Horry County Affidavit of Deceased Joint Tenant Form

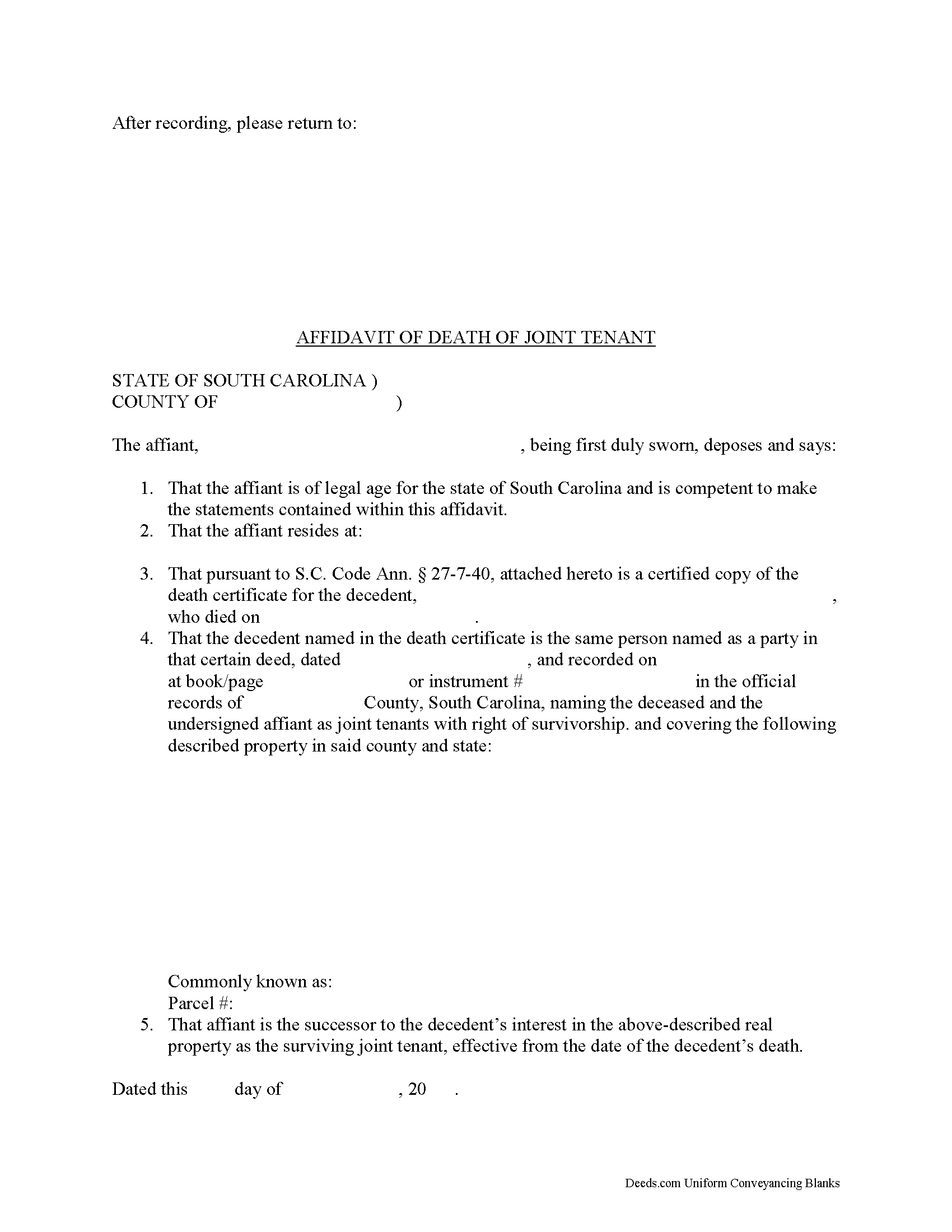

Horry County Affidavit of Deceased Joint Tenant Form

Fill in the blank form formatted to comply with all recording and content requirements.

