Wheeler County Trust Deed and Promissory Note Form

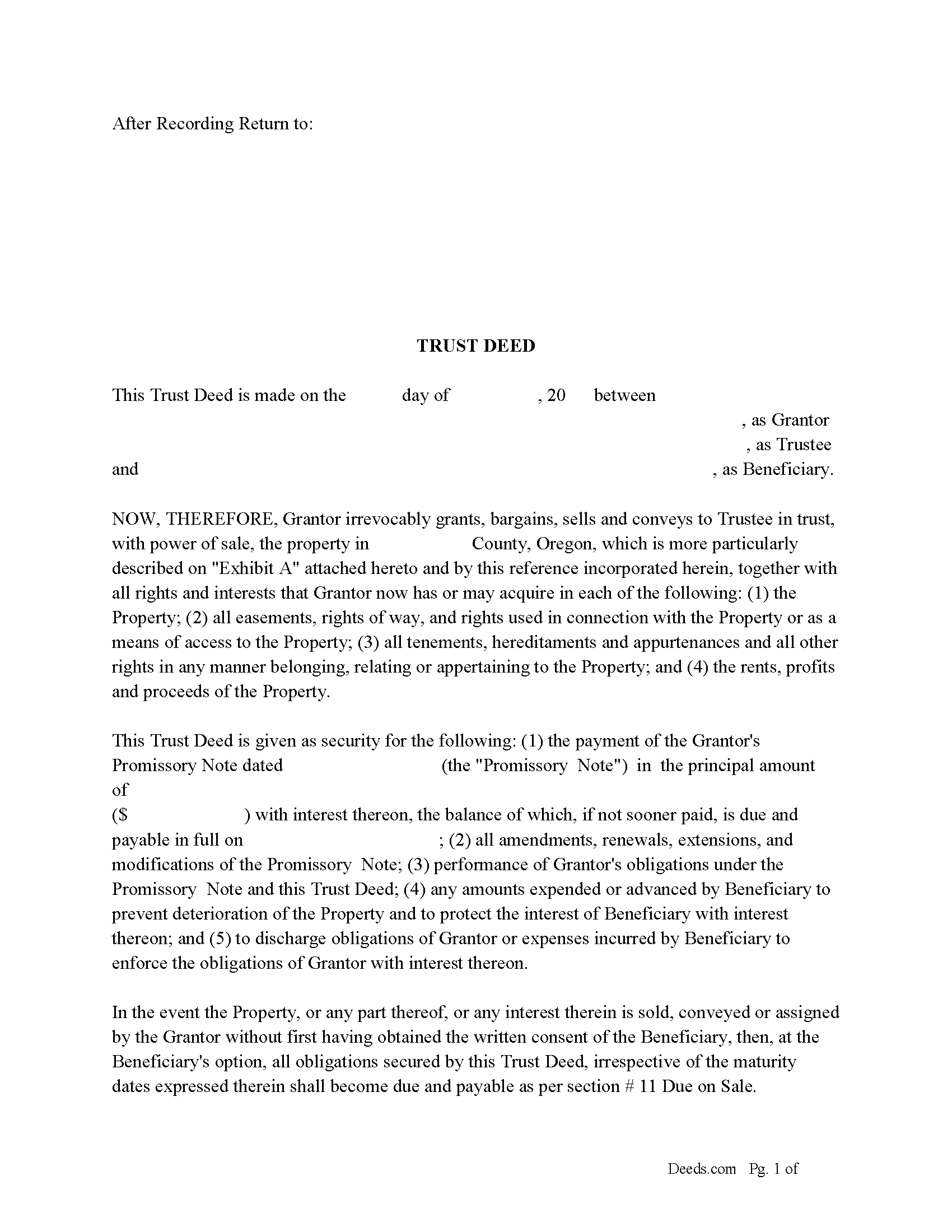

Wheeler County Trust Deed Form

Fill in the blank form formatted to comply with all recording and content requirements.

