Sumter County Affidavit of Deceased Joint Tenant Form

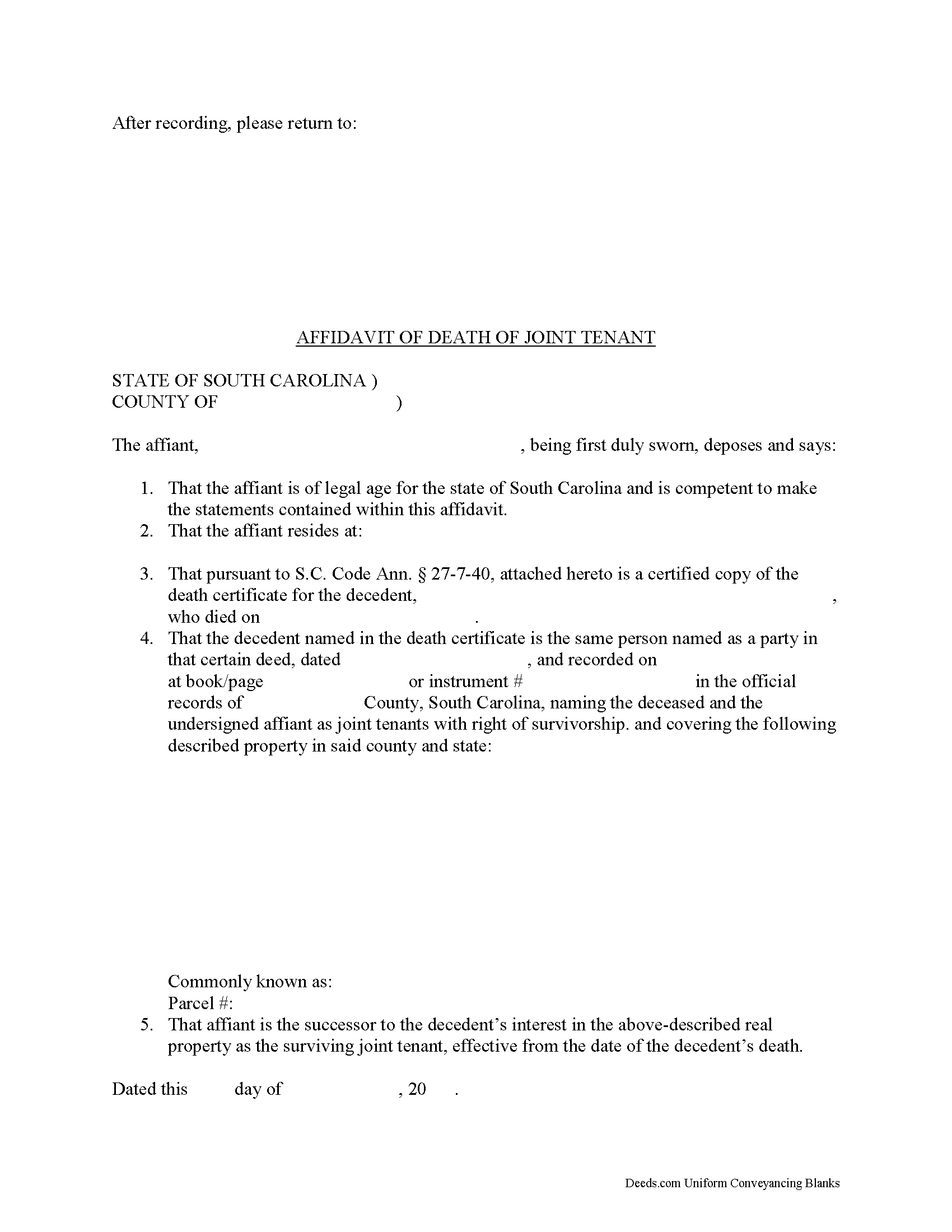

Sumter County Affidavit of Deceased Joint Tenant Form

Fill in the blank form formatted to comply with all recording and content requirements.

