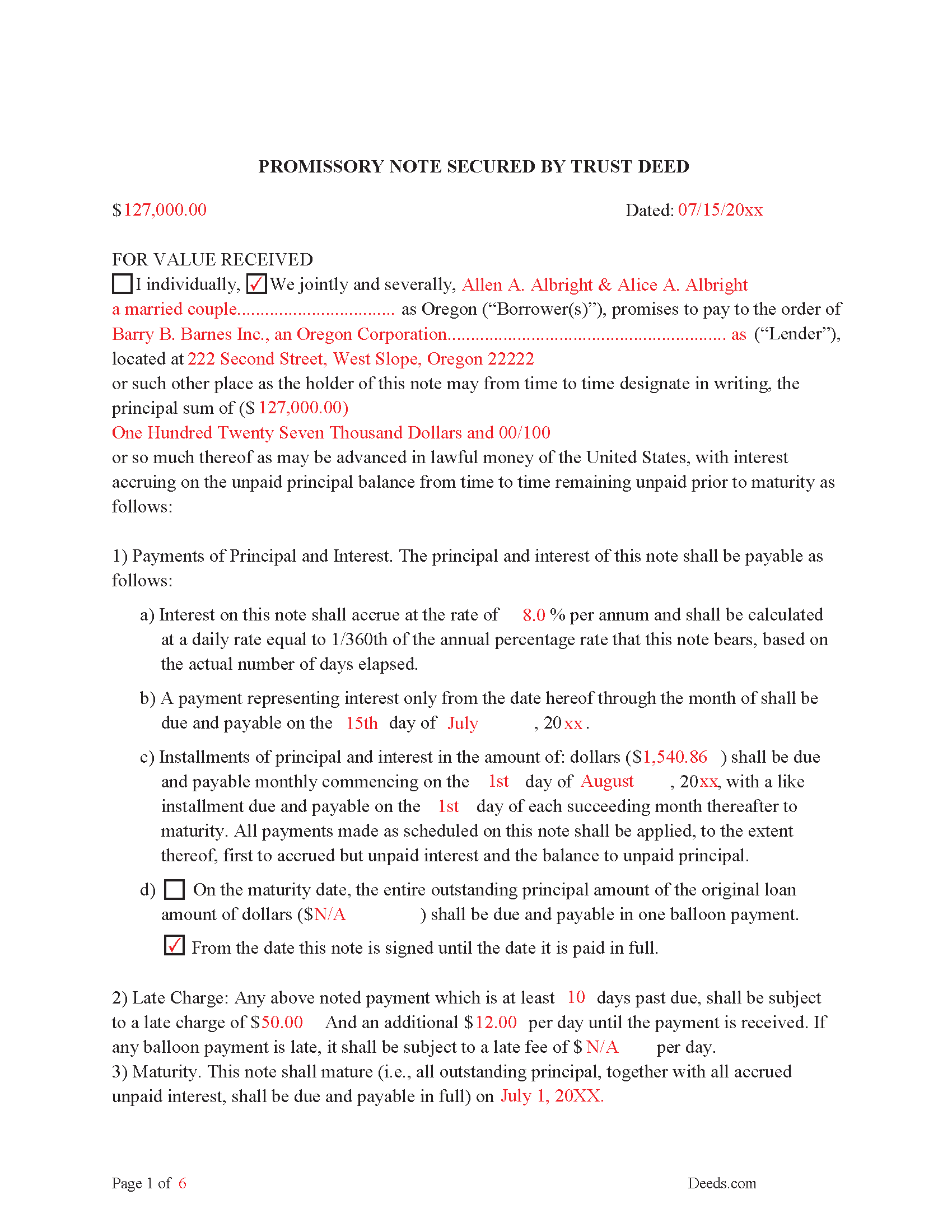

Linn County Completed Example of the Promissory Note Document

Example of a properly completed form for reference.