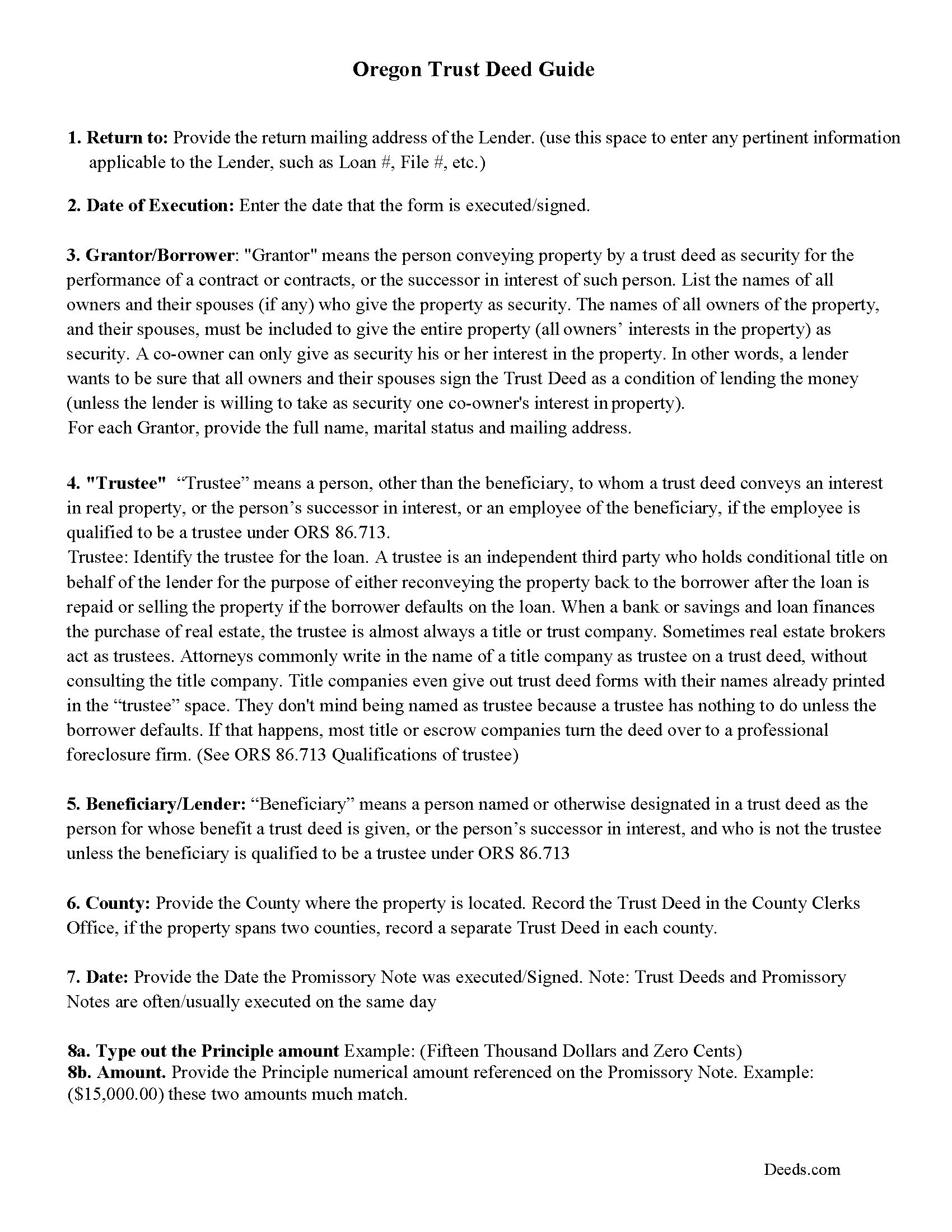

Wheeler County Trust Deed Guidelines

Line by line guide explaining every blank on the form.