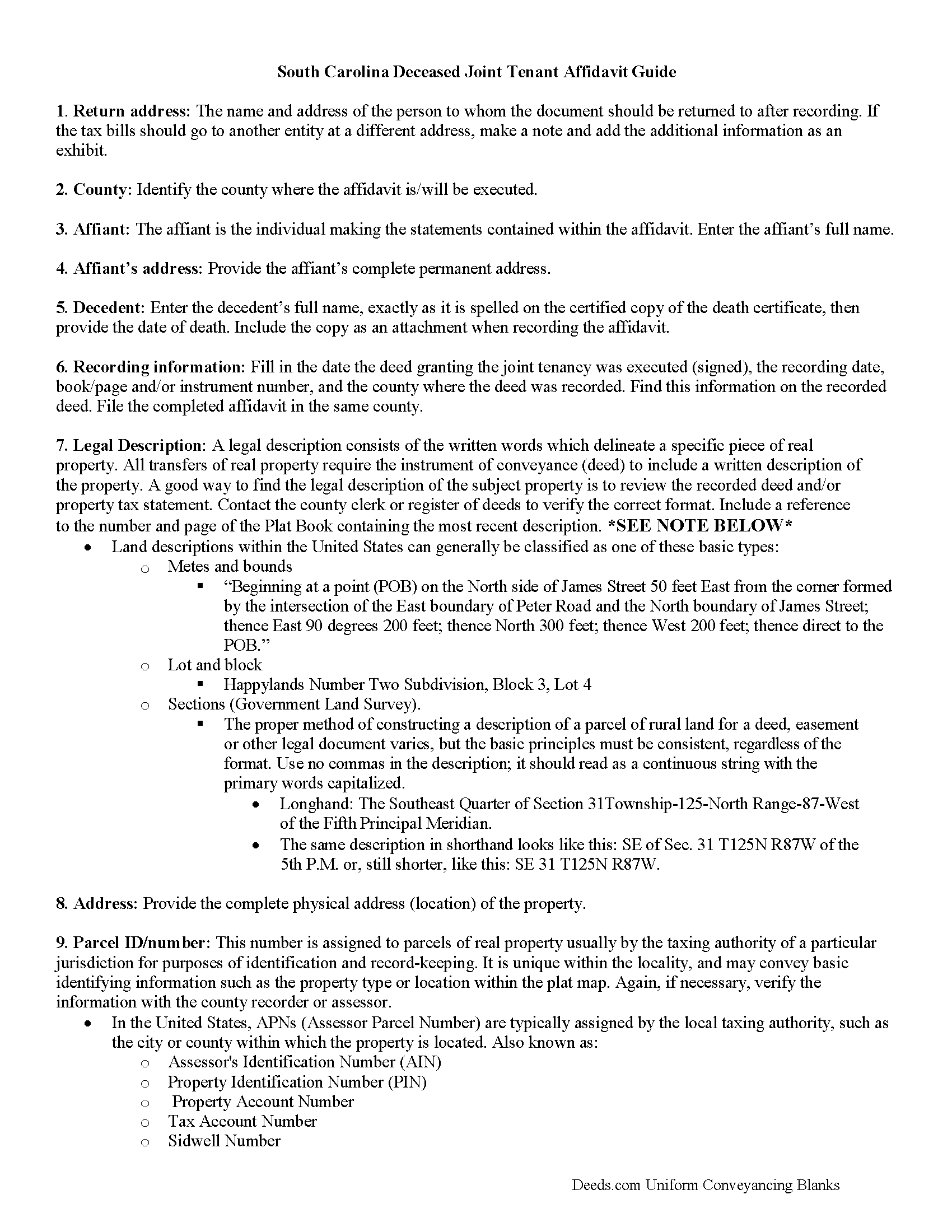

Horry County Affidavit of Deceased Joint Tenant Guide

Line by line guide explaining every blank on the form.