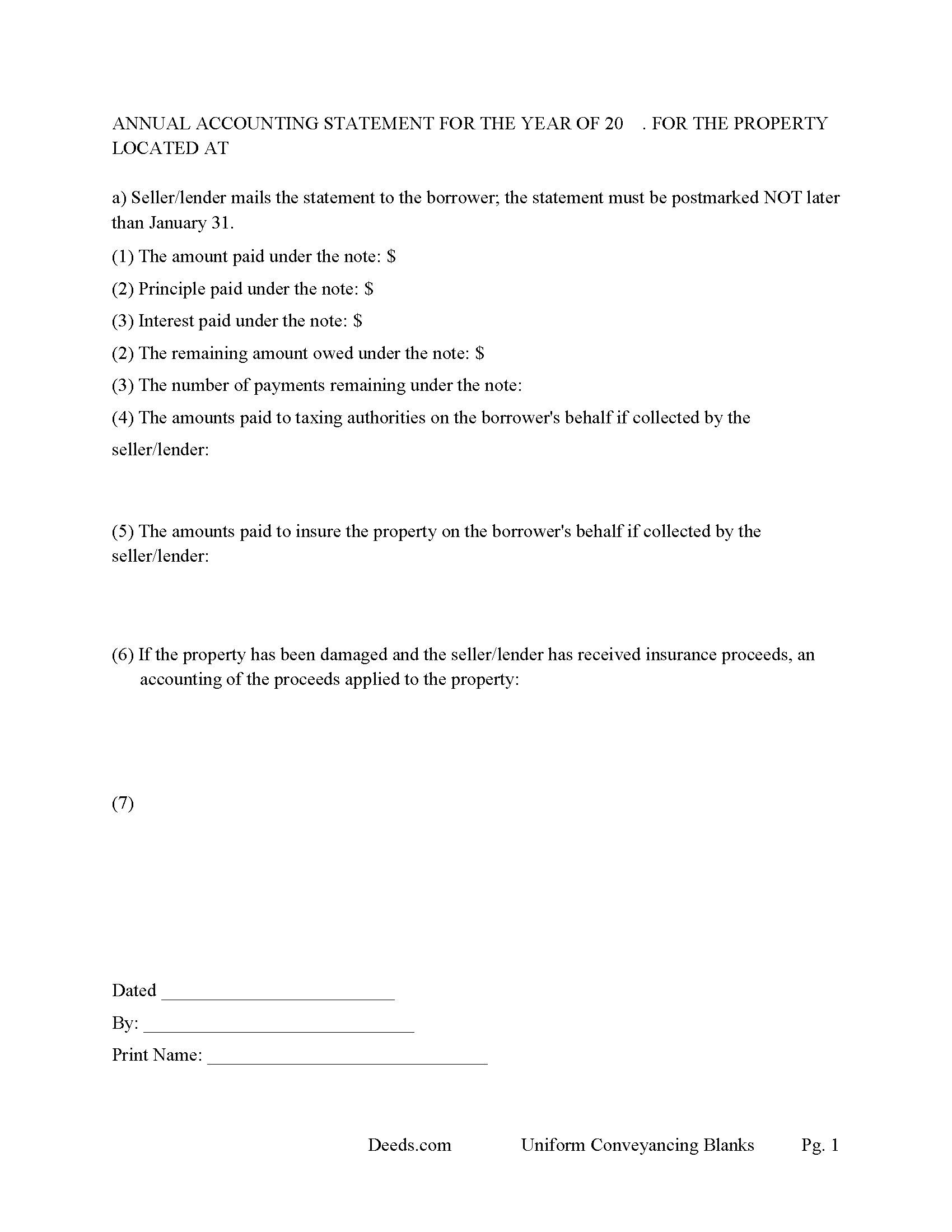

Linn County Annual Accounting Statement Form

Lender sends to borrower for fiscal year reporting.

All 7 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Oregon and Linn County documents included at no extra charge:

Where to Record Your Documents

Linn County Clerk

Albany, Oregon 97321

Hours: 8:30 to 5:00 M-F / Same-day recording until 4:00

Phone: (541) 967-3829

Recording Tips for Linn County:

- Ensure all signatures are in blue or black ink

- Check margin requirements - usually 1-2 inches at top

- Make copies of your documents before recording - keep originals safe

- Ask for certified copies if you need them for other transactions

Cities and Jurisdictions in Linn County

Properties in any of these areas use Linn County forms:

- Albany

- Brownsville

- Cascadia

- Crabtree

- Crawfordsville

- Foster

- Halsey

- Harrisburg

- Lebanon

- Lyons

- Mill City

- Scio

- Shedd

- Sweet Home

- Tangent

Hours, fees, requirements, and more for Linn County

How do I get my forms?