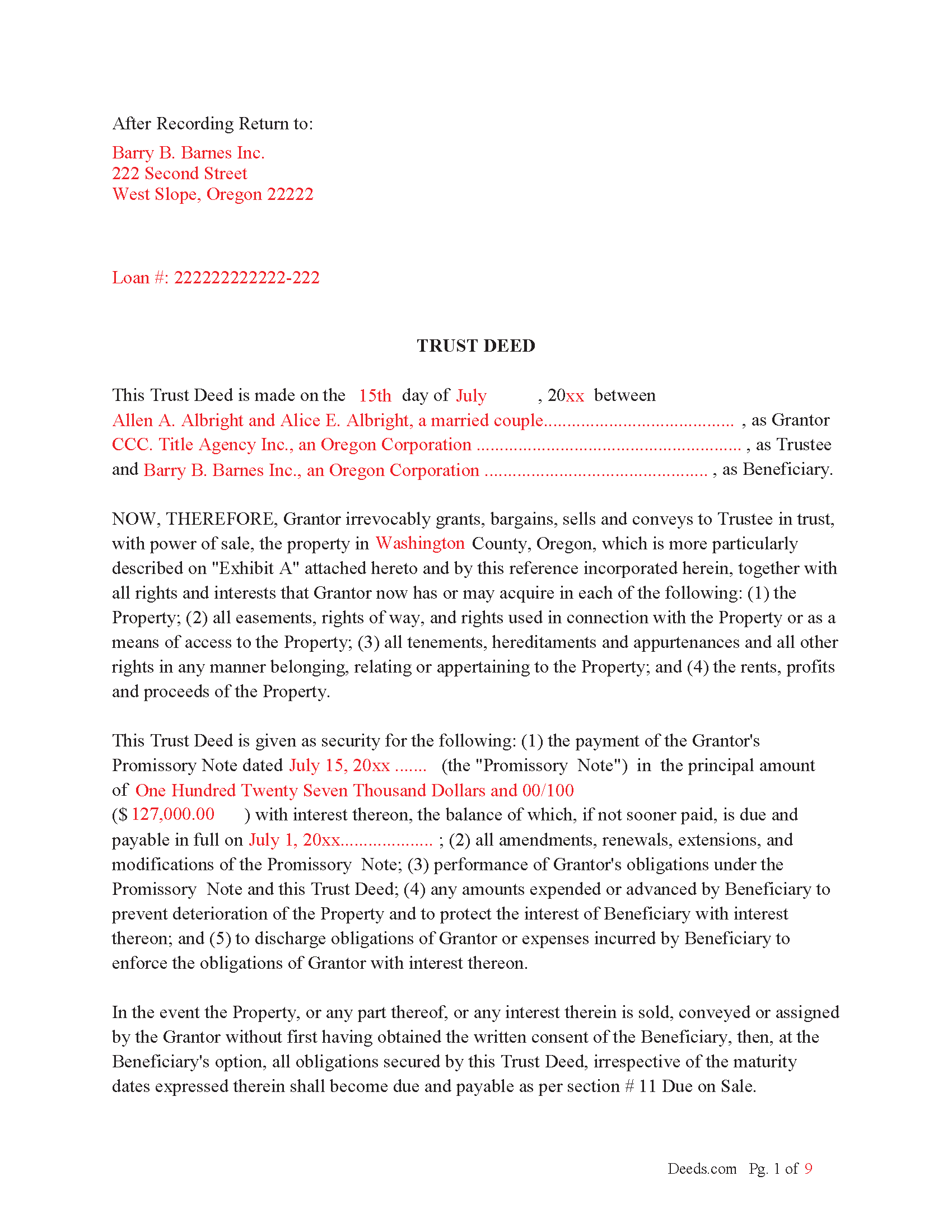

Wheeler County Completed Example of the Trust Deed Document

Example of a properly completed form for reference.

