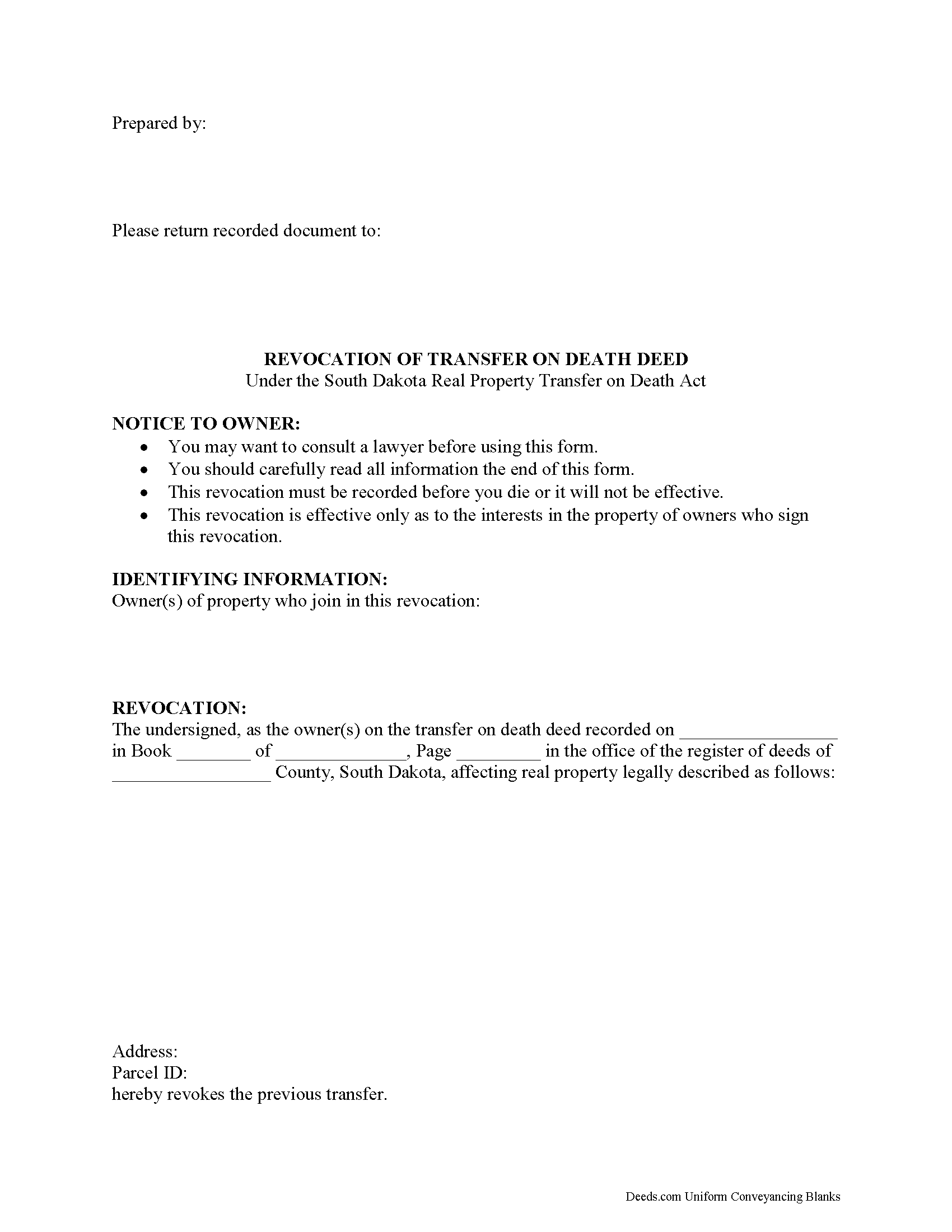

Haakon County Transfer on Death Revocation Form

Haakon County Transfer on Death Revocation Form

Fill in the blank form formatted to comply with all recording and content requirements.