Forms are available for immediate download after payment. The Linn County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Linn County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Linn County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Linn County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Linn County?

Recording fees in Linn County vary. Contact the recorder's office at (541) 967-3829 for current fees.

Questions answered? Let's get started!

There are three parties in a Trust Deed in which the Grantor/Borrower (conveys an interest in real property to a trustee in trust to secure the performance of an obligation the grantor or other person named in the deed owes to a beneficiary.) (ORS 86.705(8))

("Grantor" means the person that conveys an interest in real property by a trust deed as security for the performance of an obligation.) ( ORS 86.705(4))

("Beneficiary")/ Lender (means a person named or otherwise designated in a trust deed as the person for whose benefit a trust deed is given, or the person's successor in interest, and who is not the trustee unless the beneficiary is qualified to be a trustee under ORS 86.713) ( ORS 86.705(2))

("Trustee" means a person, other than the beneficiary, to whom a trust deed conveys an interest in real property, or the person's successor in interest, or an employee of the beneficiary, if the employee is qualified to be a trustee under ORS 86.713) ( ORS 86.705(9)) The guidelines provided explain how to easily choose a trustee.

Trust Deeds are considered advantageous for lenders, foreclosure is done non-judicially (saving time and expense), the process is called "Foreclosure by Advertisement and Sale" defined in ORS 86.735. If the Grantor/Borrower defaults the Beneficiary/Lender can choose to have the Trustee foreclose on the Trust Deed.

This Trust Deed and Promissory Note contain strong default terms. Use these forms for residential property, rental property (up to 4 units), vacant land, condominiums, and planned unit developments.

(Oregon TD Package includes forms, guidelines, and completed examples) For use in Oregon only.

Important: Your property must be located in Linn County to use these forms. Documents should be recorded at the office below.

This Trust Deed and Promissory Note meets all recording requirements specific to Linn County.

Our Promise

The documents you receive here will meet, or exceed, the Linn County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Linn County Trust Deed and Promissory Note form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4578 Reviews )

VICKI R.

July 15th, 2020

Thank you for your helpful information.

Thank you!

Janepher M.

January 27th, 2019

Easy and informative site. Helped me figure out what I was looking for.

Thank you Janepher, we appreciate your feedback!

Shonda S.

January 21st, 2023

This is the best thing I have ever done with this being my first time doing a quick claim. This has save me and my family money instead of paying a lawyer. Thanks again.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Sylvia B.

October 21st, 2020

What a wonderful resource! Forms are so easy to use, made the process a breeze. Deeds even helped with the recording. Thank you.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Thomas W.

February 4th, 2020

The serevice was fast and accurate. I would highly recommend Deeds.com to my friends and associates.

Thank you!

brian p.

October 12th, 2019

Good, easy to use, quit claim form worked as expected.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

diana c.

February 24th, 2022

quick and easy, thankyou

Thank you!

Robin B.

November 6th, 2020

Nice and easy

Thank you!

Raymond M.

January 11th, 2020

It would be really nice if you had an example of the document full size that can be examined/read before having to pay. I was gambling that it was the exact document that I needed when I paid my fee. Fortunately, it was, and I commend you for that.

Thank you for your feedback. We really appreciate it. Have a great day!

Stacie S.

June 26th, 2020

This process was very simple once I got the form right! I would definitely utilize this system in the future if I needed to.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

JOSEPH W.

September 17th, 2021

Easy peezy!

Thank you!

Thomas E.

December 18th, 2018

Great, immediate access to everything I needed to assist my client! This is truly a great resource for a Notary Public! I will surely keep my account open, and will refer others as well!

Thank you for the Kind words Thomas. We really appreciate you! Have a great day.

Kimberly G.

April 5th, 2021

It would be helpful if there were a specific example of putting a deed into a trust. Also, the limitation of characters on the description of the property was not enough.

Thank you for your feedback. We really appreciate it. Have a great day!

Joan H.

September 27th, 2019

I am happy I can record this this way.

Thank you!

EUGENE S.

December 11th, 2021

SIMPLE EASY TO UNDERSTAND PROCESS

We appreciate your business and value your feedback. Thank you. Have a wonderful day!