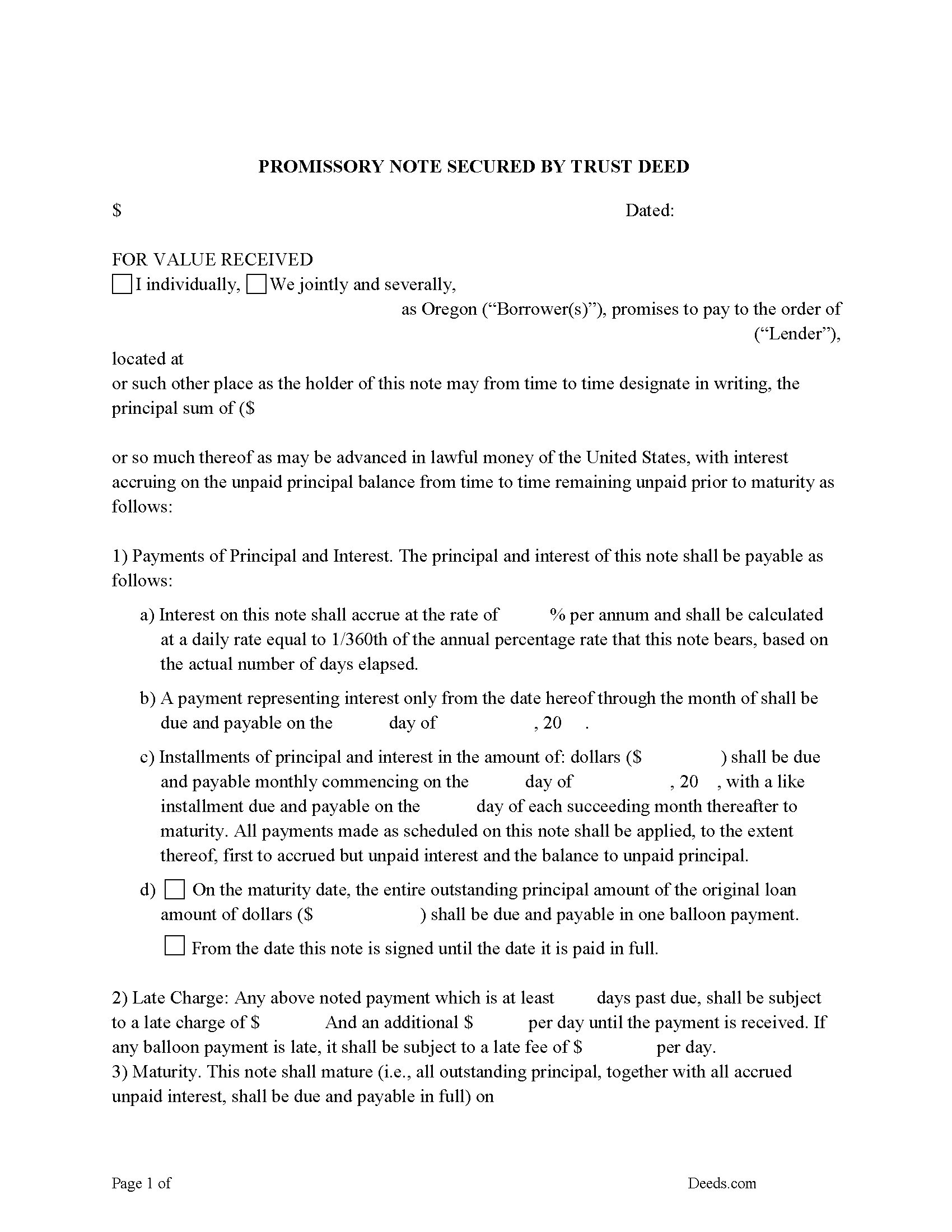

Wheeler County Promissory Note Form

Promissory Note secured by Trust Deed.