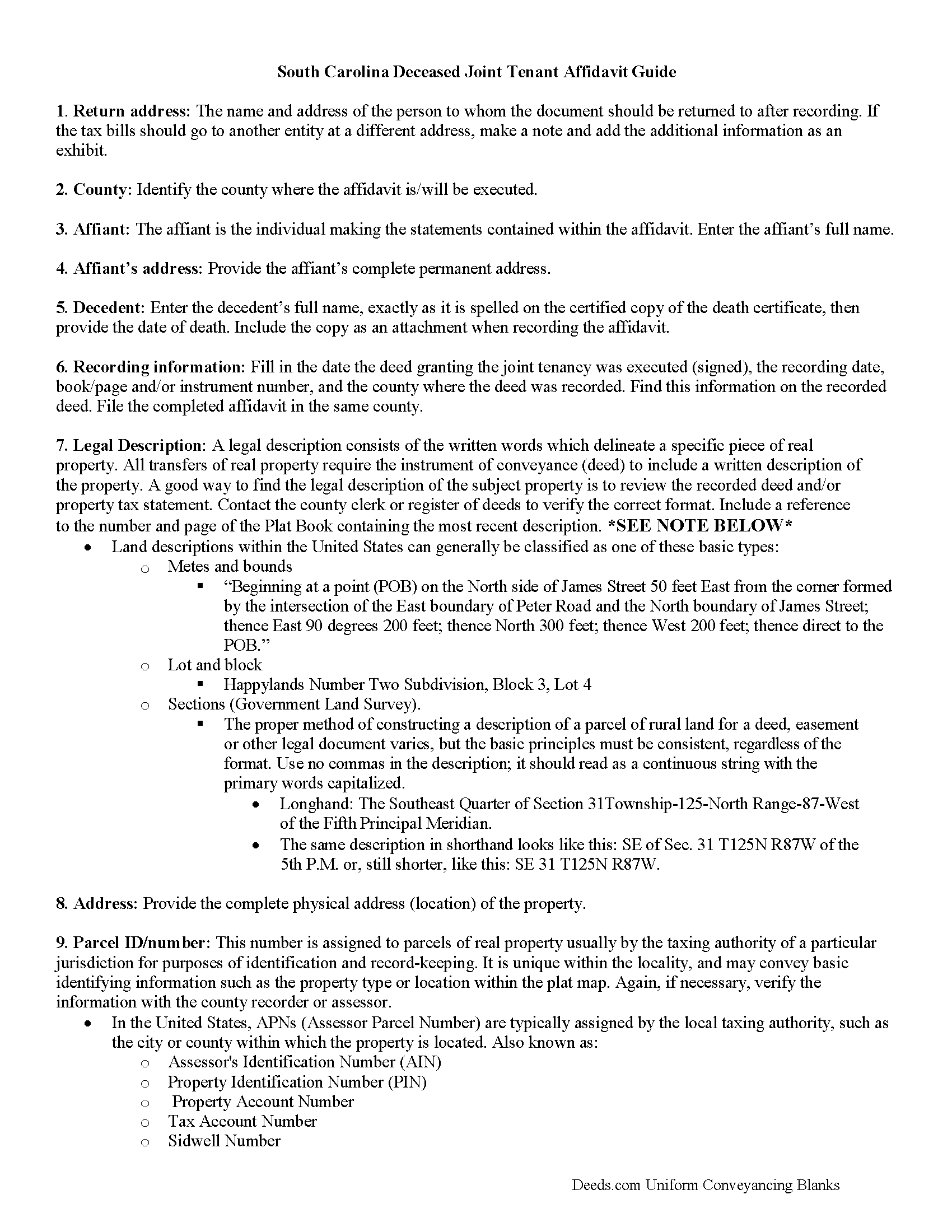

Sumter County Affidavit of Deceased Joint Tenant Guide

Line by line guide explaining every blank on the form.