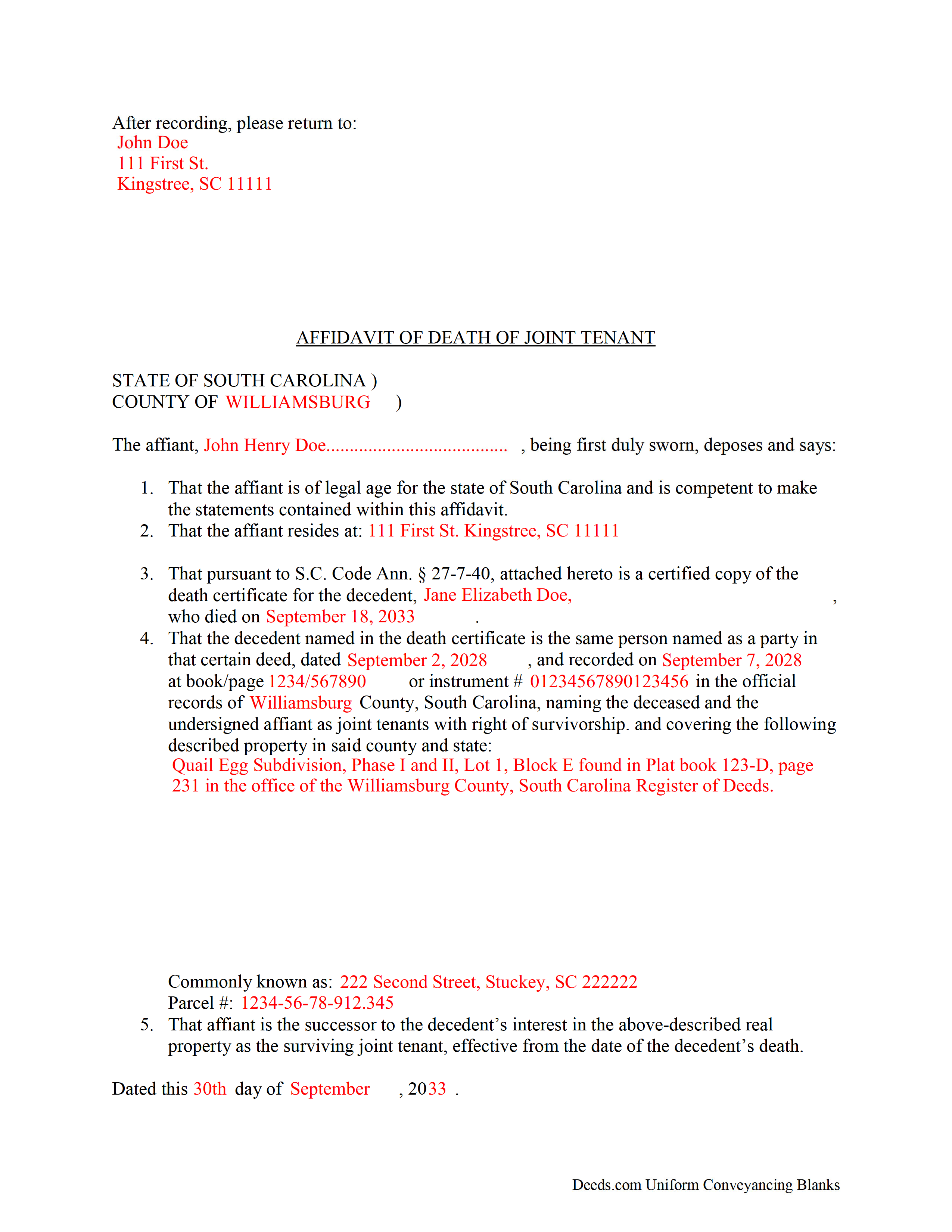

Horry County Completed Example of the Affidavit of Deceased Joint Tenant Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional South Carolina and Horry County documents included at no extra charge:

Where to Record Your Documents

Horry County Register of Deeds

Conway, South Carolina 29526 / 29528

Hours: 8:00am to 5:00pm Monday through Friday / Recording until 4:45pm

Phone: (843) 915-5430

Recording Tips for Horry County:

- Double-check legal descriptions match your existing deed

- Recorded documents become public record - avoid including SSNs

- Both spouses typically need to sign if property is jointly owned

- Recording early in the week helps ensure same-week processing

Cities and Jurisdictions in Horry County

Properties in any of these areas use Horry County forms:

- Aynor

- Conway

- Galivants Ferry

- Green Sea

- Little River

- Longs

- Loris

- Murrells Inlet

- Myrtle Beach

- Nichols

- North Myrtle Beach

Hours, fees, requirements, and more for Horry County

How do I get my forms?

Forms are available for immediate download after payment. The Horry County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Horry County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Horry County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Horry County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Horry County?

Recording fees in Horry County vary. Contact the recorder's office at (843) 915-5430 for current fees.

Questions answered? Let's get started!

Joint tenancy in South Carolina is governed by S.C. Code Ann. 27-7-40.

When two or more people share ownership of real property, they have choice of ways in which to hold title -- either as tenants in common or as joint tenants with the right of survivorship.

Tenancy in common is the standard form of co-ownership. In it, each person owns a percentage of the land, and when the owner dies, that portion passes to his/her estate where it is distributed during the probate process.

Joint tenancy, on the other hand, must be declared in the text of the deed: "whenever any deed of conveyance of real estate contains the names of the grantees followed by the words 'as joint tenants with rights of survivorship, and not as tenants in common' the creation of a joint tenancy with rights of survivorship in the real estate is conclusively deemed to have been created" ( 27-7-40(a)).

The statutes go on to explain that in the "event of the death of a joint tenant, and in the event only one other joint tenant in the joint tenancy survives, the entire interest of the deceased joint tenant in the real estate vests in the surviving joint tenant, who is vested with the entire interest in the real estate owned by the joint tenants" ( 27-7-40(a)(i)).

If one or more joint tenant survives the deceased owner, "the entire interest of the deceased joint tenant vests equally in the surviving joint tenants who continues to own the entire interest owned by them as joint tenants with right of survivorship" ( 27-7-40(a)(ii)).

So, how does the survivorship process work? The statutes direct the surviving joint tenant or tenants to file with the Register of Deeds of the county in which the real estate is located a certified copy of the certificate of death of the deceased joint tenant. The fee to be paid to the Register of Deeds for this filing is the same as the fee for the deed of conveyance. The Register of Deeds must index the certificate of death under the name of the deceased joint tenant in the grantor deed index of that office. The filing of the certificate of death is conclusive that the joint tenant is deceased and that the interest of the deceased joint tenant has vested by operation of law in the surviving joint tenant or tenants in the joint tenancy in real estate" ( 27-7-40(b)).