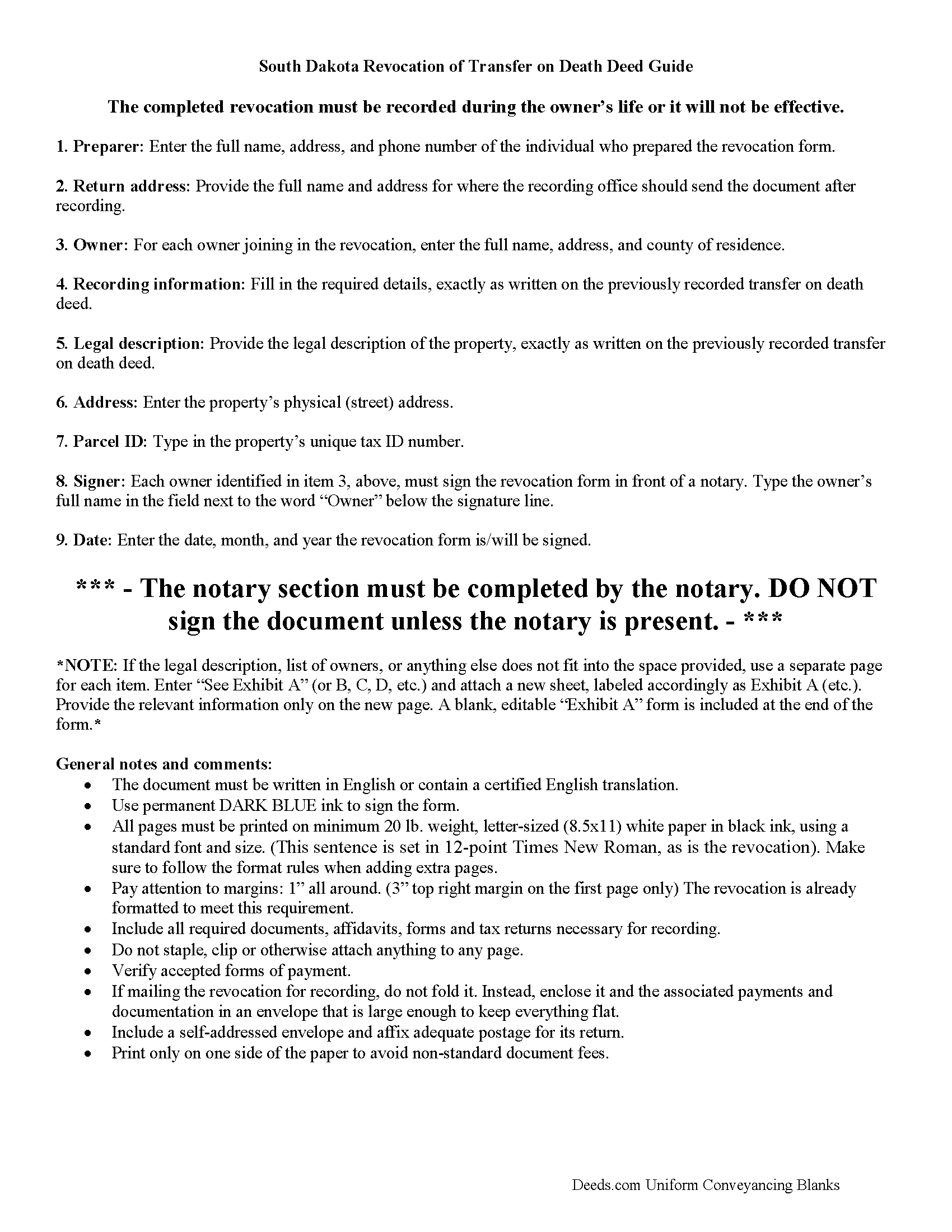

Haakon County Transfer on Death Revocation Guide

Line by line guide explaining every blank on the form.