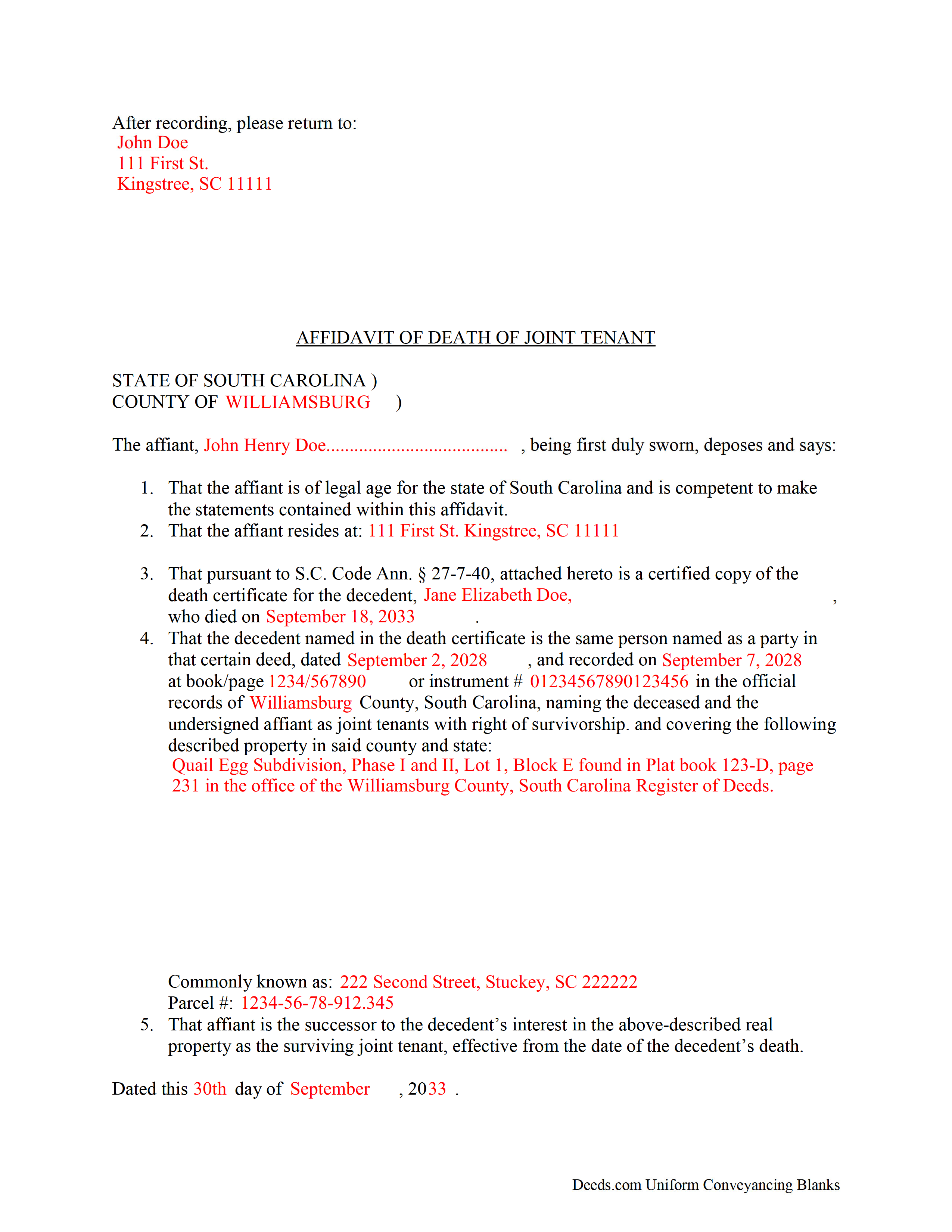

Sumter County Completed Example of the Affidavit of Deceased Joint Tenant Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional South Carolina and Sumter County documents included at no extra charge:

Where to Record Your Documents

Sumter County Register of Deeds

Sumter, South Carolina 29150

Hours: 8:30am to 5:00pm Monday through Friday

Phone: (803) 436-2177

Recording Tips for Sumter County:

- Ensure all signatures are in blue or black ink

- Bring your driver's license or state-issued photo ID

- Double-check legal descriptions match your existing deed

- White-out or correction fluid may cause rejection

- Check margin requirements - usually 1-2 inches at top

Cities and Jurisdictions in Sumter County

Properties in any of these areas use Sumter County forms:

- Dalzell

- Horatio

- Mayesville

- Pinewood

- Rembert

- Shaw A F B

- Sumter

- Wedgefield

Hours, fees, requirements, and more for Sumter County

How do I get my forms?

Forms are available for immediate download after payment. The Sumter County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Sumter County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Sumter County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Sumter County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Sumter County?

Recording fees in Sumter County vary. Contact the recorder's office at (803) 436-2177 for current fees.

Questions answered? Let's get started!

Joint tenancy in South Carolina is governed by S.C. Code Ann. 27-7-40.

When two or more people share ownership of real property, they have choice of ways in which to hold title -- either as tenants in common or as joint tenants with the right of survivorship.

Tenancy in common is the standard form of co-ownership. In it, each person owns a percentage of the land, and when the owner dies, that portion passes to his/her estate where it is distributed during the probate process.

Joint tenancy, on the other hand, must be declared in the text of the deed: "whenever any deed of conveyance of real estate contains the names of the grantees followed by the words 'as joint tenants with rights of survivorship, and not as tenants in common' the creation of a joint tenancy with rights of survivorship in the real estate is conclusively deemed to have been created" ( 27-7-40(a)).

The statutes go on to explain that in the "event of the death of a joint tenant, and in the event only one other joint tenant in the joint tenancy survives, the entire interest of the deceased joint tenant in the real estate vests in the surviving joint tenant, who is vested with the entire interest in the real estate owned by the joint tenants" ( 27-7-40(a)(i)).

If one or more joint tenant survives the deceased owner, "the entire interest of the deceased joint tenant vests equally in the surviving joint tenants who continues to own the entire interest owned by them as joint tenants with right of survivorship" ( 27-7-40(a)(ii)).