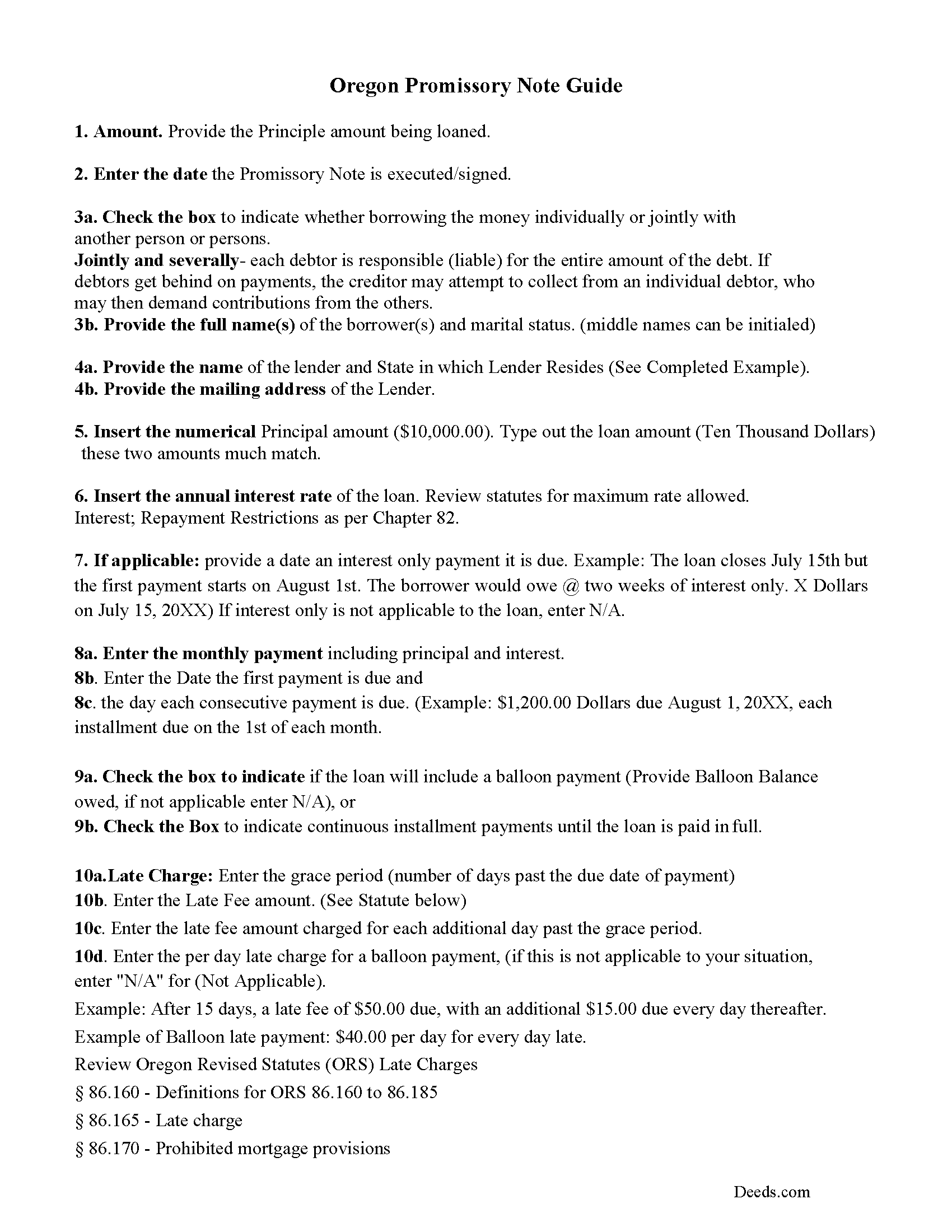

Wheeler County Promissory Note Guidelines

Line by line guide explaining every blank on the form.