While there is no specific statutory obligation to submit the certified copy of the death certificate with an affidavit attesting to the details of the change in ownership status, it makes sense to do so. An affidavit contains statements, made under oath, which can be admitted as evidence in court. By recording an affidavit of deceased joint tenant along with the death certificate, the surviving owner(s) protect the title to the real estate. Maintaining a clear chain of title leads to less complicated sales in the future because the title search will show a continuous series of owners and transfers, which reduces the likelihood of unexpected claims against the title.

Even though recording the affidavit of deceased joint tenant and the official copy of the death certificate initiates the process of distributing the decedent's share of the real property, the only way to remove his/her name from the title is to record a new deed with the updated information.

(South Carolina AODJT Package includes form, guidelines, and completed example)

Important: Your property must be located in Horry County to use these forms. Documents should be recorded at the office below.

This Affidavit of Deceased Joint Tenant meets all recording requirements specific to Horry County.

Our Promise

The documents you receive here will meet, or exceed, the Horry County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Horry County Affidavit of Deceased Joint Tenant form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4578 Reviews )

richard s.

March 26th, 2020

had exactly what i needed and good price

Thank you Richard! Have an amazing day.

Julie K.

September 4th, 2023

The process for obtaining document itself was easy, and the included guide and example are great! I do have an issue with the format itself, though. The form has pre-defined text boxes, which cannot be altered without partially rebuilding the entire document. For the 'property description' field on the Mineral Deed form, the text box is not large enough for the rather lengthy legal description entered on my original plat. Fortunately, I have a copy of Adobe Pro, so I have been able to re-build the doc to accommodate this short-coming.

Thank you for taking the time to provide feedback on our legal form. We're pleased to hear that you found the process for obtaining the document and the included guide beneficial.

We understand and appreciate your concern regarding the formatting and size limitations of certain fields, especially the 'property description' field. Our forms are designed to adhere to specific formatting requirements that are often mandated for legal compliance. Making direct alterations to the document can result in them becoming non-conforming, which is why we advise customers to use an exhibit page when their legal description is extensive or does not fit.

christopher c.

May 22nd, 2025

Everything was professionally, handled and the process was simple and easy. I appreciated the responsiveness and recommendations from the reviewer of my package and look forward to getting my other submissions done. Wish I knew about this process sooner, thanks

Thanks, Christopher! We're glad the process was smooth and our team could help. Looking forward to assisting with your future submissions!

Shellie J.

February 19th, 2020

Documents are great and easy to use, just wish there was a page helping to know where to mail documents to with an amount since it tells you mailing in is an option.

Thank you for your feedback. We really appreciate it. Have a great day!

Donald S.

July 7th, 2020

Good

Thank you!

Samantha S.

April 29th, 2021

I really appreciated Deeds.com. It was quick and easy to use. Saved me substantial time completing my deed recording.

Thank you for your feedback. We really appreciate it. Have a great day!

Kay G.

April 1st, 2019

Found just the form I was looking for. It was an easy download process. Now just have to complete the forms!

Thank you for your feedback Kay, we really appreciate it.

Michael W.

August 27th, 2021

This was really easy and very helpful. Thanks,

Thank you!

Wendling D.

August 15th, 2019

Good

Thank you!

Sheron W.

May 23rd, 2022

I've used Deeds.com for a few years. The service is good, and orders are completed fast. I will continue using them and I recommend them.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Max P.

February 26th, 2021

Excellent. Timely. Efficient. Smooth. Thank you!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Jason J.

May 20th, 2025

My first submission was super quick and easy. I had trouble with the second submission, as I was not aware of what the county would require, but the team at Deeds.com walked me through every step of the process. Will definitely use again and refer business partners to Deeds.com!

Thank you, Jason! We’re glad your first submission went smoothly and appreciate your patience with the second. County requirements can vary, and we’re always here to help make the process as simple as possible. We look forward to assisting you — and your business partners — again soon!

Maricela N.

May 5th, 2021

very easy and quick to get all the forms needed! Thank you!

Thank you for your feedback. We really appreciate it. Have a great day!

Diana H.

February 10th, 2019

little expensive same document in other county is free. however quite fast in responding. and just what i needed.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Dianne J.

August 25th, 2020

Happy to give you a 5 star rating. We have never been a position to get changes on and record our own deed. You made the process very easy. Submitted my forms on a Friday, made one correction that was requested of me, paid our fees and the received notification of deed being recorded the next Tuesday. Wonderful work on your part and super easy for me. Thanks!

Thank you for your feedback. We really appreciate it. Have a great day!