So, how does the survivorship process work? The statutes direct the surviving joint tenant or tenants to file with the Register of Deeds of the county in which the real estate is located a certified copy of the certificate of death of the deceased joint tenant. The fee to be paid to the Register of Deeds for this filing is the same as the fee for the deed of conveyance. The Register of Deeds must index the certificate of death under the name of the deceased joint tenant in the grantor deed index of that office. The filing of the certificate of death is conclusive that the joint tenant is deceased and that the interest of the deceased joint tenant has vested by operation of law in the surviving joint tenant or tenants in the joint tenancy in real estate" ( 27-7-40(b)).

While there is no specific statutory obligation to submit the certified copy of the death certificate with an affidavit attesting to the details of the change in ownership status, it makes sense to do so. An affidavit contains statements, made under oath, which can be admitted as evidence in court. By recording an affidavit of deceased joint tenant along with the death certificate, the surviving owner(s) protect the title to the real estate. Maintaining a clear chain of title leads to less complicated sales in the future because the title search will show a continuous series of owners and transfers, which reduces the likelihood of unexpected claims against the title.

Even though recording the affidavit of deceased joint tenant and the official copy of the death certificate initiates the process of distributing the decedent's share of the real property, the only way to remove his/her name from the title is to record a new deed with the updated information.

(South Carolina AODJT Package includes form, guidelines, and completed example)

Important: Your property must be located in Sumter County to use these forms. Documents should be recorded at the office below.

This Affidavit of Deceased Joint Tenant meets all recording requirements specific to Sumter County.

Our Promise

The documents you receive here will meet, or exceed, the Sumter County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Sumter County Affidavit of Deceased Joint Tenant form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4588 Reviews )

Karen B.

January 13th, 2020

Completed although having the sample really helped. Now to file.

Thank you for your feedback. We really appreciate it. Have a great day!

Alfred J. H.

August 17th, 2019

Excellent resource for legal forms. Very satisfied. Instructions and caveats explained clearly. Thank You!

Thank you!

Judith S.

February 15th, 2022

Nice and Easy: two of my favorite things.

Thank you!

Rachel E.

April 3rd, 2020

Our firm is working remotely and a lot of court services are limited with the corona-virus shutdowns, but we needed to record a Deed at the last minute. There was no other way we'd could get it done that quick without Deeds.com (staff) helped us work out some kinks and we got it recorded in less than 1 business day! Thank you!

Thank you for your feedback, we really appreciate it. Glad we could help.

Carl T.

February 23rd, 2021

Great site with good information and pricing. Let me know when you are able to record documents in California.

Thank you for your feedback. We really appreciate it. Have a great day!

Evelyn R.

July 16th, 2020

Filing my deed through your service was great. All directions were clear and specific; it was very easy to upload the documents and most of all feedback from your office was professional and very timely. You service was excellent. Thank you!! Thank you so very much!!

Thank you for your feedback. We really appreciate it. Have a great day!

Elexis C.

November 14th, 2019

Easy, fast & amazing descriptions of all forms needed.

Thank you!

Beverly L J.

August 6th, 2020

The process for receiving the quitclaim document worked well. I couldn't use the document. If I had been able to view the document before I had to pay for it, I would have known, but that isn't how your process works. However, that's the only snag I found. Otherwise the process for paying and downloading the document worked well. Thank you.

Thank you for your feedback Beverly. We certainly do not want you to pay for something you are unable to use. To that end we have canceled your order and refunded your payment. We do hope that you find something more suitable to your needs. Have a wonderful day.

Idiat A.

January 20th, 2023

Service was fast and easy to use. But let documents appear clearer next time.

Thank you for your feedback. We really appreciate it. Have a great day!

Viola J.

August 2nd, 2021

You made this so easy to process the Executor Deed. THANK YOU a thousand times. Appreciate that all forms are in one place and I did not have to search all over the internet to get what I needed.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Lillian D.

May 24th, 2020

I found the deeds.com site easy to use and very up to date. I am a senior citizen and not very tek inclined but I was able to reach the goal that I was seeking. I would use it again if the need arrived.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

darryl c.

July 24th, 2021

very easy to use website

Thank you!

Nancy D.

July 30th, 2019

Program works well. Saves a lot of time trying to find out what you need to do.

Thank you!

Michelle R.

December 23rd, 2022

Fairly easy to use. Need to be able to find platts easy.

Thank you!

Lori G.

June 17th, 2019

I needed to add my husband to my deed. an attorney would charge me $275.00. I decided to file myself. This makes it easy. Not done w/the process yet. But so far so good! :)

Thank you for your feedback. We really appreciate it. Have a great day!