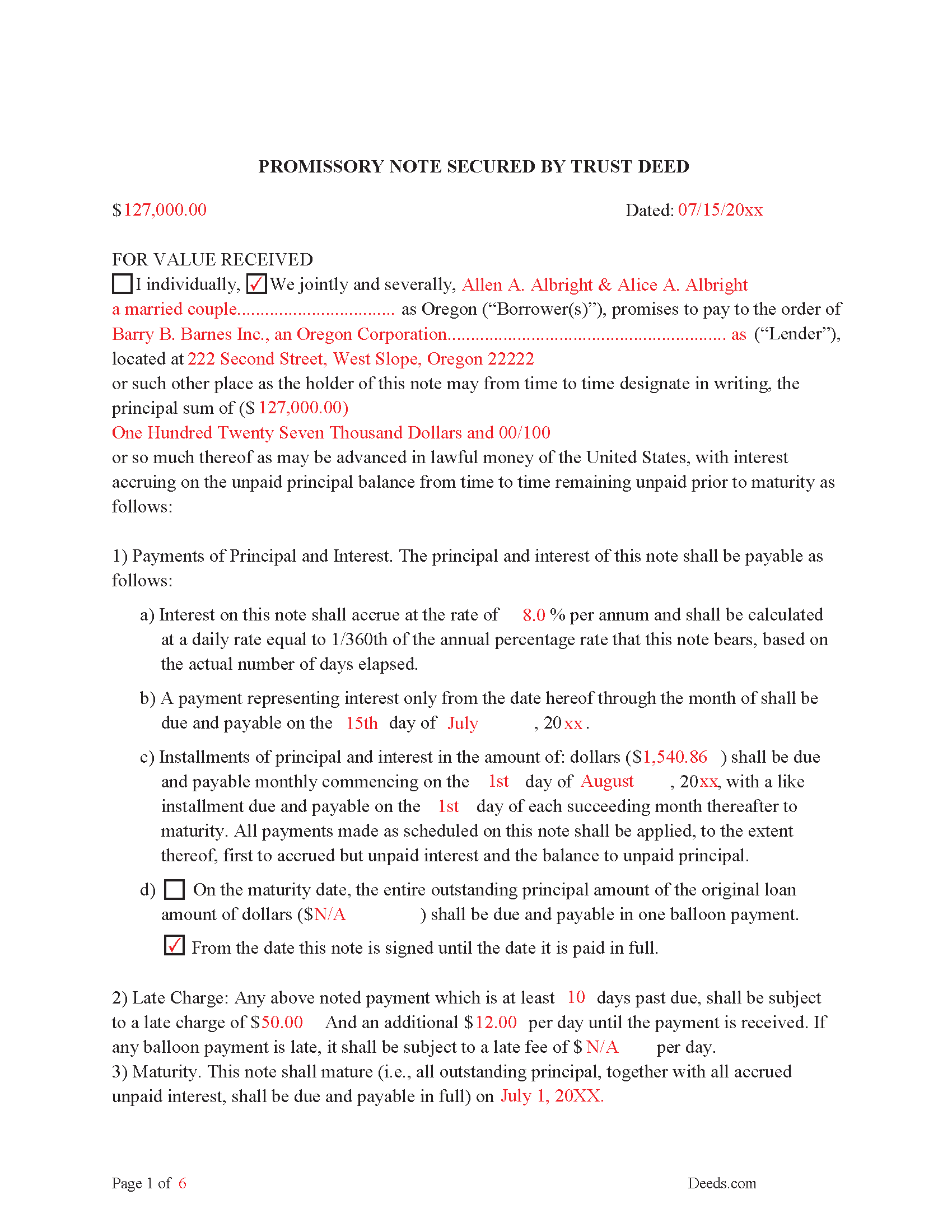

Wheeler County Completed Example of the Promissory Note Document

Example of a properly completed form for reference.