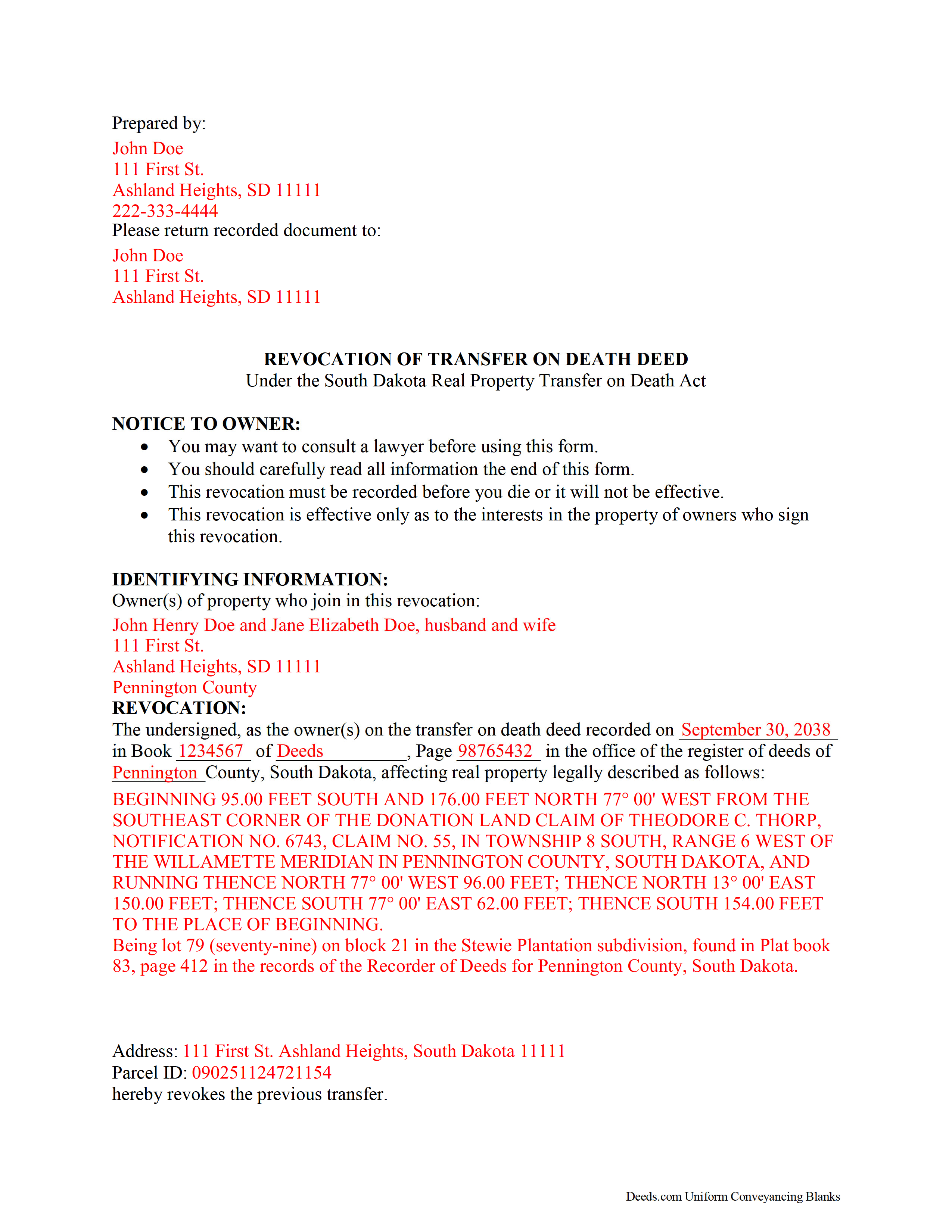

Haakon County Completed Example of the Transfer on Death Revocation Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional South Dakota and Haakon County documents included at no extra charge:

Where to Record Your Documents

Haakon County Register of Deeds

Philip, South Dakota 57567-0100

Hours: 8:00 to 12:00 & 1:00 to 5:00 M-F

Phone: (605) 859-2785

Recording Tips for Haakon County:

- Documents must be on 8.5 x 11 inch white paper

- Bring extra funds - fees can vary by document type and page count

- Multi-page documents may require additional fees per page

- Have the property address and parcel number ready

Cities and Jurisdictions in Haakon County

Properties in any of these areas use Haakon County forms:

- Midland

- Milesville

- Philip

Hours, fees, requirements, and more for Haakon County

How do I get my forms?

Forms are available for immediate download after payment. The Haakon County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Haakon County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Haakon County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Haakon County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Haakon County?

Recording fees in Haakon County vary. Contact the recorder's office at (605) 859-2785 for current fees.

Questions answered? Let's get started!

Revoking a Transfer on Death Deed in South Dakota

The South Dakota Real Property Transfer on Death Act (SDCL 29A-6-401 et seq) went into effect on July 1, 2014. It offers owners of real estate in South Dakota an option for distributing their land after death by recording a transfer on death deed (TODD). They retain absolute control over and use of the land during their lives. The transferors may even modify or revoke the future transfer without penalty, and there is no need to update their wills or subject the property to probate.