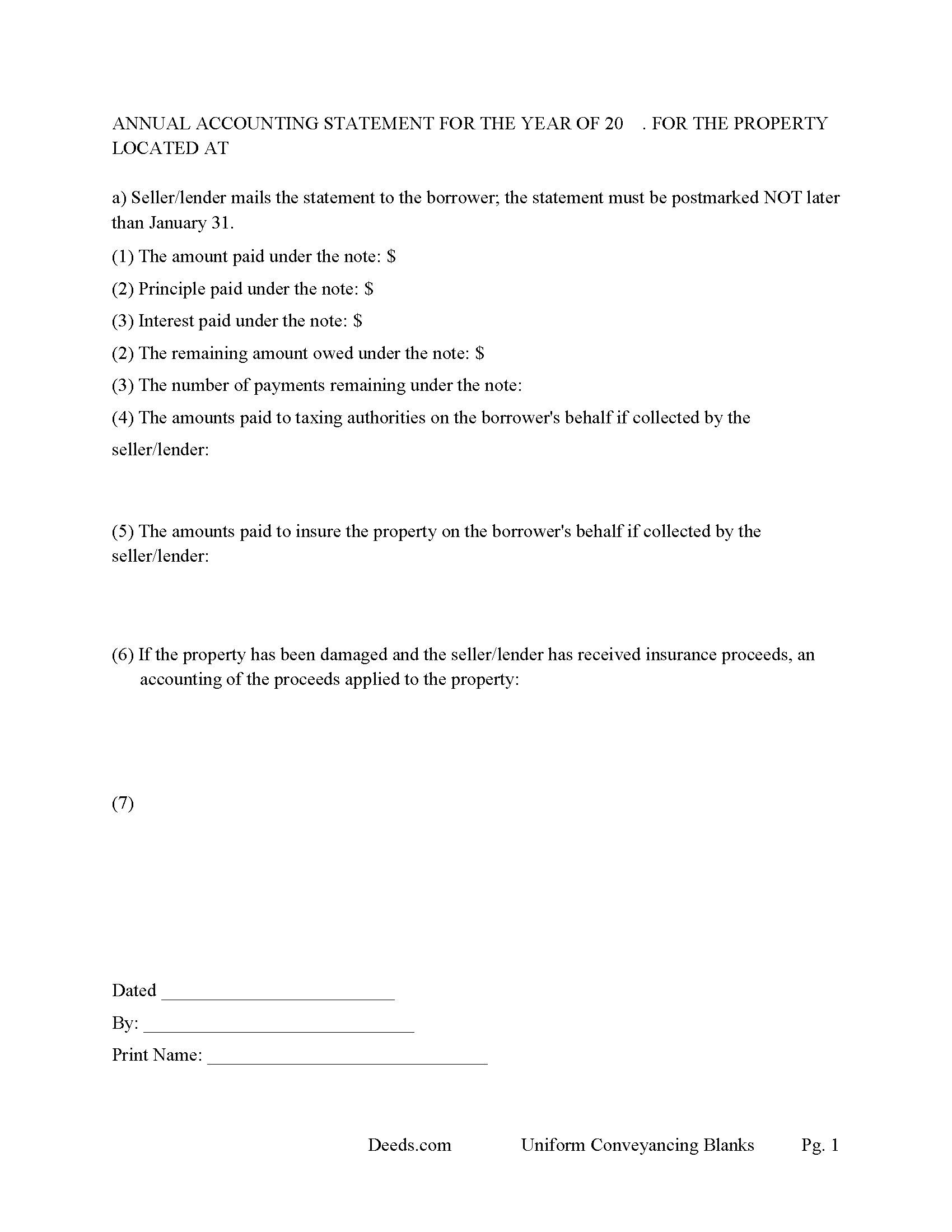

Wheeler County Annual Accounting Statement Form

Lender sends to borrower for fiscal year reporting.

All 7 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Oregon and Wheeler County documents included at no extra charge:

Where to Record Your Documents

Wheeler County Clerk

Fossil, Oregon 97830

Hours: M-F 8am - 12pm & 1pm - 4pm

Phone: (503) 763-2400, 763-2374, 763-2373

Recording Tips for Wheeler County:

- Ensure all signatures are in blue or black ink

- White-out or correction fluid may cause rejection

- Double-check legal descriptions match your existing deed

- Both spouses typically need to sign if property is jointly owned

- Recorded documents become public record - avoid including SSNs

Cities and Jurisdictions in Wheeler County

Properties in any of these areas use Wheeler County forms:

- Fossil

- Mitchell

- Spray

Hours, fees, requirements, and more for Wheeler County

How do I get my forms?

Forms are available for immediate download after payment. The Wheeler County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Wheeler County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Wheeler County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Wheeler County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Wheeler County?

Recording fees in Wheeler County vary. Contact the recorder's office at (503) 763-2400, 763-2374, 763-2373 for current fees.

Questions answered? Let's get started!

There are three parties in a Trust Deed in which the Grantor/Borrower (conveys an interest in real property to a trustee in trust to secure the performance of an obligation the grantor or other person named in the deed owes to a beneficiary.) (ORS 86.705(8))

("Grantor" means the person that conveys an interest in real property by a trust deed as security for the performance of an obligation.) ( ORS 86.705(4))

("Beneficiary")/ Lender (means a person named or otherwise designated in a trust deed as the person for whose benefit a trust deed is given, or the person's successor in interest, and who is not the trustee unless the beneficiary is qualified to be a trustee under ORS 86.713) ( ORS 86.705(2))

("Trustee" means a person, other than the beneficiary, to whom a trust deed conveys an interest in real property, or the person's successor in interest, or an employee of the beneficiary, if the employee is qualified to be a trustee under ORS 86.713) ( ORS 86.705(9)) The guidelines provided explain how to easily choose a trustee.

Trust Deeds are considered advantageous for lenders, foreclosure is done non-judicially (saving time and expense), the process is called "Foreclosure by Advertisement and Sale" defined in ORS 86.735. If the Grantor/Borrower defaults the Beneficiary/Lender can choose to have the Trustee foreclose on the Trust Deed.

This Trust Deed and Promissory Note contain strong default terms. Use these forms for residential property, rental property (up to 4 units), vacant land, condominiums, and planned unit developments.

(Oregon TD Package includes forms, guidelines, and completed examples) For use in Oregon only.

Important: Your property must be located in Wheeler County to use these forms. Documents should be recorded at the office below.

This Trust Deed and Promissory Note meets all recording requirements specific to Wheeler County.

Our Promise

The documents you receive here will meet, or exceed, the Wheeler County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Wheeler County Trust Deed and Promissory Note form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4582 Reviews )

rich b.

September 3rd, 2021

Had pretty much everything I needed. Had to slice and dice a bit.

Thank you!

James R.

September 1st, 2021

Useful and quick.

Thank you!

Roy Y.

February 7th, 2019

I paid for and received the form for a Quit Claim Deed. Hoping it is the form I need to complete my transaction. Thank you for making it possible to obtain the form I was in need of.

Thank you for your feedback Roy. We appreciate it!

Sean M.

January 2nd, 2023

This was exactly what I needed. For $25-$30 it gave me the formatted document I needed and made it so easy to input the info. I wouldn't recommend it to someone who has no clue what they're doing, but for somebody who knows all the info and just needs a formatted page to input it onto, this is perfect.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

James S.

April 22nd, 2019

easy to use

Thank you James.

Vanessa G.

January 9th, 2024

Quick, painless, and they communicated with me during the entire process. I will certainly be suing them again.

We are delighted to have been of service. Thank you for the positive review!

Amy R.

November 18th, 2021

Great personal support via messaging. Website confusing and broken links in emails.

Thank you!

Kelly H.

November 30th, 2020

This site was very fast and easy to use, highly recommend it.

Thank you for your feedback. We really appreciate it. Have a great day!

Christopher G.

August 20th, 2020

thank you - your service is awesome - i sent documents to the county - after 2 plus weeks they returned them with 'errors' - i went to your site - signed up - uploaded documents and submitted in less than 3 minutes - had it approved by the county in under 12 hours - THANK YOU - great service!!!!

Thank you Christopher, glad we could help. Have a great day!

marc g.

April 13th, 2021

Nice product and Fillable PDF's :) Thanks Deeds!!

Thank you for your feedback. We really appreciate it. Have a great day!

Cherif T.

June 17th, 2019

I wish every state offered such an easy and economical download of these forms. You were reasonable in price, I received one of every form you offered along with instructions, and it made my day so easy. Why pay a lawyer a fortune for these simple (almost) everyday forms when you can do it all for less than $20. Thank you for being reasonable, well organized, and available for common use! Cherif T.

Thank you!

Precious M.

June 23rd, 2020

great quick response

Thank you!

Cynthia W.

August 19th, 2022

I like the support documents that go along with the easement template and the fact that the format is specific to a state and county.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Dennis H.

June 26th, 2019

Thank you for this program. It will help in the future. Dennis Holt

Thank you!

Sally P.

June 22nd, 2023

I cannot thank the staff at Deeds.com enough for all of their assistance and their quick and their most pleasant responses. They were extremely quick and efficient to help me to file my documents. Thanks for everything and I will definitely be referring folks to your site.

Our team is deeply committed to providing efficient, reliable assistance and it's always rewarding to know we've made a difference for our customers. Your kind words about our quick and pleasant responses are much appreciated and will certainly serve as an extra boost of motivation for our team.

We also sincerely appreciate your intention to refer others to our site. Your trust and confidence in our service means a lot to us, and we're grateful to have you as part of the Deeds.com community.