This revocability is one of the most useful features about transfer on death deeds (TODDs) under the new law is (29A-6-405). It states that a TODD "is revocable even if the deed or another instrument contains a contrary provision." This is possible for two main reasons:

<ul><li>there is no obligation for consideration from or notice to any named beneficiaries (29A-6-409); and </li>

<li>until the owner's death, the beneficiaries have no actual, or present, interest in the property (29A-6-414).</li></ul>

Find the rules for revoking a previously recorded TODD at 29A-6-410. Subject to 29A-6-411, there are three primary ways to revoke or change the future transfer: Execute and record<ul>

<li>a new transfer on death deed that revokes the earlier TODD;</li>

<li>an instrument of revocation that expressly revokes the deed or part of the deed; or</li>

<li>an "standard" deed, such as a warranty or quitclaim deed that expressly revokes the transfer on death deed or part of the deed.</li></ul>

Note that, just as with the original transfer on death deed, any instrument of revocation must be recorded before the transferor's death in the public records in the office of the register of deeds in the county where the deed is recorded. See 29A-6-411 for information about joint owners.

Life is uncertain, and the flexibility of TODDs helps landowners respond to changes in circumstances with relative ease. Each case is unique, so contact an attorney with specific questions or for complex situations.

(South Dakota TOD Revocation Package includes form, guidelines, and completed example)

Important: Your property must be located in Haakon County to use these forms. Documents should be recorded at the office below.

This Transfer on Death Revocation meets all recording requirements specific to Haakon County.

Our Promise

The documents you receive here will meet, or exceed, the Haakon County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Haakon County Transfer on Death Revocation form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4587 Reviews )

MARILEE S.

June 24th, 2019

A very easy website....consumer friendly, which is what is so important to me. I will be using your service again. Thank you

Thank you!

Pamela C.

October 5th, 2022

It was easy to download. And your guide was informative as was the completed form for an example. But I wish that I had been able to edit the forms online and then print. My handwritten info is just not as crisp.

Thank you for your feedback. We really appreciate it. Have a great day!

Debbie M.

August 21st, 2019

Everything that I needed was included. I appreciate that there was a sample as well as the step-by-step directions included in the download. I would definitely recommend this site to anyone that needs it.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Michael P.

February 4th, 2024

WOW!! Thank you for making the availability and access to these forms an unpainful experience at a competitive price. Well done!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

ROSALYN L.

May 31st, 2021

I just now downloaded the forms. So far, so good.

Thank you for your feedback. We really appreciate it. Have a great day!

Matilde A.

October 25th, 2021

Very easy to navigate... will be back to use!

Thank you for your feedback. We really appreciate it. Have a great day!

Iva R.

August 20th, 2020

Great service. Fast, got everything done (form, recording) done in a couple of hours, lightning speed in the real estate world. Thanks!

Thank you for your feedback. We really appreciate it. Have a great day!

Brian H.

May 1st, 2019

Forms are good. But need to be able to fill in information and blanks so these can be filed. Disappointed.

Thank you for your feedback. The forms are fill in the blank, Adobe PDFs. As is noted on the site, make sure you download the documents to your computer and open them with Adobe. Sounds like you may be trying to complete them online in your browser.

Ron D.

June 2nd, 2024

The State form I chose was valid and accurate. However, I found the ability to enter information was inadequate and difficult. Converted the form to a Word document and was then able to enter the information I needed to.

Your feedback is valuable to us and helps us improve. Thank you for sharing your thoughts!

David B.

February 11th, 2021

The requested forms were easy to access. Thank you.

Thank you!

Ronald D.

July 15th, 2022

very quick and easy to find, confirm, pay, and download documents, well worth the money for peace of mind.

Thank you!

Heidi G.

August 19th, 2020

Very happy with the service that you offer. My office will use you again.

Great to hear Heidi, glad we could help. Have an amazing day!

MARIO D S.

March 7th, 2020

Well worth the $20.00 for the Transfer on Death Deed, if you are willing to do the leg work to notarize and record the deed. Money well spent and money well saved. The value is in the short, bullet type instructions and State specific forms and requirements.

Thank you!

Lisa W.

December 19th, 2019

Great E-Service Provider!

Thank you!

Shannon D.

November 4th, 2020

Extremely easy site to use. We had our document e-recorded the same day and we didn't have to make a trip downtow!

Thank you!